Transit Packaging Market Report Scope & Overview:

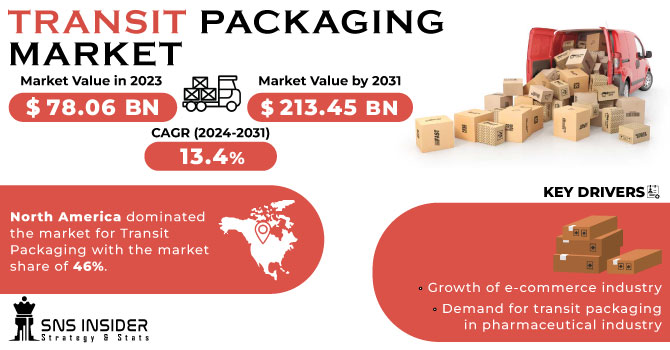

The Transit Packaging Market size was USD 78.06 billion in 2023 and is expected to Reach USD 213.45 billion by 2031 and grow at a CAGR of 13.4 % over the forecast period of 2024-2031.

Driven by the global expansion of e-commerce, the transit packaging market has witnessed steady growth. As companies increasingly rely on safe and cost-effective methods to ship their products, the need for innovative packaging solutions also increases. Manufacturers and suppliers to industries such as consumer goods, electronics, pharmaceuticals, and automobiles rely heavily on transit packaging to maintain goods integrity throughout the supply chain.

Get More Information on Transit Packaging Market - Request Sample Report

The market offers a multitude of transit packaging options, including corrugated boxes, pallets, crates and protective packaging. These solutions are designed to meet the specific requirements of different products, taking into account factors such as weight, fragility and mode of transport. As sustainability becomes more and more important, there is an increasing focus on environmentally friendly materials and packaging designs that reduce waste and promote recycling.

An important trend in the transit packaging industry is technology integration. Smart packaging solutions, equipped with sensors and tracking devices, enable real-time tracking of shipment status, including factors such as temperature, humidity and potential impacts. This improves transparency and accountability in the supply chain, allowing companies to solve problems quickly and maintain product quality.

The established packaging companies are constantly developing their products, introducing innovative materials and designs. At the same time, new entrants are focusing on disruptive technologies and sustainable materials to establish a foothold in the market.

Regulations and standards imposed by various industry and government bodies will continue to shape the market. Packaging must meet international guidelines for safe transport, which affect design, material selection and testing processes. This regulatory framework ensures that packaging can adequately protect products from damage and protect them from potential hazards during transit.

MARKET DYNAMICS

KEY DRIVERS:

-

Growth of e-commerce industry

The online shopping environment has transformed the retailing landscape and triggered a marked increase in demand for transit packaging. The security and reliability of packaging is needed in order to assure that a product stays intact at customers' doorsteps during online shopping.

-

Demand for transit packaging in pharmaceutical industry

RESTRAIN:

-

Increased cost pressure is hampering the market growth

It is a constant challenge to find balance between the need for efficient packaging and budgetary constraints. The cost of high-quality protective packaging materials and technologies can be higher, which in turn has a negative impact on total costs for the supply chain.

OPPORTUNITY:

-

Customized Packaging Solutions can increase the demand for the market

Customized packaging solutions are requested by industries with specific requirements, such as electronics and pharmaceuticals. Designing customizable packaging that meets specific needs can lead to partnerships and long-term contracts.

-

Global Trade Expansion across the globe is driving the market.

CHALLENGES:

-

Volatilities in the cost of materials

Packaging costs can be affected by price fluctuations of raw materials such as cardboard, plastic and metal. Maintaining competitiveness is an ongoing challenge to deal with these cost variations.

IMPACT OF RUSSIAN UKRAINE WAR

Russia-Ukraine conflict had a negative impact on the transit packaging market. Due to the war, the Russia is limited the export of oil to other regions, due to which the prices of the oil have increased and this has caused increase in prices of the raw materials and also the shortage of the polymers and plastics. Petroleum is the major raw material for making the polymers. A shortage of pallets for shipping products is also faced, along with polymers needed to manufacture plastic components and parts as well as steel that needs to be made into plastics. In total, Ukraine is the biggest wooden pallet producer and supplies about 15 million pallets annually to Europe alone. This would slow down global shipments by reducing the number of pallets in circulation, thus leading to raw materials sitting in warehouses waiting for shipment.

Severe economic sanctions, including a ban on American oil imports from Russia, were imposed after the outbreak of the war. The price of oil quickly rose to more than $100 a barrel, indicating that the prices for plastics were on the rise.

IMPACT OF ONGOING RECESSION

The market for transit packaging is expected to be adversely affected by the current recession. In 2023, the market is projected to decline by 3.5%. Delays in transportation and logistics, which can increase costs and delay the delivery of goods. Price increases for raw materials, which will lead to increased costs of transit packaging. Due to heavy recession North American transit packaging market is expected to see 4 % decrease.

