Ultra-Wideband Market Size & Growth:

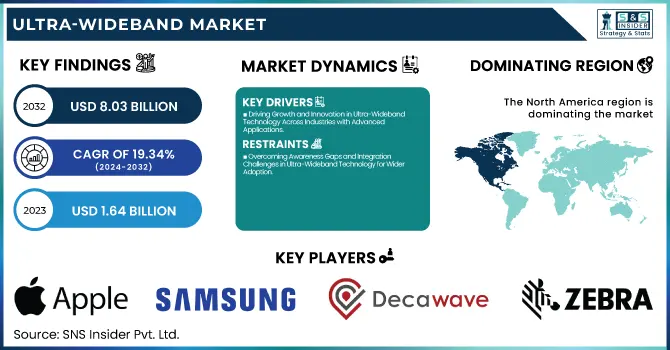

The Ultra-Wideband Market was valued at USD 1.64 billion in 2023 and is expected to reach USD 8.03 billion by 2032, growing at a CAGR of 19.34% over the forecast period 2024-2032. Demand for well-developed Ultra-Wideband (UWB) technology in automotive and industrial sectors and the widespread adoption of UWB products in consumer electronics are accounting for the rapid growth of the technology and products market. This is being and will continue to be increasingly implemented in smart home-enabled devices, asset-tracking products, and secure access control systems.

To Get more information on Ultra-Wideband Market - Request Free Sample Report

The advances in UWB technology have allowed UWB to provide features such as precision tracking, low power consumption, and security features such as anti-spoofing capabilities. The UWB conveys several advantages, from high accuracy location, fast data transfer, and high immunity to daylight to much better technical performance. And finally, operational improvements have made it easier to deploy and integrate into the IoT ecosystem while meeting characteristics such as reliable connection in challenging environments. These trends are leading UWB to become a key solution for next-generation wireless.

Ultra Wideband (UWB) Market Dynamics

Key Drivers:

-

Driving Growth and Innovation in Ultra-Wideband Technology Across Industries with Advanced Applications

Several factors are fuelling the growth of the Ultra-Wideband (UWB) technology, its possibilities are increasing across various industries. Real-time Location Systems (RTLS) market is driven by the growing demand for RTLS in healthcare, manufacturing, and logistics industry verticals. This is why the UWB has high accuracy for tracking assets, personnel, and equipment, making it perfect for positioning in an environment. Moreover, increasing penetration of smart home and smart building solutions is fueling demand for ultra-wideband owing to its secure access control, occupancy detection, and automated lighting applications. Additionally, the increasing integration of UWB technology in consumer premises equipment (CPE) including smartphones and wearables is also driving the growth of the market. The ongoing adoption is accelerated by incorporating UWB in companies like Apple and Samsung for better connectivity and tracking.

Restrain:

-

Overcoming Awareness Gaps and Integration Challenges in Ultra-Wideband Technology for Wider Adoption

A major challenge is the limited awareness and technical knowledge of end-users. With UWB being a rather niche tech, a lot of the industry does not bear sufficient awareness that could lead to effective implementation and utilization of its capabilities. This has the potential to slow adoption, particularly in areas where traditional positioning systems (e.g., Bluetooth or Wi-Fi) are already entrenched. Also, integration can be problematic due to the compatibility problems between UWB systems and current network infrastructures, forcing businesses to invest in either specialized hardware or systems upgrades.

Opportunity:

-

Unlocking Opportunities in Ultra-Wideband Technology for Automotive Industrial Automation and Smart Cities

Huge opportunities are emerging in the UWB market for automotive applications and industrial automation. UWB is gaining momentum in the automotive segment for secure access to cars, keyless ignition, and anti-theft. Focus area growth in smart city projects is also likely to present high revenue opportunities such as outdoor positioning systems for navigation and public safety. Additionally, 5G connectivity is evolving with UWB, improving communication experiences that pave the way for faster data transfer, larger bytes transferred, increased security levels, and improved convenience in IoT environments.

Challenges:

-

Addressing Regulatory Spectrum and Security Challenges in Expanding Ultra-Wideband Technology Applications

Regulatory issues and spectrum management are other key challenges. UWB works in the wide frequency range which may interrupt the other wireless communication systems if not managed properly. UWB is subject to stringent regulation in terms of transmission power levels that can affect its range and effectiveness. Moreover, another big challenge is data privacy and security, especially in cases such as healthcare, finance, and automotive, where the information is sensitive. With UWB adoption expanding, addressing these key risks is required to ensure continued penetration for UWB which relies upon improved encryption protocols and enterprise security frameworks that protect and mitigate improved beaconing.

UWB Technology Market Segments Analysis

By Positioning System

In 2023, the Indoor Positioning System segment occupied a large share of the Ultra-Wideband (UWB) market at 68.8%. Such dominance can be associated with its widespread adoption in smart buildings, warehouses, and healthcare facilities for accurate asset tracking as well as personnel monitoring. As a result, industries are moving towards UWB-based indoor positioning solutions that provide high accuracy even in GPS-denied and challenging indoor environments.

