Shortwave Infrared (SWIR) Market Size:

Get more information on Shortwave Infrared (SWIR) Market - Request Sample Report

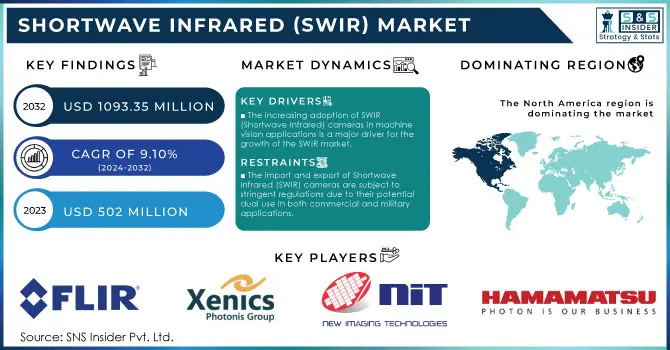

The Shortwave Infrared (SWIR) Market Size was valued at USD 502 Million in 2023 and is expected to reach USD 1093.35 Million by 2032, growing at a CAGR of 9.10% over the forecast period 2024-2032.

The shortwave infrared (SWIR) market has witnessed substantial growth in recent years, fueled by increasing demand across various industries, including defense, industrial, and commercial sectors. The SWIR market has experienced significant growth lately due to rising demand in defense, industrial, and commercial sectors. Technological advancements, increased research and development efforts, and the growing demand for better imaging solutions are the main factors driving the market expansion. A significant benefit of SWIR imaging is its remarkable ability to distinguish objects that look very similar in the visible spectrum, making it useful in various industries. The C-RED SWIR camera family showcases innovation with its global shutter, high frame rate, and impressive 14-bit output. This guarantees that pixel depth remains uncompromised, even when frame rates are faster. At the full resolution of 640 x 512 pixels, an impressive frame rate of 602 Hz can be reached, making it easier to identify objects in SWIR light. SWIR technology is especially useful for outdoor imaging because of natural sources like ambient starlight and background radiance. Traditional quartz or halogen bulbs can also function as dependable SWIR light sources. Some SWIR camera sensors can be set up to show a linear or logarithmic response, depending on the application, to prevent saturation. Recent progress in InGaAs sensor technology has continued to drive the SWIR market forward, making it possible to capture both visible and SWIR light through imaging. One example is Sony's SenSWIR technology, which enables the use of wavelengths from 400 nm to 1700 nm, with the possibility of extending beyond the usual 1.7 µm limit to reach 2.2 µm.

In the realm of small animal imaging, particularly in preclinical studies related to drug discovery, drug effectiveness, and early cancer detection, SWIR imaging has gained notable traction. The SWIR range provides significant advantages over both visible and infrared wavelengths for in vivo imaging. SWIR light enables deeper tissue penetration while maintaining high resolution, resulting in low light absorption and reduced scattering within biological tissues. This property renders SWIR imaging particularly appealing for studying living organisms. A major benefit of SWIR imaging is its negligible auto-fluorescence, which enhances contrast and sensitivity compared to traditional imaging methods in the near-infrared (NIR) and visible ranges.

Shortwave Infrared Market Dynamics

Drivers

-

The increasing adoption of SWIR (Shortwave Infrared) cameras in machine vision applications is a major driver for the growth of the SWIR market.

SWIR cameras provide improved imaging capabilities in difficult conditions like low-light settings, where conventional visible light cameras are not as effective. These cameras can penetrate materials such as silicon and glass, delivering excellent contrast and clarity. This quality makes them perfect for various industrial uses that require precision and accuracy. For example, FLIR Systems, a top company in thermal imaging and infrared technology, has created SWIR cameras that are commonly used in manufacturing for quality control and inspection purposes. These cameras play a crucial role in identifying flaws in semiconductor wafers, examining photovoltaic cells, and verifying the quality of pharmaceutical packaging. SWIR technology allows manufacturers to detect imperfections that cannot be seen in the regular light spectrum, ensuring high product quality and lowering the occurrence of production mistakes. Moreover, SWIR cameras find applications in the food and agriculture sector to sort and evaluate produce by measuring moisture levels and maturity. This improves the effectiveness of sorting and reduces the amount of wasted food, creating value throughout the supply chain. SWIR cameras in vision-guided robotic systems benefit the automotive industry by detecting defects in vehicle parts, ensuring high assembly standards.

-

The increased use of Shortwave Infrared (SWIR) cameras in military and defense sectors is a significant driving factor for the SWIR market.

SWIR technology can take pictures in dark settings, identify objects in fog, smoke, and haze, and offer excellent visibility for night vision. This makes SWIR cameras especially useful in military surveillance, target acquisition, and reconnaissance operations, where awareness of the situation and accuracy are important. SWIR cameras are being more commonly utilized in tasks like monitoring borders and securing perimeters, aiding in identifying unauthorized actions even in difficult weather conditions. One instance is SWIR imaging's ability to identify concealed objects like enemy personnel or vehicles under foliage or shadows, which conventional cameras may not detect. Moreover, SWIR technology is utilized in guided munitions and missile tracking systems to improve imaging for precise target engagement. Another use is in drone-based surveillance, with SWIR-equipped UAVs able to carry out secret missions without being easily detected because the cameras don't emit visible light. This is essential for missions that need to be carried out discreetly. Additionally, SWIR technology offers improved visibility in low light or no light conditions like underground or cave expeditions. SWIR cameras are essential for military operations that involve night-time reconnaissance or navigating in low-visibility environments.

