Logistics Packaging Market Key Insights:

Get More information on Logistics Packaging Market - Request Sample Report

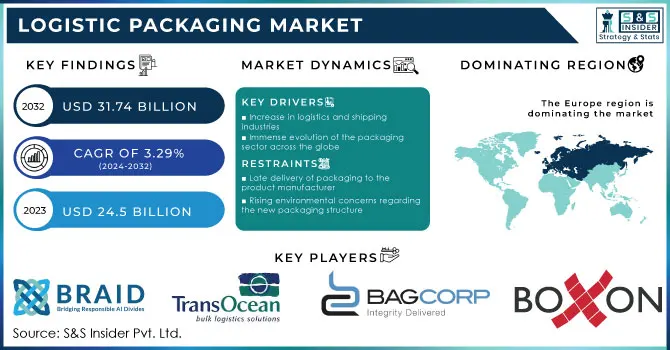

The Logistic Packaging Market Size was valued at USD 24.5 billion in 2023 and is projected to grow to USD 31.74 billion by 2032, accounting for CAGR of 3.29% during the forecast period from 2024 to 2032

Logistic packaging mainly focuses on the combined benefits achieved by integrating the system of logistics and packaging with increasing the potential of supply chain effectiveness as well as efficiency by improving packaging and logistic-related activities.

Logistics packaging ensures that product reaches their destination intact, saving time and money for the sender as well as the receiver. Logistic packaging makes storage a lot easier when there is a time gap between manufacturing and shipping. The manufacturers of Logistic packaging use plastic, metal, wood pellets, paper, and fiber for assembling different kinds of packaging for modern and efficient applications.

Packaging serves four major functions: containment, communication, protection, and utility. These functions are crucial in maximizing sales and profits while minimizing losses and wastage. Additionally, they play a critical role in enhancing the consumer and overall brand experience. In today's market, packaging is considered a vital link between consumers and brands. It effectively communicates that hygiene is maintained, safety is prioritized, and product or service quality is not compromised.

Market Dynamics

Drivers

-

Increase in logistics and shipping industries

-

Immense evolution of the packaging sector across the globe

-

Advancement in the packaging technology

-

Increase in urbanization and industrialization

-

Growth of import and export across the globe

-

New development and discoveries in the logistics sector

Recent advancements and discoveries in the logistics industry are propelling the growth of the Logistics Packaging Market. This market is experiencing a surge in demand due to the increasing need for efficient and effective packaging solutions in the transportation and storage of goods. The logistics sector is constantly evolving, and with the emergence of new technologies and innovative packaging materials, the Logistics Packaging Market is poised for significant expansion.

Restrain

-

Late delivery of packaging to the product manufacturer

-

Rising environmental concerns regarding the new packaging structure

The Logistics Packaging Market is facing a significant challenge due to increasing environmental concerns surrounding its packaging structure. This restraint is impacting the market's growth and development. To address this issue, companies must prioritize sustainable packaging solutions that minimize their environmental impact. By doing so, they can not only meet consumer demands for eco-friendly products but also contribute to a healthier planet.

Opportunities

-

Increasing consumer demand for logistic packaging pharmaceutical and food products

Challenges

-

High cost associated with the packaging solution

Impact of COVID-19:

The COVId-19 pandemic has reduced the demand for certain types of packaging while accelerating the growth of some other types of packaging such as emerging E-commerce shipments. Due to these changes, many packaging companies have faced various challenges regarding the logistics packaging market.

The intrinsic role of packaging to protect and deliver the product to consumers without damage and contamination has never been as prominent as during the coronavirus crisis. In light of the need for physical distancing and minimizing human contact with groceries to reduce the spread of the virus, packaging plays a crucial role in ensuring safety. Proper packaging not only protects the products but also provides a layer of protection for consumers. The industry proved resilient in meeting stockpiling peaks while navigating its own logistic obstacles, including explaining its critical place in the supply chain, notably as countries apply movement restrictions.

Impact of Russia-Ukraine War:

The ongoing conflict between Russia and Ukraine has resulted in the departure of approximately 350 major foreign companies, leading to the closure of production and packaging facilities in both countries. As a result, the logistics packaging market has been significantly impacted by the Russian invasion of Ukraine. The consequences of this conflict have been far-reaching, affecting not only the economies of Russia and Ukraine but also the global market. The closure of these facilities has disrupted supply chains and caused delays in the delivery of goods, leading to increased costs and decreased efficiency.