From 2024 to 2032, the Outdoor Positioning System is estimated to have the highest CAGR growth. The growth is due to increasing requirements for vehicle tracking, public safety, and smart city infrastructure. The UWB technology enhances the feasibility of accurate and secure positioning in spacious outdoor venues which makes it ideal for many applications like autonomous vehicles, transportation systems, and logistics and thus will result in swift growth over the next few years.

By End Use

The Ultra-Wideband (UWB) market was dominated by the Consumer Electronics segment in 2023, which accounted for the largest share of 45.2% driven by increased adoption of UWB technology in smartphones, smartwatches, and wearable devices. Major players such as Apple, Samsung, and Xiaomi have built support for UWB to allow for finer device tracking, easier secure file sharing, and improved interoperability between devices. This massive uptake has been a major spur for UWB's rollout of consumer hardware.

The automotive & transportation segment is predicted to to grow at the highest CAGR between 2024 and 2032. The automotive sector is adopting UWB in response to the growing need for secure keyless entry, vehicle tracking, and anti-theft systems. As automakers continue to develop better solutions to protect vehicles while also improving user convenience, UWB technology is becoming an important component for next-generation automotive applications.

By Application

In 2023, the Real-time Location System (RTLS) segment captured the largest share of the Ultra-Wideband (UWB) market, accounting for a significant 50.7% share. The increasing need for asset tracking, personnel monitoring, and inventory management in sectors such as healthcare, manufacturing, and logistics is driving this dominance. UWB accurately offers at least centimeter-level precision so that it can achieve perfect indoor positioning tasks even in sophisticated areas, enabling higher operational design and safety features.

During the forecast period 2024 to 2032, the fastest CAGR is anticipated in the Imaging segment. This growth has been driven mainly by the increasing adoption of UWB in the fields of medical imaging, security systems, and industrial inspection. Owing to its non-invasive nature and ability to image through obstacles with the help of high-resolution imaging, UWB is steadily gaining popularity in advanced medical diagnostics & security solutions contributing to a rapid expansion during the forecast period.

Ultra-Wideband Market Regional Insights

The Ultra-Wideband (UWB) market in North America stood at 33.5 % in 2023, owing to the ubiquitous adoption of UWB technology in the healthcare, automotive, and consumer electronics industries. The activity of major players such as Apple, Hewlett Packard Enterprise (HPE), and Decawave has fast-tracked on-the-board mounting of UWB in smart devices and enterprise solutions. Examples of UWB technology in consumer products include Apple using this for AirTag for accuracy. UWB-based RTLS solutions are also popular in U.S. healthcare facilities for medical equipment tracking (bio-sensors), staff and patient search, delivery, status monitoring, and the like to increase operational efficiency and safety.

The Asia Pacific region is anticipated to experience the fastest CAGR from 2024 to 2032. UWB adoption in consumer electronics and automotive sectors is increasing in countries like China, Japan, and South Korea. Take Xiaomi and Samsung for instance Both of these companies have included UWB in their latest devices and use the tech to connect with smart home devices or share files securely. Japan is another major contributor to this market, mainly due to the investments of automobile giants in developing UWB-based keyless entry and vehicle tracking systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Ultra-Wideband Market are:

-

Apple Inc. (U1 Chip)

-

Samsung Electronics Co., Ltd. (SmartThings Find)

-

Decawave (DW1000)

-

Qorvo, Inc. (UWB IoT Modules)

-

NXP Semiconductors (Trimension SR040)

-

Zebra Technologies (MotionWorks)

-

Sony Corporation (UWB-Based Tracking System)

-

Sewio Networks (RTLS UWB Tag)

-

Impinj, Inc. (Impinj Speedway Reader)

-

BeSpoon (UWB Positioning System)

-

Spark Microsystems (SR1000 UWB Transceiver)

-

Johanson Technology (UWB Antennas)

-

LitePoint (IQgig-UWB Tester)

-

Taoglas (UWB Antennas and Modules)

-

CEVA, Inc. (UWB IP Solutions)

Recent Trends

-

In February 2025, Samsung is set to revolutionize wireless audio by integrating Ultra-Wideband (UWB) technology into its upcoming wireless earbuds. This advancement promises faster pairing, low-latency audio, and enhanced spatial awareness.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.64 Billion |

| Market Size by 2032 | USD 8.03 Billion |

| CAGR | CAGR of 19.34% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Positioning System (Indoor Positioning System, Outdoor Positioning System) • By End Use (Residential, Automotive & Transportation, Manufacturing, Consumer Electronics, others) • By Application (Real-time Location System (RTLS), Imaging, Communication) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Samsung Electronics Co., Ltd., Decawave, Qorvo, Inc., NXP Semiconductors, Zebra Technologies Corporation, Sony Corporation, Sewio Networks, Impinj, Inc., BeSpoon, Spark Microsystems, Johanson Technology, LitePoint, Taoglas, CEVA, Inc. |