DC Chargers Market Size and Overview

To get more information on DC Chargers Market - Request Sample Report

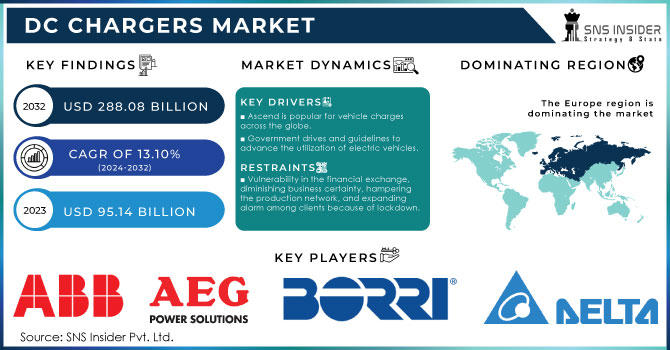

The DC Chargers Market Size was valued at USD 95.14 Billion in 2023 and is projected to reach USD 288.08 Billion by 2032, growing at a CAGR of 13.10% over the forecast period 2024-2032.

DC chargers give DC power yield. DC batteries consume DC power and are utilized to charge batteries for gadgets, alongside auto and modern applications. They convert the information sign to a DC yield signal. DC chargers are the favored kind of chargers for the greater part of electronic gadgets. In DC circuits, there is a unidirectional progression of the current instead of the AC circuits. DC power is utilized at whatever point, AC power transmission is not possible to ship. The DC chargers are progressively used to charge convenient electronic gadgets like mobile phones, workstations, tablets, and other wearable gadgets. The worldwide DC chargers market income is supposed to observe critical development as the interest for these convenient gadgets is on the ascent. DC chargers track down applications in cell phones, PCs, tablets, electric vehicles, and modern hardware.DC chargers for electric vehicles are the most recent advancement in the car business. They give DC power straightforwardly to electric vehicles. DC chargers for electric vehicles have made it conceivable to cover the distance of 350 km and more in a solitary charge. The quick DC charging has helped the vehicle proprietors and drivers to re-energize during their voyaging time or on a brief break rather than being connected for the time being, for several hours to get charged. Various sorts of quick DC chargers are accessible on the lookout. They are joined charging framework, CHAdeMO, and Tesla supercharger.

The DC chargers market is witnessing remarkable growth, driven by the rising adoption of electric vehicles (EVs) and the pressing need for a comprehensive charging infrastructure. This expansion is largely fueled by the demand for efficient and rapid charging solutions that cater to the expanding EV user base. As nations, including India, increasingly focus on sustainable transportation and greener technologies, investments in fast-charging infrastructure are anticipated to soar.ZETWERK's recent approval of 60kW and 120kW DC fast chargers by the Automotive Research Association of India (ARAI) exemplifies the initiatives aimed at enhancing EV infrastructure in the country. This certification aligns perfectly with the government's 'Make-in-India' initiative, emphasizing the commitment to strengthening the electric vehicle ecosystem. Through a partnership with Indian Oil Corporation Limited (IOCL), ZETWERK plans to install over 1,400 fast chargers, featuring advanced options like the DC Dual Gun CCS2 DC Charger, which will greatly enhance accessibility to charging stations. Such efforts are essential for tackling the challenges of charging availability and improving the overall experience of EV ownership. ZETWERK is in the process of developing Super DC Chargers of 240 kW and 360 kW, designed for commercial and public charging stations, which offer even faster charging capabilities. This initiative not only meets the growing consumer demand for rapid charging solutions but also reflects a broader market trend towards high-capacity charging infrastructure that aligns with the evolving needs of electric vehicle users. As the DC fast chargers market continues to grow, the introduction of innovative technologies and strategic collaborations will be crucial in shaping the future of electric mobility in India and beyond.

DC Chargers Market Dynamics

Drivers

-

The Role of Advanced DC Chargers Market in speeding up EV adoption.

