LED Video Wall Market Report Scope & Overview:

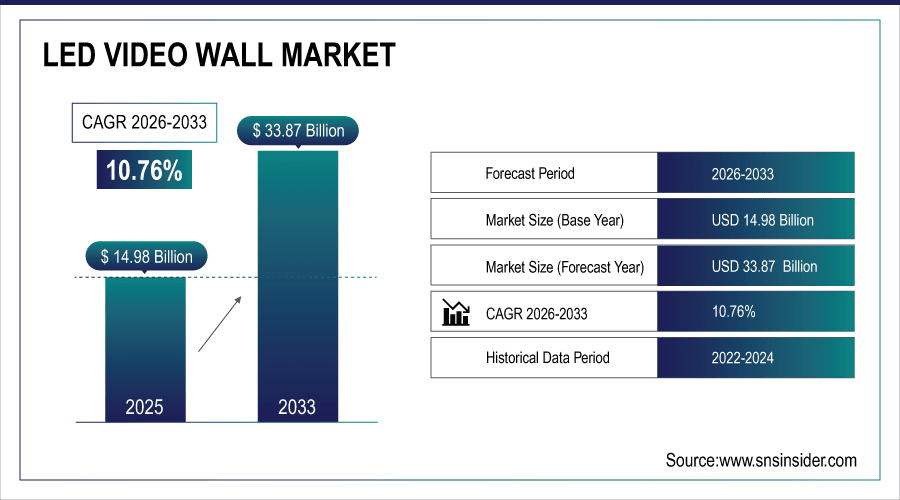

The LED Video Wall Market size was valued at USD 14.98 Billion in 2025E and is projected to reach USD 33.87 Billion by 2033, growing at a CAGR of 10.76% during 2026-2033.

The LED Video Wall Market is expanding due to the high-definition displays in retail, sports and entertainment are driving growth of the LED Video Wall Market. Developments in fine-pitch and micro-LEDs are fueling uptake for immersive. The LED panel is becoming more affordable and the move from LCD/Projection has been happening at a faster pace. Increased adoption across smart cities, airports and business establishments are contributing to this growth.

Fine-pitch and micro-LED shipments are expected to rise by 35% YoY in 2024, as falling panel prices accelerate LCD/projection replacement; smart city and corporate deployments now account for nearly 40% of new installations, driven by energy savings and 100,000+ hour lifespans.

To Get More Information On LED Video Wall Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 14.98 Billion

-

Market Size by 2033: USD 33.87 Billion

-

CAGR: 10.76% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

LED Video Wall Market Trends

-

The rapid rise of fine-pitch LED walls (<2mm pixel pitch) is revolutionizing visualization for retail, command centers and broadcasting markets providing crisp and immersive representation.

-

As a superior substitute for the current modular LED Display, we’re seeing micro-LED become increasingly popular among integrators thanks to its unparalleled brightness, exceptional energy efficiency and long-lasting performance making it a premium technology option for videowalls of the future.

-

Corporate, airports and shopping malls are increasingly turning to indoor LED video walls for digital signage, advertising and communication, bringing higher demand for personalized large-scale displays.

-

Declining LED panels production cost and the economies of scale achieved will bring average selling prices of video walls down, making this format feature affordable for both SMEs and middle-sized businesses.

-

LED video wall solutions are also part of smart city efforts by governments for traffic control, public information and security, which in turn offer substantial long-term multi-facility deployment opportunities.

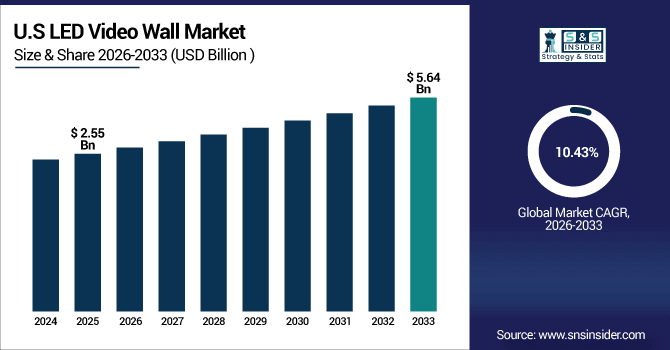

The U.S. LED Video Wall Market size was valued at USD 2.55 Billion in 2025E and is projected to reach USD 5.64 Billion by 2033, growing at a CAGR of 10.43% during 2026-2033. LED Video Wall Market growth is driven by increasing demand across sports arena, retail stores and corporate communication solution will boost US LED video wall market. Introduction of fine-pitch and micro-LED market displays is gaining attraction. Rising installation of digital signage for advertising and branding drive the market growth.

