Cooking Robot Market Size & Growth Insights:

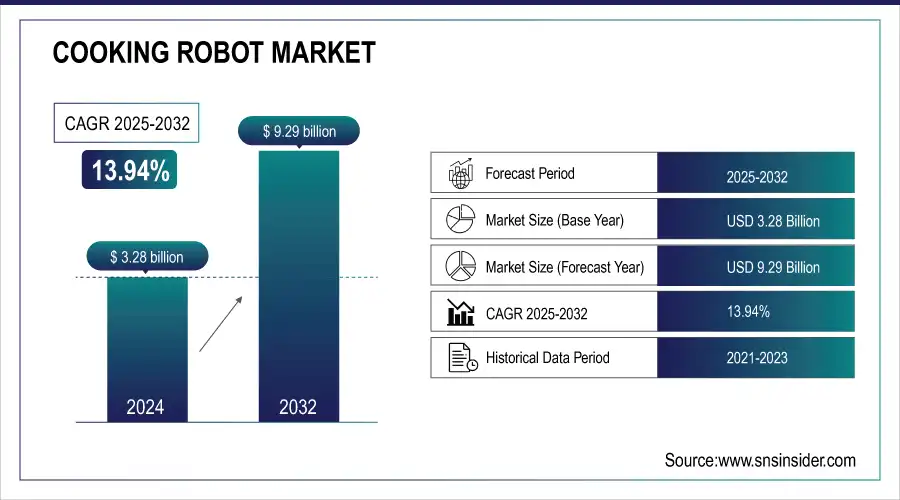

The Cooking Robot Market size was valued at USD 3.28 billion in 2024 and is expected to reach USD 9.29 billion by 2032 and grow at a CAGR of 13.94% over the forecast period of 2025-2032.

The global cooking robot market analysis covers detailed market performance, pricing trend, feature preference, and technology integration across consumer and commercial segments. Key drivers include increasing kitchen automation, rising urban lifestyle, and growing demand for convenience. Along with this, AI-based Meal preparation solutions are improving user experience which is further boosting global expansion. The cooking robot market is all set to witness a high share of North America, Asia Pacific, and Europe across all product types, functionality, and end-user applications.

To Get more information on Cooking Robot Market - Request Free Sample Report

For instance, customer retention for premium cooking robots stood at 87%, driven by high ease-of-use and time-saving benefits.

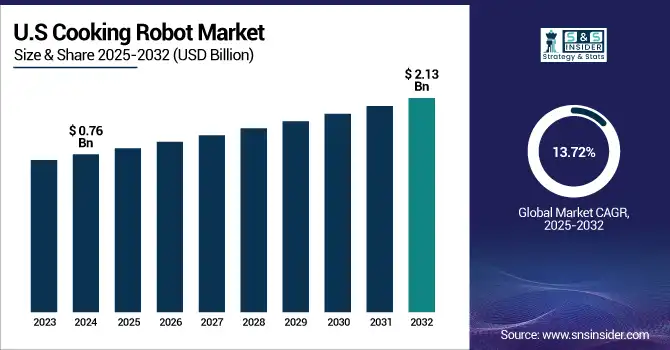

The U.S. Cooking Robot Market size was USD 0.76 billion in 2024 and is expected to reach USD 2.13 billion by 2032, growing at a CAGR of 13.72% over the forecast period of 2025–2032.

The U.S. market is major beneficiary of the rising application in smart home concepts in urban homes, rising cost of labor in food and hospitality industries. The extensive penetration and tech-savvy consumer population is accelerating the demand further. Moreover, the AI incorporation, and collaborations with various size of kitchen, hospitality and food industry institutions can increase the horizon further. These across both consumer and enterprise users.

For instance, more than 75% of new cooking robot models in the U.S. feature AI for automated recipe selection and adaptive cooking.

Cooking Robot Market Dynamics:

Key Drivers:

-

Growing Automation in the Commercial Foodservice Industry to Reduce Labor Dependency and Enhance Efficiency

The commercial foodservice industry, including restaurants, hotels, and cloud kitchens, is increasingly adopting cooking robots. Rising labor costs and a shortage of skilled employees are key growth enablers. Restaurants and cloud kitchens benefit immensely from offering uniform quality, faster service, and 24/7 operations with minimum human intervention. Moreover, minimal human involvement reduces the risk of errors, and maintenance and hygiene considerations, making it more viable from a health and safety perspective. The hospitality sector continues to move forward with AI, robotics, and IoT, making them a sweet spot for cooking robots. Chain restaurants and automated food kiosks are the most common providers in this category. Developed markets and high-footfall commercial spaces will significantly fuel this trend.

For instance, 84% of hospitality operators cited improved hygiene and safety compliance as the key benefit of robotic kitchen adoption.

