Licensed Sports Merchandise Market Report Scope & Overview:

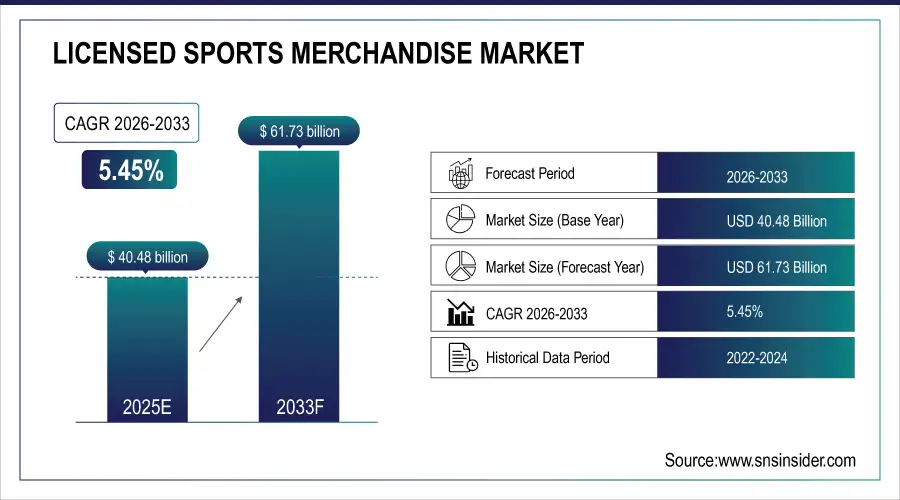

The Licensed Sports Merchandise Market Size was valued at USD 40.48 Billion in 2025E and is projected to reach USD 61.73 Billion by 2033, growing at a CAGR of 5.45% during the forecast period 2026–2033.

The Licensed Sports Merchandise Market analysis report presents growth factors that may influence future expansion, the range of products available, and the various services offered by major players. Increasing sales of clothing, collectibles, and footwear through both online and offline channels are driving market growth.

Licensed Sports Merchandise sales reached 1.2 billion units in 2025, driven by rising fan engagement and demand for apparel, footwear, and collectibles across channels.

Market Size and Forecast:

-

Market Size in 2025: USD 40.48 Billion

-

Market Size by 2033: USD 61.73 Billion

-

CAGR: 5.45% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Licensed Sports Merchandise Market - Request Free Sample Report

Licensed Sports Merchandise Market Trends:

-

Growing fan engagement and lucrative loyalty programs are driving demand for apparel, footwear and collectibles from major sports leagues.

-

Mention of sports events and competitions is fuelling interest in limited edition, exclusive merchandise.

-

E-commerce and omnichannel is making the world smaller and leveling regional sales.

-

Demand from consumers for quality, sustainable and officially licensed products is driving brands to innovate and offer more choice.

-

Focusing on market trends, that preference is for personalisation, brand partnerships and unique fan experiences to meet changing fan demands and lifestyle choices.

U.S. Licensed Sports Merchandise Market Insights:

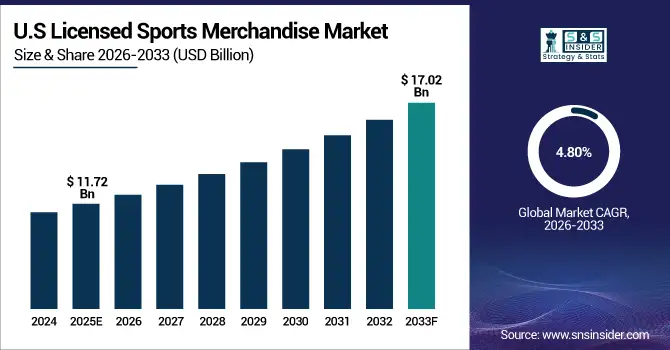

The U.S. Licensed Sports Merchandise Market is projected to grow from USD 11.72 Billion in 2025E to USD 17.02 Billion by 2033, at a CAGR of 4.80%. The growth is attributed with increasing popularity, demand of apparels, collectibles and footwear and the growing scope of adoption through on-line and off-line retail channels.

Licensed Sports Merchandise Market Growth Drivers:

-

Rising fan engagement and loyalty programs, fueling demand for apparel, collectibles, and exclusive sports merchandise.

