Paper Straw Market Report Scope & Overview:

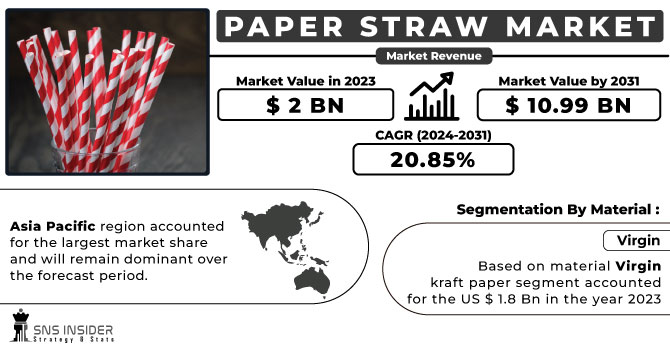

The Paper Straw Market size was USD 2 billion in 2023 and is expected to Reach USD 10.99 billion by 2031 and grow at a CAGR of 20.85% over the forecast period of 2024-2031.

In the first half of 2022, StatsCan estimated that there would be an increasing trend in food service and drinking establishments in Canada. In January 2022, the value of sales increased to USD 3.32 billion, and in July 2022 it went up to EUR 5.79 billion. This trend shows that, in the period under review, sales of food and drink are increasing at an increased pace with a direct effect on demand for Paper Straws within restaurants and drinking establishments.

Get More Information on Paper Straw Market - Request Sample Report

Ulfex launched the UShape Paper Straw, which was designed to produce 100 million straws per month and 200 million straw a month from April 2022, with an initial production target of 100 million. In addition, 2.4 billion straws were to be produced annually by Ulfex.

MARKET DYNAMICS

KEY DRIVERS:

- Environmental Concerns and Plastic Bans to drive the paper straw market

The growing awareness about plastic pollution and its effect on marine life and ecosystems has led to an increased demand for environmentally friendly alternatives to single use plastics. The growing demand for sustainable alternatives such as paper straw is behind a number of governments and organizations which have imposed or proposed bans on plastic straws.

- Increased demand from the hospitality and catering sectors for paper straw.

RESTRAIN:

- As compared with plastic straw, costs and affordability of paper straws is much higher

The cost of materials and the processes involved in producing paper straws may make them more costly to manufacture as compared with conventional plastic straw. Some companies, particularly small establishments with limited budgets, may not have the ability to adopt paper straws due to these cost differences.

-

Harmful side-effects of paper-based straws is also restricting the market growth.

OPPORTUNITY:

-

Increasing demand for the sustainable product

Businesses that make compliance and sustainable alternatives, such as paper straws, can take advantage of the continued implementation by governments of regulations against Single Use Plastics.

-

To limit their carbon footprint, companies can use ecofriendly packaging solutions such as paper straws as a part of CSR activities.

CHALLENGES:

-

Maintaining Cost Competitiveness with the alternatives can be a challenge

Even though the demand for sustainability alternatives increases, it may be difficult to ensure that paper straw is still cost competitive with other options because of production and material costs.

IMPACT OF RUSSIAN UKRAINE WAR:

The market for paper straws has been significantly affected by the war between Russia and Ukraine. The main paper straws producers of raw materials in the global market are Russia and Ukraine, which account for about 20% of total sales. As a result of this war, the supply of paper straw from these countries has been affected and there have been shortages and price increases. In the first quarter of 2023, paper straw prices in the US have gone up by 20%. According to our research, the war could lead to worldwide shortages of paper straws as demand outstrips supply by 10% in 2023.

IMPACT OF ONGOING RECESSION:

Due to a downturn in the economy, demand for paper straws is estimated to fall by 2.5% between now and 2023. In developing countries, where consumers have a better awareness of the impact on the environment of plastic straw, demand is expected to decline more sharply. There has been a rapid growth in the market for paper straw substitutes. Paper straws are made up of a number of alternatives, such as metal stirrers, bamboo stirrers and reusable plastic stirrers. Compared with paper straws, these alternatives are expected to be more durable and last a longer period of time which is increasing their popularity. There is also a rapid increase in the market for bamboo straws. The market for bamboo straw is expected to be worth USD 362 million in 2022.