LED Video Wall Market Growth Drivers:

-

Rising Demand for High-Resolution Displays Across Retail, Sports, Entertainment, and Corporate Applications Worldwide.

The LED Video Wall Market is expanding because of rising demand for visually appealing communication solutions is propelling the LED video wall market. Retail and advertising sectors deploy LED walls to increase consumer interactivity. Stadiums and arena use big screens for an immersive experience. As it becomes increasingly common, we see video walls being installed in corporate offices to allow presentations and real-time data display. More recent advances such as fine-pitch LEDs enhance both clarity and performance. Together, they form an environment of continuous global demand and market expansion.

In 2024, global LED video wall installations in retail and advertising are projected to grow by 28% YoY, with interactive displays boosting customer engagement by up to 40% and driving ROI for brands investing in experiential marketing.

LED Video Wall Market Restraints:

-

High Initial Investment and Maintenance Costs Limit Adoption Among Small and Medium-Sized Enterprises Globally

The LED Video Wall Market faces several restraints that may hinder its growth potential. Although the market has seen a decline in panel prices, LED video walls still require large amounts of capital outlay when compared with LCD or projection technologies. Added to the cost of ownership is installation complexity and space demands. Maintenance cost, including re-calibration and repairing is significantly expensive. SMEs, which have reduced budgets, tend to postpone acceptance as alternated cheaper types of display exist. The absence of standard prices for the same types of tests and procedures by area only serves to muddy the waters even more. These barriers limit penetration in cost-sensitive regions, depressing overall growth rates.

LED Video Wall Market Opportunities:

-

Growing Integration of LED Video Walls in Smart Cities, Transportation Hubs, and Digital Advertising Networks

The LED Video Wall Market is witnessing strong opportunities as advancements in global smart city projects are driving massive digital display demand. Airports, metro stations and highways are utilizing LED video walls more and more as an information hot spot. LED walls are used by municipalities in traffic and public safety. LED marketing campaigns are being scaled for visibility in digital out-of-home (DOOH) advertising networks. Sustainable goals are best supported by energy-saving long life LED panels. This presents substantial long-term potential for manufacturers and service providers.

In 2024, smart city digital display deployments are surging — over 75% of new urban infrastructure projects globally integrate LED video walls in airports, metros, and highways, with DOOH ad spend hitting $28 billion, 35% of which flows into LED-based networks for high-impact visibility.

LED Video Wall Market Segment Analysis

-

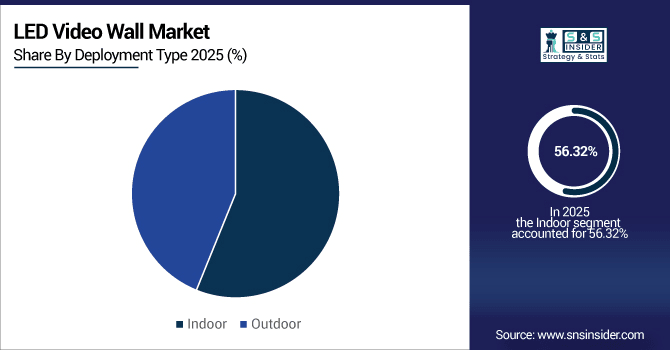

By deployment type, indoor LED video walls led the market with a 56.32% share in 2025E, while outdoor installations are expected to grow fastest with a CAGR of 9.33%.

-

By application, the retail sector dominated with a 35.67% share in 2025E, whereas transportation is forecasted to be the fastest-growing application segment, registering a CAGR of 8.34%.

-

By type, Direct View LED video walls led the market with a 51.23% share in 2025E and are also projected to record the fastest growth at a CAGR of 9.42%.

-

By end-user, media and advertising accounted for the largest share at 45.39% in 2025E, while transportation is anticipated to expand at the highest CAGR of 9.16%.