Rising fan engagement and loyalty programs are the primary drivers of Licensed Sports Merchandise Market Growth. Mounting enthusiasm for the big league and major tournaments is driving sales of apparel, footwear and collectibles through online and offline retailers. E-commerce and modern retail reach urban and regional markets. Product appeal is being maximized, differentiation and long-term market positioning are being achieved through product features including limited editions, personalization and sustainable production.

Sales of Licensed Sports Merchandise grew 8.2% in 2025, driven by rising fan engagement, loyalty programs, and demand for apparel, collectibles, and footwear.

Licensed Sports Merchandise Market Restraints:

-

High licensing fees, counterfeit products, and limited access to official merchandise are constraining Licensed Sports Merchandise Market growth.

High licensing fees, counterfeit products, and limited access to official merchandise are key restraints for the Licensed Sports Merchandise Market. Brands are shackled by intricate exclusivity agreements and royalty due across various leagues and territories, which stifles operations. Brand damage and lost sales Merchandise that is faked erodes brand values and reduces authentic sales, most notably in emerging markets. Also, to develop premium quality officially licensed products takes significant capital expenditure often limiting ability to scale quickly and keep market share fair among old and new entrants.

Licensed Sports Merchandise Market Opportunities:

-

Expanding fan bases and digital engagement present opportunities for personalized, limited-edition, and collaborative sports merchandise offerings.

Expanding fan bases and growing digital engagement present significant opportunities for Licensed Sports Merchandise Market growth. With the demand of consumers for original, personalized products and limited editions, labels are embracing collaborations, exclusive collections and cutting-edge design. Sustainability, ethical production and digital customization become part of the brand value. The step-by-step trajectory of this trend of customization, individuality and conscious manufacturing gives a competitive edge to the products, continues to build loyalty among customers and helps in establishing sustainable growth.

Personalized and limited-edition sports merchandise accounted for 32% of new product launches in 2025, driven by growing fan engagement and digital customization trends.

Licensed Sports Merchandise Market Segmentation Analysis:

-

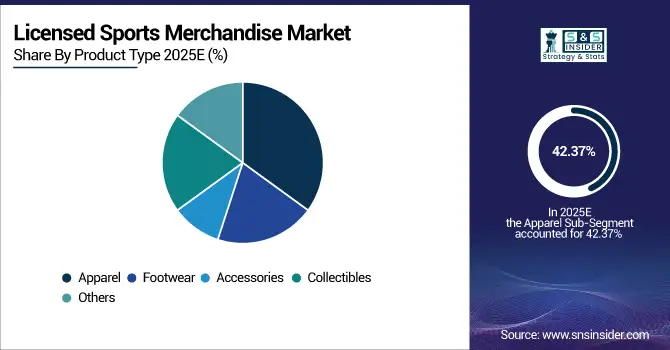

By Product Type, Apparel held the largest market share of 42.37% in 2025, while Collectibles are expected to grow at the fastest CAGR of 6.28% during 2026–2033.

-

By Sports Type, Football dominated with a 38.45% share in 2025, while Basketball is projected to expand at the fastest CAGR of 5.94%.

-

By Distribution Channel, Offline Retail accounted for the highest market share of 46.12% in 2025, and Online Retail is expected to record the fastest CAGR of 7.11%.

-

By End-Use, Fans held the largest share of 51.28% in 2025, while Corporate is expected to grow at the fastest CAGR of 6.03% during the forecast period.

By Product Type, Apparel Dominates While Collectibles Expand Rapidly:

Apparel segment dominated the market as they were highly popular with strong brand identification and frequently used by fans in sporting events. Wide-spread retail presence in online and offline channels, along with star endorsements and league tie ups horizontal growth is guarantee. Collectibles are the fastest growing segment, due to growing appetite for autographed items, limited edition product offerings and display-worthy merchandise. Premium designs, exclusive releases and fan loyalty are helping to drive their rapid growth.

By Sports Type, Football Dominates While Basketball Expands Rapidly:

Football segment dominated the market and this can be attributed to popularity of the sport, a loyal fan base and large licensing deals. Due to high participation during tournaments, and club loyalty, sales are steady. Basketball is the fastest growing segment, due to the rise of leagues such as NBA, social media, athlete endorsements. Younger consumers are attracted by limited-edition releases, fan-focused merchandise and new designs, expanding the segment quickly and providing long-term market growth across several geographies.