The significant increase in global electric mobility is largely being fueled by advancements in charging technology, specifically the development of high-capacity DC fast chargers. An outstanding instance is the Alpitronic HYC400, which is now the initial 400-kilowatt (kW) charger approved by UL Solutions in Europe, signifying a significant achievement in the realm of EV charging. This certification helps Alpitronic break into the North American market and demonstrates dedication to improving the safety, reliability, and performance of electric vehicle (EV) charging solutions. With governments around the world aiming to boost the presence of electric vehicles on the roads by 2030, the need for effective charging infrastructure is becoming increasingly urgent. The HYC400 tackles a key obstacle in EV adoption – range anxiety and the time taken for charging – by significantly decreasing charging times in comparison to traditional methods. The increased focus on fast chargers mirrors the overall trend in the DC fast charger industry, which is experiencing a rise in installations as electric vehicle sales increase and efforts are made to enhance the accessibility and compatibility of charging networks. In the last ten years, there has been a notable growth in the EV charging infrastructure, specifically in public charging stations, especially fast chargers, due to the increased popularity of electric vehicles. By advancing in charging technology, industry leaders like Alpitronic are improving the user experience and driving the shift towards electric mobility, thereby promoting a sustainable transportation future.

Restraints

-

Overcoming Major Challenges Impacting the DC Chargers Market

The DC chargers market, while experiencing significant growth, faces several restraints that could impede its expansion. One major challenge is the high infrastructure development costs associated with installing fast charging stations. According to a report from the International Energy Agency (IEA), the average cost of a DC fast charging station can range from $50,000 to $150,000, which poses a significant investment barrier for potential operators, especially in developing regions. Additionally, the lack of standardization in charging protocols complicates interoperability among different EV models and charging systems, leading to consumer confusion and limiting user adoption. Moreover, the relatively limited availability of electrical grid capacity in certain areas can restrict the deployment of high-capacity DC chargers, creating bottlenecks in urban and rural settings alike. Furthermore, safety regulations and certifications, although necessary for ensuring reliable performance, can prolong the time to market for new charging technologies. As the demand for electric vehicles continues to rise, addressing these challenges is crucial for the sustainable growth of the DC chargers market. The U.S. Department of Energy emphasizes the need for comprehensive strategies to improve charging infrastructure accessibility to support the EV ecosystem effectively.

DC Chargers Market Segment Outlook

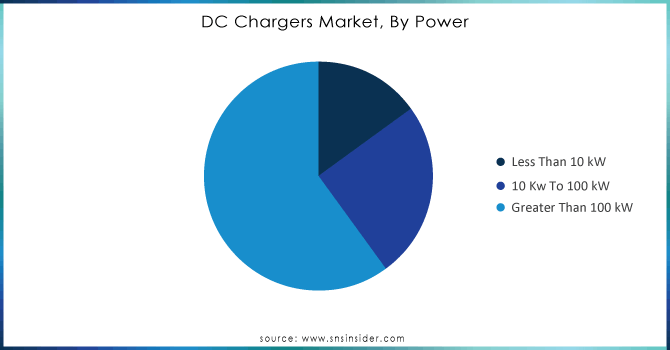

By Power

Based on Power, Greater Than 100 kW is captured the largest share in DC Chargers Market with 60% of share in 2023. This dominance is primarily attributed to the growing demand for rapid charging solutions that cater to the increasing number of electric vehicles (EVs) on the roads. High-capacity chargers significantly reduce charging times, which is crucial for enhancing the user experience and mitigating range anxiety among EV users. Leading companies in the industry, such as Alpitronic and ZETWERK, have made substantial strides by launching advanced chargers that cater to this segment. For instance, Alpitronic recently launched the HYC400, a 400 kW DC fast charger that has achieved UL certification, reinforcing its commitment to delivering high-performance charging solutions. Similarly, ZETWERK's launch of the 60 kW and 120 kW DC fast chargers, along with their plans to develop Super DC Chargers of 240 kW and 360 kW, demonstrates a focused approach to expanding the high-power charging infrastructure in India. These innovations not only enhance charging efficiency but also align with global trends towards sustainable transportation and increased EV adoption, positioning greater than 100 kW chargers as the backbone of future charging networks.

