LED Modular Display Market Report Scope & Overview:

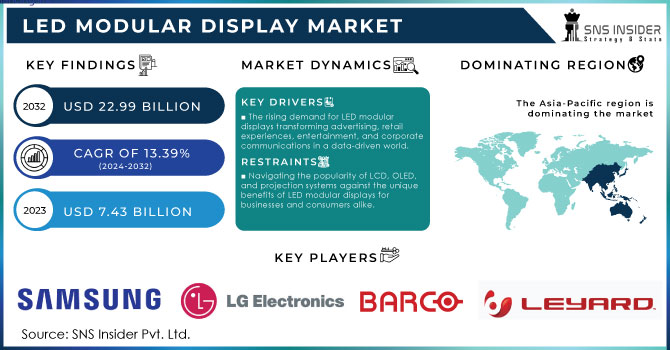

The LED Modular Display Market was valued at USD 7.43 Billion in 2023 and is expected to reach USD 22.99 Billion by 2032, growing at a CAGR of 13.39% over the forecast period 2024-2032.

The LED modular display market has witnessed remarkable growth in recent years, driven by advancements in technology and an increasing demand for high-quality visual displays across various industries. One of the primary factors contributing to the expansion of the LED modular display market is the surge in digital advertising and digital signage. Digital signage has become a powerful communication tool, with 70% of Americans reporting they've seen a digital display at least occasionally. Notably, 47% recall specific ads or messages, with this figure rising to 55% for outdoor digital billboards. Furthermore, 80% of shoppers have entered stores due to interest piqued by digital signs. This high visibility translates to effectiveness, as 90% of information transmitted to the brain is visual, with 30% of the brain's cortex dedicated to processing visual information. People can remember over 2,000 images with 90% accuracy for several days while retaining only 20% of written or spoken information after three days.

To Get More Information on LED Modular Display Market - Request Sample Report

Technological advancements, such as the development of energy-efficient LED modules and improved image quality, are further propelling the growth of the LED modular display market. Manufacturers are continually innovating to provide displays with higher resolution, better color accuracy, and increased durability, catering to the diverse needs of end-users. The rise of smart technologies, including the integration of IoT capabilities, allows for remote monitoring and control of LED displays, adding to their appeal in various applications like retail, hospitality, entertainment, and corporate environments. The growing trend of digital transformation and the adoption of interactive display solutions are further boosting the market, with applications in outdoor advertising, sports arenas, transportation hubs, and smart cities. As demand for customizable LED modular displays grows, the market is expected to experience sustained growth, driven by innovations in LED technology, increasing investment in smart infrastructure, and the growing importance of visual communication in the digital age.

Market Dynamics

Drivers

- The rising demand for LED modular displays transforming advertising, retail experiences, entertainment, and corporate communications in a data-driven world.

Top-notch visual presentations are crucial for grabbing audience interest in a world overflowing with data. LED modular displays provide better brightness, color accuracy, and clarity in contrast to conventional display technologies. This quality makes them very appealing for advertising, as vivid images can greatly improve brand recognition and message recall. LED displays are more commonly utilized in retail to display products in an engaging and eye-catching manner. Companies can use these screens to develop engaging shopping experiences that increase customer interaction and drive sales. Likewise, LED screens play a crucial role in the entertainment industry by improving audience experience at concerts, sports events, and live performances with captivating visuals and up-to-date information. The business industry is also moving towards utilizing LED screens for presenting information and internal messaging. With the increase in remote work, companies are purchasing top-notch displays to enhance virtual meetings and collaborations. The demand for advanced display technologies, driven by the requirement for professional-grade presentations and visual aids, is boosting the growth of the LED modular display market.

- Transforming marketing and communication through dynamic digital signage in retail, hospitality, and transportation industries.