Restraints:

-

Lack of Consumer Awareness and Limited Availability in Developing Regions Impact Market Penetration

Consumer awareness of cooking robot solutions is not present in much of the developing world, due in part to limited means of access to retail channels where they could be found. Low visibility owing to having limited marketing outreach, very high localization needs on foods preferences, and very low presence of regional distributors. Often, buyers question the cooking performance or usability of the robot. Plus, regional cuisines can demand subtle techniques that current models cannot program. Also this gap of knowledge & access sets apart larger adoption in the countries including Latin America, Africa & parts of South East Asia.

Opportunities:

-

Integration With Smart Home Ecosystems and Voice Assistants Will Create Massive Expansion Potential

Consumers are now looking for nutrition, and individualized meals customized for their specific dietary and fitness needs. This is where cooking robots that come with meal planning functions and calorie tracking capabilities come in handy, as they fulfil this demand with precision and accuracy. With interest in healthful living spreading into the urbane populace, automated portioning, diet computation and dietary regimen recommendation via cooking robots can therefore serve as a major advantage. Combination with health apps and wearable wellness devices will only accelerate adoption among the health-oriented base. Wellness is a trend with particularly strong traction amongst developed markets and emerging amongst global, fitness-oriented millennials.

For instance, millennials and Gen Z account for 65% of users interested in diet-linked robotic kitchen solutions.

Challenges:

-

Rising Health and Nutrition Awareness Fuels Demand for Personalized, Automated Meal Planning Robots

However, Cooking robots struggle with regional cuisines which require better techniques, spices and cooking style. Though robots are adept at following simple recipes, executing the complex preparation of dishes deeply entrenched in culture, is not yet possible. Localization for each market is high, requiring custom engineering and R&D in large effort. This hampers product rollout, and minimizes scalability for manufacturers. Additionally, consumer confidence in traditional dishes cooked by robots is still low. To solve this, AI innovation, recipe learning prowess, and collaboration with local culinary experts will be needed to help address disconnects in cultural acceptance and functionality.

Cooking Robot Market Segmentation Analysis:

By Type

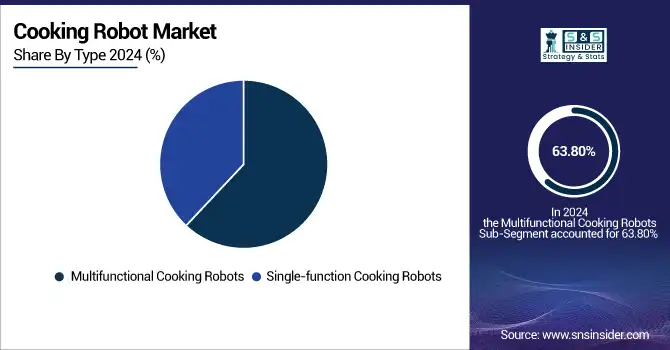

Multifunctional Cooking Robots accounted for the maximum revenue share in the Cooking Robot Market, and that is about 63.80% in 2024 and is expected to grow at the fastest CAGR of nearly 14.26% during 2024–2032, as these cooking robots can chop, stir, cook, and clean. They are loved for the one-stop solution they provide to the home and commercial users who seek convenience, space-saving and automation. The adoption has been powered by smart, compact and feature-rich multifunctional units, such as those offered by Thermomix (by Vorwerk). Other features such as guided recipes and voice control make them even more attractive.

By Features

The Cooking Robot Market was dominated by the Automated Cooking segment, which accounted for approximately 33.50% in 2024, as we all know every one of feels a need of time savers for cooking that can cook you food by themselves. When it comes to preparing meals on a daily basis, consumers want consistency more than ever. So at the center of this is the idea of automated cooking, which is a staple offering from brands such as Moley Robotics, which designs robotic kitchen systems that can automate all the different tasks associated with cooking. This ensures wide usage across home kitchens and high-efficiency commercial environments.

The Voice Control segment is projected to witness the highest CAGR of approximately 16.42% during the forecast period (2024–2032) owing to its growing adoption with smart home assistants. With this demand for hands-free, LG Electronics is developing cooking robots that listen to voice commands and are compatible with voice control platforms, including Google Assistant. It increases user engagement, adjustments in real time and cross-device compatibility, which expediates the adoption process across residential smart homes.

By Price Range

The Cooking Robot Market was dominated by mid-range ($500–$1,000) segment with a revenue share of approximately 41.30% in 2024, strikes a balance between affordability and advanced features. These models appeal to urban middle-class households that are looking for smart kitchen technology. Panasonic and other companies offer affordable cooking robots that have built-in smart features suitable for modern homes. They remain strong drivers of both volume and revenue, thanks to pricing and their mass-market appeal also for performance.