To Get Customized Report as per your Business Requirement - Request For Customized Report

By End User

Based on End User, Automotive is hold the largest share in DC Chargers Market with 60% of share in 2023. This dominance is largely driven by the rapid expansion of the electric vehicle (EV) market, as consumers increasingly shift towards sustainable transportation solutions. Major automotive manufacturers are investing heavily in electric mobility and, consequently, in the development of robust charging infrastructures. Companies like Tesla have significantly contributed to this growth by establishing extensive networks of high-capacity Superchargers that cater specifically to their EV lineup, ensuring fast charging capabilities that enhance user convenience. Additionally, Ford has been expanding its EV offerings and is partnering with charging network providers to install DC fast chargers across the United States. General Motors is also advancing its initiatives by planning to deploy thousands of fast chargers nationwide to support its growing electric vehicle lineup. Furthermore, new entrants such as Rivian are innovating in the automotive space, creating their own fast-charging networks tailored for their electric trucks. This concerted effort from automotive companies not only strengthens the infrastructure but also encourages greater EV adoption, ensuring that the automotive sector remains the pivotal driver of growth in the DC chargers market.

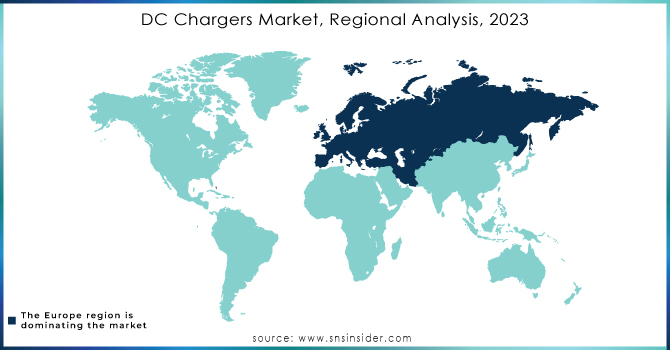

DC Chargers Market Regional Analysis

Asia-Pacific dominated the largest share revenue in DC Chargers with 42% of share in 2023. This leadership is fueled by the region's robust electric vehicle (EV) adoption rates, supported by favorable government policies and substantial investments in charging infrastructure. Countries like China have taken significant strides, with initiatives aimed at expanding EV charging networks nationwide, reflecting their commitment to reducing carbon emissions and promoting green technology. The Chinese government has set ambitious targets to increase the number of charging stations, thus facilitating broader EV acceptance. In India, ZETWERK made notable advancements by launching its 60 kW and 120 kW DC fast chargers, which have been approved by the Automotive Research Association of India (ARAI). These chargers are set to enhance the country’s EV infrastructure and align with the ‘Make-in-India’ initiative. Furthermore, the collaboration between ZETWERK and Indian Oil Corporation Limited (IOCL) to install over 1,400 fast chargers is poised to significantly improve the accessibility of charging stations across the country. Meanwhile, Japan continues to innovate with companies like Mitsubishi and Nissan, developing high-capacity chargers that cater to the growing EV market. Collectively, these developments position Asia-Pacific as a key player in shaping the future of electric mobility globally.

In 2023, North America has emerged as the fastest-growing region in the DC chargers market, driven by a surge in electric vehicle (EV) adoption and increasing investments in charging infrastructure. The region is experiencing a robust transformation in its transportation landscape, fueled by federal initiatives and state-level incentives aimed at promoting electric mobility. Companies like Tesla continue to lead the charge, expanding their extensive Supercharger network across the United States and Canada, providing high-capacity charging solutions that significantly reduce charging times for EV users. Additionally, ChargePoint has announced the deployment of its new Express 250 DC fast chargers, designed to deliver rapid charging for a variety of electric vehicles, enhancing the convenience for drivers and supporting the growing demand for fast charging solutions. Electrify America is making significant strides by launching over 800 DC fast charging stations across the country, aiming to create an extensive network that supports both urban and rural EV users. The Biden administration's commitment to installing 500,000 public chargers by 2030 is also fostering an environment conducive to market growth, encouraging partnerships between government and private enterprises to enhance charging accessibility. This strategic focus on building a robust charging infrastructure not only solidifies North America's position as a leader in the EV sector but also establishes a comprehensive ecosystem that supports the ongoing transition to electric mobility.