By Deployment Type, Indoor Leads Market While Outdoor Registers Fastest Growth

In 2025, LED video walls for indoor use leads the market, thanks to growing number of installations in retail shops, airports, shopping malls, and commercial buildings reflecting significant demand for high resolution and esthetics. Indoor advertisement, branding and communication companies are on the rise. Outdoor LED walls, meanwhile, will continue to see the fastest gains on demand in sports stadiums, transportation terminals and smart city projects where large-scale visibility is needed as well as strength to weather.

By Application, Retail Dominate While Transportation Shows Rapid Growth

In 2025, Retail applications account for the largest market share of LED video walls, as customers seek more immersive displays to engage shoppers, promote goods and services, or enhance in-store environment. The retail industry is another area that has great use of LED walls with dynamic and personal content. On the flip side, transportation is in a phase of quick expansion, with airports, railway stations and metro networks installing LED displays for passenger information, navigation, advertisement display and real-time communication which are driving growth.

By Type, Direct View LED Video Walls Lead and also Registers Fastest Growth

In 2025, Direct View LED video walls dominate the market because of its higher brightness, power efficient and upfront scaling vis-a-vis projection or LCD. Their capability for producing borderless, bezel-free screens are extremely appealing for scenarios at both business and entertainment. Direct View LED, too - sees the fastest growth as a result of developments in technology for fine pitch displays impacting panel costs, and broad-based usage including retail, corporate and government applications.

By End-User, Media & Advertising Lead While Transportation Grow Fastest

In 2025, Media & Advertising the market for LED video wall is dominated by the media and advertising sector where agencies & brands are using huge high definition displays in impactful digital campaigns, outdoor promotions or musical performances. And their skill to get the attention of the audience makes them favorite also. Market is expected to see highest growth in the transportation end-use application, as there is rising demand for LED walls in airports, metro stations and highways for passenger information, navigation, public safety alerts & advertisement purposes which will create significant global market demand.

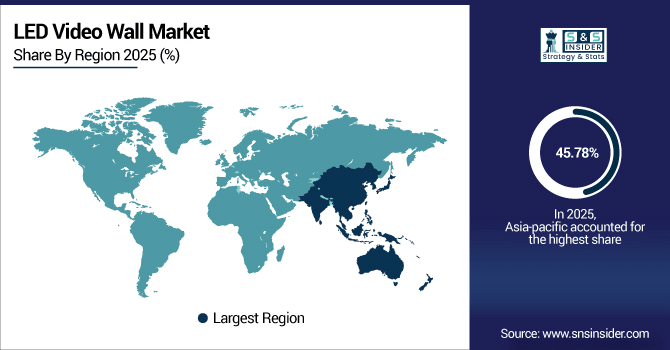

LED Video Wall Market Regional Analysis:

Asia-pacific LED Video Wall Market Insights

In 2025E Asia-Pacific dominated the LED Video Wall Market and accounted for 45.78% of revenue share and as well as witness the fastest growth with 11.07% CAGR, this leadership is due to the accelerated urbanization, growing retail and entertainment industry, and increasing acceptance of digital signage. Smart city government projects’ initiatives also support expansion in transportation and public segments. Also, a robust presence of manufacturing facilities in China, Japan and South Korea is driving market penetration.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China LED Video Wall Market Insights

China is the largest contributor to LED Video Wall Market and it’s domestic manufacturing capabilities. In retail, corporate offices and public infrastructure LED walls are becoming more common. Government funds for smart cities and digital displays in transportation is driving demand.

North America LED Video Wall Market Insights

North America in the LED Video Wall Market rising installation across sports arenas, retail as well media broadcast industry. Growth is being driven by corporate communications and digital signage offerings. Growing emphasis on indoor applications and interactive display drives the growth of the market. Broader deployment is supported by technology innovation and energy-efficient products.

U.S. LED Video Wall Market Insights

US is prevailing the North American LED Video Wall Market with corporate, retail and entertainment being the key applications. High-resolution, immersive displays are what the sports venues and media companies want. Furthermore, the use of both indoor and outdoor systems continues to grow with enhancements that create this potential.

Europe LED Video Wall Market Insights

In 2025, Europe outclasses Asia in LED Video Wall Market, with Germany, France, and the U.K. at the helm Industrial, retail and entertainment industries have been significant users. Digital signage and corporate communication investments fuel indoor installations increase. Out-of-door placements at transportation hubs and sports arenas are on the rise.

Germany LED Video Wall Market Insights

Germany is the bestselling country of the LED Video Walls in Europe due to strong retail, corporate and industrial applications. It is with mounting regularity that games and public venues use very high-definition LED walls. Market Growth Dynamics The display is the fastest evolving digital electronic part in a TV.