Impact of Recession:

The ongoing recession has impacted the logistics packaging market badly. The downturn has resulted in a decrease in demand for logistics packaging products and services, as businesses have been forced to cut costs and reduce their overall spending. This has led to a decrease in the production and sales of logistics packaging products, which has had a negative impact on the industry as a whole. Many companies have been forced to downsize or even close their doors due to the economic downturn, which has further exacerbated the situation.

Key Market Segmentation

By Packaging Durability Type

-

Flexible Logistics Packaging

-

Rigid Logistics Packaging

By Material Durability Type

-

Durable Goods

-

Non-Durable Goods

By Material

-

Plywood

-

Wood

-

Corrugated

-

Plastic

-

Steel

-

Others

By End-users

-

Automotive

-

Healthcare

-

Food & Beverages

-

Manufacturing

-

Consumer Goods

-

Others

By Type

-

Individual packaging

-

Inner packaging

-

Outer packaging

Get Customized Report as per your Business Requirement - Request For Customized Report

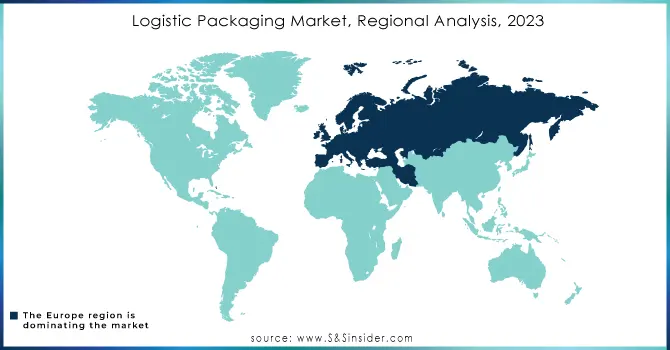

Regional Analysis

Europe region dominated the market with the highest market share and is expected to show significant growth during the forecast period. Rising demand for logistic packaging across various industries, development in rigid and flexible packaging, and continuous changes in the packaging structure are some key factors that fuel the growth of the logistics packaging market.

After Europe, North America is the second dominating market of logistics packaging market owing to the increase in global Import and export volumes across the various regions. Advancement of the Transportation industry which demands improved packaging drives the market for logistic packaging.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major key players are Braid Logistics, Trans Ocean Bulk Logistics, BLT Flexitank Industrials Co. Ltd., BAG Corp., Jumbo Bag Corporation, Boxon USA., Buske Logistics, and other key players will be included in the final report.

Recent Developments:

-

Buske Logistics, a well-known provider of contract logistics services with a wealth of experience in the packaging, food and beverage, and automotive industries, has been announced for acquisition by Fourshore Partners in March 2022. This acquisition is set to further enhance Buske Logistics' capabilities and expand its reach in the logistics industry.

-

In other news, Sourceful, a company dedicated to promoting supply chain transparency, has announced its plans to raise USD 20 million in a Series A round of funding in March 2022. This funding will enable Sourceful to continue its mission of creating a more sustainable and ethical supply chain for businesses and consumers alike.

| Report Attributes | Details |

| Market Size in 2023 | US$ 24.5 Billion |

| Market Size by 2032 | US$ 31.75 Billion |

| CAGR | CAGR of 5.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Packaging Durability Type (Flexible Logistics Packaging, Rigid Logistics Packaging) • By Material Durability Type (Durable Goods, Non-Durable Goods) • By Material (Plywood, Wood, Corrugated, Plastic, Steel, and Others) • By End-users (Automotive, Healthcare, Food & Beverages, Manufacturing, Consumer Goods, Others) • By Type (Individual packaging, Inner packaging, Outer packaging) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Braid Logistics, Trans Ocean Bulk Logistics, BLT Flexitank Industrials Co. Ltd., BAG Corp., Jumbo Bag Corporation, Boxon USA., Buske Logistics |

| Key Drivers | • Increase in logistics and shipping industries • Immense evolution of the packaging sector across the globe |

| Market Opportunities | • Increasing consumer demand for logistic packaging pharmaceutical and food products |