ESG Reporting Software Market Report Scope & Overview:

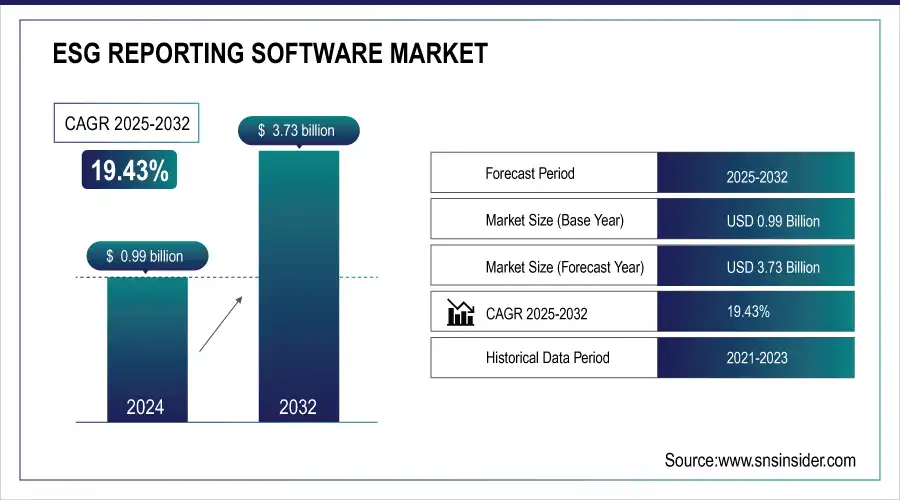

The ESG Reporting Software Market size was valued at USD 0.99 Billion in 2025E, is projected to reach USD 3.73 Billion by 2033, growing at a compound annual growth rate CAGR of 19.43% during the forecast period 2026-2033.

The increasing awareness and demand from investors and stakeholders for greater corporate accountability and sustainability are fueling market growth. Investors are increasingly looking to align their portfolios with companies that adhere to ESG principles, which requires businesses to provide accurate and detailed ESG reports. This shift is leading to a heightened emphasis on robust ESG reporting tools that can efficiently manage and analyze large volumes of data. additionally, the rise of corporate social responsibility (CSR) initiatives and the integration of ESG factors into strategic decision-making are contributing to the market’s expansion.

ESG Reporting Software Market Size and Forecast:

-

Market Size in 2025E: USD 0.99 Billion

-

Market Size by 2033: USD 3.73 Billion

-

CAGR: 19.43% (from 2026 to 2033)

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on ESG Reporting Software Market - Request Free Sample Report

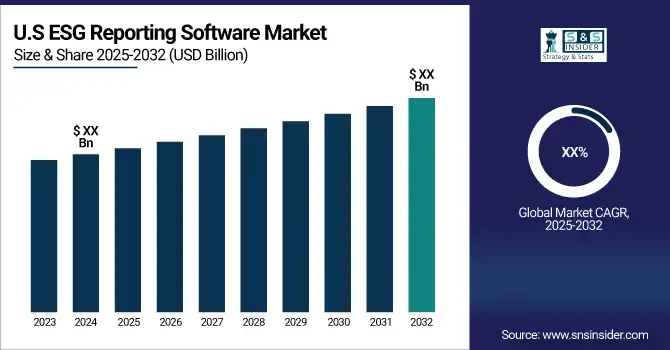

The U.S. ESG Reporting Software market size was valued at an estimated USD 0.38 billion in 2025 and is projected to reach USD 1.45 billion by 2033, growing at a CAGR of 18.7% over the forecast period 2026–2033. Market growth is driven by increasing regulatory pressure for transparency in environmental, social, and governance disclosures, along with rising corporate focus on sustainability and responsible business practices. Growing adoption of digital ESG reporting platforms to streamline data collection, compliance, and performance tracking across enterprises is accelerating market expansion. Additionally, integration of ESG software with enterprise systems, advancements in data analytics and automation, and strong demand from financial institutions and large corporations further strengthen the growth outlook of the U.S. ESG reporting software market during the forecast period.