KEY MARKET SEGMENTS

By Material

-

Polyethylene

-

Polypropylene

-

Polyurethane

-

Ethylene Vinyl Alcohol

-

Polyvinyl Chloride

-

Wood

-

Metal

By Product Type

-

Crates

-

Pallets

-

Corrugated Boxes

-

Others

By Packaging Type

-

Transit Cartons

-

Transit Containers

-

Transit Intermediate Bulk Containers

-

Transit Wooden Crates

-

Transit Barrels

-

Transit Corrugates Boxes

-

Transit Strapping, Others

By End Use

-

Food & Beverages

-

Consumer Goods

-

E-commerce

-

Third Party Logistics

-

Chemicals

-

Industrial Machinery & Equipment

-

Automotive

-

Electrical & Electronics

-

Building & Construction

-

Pharmaceuticals

REGIONAL ANALYSIS

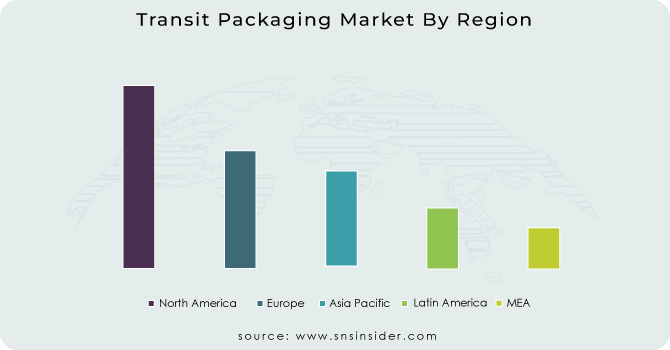

North America dominated the market for Transit Packaging with the market share of 46%. This is due to the presence of the major Pharmaceutical, Food & Beverage, and Automotive manufacturers in the US, Canada and Mexico. The use of the plastic reusable containers which give more robustness, and is lightweight gave the market growth in this region. US, dominated the market with the highest market share followed by Canada which is fastest growing market.

Europe transit packaging market is growing positively. The expansion of e-commerce sector in the region, is growing the market for logistics giving rise to the transit packaging. In addition, the increasing demand for the durable packaging for fragile products, and increasing import and export are booming the market in the European region.

The Asia Pacific region will show the significant growth over the forecast period. This is due to the rapid developing industrial sector in the region. The presence of the raw materials such as the metal and plastic are increasing the market growth. China market is the dominating the transit packaging followed by the Indian market which is the fastest growing market over the forecast period.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Switzerland

- Austria

- Rest of Western Europe

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some major key players in the Transit Packaging market are Smurfit Kappa, West Rock Company, Flex-Pak Corporation, International Paper, El Dorado Packaging, Multifab Packaging, Pak-Line Limited, Louisiana Pacific Corporation, Polymax, Inc, Celanese Corporation and other players.

West Rock Company-Company Financial Analysis

RECENT DEVELOPMENT

-

In order to save an average of 249 tonnes of CO2 per year, Jgermeister has adapted its shipping containers to be manufactured from cardboard and is said to include more than 90% recycled paper, amongst other changes.

-

To meet the needs of modern pharmaceutical companies, and to help their products move safely into the supply chain, a Magnum Optimum Hopper 1208 has been added to Schoeller Allibert's widest range of foldable containers.

| Report Attributes | Details |

| Market Size in 2023 | US$ 78.06 Bn |

| Market Size by 2031 | US$ 213.45 Bn |

| CAGR | CAGR of 13.4 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Polyethylene, Polyethylene Terephthalate, Polypropylene, Polyurethane, Ethylene Vinyl Alcohol, Polyvinyl Chloride, Paper & Paperboard, Wood, Metal) • by Product Type (Crates, Pallets, Corrugated Boxes, Others) • by Packaging Type (Transit Cartons, Transit Containers, Transit Intermediate Bulk Containers, Transit Wooden Crates, Transit Barrels, Transit Corrugates Boxes, Transit Strapping, Others) • by End Use (Food & Beverages, Consumer Goods, E-commerce, Third Party Logistics, Chemicals, Industrial Machinery & Equipment, Automotive, Electrical & Electronics, Building & Construction, Pharmaceuticals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Smurfit Kappa, West Rock Company, Flex-Pak Corporation, International Paper, El Dorado Packaging, Multifab Packaging, Pak-Line Limited, Louisiana Pacific Corporation, Polymax, Inc, Celanese Corporation |

| Key Drivers | • Growth of e-commerce industry • Demand for transit packaging in pharmaceutical industry |

| Market Restraints | • Increased cost pressure is hampering the market growth |