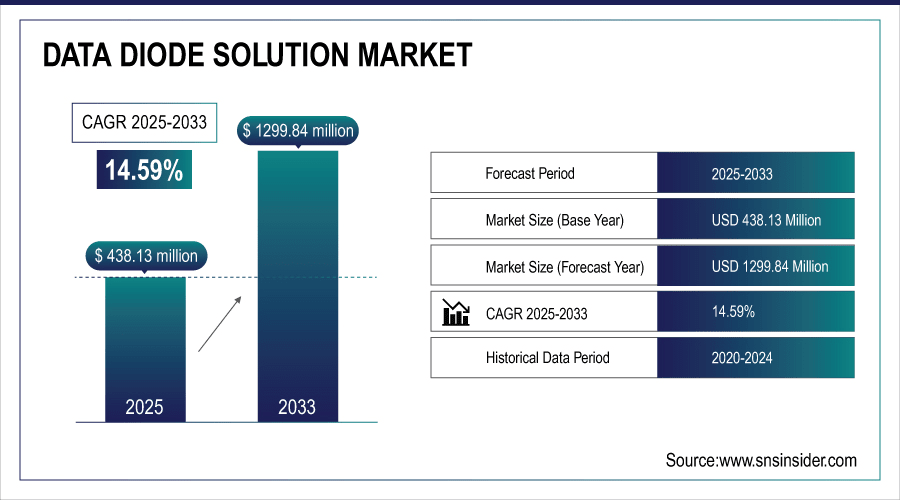

Data Diode Solution Market Size & Growth:

The Data Diode Solution Market size was valued at USD 438.13 Million in 2025E and is projected to reach USD 1299.84 Million by 2033, growing at a CAGR of 14.59% during 2026-2033.

The Data Diode Solution Market is expanding due to the increasing demand for secure one-way transfer of data in critical infrastructure, ICS, and government networks. Growing cyber threats and compliance needs are pushing applications in sectors. Rising network security technologies’ development and their implementation with industrial automation and IoT systems foster market growth. The need for secure, low-latency and immutable communication solutions in utility, energy and defense industries is growing.

Demand from the energy, utilities, and defense sectors accounts for over 60% of market revenue, with North America and Europe leading adoption due to strict regulatory compliance and increasing integration with OT/IT networks and industrial IoT systems.

To Get More Information On Data Diode Solution Market - Request Free Sample Report

Key Data Diode Solution Market Trends

-

Increasing Cyber-Attacks on Energy, Defense, and Industrial Verticals is Growing the Demand for Data Diode Solutions.

-

penalizing frameworks such as NERC CIP, and FISMA are requiring secure, strong data transfer protocols requirements.

-

Growth of smart manufacturing, IoT devices and smart grids is driving the need for reliable, unidirectional data flow.

-

Deep Integration with Secure Data Diodes along with advanced AI-powered analytics, cloud capabilities and more increase operational efficiency and data fidelity.

-

The emergence of data diode devices that are inexpensive, small and portable is making markets and small businesses possible.

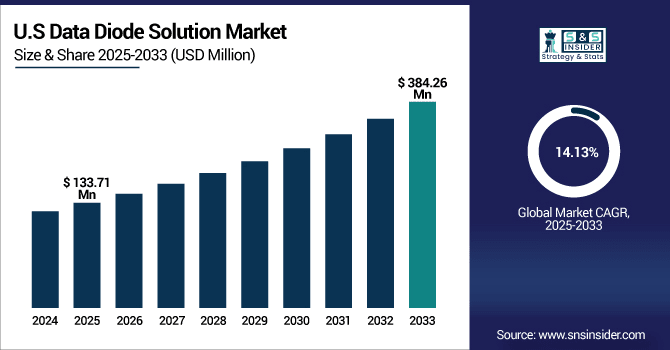

The U.S. Data Diode Solution Market size was valued at USD 133.71 Million in 2025E and is projected to reach USD 384.26 Million by 2033, growing at a CAGR of 14.13% during 2026-2033.

Data Diode Solution Market growth is driven by rising demand for cybersecurity for critical infrastructure such as power, defense, and industrial control systems. There has been a growing threat to critical government and enterprise networks from increasing cyberattacks, which has also increased the demand for secure one-way data transfer. Stringent regulations and compliance standards, including NERC CIP and FISMA, are driving organizations towards the use of next-gen data diode technologies. Additionally, the demand for data diodes with IoT devices, industrial automation, and smart grids continues to rise. Furthermore, the adoption of low-latency, highly reliable and tamper-proof communication solutions is broadening.