Technological advancements also play a vital role in this market’s growth. The integration of AI and machine learning in ESG reporting software enhances data accuracy, predictive analytics, and real-time reporting capabilities. This innovation helps organizations streamline their ESG reporting processes, making it easier to meet regulatory requirements and stakeholder expectations.

Regulatory pressures are a major driver. Governments and regulatory bodies worldwide are enforcing stricter ESG disclosure requirements. For example, the European Union's Corporate Sustainability Reporting Directive (CSRD) and the U.S. Securities and Exchange Commission's (SEC) proposed climate-related disclosure rules are driving companies to implement comprehensive ESG reporting practices.

Key Highlights of the ESG Reporting Software Market

-

AI and machine learning integration enhances data accuracy, predictive analytics, and real-time ESG reporting.

-

Regulatory pressures, including the EU’s CSRD and U.S. SEC climate disclosure rules, are driving adoption.

-

Rising investor demand for transparency and accountability boosts the need for accurate reporting tools.

-

Growing CSR initiatives encourage companies to align ESG reporting with sustainability goals.

-

Lack of universal ESG standards leads to inconsistencies in reporting practices.

-

High software acquisition and integration costs challenge especially small and medium enterprises.

-

Shortage of skilled professionals in both ESG compliance and software usage hinders effective implementation.

ESG Reporting Software Market Drivers

-

Rising CSR initiatives compel companies to adopt comprehensive ESG reporting to align with sustainability goals and improve their public image.

-

Growing interest from investors for transparency and accountability in ESG performance drives the need for accurate reporting tools.

-

The demand for accurate data management and adherence to ESG standards drives the adoption of specialized reporting software.

The need for precise data management and compliance with ESG standards is a major driver for adopting specialized reporting software. As regulatory requirements become more stringent, accurate and comprehensive ESG reporting is crucial for companies. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), effective in 2024, mandates detailed ESG disclosures from a broader range of companies, impacting over 50,000 firms across the EU. Similarly, the U.S. Securities and Exchange Commission (SEC) is pushing for enhanced climate-related disclosures, affecting thousands of publicly traded companies.

Specialized ESG reporting software helps organizations manage vast amounts of data with high accuracy, ensuring compliance with these evolving standards. This software facilitates the collection, analysis, and reporting of ESG metrics, which are increasingly scrutinized by regulators and investors. By adopting these tools, companies can streamline their reporting processes, mitigate compliance risks, and enhance their credibility with stakeholders, thereby aligning with global ESG expectations.

The growing interest from investors in transparency and accountability regarding ESG performance is a significant factor driving the demand for accurate reporting tools. Investors increasingly prioritize ESG metrics when making investment decisions, seeking to understand how companies manage environmental, social, and governance risks and opportunities. According to a 2023 survey by PwC, nearly 80% of institutional investors now consider ESG factors when evaluating potential investments. This shift is prompting companies to enhance their ESG reporting to meet investor expectations and attract capital.

Accurate ESG reporting tools are essential for providing investors with reliable, comprehensive data on a company’s sustainability practices. By leveraging these specialized tools, companies can produce detailed and verifiable ESG reports that meet investor demands, reduce the risk of greenwashing, and improve overall investment attractiveness. This trend emphasizes the vital role of robust ESG reporting in fostering investor confidence and driving informed investment decisions.

ESG Reporting Software Market Restraints

-

The absence of universally accepted ESG reporting standards and frameworks can lead to inconsistencies and difficulties in software implementation.

-

The expense involved in acquiring and integrating ESG reporting software can be significant, especially for small and medium-sized enterprises.

-

A shortage of skilled professionals who understand both ESG reporting requirements and the software’s capabilities can hinder effective implementation and usage.

In the ESG Reporting Software market, a shortage of skilled professionals who are knowledgeable about both ESG reporting requirements and the software's functionalities presents a significant challenge. Effective implementation and usage of ESG reporting software rely on expertise in two critical areas: understanding the complex and evolving ESG regulations and the technical capabilities of the software itself. Professionals must navigate diverse and often intricate ESG standards, while also leveraging the software’s features to accurately collect, analyze, and report data. The lack of individuals who possess both sets of skills can lead to difficulties in configuring the software correctly, ensuring compliance, and generating reliable reports. This skills gap can result in inefficient use of the software, missed compliance deadlines, and ultimately, less effective ESG reporting. Addressing this shortage is crucial for maximizing the benefits of ESG reporting tools and achieving robust sustainability reporting.