Key Players

Some of the Major Players in DC Chargers Market who offer their product and offering:

-

ABB Ltd. (Terra HP, Terra 94 DC fast chargers)

-

Aeg Power Solutions (3W Power S.A.) (Protect 8 series DC chargers)

-

Borri S.P.A (Legrand Group) (E3001 series DC chargers)

-

Delta Electronics, Inc. (Delta Ultra Fast Charger, DC Wallbox)

-

Helios Power Solutions Group (Helios DC Power Systems)

-

Hitachi Hi-Rel Power Electronics Private Ltd. (Hitachi, Ltd.) (RANGE IGBT-based DC chargers)

-

Kirloskar Electric Company Ltd. (Kirloskar DC fast chargers)

-

Phihong Technology Co., Ltd. (Phihong DC Fast Charging Station)

-

Siemens AG (SICHARGE D series DC chargers)

-

Statron Ltd. (Statron DC Power Systems)

-

Tritium Pty Ltd. (RTM 75 and PKM 150 DC fast chargers)

-

Schneider Electric SE (EVlink DC fast chargers)

-

EVBox Group (EVBox Troniq Modular DC charger)

-

Alpitronic GmbH (HYC 300/350 DC fast chargers)

-

Efacec Power Solutions (HV160 and QC45 DC fast chargers)

-

Tesla, Inc. (Supercharger V3)

-

BYD Company Ltd. (DC Fast Chargers for electric buses and trucks)

-

Blink Charging Co. (IQ 200 DC fast charger)

-

BP Pulse (BP Pulse Ultra-Fast DC Chargers)

-

EVgo Services LLC (150kW and 350kW DC fast chargers)

-

Others

Recent Development

-

On May 14, 2024, Exicom unveiled India's fastest DC charger for electric vehicles, the Harmony Gen 1.5. This advanced DC fast charger boasts a modular design, offering power outputs ranging from 60 kW to 400 kW. It is designed for versatile use, making it ideal for in-city locations, highways, and heavy-duty fleets, marking a significant leap in India's EV charging infrastructure.

-

On September 18, 2024, General Motors announced that its drivers can now access over 17,800 Tesla Superchargers using a GM-approved NACS DC adapter. This move expands GM customers' access to more than 231,800 public Level 2 and DC fast chargers across North America.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 95.14 Billion |

| Market Size by 2032 | USD 288.08 Billion |

| CAGR | CAGR of 13.10 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Power Output (Less Than 10 Kw, 10 Kw To 100 Kw, Greater Than 100 Kw) • By End User(Automotive, Consumer Electronics, And Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Ltd., Aeg Power Solutions (3w Power S.A.), Borri S.P.A (Legrand Group), Delta Electronics, Inc., Helios Power Solutions Group, Hitachi Hi-Rel Power Electronics Private Ltd. (Hitachi, Ltd.), Kirloskar Electric Company Ltd, Phihong Technology Co., Ltd., Siemens Ag, Statron Ltd.,Tritium Pty Ltd. ,Schneider Electric SE ,EVBox Group ,Alpitronic GmbH ,Efacec Power Solutions ,Tesla, Inc. ,BYD Company Ltd., Blink Charging Co. ,BP Pulse ,EVgo Services LLC & Others |

| Key Drivers | • The Role of Advanced DC Chargers Market in speeding up EV adoption. |

| RESTRAINTS | • Overcoming Major Challenges Impacting the DC Chargers Market |