Data Diode Solution Market Growth Drivers:

-

Rising Cybersecurity Threats and Regulatory Compliance Boost Demand for Data Diode Solutions Globally.

The market for Data Diode Solution is mainly driven by increasing cyber-attacks on critical infrastructure. Enterprises in the energy, defense and industrial markets need secure, unidirectional transfer of selective data. Tight regulations, NERC CIP (North American Electric Reliability Corporation Critical Infrastructure Protection) and FISMA, mandate strong cybersecurity. With the rise of IoT, industrial automation, smart grids the dependency of data diode technology increases. The market adoption is further propelled by low-latency, tamper-proof, and high-reliability technology advancements.

ver 70% of deployments are concentrated in energy, defense, and industrial sectors, with compliance to regulations like NERC CIP and FISMA influencing more than 60% of procurement decisions.

Data Diode Solution Market Restraints:

-

High Implementation Costs and Technical Complexity Limit Adoption of Data Diode Solutions Worldwide

Data diode solutions are yet to be widely adopted because of their expensive acquisition and installation costs. Challenging installation and integration process for organizations that are small since it has to be combined with IT and OT systems. It also costs more in terms of maintenance and training. For small firms, Zhe explained that low awareness of benefits hindered market penetration. Problems concerning compatibility with old systems can also slow down broader adoption in some sectors.

Data Diode Solution Market Opportunities:

-

Growing Industrial Automation and IoT Integration Create New Revenue Streams for Data Diode Solutions

Growth of Industry 4.0 and smart manufacturing provides considerable potential for data diodes. Secure data transfer in a single direction is indispensible in the context of IoT devices and interconnected systems to avoid cyber intrusions. It allows emerging markets and SMMEs to appreciate the importance of advanced cybersecurity systems. When combined with cloud or AI-based analytics, it can work to improve operational efficiency while ensuring data accuracy. Advancements in affordable, small, and nimble data diode solutions have paved the way for future market expansion.

Over 45% of small-to-medium enterprises (SMEs) in manufacturing are now investing in cybersecurity solutions like data diodes, up from 30% in 2022, while integration with cloud platforms and AI-driven analytics is anticipated to boost market penetration by 25% in industrial IoT environments.

Data Diode Solution Market Segment Analysis

-

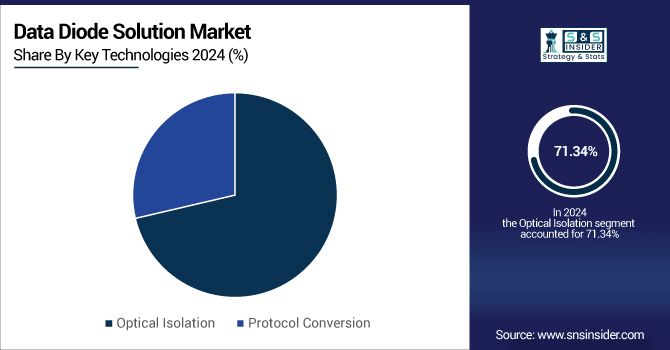

By key technology, Optical Isolation is expected to lead the market with approximately 71.34% share in 2025, while Protocol Conversion is projected to be the fastest-growing technology with a CAGR of 14.98%.

-

By application, the Energy and Power sector is expected to dominate with around 28.56% share in 2025, whereas Aerospace and Defense is anticipated to register the fastest growth with a CAGR of 15.83%.

-

By type, Ruggedized Data Diode is expected to lead the market with approximately 63.22% share in 2025, while Regular Data Diode is projected to grow the fastest with a CAGR of 15.01%.

-

By form product, Rack Mounted products are expected to hold the largest share at 42.75% in 2025, whereas Small/Portable data diodes are anticipated to grow the fastest with a CAGR of 14.97%.

By Key Technology, Optical Isolation Leads Market While Protocol Conversion Registers Fastest Growth

Data Diode Solution Market is dominated by Optical Isolation, which is able to ensure secure and seamless unidirectional data transfer. The highest growth rates among these are for conversion of protocols: As there is a growing need for multi-protocol and easily networked equipment. Technological advancements and improved performance benefits are boosting the penetration across end-user sectors. Enterprises are working on R&D to increase the efficiency and scalability of these offerings. It’s a tech driven world after all and the market’s rapid growth is being influenced by the technology landscape.