In the ESG Reporting Software market, the costs associated with acquiring and integrating ESG reporting solutions can be substantial, particularly for small and medium-sized enterprises (SMEs). These costs encompass software licensing fees, customization expenses, and the resources required for integrating with existing IT systems.

Additionally, ongoing costs for training staff, maintaining software, and keeping up with frequent updates due to evolving ESG regulations can further strain budgets. For SMEs, which often operate with limited financial and technical resources, these expenses can be a significant barrier to adoption. High costs can deter smaller organizations from investing in advanced ESG reporting tools, limiting their ability to effectively track and report on sustainability metrics. As a result, SMEs may struggle to meet regulatory requirements or respond to stakeholder demands for transparency, ultimately impacting their market competitiveness and ability to demonstrate their ESG commitments effectively.

ESG Reporting Software Market Segment Analysis

-

By Offering

The environmental ESG reporting software segment is expected to capture the largest market share during the forecast period 2026-2033. This software allows companies to collect, analyze, and report on various environmental metrics, including carbon emissions, energy consumption, water usage, waste generation, and air and water quality. It simplifies data collection by enabling organizations to gather information from multiple sources, such as internal systems, third-party providers, and manual inputs. The environmental ESG market offers features like data validation and normalization to ensure the accuracy and consistency of the data collected. Additionally, it helps organizations calculate essential environmental KPIs and generate detailed reports that align with industry standards and regulatory requirements. The software also enables companies to effectively communicate their environmental performance to internal and external stakeholders, including investors, customers, regulators, and the public, through customizable dashboards, reporting templates, and data visualization tools, enhancing transparency and accountability in their sustainability efforts.

-

By Vertical

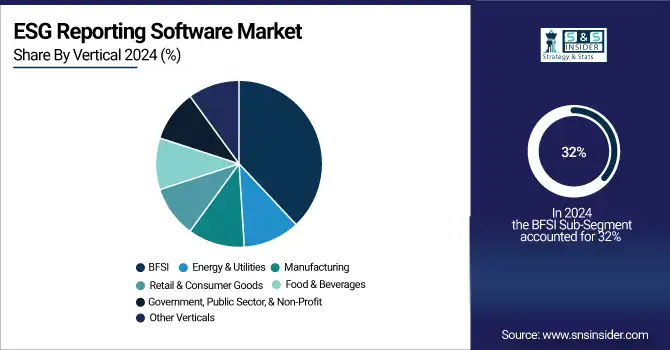

The BFSI segment dominated the market with the highest revenue share of more than 32% in 2025 due to stringent regulatory requirements, such as the EU Sustainable Finance Disclosure Regulation (SFDR) and the Basel III framework, which demand comprehensive ESG disclosures. The sector is also experiencing heightened investor scrutiny and ESG-related risks, which is driving the adoption of ESG reporting software to improve risk management, transparency, and strategic decision-making.

Meanwhile, the government sector is expected to exhibit the highest CAGR due to increasing regulatory pressures, mandates for transparent governance, and the need to monitor and mitigate environmental impacts. This creates a demand for advanced software solutions to streamline data collection, analysis, and reporting processes. These applications are propelling the adoption of ESG reporting software across various industries.