Restraints

-

The import and export of Shortwave Infrared (SWIR) cameras are subject to stringent regulations due to their potential dual use in both commercial and military applications.

The regulations frequently come under international trade controls, like the International Traffic in Arms Regulations (ITAR) in the U.S., which limit the export of sensitive technologies suitable for surveillance or military activities. SWIR cameras are seen as sensitive equipment because they can identify objects in dim lighting or obstructed conditions, such as smoke and haze. The regulatory limitations pose obstacles for SWIR camera producers seeking to tap into new global markets, requiring them to secure particular permits and adhere to intricate export regulations. Limitations can lead to extended wait times for acquiring new clients, increase expenses for following regulations, and restrict the growth of the market. For example, manufacturers of SWIR cameras used for tasks such as agriculture monitoring or manufacturing quality control might have difficulty exporting these devices to specific countries due to complex bureaucratic procedures. Furthermore, SWIR cameras are utilized in defense and aerospace fields for navigation, targeting, and surveillance purposes because of their capability to operate in low light and adverse weather conditions. This feature results in strict regulation to prevent unauthorized access that could jeopardize national security. Although these regulations ensure that the technology is used correctly, they also restrict the unrestricted flow of products, impacting the global growth potential of the SWIR camera market. Consequently, businesses encounter limitations that may hinder the growth of their market and restrict entry to new opportunities in different areas.

SWIR Market Segmentation Analysis

by Imaging Type

Thermal imaging led the market with a 41% market share in 2023 in the shortwave infrared market because it is widely used for security, surveillance, and industrial inspections. This technology senses heat given off by objects, making it perfect for use in dark environments without any light, like night surveillance, search and rescue missions, and electrical inspections. Its value lies in its capability to spot changes in temperature and heat signatures, which is crucial for sectors such as defense, where it plays a role in surveillance and identifying targets. An illustration is FLIR Systems, a key player in this industry, which offers SWIR thermal imaging solutions designed for military uses, such as monitoring drones.

Spectral imaging is to experience a rapid growth rate in 2024-2032 in the shortwave infrared (SWIR) market because it can accurately analyze material composition at different wavelengths. This method collects information from various spectral bands, making it perfect for tasks needing specific material identification. It is highly efficient in areas such as food quality assessment, pharmaceuticals, and environmental monitoring, where accurate identification of chemical compositions is essential. For instance, Specim, a major player in this industry, utilizes SWIR spectral imaging for agricultural assessments to identify plant wellness and moisture levels.

by Technology

The cooled segment dominated the shortwave infrared (SWIR) market with a 57% market share. Cooled SWIR detectors use a cooling mechanism, such as a cryogenic cooler, to reduce thermal noise and achieve higher sensitivity and image quality, making them ideal for applications requiring precision. This enhanced performance makes them preferred for defense and aerospace, where they are used for surveillance and target detection under low-light conditions. For example, companies like Teledyne FLIR utilize cooled SWIR technology in their advanced thermal imaging cameras for industrial and defense applications.

The uncooled segment is projected to have the fastest CAGR during 2024-2032, driven by its cost-effectiveness and ease of integration. Unlike cooled detectors, uncooled SWIR systems do not require complex cooling mechanisms, resulting in a compact design and lower manufacturing costs. This makes them suitable for a wider range of commercial applications, such as food inspection, waste sorting, and agricultural monitoring, where high sensitivity is not the primary requirement. For instance, Sensors Unlimited (a division of Collins Aerospace) develops uncooled SWIR cameras that are compact and suitable for various industrial uses.

Shortwave Infrared (SWIR) Market Regional Outlook

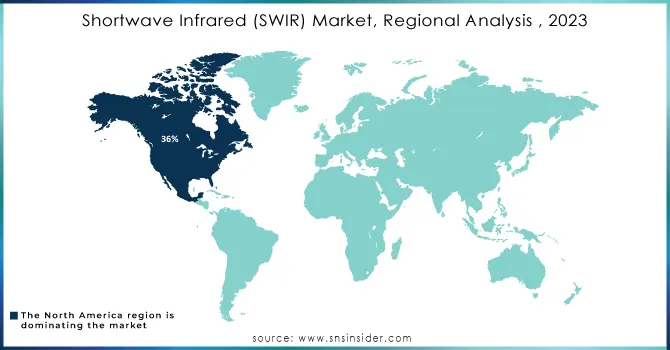

North America held a market share of 36% in 2023 and led the shortwave infrared (SWIR) market, due to advanced technological infrastructure and increased defense and surveillance activities. Uses influence the need for SWIR cameras and sensors in the area of military imaging, industrial process monitoring, and research. FLIR Systems and Collins Aerospace, both based in the United States, are major players in the advancement of SWIR technologies. These applications are present in the aerospace, defense, and automotive industries, improving the functions of night vision and low-light imaging. The increasing emphasis on security, along with strong investments in research and development, helps maintain North America's dominance in the SWIR market.