Digital signage, as opposed to static signage, allows for content that is dynamic and can be quickly updated and personalized in real-time. This adaptability allows companies to promptly adapt to shifting market conditions and customer preferences. LED modular displays are commonly utilized in industries like retail, hospitality, and transportation for advertising, promotions, and sharing information. Retailers can display products, advertise sales, and share brand narratives with captivating visuals that capture the interest of customers. Within the hospitality industry, digital signage improves guest experiences by presenting engaging information about services, events, and promotions. Transportation centers, like airports and train stations, utilize digital signage to give current information on schedules, directions, and safety details. Utilizing LED displays in such settings guarantees visibility and clarity, even in difficult lighting conditions.

Restraints

- Navigating the popularity of LCD, OLED, and projection systems against the unique benefits of LED modular displays for businesses and consumers alike.

LCDs are often more affordable than LED displays, making them attractive options for businesses with budget constraints. On the other hand, OLED displays offer exceptional color reproduction and contrast ratios, appealing to high-end consumers and businesses. Furthermore, projection systems remain a viable alternative for larger display needs, especially in environments where space is limited. Projectors can deliver impressive visuals at a lower cost, providing a cost-effective solution for presentations and events. As a result, LED modular displays must compete not only on quality but also on pricing and application suitability. This competition can limit market growth, particularly in price-sensitive segments where organizations prioritize cost over quality. To address this challenge, LED manufacturers need to emphasize the unique benefits of their products, such as superior brightness, durability, and versatility. Developing innovative applications and enhancing energy efficiency can also help differentiate LED displays from competitors, creating a stronger value proposition for potential buyers.

Market Segmentation Analysis

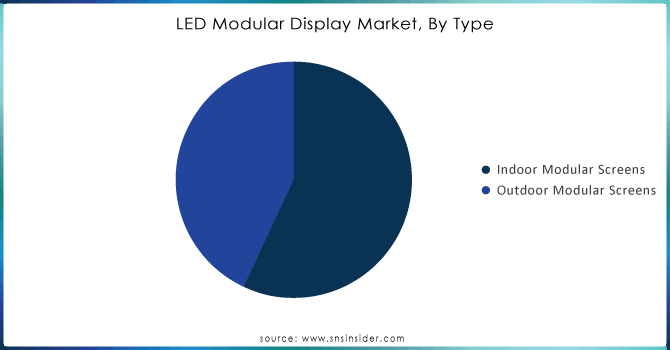

By Type

Indoor modular screens led the market in 2023 with a 59% market share. These displays are specially created for use in different indoor locations, such as malls, offices, airports, and entertainment sites. Their excellent clarity and luminosity improve visibility and interaction, making them perfect for advertising, presentations, and interactive displays. The flexible configurations of the modular design make it easy to cater to various spatial requirements during installation. Companies like Samsung and LG have effectively integrated indoor modular screens into their commercial offerings, delivering vivid displays for retail spaces and events.

Outdoor modular screens are expected to register the fastest CAGR during 2024-2032. These screens are commonly utilized for billboards, sports arenas, concerts, and public events, as they are created to endure different weather conditions. Advertisers and event organizers find them appealing due to their strong resilience and intense luminosity, ensuring visibility even in the glare of the sun. The increased focus on outdoor advertising and timely information sharing has led to a higher demand for outdoor modular screens. For instance, Daktronics and Absen are examples of firms that offer state-of-the-art outdoor modular display solutions, enabling easy integration into different settings.

Do You Need any Customization Research on LED Modular Display Market - Inquire Now

Regional Analysis

Asia-Pacific led the market regionally in 2023 with a 36% market share, due to its strong manufacturing abilities, fast urban growth, and rising need for digital signage solutions. Nations such as China, Japan, and India are leading the way, making significant investments in technology and infrastructure. Major companies like Sony and Panasonic are actively investing in LED technology to offer cutting-edge solutions for both indoor and outdoor applications. For instance, Leyard has established a strong presence in the region by providing high-performance LED displays for large-scale events and exhibitions. The area's increasing focus on events, concerts, and advertising strategies strengthens its market leadership, as ongoing innovations in LED technology maintain a dynamic and competitive environment.