ESG Reporting Software Market Regional Outlook

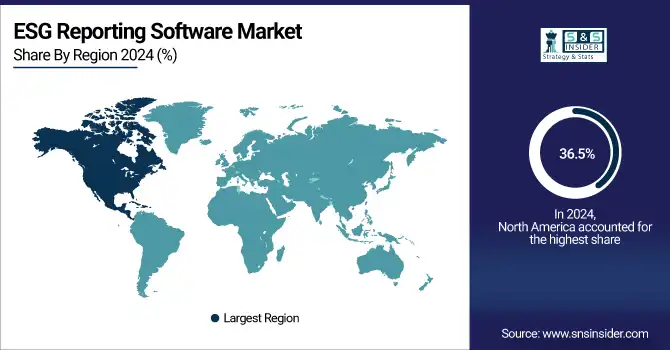

In 2025, North America held the largest share of more than 36.5% in the ESG reporting software market, driven by its advanced regulatory environment, including SEC requirements, which has led to the widespread adoption of ESG reporting solutions. The ESG reporting software market in North America is experiencing substantial growth, fueled by investor pressure, and rising stakeholder expectations. Companies increasingly acknowledge the importance of ESG reporting for compliance, maintaining a positive reputation, attracting investors, and mitigating risks.

The market is growing increasingly competitive as established software providers and new entrants compete for market share by offering innovative features, user-friendly interfaces, and customizable solutions tailored to the diverse needs of companies looking to improve their ESG performance and reporting capabilities.

The Asia Pacific region is anticipated to achieve the highest CAGR in the ESG software market due to its rapidly evolving regulatory landscape and the rising adoption of sustainable business practices. Additionally, increasing investor demand for ESG integration is fueling the need for advanced ESG software solutions in the region.

Need any customization research on ESG Reporting Software Market - Enquiry Now

ESG Reporting Software Market Companies

-

Cortify

-

Intelex

-

Benchmark Digital Partners LLC

-

Brightest Inc.

-

Workiva

-

Salesforce, Inc.

-

UL Solutions

-

SAP SE

-

Oracle Corporation

-

Refinitiv Ltd

-

Greenstone

-

Novisto

-

Emex

-

Enhelix

-

Anthesis Group

-

Diginex

-

Bain & Company

ESG Reporting Software Market Competitive Landscape

Salesforce, Inc. is a global leader in cloud-based customer relationship management (CRM) solutions, headquartered in San Francisco, California. Founded in 1999, the company provides a comprehensive suite of enterprise applications focused on sales, service, marketing, analytics, and collaboration. Salesforce plays a growing role in sustainability and ESG reporting through its Net Zero Cloud platform, enabling organizations to track carbon emissions, manage environmental data, and ensure regulatory compliance. With a strong global presence and a diverse customer base across industries, Salesforce continues to drive digital transformation by integrating AI, analytics, and cloud innovations into enterprise workflows.

-

In September 2023, Salesforce introduced new Einstein features for Net Zero Cloud to simplify ESG reporting for companies in response to evolving regulations.

KPMG International Limited is one of the world’s leading professional services firms, providing audit, tax, and advisory services across more than 140 countries. Headquartered in Amstelveen, Netherlands, KPMG is widely recognized for its expertise in governance, risk management, and sustainability consulting. The firm plays a vital role in the ESG reporting software market by helping organizations implement robust sustainability strategies and comply with evolving regulatory frameworks. Through its advisory services, KPMG supports businesses in enhancing transparency, meeting investor expectations, and integrating ESG performance into long-term growth strategies, making it a key enabler in corporate sustainability transformation.

-

In July 23, KPMG partnered with Microsoft to introduce innovative solutions that support businesses in their ESG journey.

| Report Attributes | Details |

| Market Size in 2025E | USD 0.99 Billion |

| Market Size by 2033 | USD 3.73 Billion |

| CAGR | CAGR of 19.43% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By offering (Software and Services) • By Deployment (On-premises and Cloud) • By Organization Size (Small and Medium-sized Enterprises (SMEs) and Large Enterprises) • By Vertical (BFSI, Government, Public Sector, & Non-Profit, Manufacturing, Food & Beverages, Retail & Consumer Goods, Energy & Utilities,and Other Verticals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Diligent, Cortify, Intelex, Wolters Kluwer, Benchmark Digital Partners LLC, Brightest Inc., Nasdaq, Workiva, Salesforce, Inc., UL Solutions, SAP SE, Oracle Corporation, Refinitiv Ltd, Greenstone, Novisto, Emex, Enhelix, Anthesis Group, Diginex, Bain & Company, and others. |