By Distribution Channel, Offline Retail Dominates While Online Retail Expands Rapidly:

Offline Retail segment dominated the market as it holds presence in malls, specialty stores and stadium shops which provided direct product engagement to the consumers. Dominance is bolstered by strong partnerships with leagues and sports brands. Online retail is the fastest-growing segment and rising factors are e-commerce penetration, convenience and reach. Exclusive debuts, customized products and web deals attract a younger following, driving usage, increasing market share and driving steady top-line growth.

By End-Use, Fans Dominate While Corporate Expands Rapidly:

Fans segment dominated the market by buying merchandise for personal use, attending events, and harvesting collections that led to strong sales volumes across apparel, footwear, and accessories. Loyalty programs, fan experiences and constant product drops enhance their clout. Corporate is the fastest growing segment, as businesses use the product for merchandise in promotions, gifts and sponsorship tie-ins. Customization, order quantities and premium options allow companies to achieve their branding goals, driving growth and encouraging further market expansion beyond plain fan demand.

Licensed Sports Merchandise Market Regional Analysis:

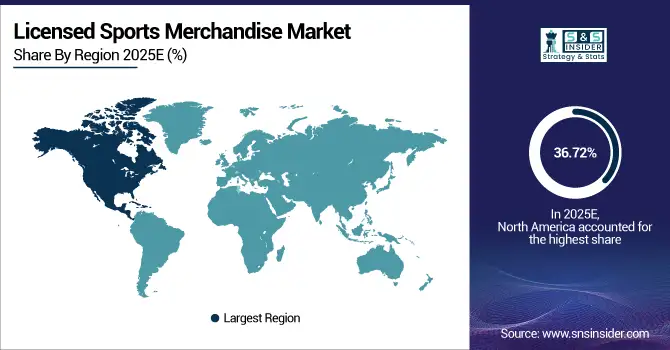

North America Licensed Sports Merchandise Market Insights:

North America dominates the Licensed Sports Merchandise Market with a 36.72% share in 2025, driven by high fan engagement levels and strong league followings coupled with brand loyalty. Increasing need of clothing, footwear and collectibles due to existing retail networks and e-commerce proliferation. Sales are further boosted by limited-edition releases, endorsements from celebrities and promotional campaigns. Rising digital engagement, customized merchandising and corporate sponsorships should drive market growth and also support the company's regional presence over the long term.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Licensed Sports Merchandise Market Insights:

The U.S. Licensed Sports Merchandise is expected to be driven by increasing popularity and preference for apparel, footwear, and accessories based on leagues in U.S. Growth is underpinned by a growing customer base (both online and offline), increasing disposable income, digital engagement, exclusive product drops and brand partnerships with long-term market expansion.

Asia-Pacific Licensed Sports Merchandise Market Insights:

The Asia-Pacific Licensed Sports Merchandise Market is the fastest-growing region, projected at a CAGR of 7.08% during 2026–2033. Rise in popularity of sports, growth in fan base and surge in demand for sports apparel, footwear and collectibles foster the market growth. Top markets are China, India, Japan and Australia. Urbanisation, increasing disposable income and digital engagement underpin consumption; e-commerce is boosting accessibility, while modern retail channels offer opportunities for regional market expansion.

China Licensed Sports Merchandise Market Insights:

The China Licensed Sports Merchandise Market is supported by various factors such as a surge in disposable income, accelerating urbanization and increase in retail e-commerce. With rising consumer demand for wearable items such as apparel, footwear and collectibles and greater fan engagement and growing league popularity, China is proving itself to be a significant factor in the quick-growing marketplace of Asia-Pacific.

Europe Licensed Sports Merchandise Market Insights:

Europe, holding a significant share in 2025, is experiencing strong growth due to high sports popularity, established league followings, and strong fan engagement. The prime markets are Germany, UK and France. Growth will be supported by the introduction of product lines including apparel and footwear, expansion in modern retail stores, e-commerce and more corporate and promotional uses. Brand partnerships, limited edition releases and discord engagement will add to market exposure and long-term growth.

Germany Licensed Sports Merchandise Market Insights:

Germany is one of the leading markets for Licensed Sports Merchandise and enjoys high sales through retail, e-commerce and stadium outlets. The growth is fueled by strong fan engagement, league popularity, and interest in consumer products such as apparel, footwear and collectibles. Brand partnerships, limited offerings and high-quality goods are also spurring market growth.

Latin America Licensed Sports Merchandise Market Insights:

The Latin America Licensed Sports Merchandise Market is being developing due to increasing fan involvement and craze for apparel, footwear, and other collectibles. Growth is underpinned by a growing in retail and e-commerce channels, rising disposable incomes, brand tie-ups. Key markets include Brazil, Mexico and Argentina where innovation and unique product offerings are leading market expansion.