KEY MARKET SEGMENTS

By Material

-

Virgin

-

Recycled

Based on material Virgin kraft paper segment accounted for the US $ 1.8 Bn in the year 2023, and recycled paper segment will grow at the pace of 2.2 times faster over the forecast period.

By Type

-

Flexible

-

Non-Flexible

By Product

-

Printed

-

Non-Printed

Based on the product type, the printed segment will dominate the market in terms of CAGR. The non printed segment will create the growth opportunity of US $ 2.3 Bn over the forecast period.

By Straw Length

-

5.75 inches

-

5.75-7.75 inches

-

7.75-8.5 inches

-

8.5-10.5 inches

-

>10.5 inches

By Straw Diameter

-

<0.15 inches

-

0.15-0.195 inches

-

0.195-0.25 inches

-

0.25-0.4 inches

-

>0.4 inches

By Application

-

Household

-

Institutional

-

Food Service

REGIONAL ANALYSIS:

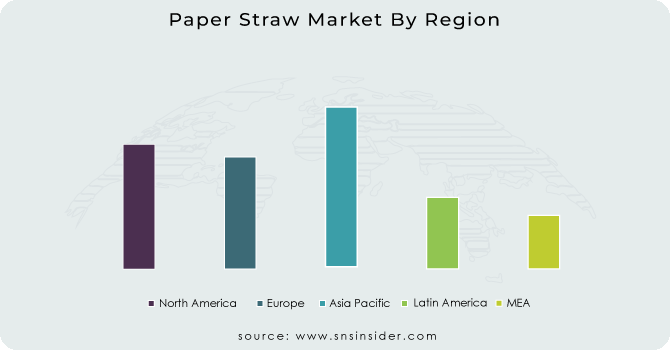

Asia Pacific region accounted for the largest market share and will remain dominant over the forecast period. By revenue Asia pacific region holds around US $ 0.72 Billion in 2022. Paper straw is becoming very popular in this region. Government regulations on the ban of plastic, and the growth of the food and beverage industry is giving the growth to the market in this region.

North America is the second largest paper straw market. The large amount of producers and suppliers of paper straws in this region is giving the growth to the market in this region. The consumption of the non-alcoholic beverages is also anticipated to give growth to the market over the forecast period.

European region will show the fastest growth over the forecast period. The increasing demand for the paper straws from the regions such as UK, France is giving growth to the market. Stringent rules and regulations against the ban on the use of plastic is giving growth to the regional market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Paper Straw market are Hoffmaster Group Inc, Transcend Packaging Ltd, Huhtamaki Oyj, Nippon Paper Group, Tetra Pak, Footprint, Fueling Technology, Duni Group, Soton Daily Necessity Co. Ltd, Canada Brown Eco Products Ltd and other players.

Transcend Packaging Ltd-Company Financial Analysis

RECENT DEVELOPMENT

-

In 2023, Hoffmaster Group Inc, introduced Earthwise Plant Based Straws

-

In April 2023, Transcend Packaging entered into a strategic partnership with ITOCHU Corporation, one of Japan's largest manufacturers of paper and pulp products.

| Report Attributes | Details |

| Market Size in 2023 | US$ 2 Bn |

| Market Size by 2031 | US$ 10.99 Bn |

| CAGR | CAGR of 20.85% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Virgin, Recycled) • by Type (Flexible, Non-Flexible) • by Product Type (Printed, Non-Printed) • by Straw Length (<5>10.5 inches) • by Straw Diameter (<0>0.4 inches) • by Application (Household, Institutional, Food Service) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Hoffmaster Group Inc, Transcend Packaging Ltd, Huhtamaki Oyj, Nippon Paper Group, Tetra Pak, Footprint, Fueling Technology, Duni Group, Soton Daily Necessity Co. Ltd, Canada Brown Eco Products Ltd |

| Key Drivers | • Environmental Concerns and Plastic Bans to drive the paper straw market • Increased demand from the hospitality and catering sectors for paper straw. |

| Key Restraints | • As compared with plastic straw, costs and affordability of paper straws is much higher • Harmful side-effects of paper-based straws is also restricting the market growth. |