By Application, Energy and Power Dominate While Aerospace and Defense Shows Rapid Growth

In application, Energy and Power industry holds a majority share in the market as a result of the need to protect critical infrastructure, and meet the compliance mandates. Aerospace and Defense is experiencing very fast growth, driven by a growing need for cybersecurity and secure communications solutions. The expansion is also supported by increasing industrial automation and IoT inclusion. Enterprises are focusing on secure and immutable data exchange to safeguard mission-critical activities. These are trends that are leading to consistent market expansion across applications.

By Type, Ruggedized Data Diode Lead While Regular Data Diode Registers Fastest Growth

Ruggedized Data Diodes dominate the market due to their ruggedness and reliability in harsh and mission-critical situations. Standard Data Diodes are experiencing the highest growth as they are the most cost-effective solution for mass business and industrial usage. User friendliness and deployment feasibility are also rising in this miniaturization and technological progress. Rising awareness of data integrity and cybersecurity in all industries is driving adoption. A showcase for the type segment as a solidifying leader and an emerging area of growth.

By Form Product, Rack Mounted Lead While Small/Portable Grow Fastest

The Rack Mounted segment is dominated by the market for Data Diode Solution, which is used in enterprise and industrial applications and can be easily integrated and scaled, unlike other form factors available. Small/Portable data diodes are growing the fastest, due to requirement for flexible, small and cost-effective solutions, in temporary or remote environments. With further miniaturization and performance development, the use in industries is spreading. Growth in industries such as energy, defense, and industrial automation is driving demand for automation controllers, and in turn, driving the market for industrial automation.

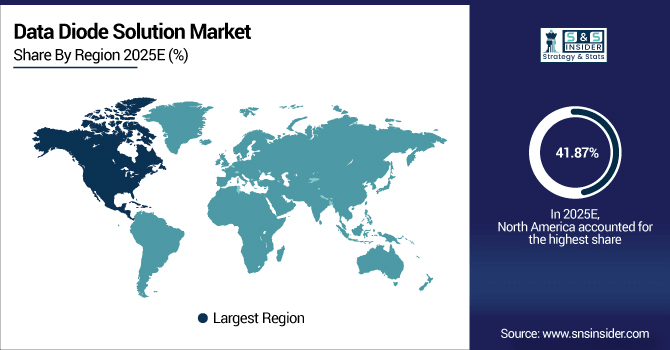

North America Data Diode Solution Market Insights

In 2025E North America dominated the Data Diode Solution Market and accounted for 41.87% of revenue share, this leadership is due to the cyber-attacks on hadoop and govt. networks and surging demand of secure unidirectional communications are driving the market growth. Heavy regulation and compliance, such as NERC CIP, FISMA, are pushing its adoption across vertical markets.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Data Diode Solution Market Insights

U.S. accounts for the highest penetration of the market owing to huge investments in cybersecurity in various industries such as energy, defense, and industrial among others. The growing realization of the importance of data integrity and operational security is fueling demand for data diode technology.

Asia-Pacific Data Diode Solution Market Insights

Asia-Pacific is expected to witness the fastest growth in the Data Diode Solution Market over 2026-2033, with a projected CAGR of 15.33% due to increase in industrial automation and investments in cyber security. On the other hand, in nations such as China, India, and Japan, data diode solutions are being employed to guard their infrastructure and energy services. Growing knowledge about cyber-threats and enhanced government initiatives are driving market penetration.

China Data Diode Solution Market Insights

China is growing at a significant rate due to the demand for security within critical infrastructure environment. Demand for government programs and policies that increase cybersecurity for energy, defense and industrial systems is also driving growth. Increasing uptake of industrial IoT and automation also contribute to its growth of the market.

Europe Data Diode Solution Market Insights

In 2025E, Europe markets are also consolidating and are pushed by robust cyber security regulation and flourishing industrial base. Germany, the UK and France are at the forefront of uptake in the energy, defense and industrial sectors. Growth is backed by strong awareness of cyber risks and government initiatives to safeguard critical assets. Strategic partnerships between European OEM and non-EU technology world widen the product portfolios.