The Premium ($1,000 and above) segment is anticipated to witness the fastest CAGR of nearly 14.41% during the forecast period as a result of increasing demand for high-end consumers and premium foodservice providers for luxury foodservice providers. Commercial kitchen robots, such as Miso Robotics' Flippy, are contributing significantly to the growth of this market segment. These features make them attractive to high-end restaurants and even smart home aficionados with their AI-driven predictive accuracy and ability to automate lengthy preparation work.

By End-User

The residential segment accounted for the highest Cooking Robot Market share of approximately 58.90% in 2024 due to the need for time-saving and easy-to-use solutions in the home kitchen. With so many dual-income households and smart appliances, robots may seem a wonderful addition. The CEOs/Directors build upon this premise to say -- Companies such as Zimplistic, manufacturers of Rotimatic, are at the helm of the home-cooking automation wave with niche products designed for everyday use that have led to residential market leadership.

The commercial segment is expected to observe the highest CAGR of approximately 14.13% over the forecast period 2024–2032, owing to deployment of automation in restaurants and hotels for better food quality and efficiency. Automation is revolutionising the foodservice sector — and Picnic Works is one such example with its pizza-making robots made for mass production. These innovations enable less labor dependence, greater consistency, and lower operational costs that propel the commercial segment growth.

Cooking Robot Market Regional Insights:

In 2024, North America captured the largest revenue share of approximately 31.20% in the Cooking Robot Market, owing to early adoption of kitchen automation technologies and significant presence of major players in the U.S. High disposable income paired with a mature smart home infrastructure and substantial investments in residential and commercial AI powered devices contribute to the growth in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. dominates the North American cooking robot market due to early smart home adoption, high disposable income, advanced R&D ecosystem, and strong presence of tech firms. Commercial kitchen automation is also accelerating growth across restaurants, hotels, and foodservice chains.

Asia Pacific is projected to register the highest CAGR of approximately 14.64% during the forecast period 2024–2032 due to rapid urbanization, growing disposable income, and home automation acceptance among consumers. China, Japan and South Korea are at the forefront of innovation and adoption, due in part to government policy assistance, and consumer population more prone to incorporating robotic solutions into their everyday lives.

-

China leads the Asia Pacific market with strong manufacturing capabilities, rising urbanization, government support for AI, and increasing consumer demand for smart appliances. Domestic companies and startups are actively innovating affordable and multifunctional cooking robots for urban households and small restaurants.

Europe’s cooking robots industry is expanding steadily due to growing interest in smart kitchen technologies, labor shortages in the foodservice sector, and strong environmental and energy efficiency regulations. Countries including Germany, France, and the U.K. are investing in AI-driven culinary automation. Rising health-consciousness and demand for precision-based meal prep are further driving residential and commercial adoption across the region.

-

Germany dominates the European cooking robot market due to its advanced automation industry, strong consumer demand for smart appliances, and high R\&D investment. Its tech-driven ecosystem and early adoption of innovative kitchen technologies give it a competitive edge over other countries.

The Middle East & Africa region is led by the UAE, driven by luxury living trends, smart home adoption, and rising tech investments. In Latin America, Brazil dominates due to its expanding urban population, increasing interest in kitchen automation, and growing integration of cooking robots in modern residential and commercial kitchens.

Cooking Robot Companies are:

Major Key Players in Cooking Robots Market are Moley Robotics, Sony Corporation, Samsung Electronics, LG Electronics, Panasonic Corporation, Bosch, Breville Group Limited, Electrolux AB, Chowbotics, Nymble Labs, Bear Robotics, Karakuri Ltd., Picnic Works, Cecilia.ai, Miso Robotics, Dexai Robotics, Anova Culinary, Thermomix, Zimplistic and Suvie Smart Kitchen and others.

Recent Developments:

-

In July 2025, Vorwerk Spain reported recovery with 117 million euros in real sales, marking a 1% year-over-year increase and demonstrating resilience amid competition from lower-cost brands such as Lidl and Cecotec.

-

In October 2024, Moley hosted a high‑profile virtual cooking showcase featuring its fully robotic kitchen, highlighting models such as the B‑AiR and Chef’s Table kitchens designed for luxury residential and commercial use.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.28 Billion |

| Market Size by 2032 | USD 9.29 Billion |

| CAGR | CAGR of 13.94% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Multifunctional Cooking Robots and Single-function Cooking Robots) • By Features (Automated Cooking, Guided Recipes, Wireless Connectivity, Voice Control and Meal Planning) • By Price Range (Budget-friendly (Under $500), Mid-range ($500-$1,000) and Premium ($1,000 and above)) • By End-User (Residential and Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Moley Robotics, Sony Corporation, Samsung Electronics, LG Electronics, Panasonic Corporation, Bosch, Breville Group Limited, Electrolux AB, Chowbotics, Nymble Labs, Bear Robotics, Karakuri Ltd., Picnic Works, Cecilia.ai, Miso Robotics, Dexai Robotics, Anova Culinary, Thermomix, Zimplistic and Suvie Smart Kitchen. |