North America is expected to register a rapid growth rate due to the rising use of advanced display technologies in retail, advertising, and events. The increasing need for high-quality screens for ads and sharing information in cities has sped up market expansion. Leading companies such as Samsung and LG Electronics are consistently improving their product lineup to improve screen quality and energy efficiency. Examples of usage range from digital billboards in Times Square to interactive displays in retail settings, and even large-scale video walls for corporate events.

Key Players

The major key players in the LED Modular Display Market are:

-

Samsung Electronics (Samsung IF Series, Samsung QLED Signage)

-

LG Electronics (LG MAGNIT, LG Transparent OLED)

-

Sony Corporation (Sony Crystal LED, Sony BRAVIA Professional Displays)

-

Barco (Barco LED displays, Barco UniSee)

-

Christie Digital Systems (Christie Pandoras Box, Christie MicroTiles)

-

Daktronics (Daktronics Tickers, Daktronics LED Video Displays)

-

Leyard (Leyard TVH Series, Leyard CarbonLight Series)

-

Unilumin (Unilumin Upanel, Unilumin LED Video Wall)

-

Absen (Absen A2720, Absen PL Series)

-

Planar Systems (Planar UltraRes X, Planar TVF Series)

-

Sharp NEC Display Solutions (NEC LED Display, NEC MultiSync)

-

VTRON Technologies (VTRON LED Display, VTRON R&D Solutions)

-

BenQ (BenQ LU951, BenQ ST100)

-

Mitsubishi Electric (Mitsubishi Diamond Vision, Mitsubishi LED Video Walls)

-

ViewSonic (ViewSonic LD Series, ViewSonic IFP Series)

-

Peerless-AV (Peerless-AV Xtreme™ Outdoor Displays, Peerless-AV Full HD Displays)

-

Infinito (Infinito Infinity Series, Infinito Performance Series)

-

AOTO Electronics (AOTO P1.56, AOTO P2.5)

-

Nanolumens (Nanolumens Aware, Nanolumens Flex Series)

-

KONKA (KONKA Transparent LED, KONKA Indoor LED Display)

Recent Developments

-

May 2023: Porotech debuted the world's first 0.26-inch active matrix full-color Micro LED on silicon with an array frame at Slide Display Week. Dynamic Pixel Tuning (DPT) technology ensures fast color switching with no RGB color stacking, which is a very innovative display.

-

March 2024: Samsung details a new version of its Wall All-in-One, a modular MicroLED display. This new device has a better resolution than the old version and is capable of fitting into locations in retail, corporate, or other sites.

-

January 2024: Leyard introduced its LVP Series LED video wall displays. These are indoor displays with ultra-slim bezels and high brightness. Targeted at control rooms, broadcast studios, and public venues, they offer enhanced viewing experience due to the products' excellent image quality and seamless integration.

-

February 2023: LG unveiled a new lineup of 4KUHD LED digital signage solutions that are modular and easy to install and maintain. These screens boast brilliant colors and crisp images that make them ideal for a wide array of contexts, from retail to event environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.43 Billion |

| Market Size by 2032 | USD 22.99 Billion |

| CAGR | CAGR of 13.39% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Indoor Modular Screens, Outdoor Modular Screens) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics, LG Electronics, Sony Corporation, Barco, Christie Digital Systems, Daktronics, Leyard, Unilumin, Absen, Planar Systems, Sharp NEC Display Solutions, VTRON Technologies, BenQ, Mitsubishi Electric, ViewSonic, Peerless-AV, Infinito, AOTO Electronics, Nanolumens, KONKA. |

| Key Drivers | • The rising demand for LED modular displays transforming advertising, retail experiences, entertainment, and corporate communications in a data-driven world. • Transforming marketing and communication through dynamic digital signage in retail, hospitality, and transportation industries. |

| RESTRAINTS | • Navigating the popularity of LCD, OLED, and projection systems against the unique benefits of LED modular displays for businesses and consumers alike. |