Middle East and Africa Licensed Sports Merchandise Market Insights:

The Middle East & Africa Licensed Sports Merchandise Market is anticipated to invert trends in retail space, online stores, and stadium outlets. Increasing disposable income, increasing sports consumption and expanding hospitality are some of the factors driving growth. Brand tie-ups, special editions and evolving fan engagement habits are also driving long-term market growth across the region.

Licensed Sports Merchandise Market Competitive Landscape:

Fanatics Inc., headquartered in the U.S., is a leader in licensed sports merchandise, specializing in apparel, collectibles, and fan gear. They have exclusive licensing rights for the NFL, NBA, MLB and NHL which gives them an unfair advantage for access to official merchandise. With its super e-commerce platform, speedy fulfillment capabilities and distribution networks, AFG provides customized orders, a limited-edition releases plan and precise marketing in order to generate high fan engagement and steady revenue growth.

-

In September 2025, Fanatics launched the NFL "Rivalries" Uniforms Collection with alternate jerseys for AFC East and NFC West teams. This release meets growing fan demand for officially licensed, collectible sports merchandise, strengthening Fanatics’ market leadership and engagement.

Nike Inc., headquartered in the U.S., is one of the world’s largest athletic footwear and apparel manufacturers, offering a broad portfolio of licensed sports merchandise. It leads the market predominantly by brand awareness, new product innovation and robust retail and e-commerce capabilities across the world. Nike’s strong relationships with professional sports teams and leagues and leading-edge marketing, star player endorsement and sustainable product initiatives all serve to keep the company a clear leader in driving licensed sales.

-

In September 2025, Nike introduced the NikeSKIMS Women’s Activewear Line in collaboration with Kim Kardashian’s SKIMS. The launch expands Nike’s licensed sports merchandise portfolio, addressing rising demand for inclusive, stylish fan apparel and enhancing engagement among sports enthusiasts.

Adidas AG, headquartered in Germany, is a sportswear giant known for athletic footwear, apparel, and licensed merchandise. The company has market share due to its partnerships with football leagues, athletes and clubs providing access to unique merchandise. Strong Supply Chain, Unique Design, and Great Brand Appeal in Europe, Asia and North America reinforce market position. Sustainable, limited-edition drops and digital engagement are also fuelling sales and underlining Adidas's position at the head of the pack.

-

In October 2025, Adidas launched the Adidas Originals x Thug Club Collection, including Korea-exclusive items. This launch targets fans seeking limited-edition licensed merchandise, reinforcing Adidas’ position in the licensed apparel and collectibles market while boosting brand loyalty and youth engagement.

Licensed Sports Merchandise Market Key Players:

Some of the Licensed Sports Merchandise Market Companies are:

-

Fanatics Inc.

-

Nike Inc.

-

Adidas AG

-

Under Armour Inc.

-

Puma SE

-

VF Corporation

-

Hanesbrands Inc.

-

Reebok International Ltd.

-

New Era Cap Co., Inc.

-

G-III Apparel Group, Ltd.

-

DICK’S Sporting Goods Inc.

-

Sports Direct International plc

-

Anta Sports Products Ltd.

-

Li-Ning Company Limited

-

U.S. Polo Assn.

-

Mitchell & Ness Nostalgia Co.

-

Franklin Sports, Inc.

-

New Balance Athletics, Inc.

-

JD Finish Line

-

Columbia Sportswear Company

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 40.48 Billion |

| Market Size by 2033 | USD 61.73 Billion |

| CAGR | CAGR of 5.45% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Apparel, Footwear, Accessories, Collectibles, Others) • By Sports Type (Football, Basketball, Baseball, Soccer, Others) • By Distribution Channel (Online Retail, Offline Retail, Specialty Stores, Others) • By End-Use (Fans, Corporate, Institutions, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Fanatics Inc., Nike Inc., Adidas AG, Under Armour Inc., Puma SE, VF Corporation, Hanesbrands Inc., Reebok International Ltd., New Era Cap Co., Inc., G-III Apparel Group, Ltd., DICK’S Sporting Goods Inc., Sports Direct International plc, Anta Sports Products Ltd., Li-Ning Company Limited, U.S. Polo Assn., Mitchell & Ness Nostalgia Co., Franklin Sports, Inc., New Balance Athletics, Inc., JD Finish Line, Columbia Sportswear Company |