Latin America (LATAM) and Middle East & Africa (MEA) LED Video Wall Market Insights

In Latin America (LATAM) and Middle East & Africa (MEA), the retail, corporate, public infrastructure and hospitality end users are increasingly installing the LED video walls. Request Sample Growth Drivers The demand for smart glass in the Latin American countries such as Brazil and Mexico, Middle Eastern countries such as UAE and Saudi Arabia, and South Africa are fueled by smart city projects and large scale airports, transportation hubs and sports venues. Increase in the awareness regarding benefits of digital signage fosters market growth.

LED Video Wall Market Competitive Landscape:

Unilumin Group Co., Ltd. Founded in 2004, Unilumin is a leading LED application products and integrated solutions provider dedicated in LED product development, manufacturing, as well as worldwide sales and after-sales services. The company is enthusiastic about innovation, energy-efficient light sources and high-quality technologies; serving customers in the sports, entertainment, retail and corporate markets.

-

In April 2025, Unilumin showcased 1,800 sqm of LED solutions at Expo 2025 Osaka, enhancing global pavilion experiences with immersive visual technology.

Leyard Optoelectronic Co., Ltd. undertakes development and production of LED display solutions for indoor, outdoor, and rental applications. Leyard specializes in fine-pitch LED, video walls and interactive displays for retail, corporate, entertainment and broadcasting sectors. With innovation as its central identity, product robustness and install sizes are winning on a global stage in the LED video wall marketplace.

-

In May 2025, Leyard will exhibit at G2E Asia 2025 in Macao, presenting innovative LED display solutions tailored for the gaming industry.

Barco NV is a global technology company specializing in visualization products including LED walls, projectors and display systems. Providing healthcare facilities, concept stores, and entertainment venues with laser projectors, high-quality displays, and visualization technology, Barco focuses on the image in all its forms.

-

In June 2025, Barco will launch a new LED video wall platform at InfoComm 2025, introducing the NT-I series with refined pixel pitch options for control room applications.

Daktronics, Inc. is a United States based company providing LED video displays for sports/headline and transportation services as well as programming display systems around the world. The company provides big LED video walls and Scoreboards, and robust digital signage solutions with high brightness. Key strengths are innovation, energy efficiency and service support.

-

In April 2025, Daktronics installed 37 LED displays at CHI Health Center Omaha, featuring a five-display centerhung configuration with 2.5mm pixel spacing, enhancing the venue's digital video experience.

LED Video Wall Market Key Players:

Some of the LED Video Wall Market Companies are:

-

Unilumin Group Co., Ltd.

-

Leyard Optoelectronic Co., Ltd.

-

Barco NV

-

Daktronics, Inc.

-

Lighthouse Technologies Ltd.

-

Absen Optoelectronic Co., Ltd.

-

Samsung Electronics Co., Ltd.

-

LG Electronics Inc.

-

Sony Corporation

-

Panasonic Corporation

-

Sharp Corporation

-

Mitsubishi Electric Corporation

-

Toshiba Corporation

-

NEC Corporation

-

Philips Electronics N.V.

-

Planar Systems, Inc.

-

Christie Digital Systems USA, Inc.

-

Eizo Corporation

-

AU Optronics Corp.

-

Innolux Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 14.98 Billion |

| Market Size by 2033 | USD 33.87 Billion |

| CAGR | CAGR of 10.76% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Type (Indoor and Outdoor) • By Application (Retail, Corporate, Transportation, Hospitality, Entertainment and Others) • By Type (Direct View LED Video Walls, Indoor LED Video Walls and Blended Projection Video Walls System) • By End-User (Media & Advertising, BFSI, Healthcare, Education , Transportation and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Unilumin Group Co., Ltd., Leyard Optoelectronic Co., Ltd., Barco NV, Daktronics, Inc., Lighthouse Technologies Ltd., Absen Optoelectronic Co., Ltd., Samsung Electronics Co., Ltd., LG Electronics Inc., Sony Corporation, Panasonic Corporation, Sharp Corporation, Mitsubishi Electric Corporation, Toshiba Corporation, NEC Corporation, Philips Electronics N.V., Planar Systems, Inc., Christie Digital Systems USA, Inc., Eizo Corporation, AU Optronics Corp., Innolux Corporation |