Germany Data Diode Solution Market Insights

Germany is a significant European market also characterized by strong industrial base and a well-developed sense of cybersecurity. The country concentrates on guarding the vulnerable infrastructure of its energy, transport and manufacturing sectors. The use of the data diode is also promoted by governmental regulations and industry-specific cybersecurity standards.

Latin America (LATAM) and Middle East & Africa (MEA) Data Diode Solution Market Insights

The Data Diode Solution Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the increasing investment in cybersecurity and critical infrastructure security. Brazil, Mexico, UAE, and Saudi Arabia are taking the lead in adoption especially in energy, industrial and defense applications. Public and private sector efforts, as well as international provider collaborations, are expanding technology capacity in both areas.

Data Diode Solution Market Competitive Landscape:

BAE Systems is one of the major players in the Data Diode Solution Market, providing high-assurance unidirectional data transfer solutions for defense and critical infrastructure applications. Based on simplex fiber optic designs, their solutions in 100 Mbps, 1 Gbps, and 10 Gbps variants support tamper-proof, one-way communication.

-

In September 2024, BAE Systems partnered with Crystal Group to develop the XTS-Hercules, a rugged cross-domain solution featuring XTS Diodes optimized for secure, unidirectional data transfer in tactical military contexts.

Belden Inc., a prominent organization in the Data Diode Solution Market, manufactures strong and secure unidirectional data transfer system that are used in critical infrastructure, defense, energy, and industrial automation industries. Their smart-use products provide strong protection against unauthorized network access and ensure data security where very high-security is required.

-

In June 2023, Belden launched the Belden Horizon Data Manager (BHDM) and Belden Horizon Data Operations (BHDO)—software solutions designed to help industrial enterprises manage complex data securely through analytics and integrated operations.

Siemens AG is one of the leading players in the worldwide Data Diode Solution Market providing industrial unidirectional gateway solutions for secure data transfer, especially in industrial and safety critical systems. Their technologies use electromagnetic induction and proprietary chip designs developed to meet high level safety targets such as SIL 4, which makes secure incorporation of IoT and analytics possible.

-

In June 2024, Siemens AG launched the SINEC OCT, a next-generation optical data diode, designed specifically for secure, unidirectional data transfer in industrial automation and critical infrastructure environments.

ST Engineering provides next-generation data diode products designed for one-way data transfer needs for defense, energy, industrial controls, and other critical infrastructure. Implementations of the products include file-loss detection and a modular design with a secure gateway, providing reliability and fit in operational environments. This ability makes their solutions great for government, industrial and enterprise applications too.

-

In May 2024, ST Engineering launched an enhanced version of its Data Diode Secure Transfer Platform, featuring integrated AI-based anomaly detection and real-time file integrity verification to improve data loss prevention and cybersecurity resilience.

Data Diode Solution Companies are:

-

Belden Inc.

-

Siemens AG

-

ST Engineering Ltd.

-

Everfox

-

Owl Cyber Defense

-

OPSWAT (Fend Incorporated)

-

Advenica AB

-

Patton Electronics Co.

-

Fox-IT

-

Deep Secure Ltd.

-

Oakdoor Ltd.

-

Rohde & Schwarz GmbH & Co. KG

-

Rovenma

-

VADO Security Technologies Ltd.

-

Garland Technology

-

Waterfall Security Solutions Ltd.

-

Forcepoint LLC

-

Nexor Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 438.13 Million |

| Market Size by 2032 | USD 1299.84 Million |

| CAGR | CAGR of 14.59% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By By Key Technologies (Optical Isolation and Protocol Conversion), • By Application (Government, Energy and Power, Manufacturing, Oil and Gas, Aerospace and Defense, Critical Infrastructure and Others) • By Type (Regular Data Diode and Ruggedized Data Diode) • By Form Product (DIN Rail, Rack Mounted and Small/Portable) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | BAE Systems plc, Belden Inc., Siemens AG, ST Engineering Ltd., Fibersystem AB, Everfox, Owl Cyber Defense, OPSWAT (Fend Incorporated), Advenica AB, Patton Electronics Co., Fox-IT, Deep Secure Ltd., Oakdoor Ltd., Rohde & Schwarz GmbH & Co. KG, Rovenma, VADO Security Technologies Ltd., Garland Technology, Waterfall Security Solutions Ltd., Forcepoint LLC, Nexor Ltd. |