The Asia-Pacific is anticipated to become the fastest-growing region during 2024-2032 in the market, due to increasing industrial automation and heightened demand for surveillance in countries like China, Japan, and India. The increasing adoption of SWIR technologies in quality control, food inspection, and electronics is driving this growth. Major companies like Hamamatsu Photonics and Sony are progressing in SWIR technologies to meet the needs of various uses in automotive safety, healthcare imaging, and agricultural monitoring. The fast urbanization of the region and the focus on smart city projects are also boosting the use of SWIR solutions, fueling the growth of the APAC market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The major key players in the Shortwave Infrared (SWIR) Market are:

-

FLIR Systems (FLIR A6750sc SLS, FLIR A50/A70)

-

Sensors Unlimited (a division of Collins Aerospace) (MicroSWIR 640CSX, SU320HX)

-

Xenics (Bobcat-640 Series, Ceres T 1280)

-

New Imaging Technologies (NIT) (WiDy SenS 320, WiDy Vision)

-

Hamamatsu Photonics (C12741-03 InGaAs, G12230-10R InGaAs)

-

Princeton Instruments (NIRvana LN, NIRvana ST)

-

Allied Vision (Goldeye G-008 SWIR, Goldeye G-033 SWIR)

-

Raptor Photonics (OWL 640 T, Ninox 640 II)

-

Teledyne DALSA (Linea SWIR, Calibir GXF)

-

Leonardo DRS (Tenum™ 640, SLS MWIR 1280)

-

Intevac (Photonic Vision SWIR Camera, NightVista™ SWIR)

-

Photonis (NOCTURN SWIR, Lynx CMOS)

-

Sofradir (a part of Lynred) (Galatea MW, ALTAIR MW)

-

Quantum Imaging (QI-SWIR 640, QI-SWIR 320)

-

IRCameras (IRC800, IRC900)

-

Xenics Infrared Solutions (Xeva 320, Tigris-640)

-

BaySpec Inc. (OCI-1000 Hyperspectral Imager, SuperGamut™ Series)

-

InfraTec GmbH (ImageIR® 9300, VarioCAM® HD head 900)

-

FLIR Defense (formerly Extech Instruments) (Raven-384, Ranger HRC)

-

Photonic Science and Engineering (IR-enhanced Camera, Cooled SWIR Camera)

Suppliers who provide raw materials or components to these key players in the SWIR market:

-

Aixtron SE

-

IQE plc

-

Nichia Corporation

-

Cree Inc. (Now Wolfspeed)

-

Umicore Electro-Optic Materials

-

Sumitomo Electric Industries, Ltd.

-

II-VI Incorporated

-

Fujitsu Optical Components Limited

-

NTT Electronics

-

Advanced Photonix Inc.

Recent Development

-

April 2023: Infrared and laser specialist SCD launched a new shortwave infrared (SWIR) detector called the SWIFT-EI. According to SCD, the SWIFT-EI is the world's first SWIR detector that integrates event-based imaging capabilities and is marketed as a compact device with low SWaP, low cost, and a VGA-format, 10-micron-pitch SWIR detector.

-

July 2024: New Imaging Technologies (NIT) launched the SenS 1920, a full HD (1920 x 1080 resolution at 8 µm pixel pitch) SWIR (short wave infrared) camera. The camera incorporates the company’s NSC2101 InGaAs sensor, providing imaging in the 900 to 1700 nm wavelength range.

-

July 2024: New Imaging Technologies (NIT) announced the launch of its groundbreaking Full HD resolution SWIR camera. This cutting-edge camera provides exceptional low-noise performance at 25e-, created to meet the stringent requirements of different industries and provide unmatched imaging quality and accuracy.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 502 Million |

| Market Size by 2032 | USD 1093.35 Million |

| CAGR | CAGR of 9.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Imaging Type (Spectral Imaging, Thermal Imaging, Hyperspectral Imaging, Other Imaging Types) • By Offering (Modules, Cameras, Software, Services) • By Technology (Cooled, Uncooled) • By Use Case (Security & Surveillance, Monitoring & Inspection, Detection) • By End User (Industrial, Non-industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | FLIR Systems, Sensors Unlimited, Xenics, New Imaging Technologies, Hamamatsu Photonics, Princeton Instruments, Allied Vision, Raptor Photonics, Teledyne DALSA, Leonardo DRS, Intevac, Photonis, Sofradir, Quantum Imaging, IRCameras, Xenics Infrared Solutions, BaySpec Inc., InfraTec GmbH, FLIR Defense, Photonic Science and Engineering |

| Key Drivers | • The increasing adoption of SWIR (Shortwave Infrared) cameras in machine vision applications is a major driver for the growth of the SWIR market. • The increased use of Shortwave Infrared (SWIR) cameras in military and defense sectors is a significant driving factor for the SWIR market. |

| RESTRAINTS | • The import and export of Shortwave Infrared (SWIR) cameras are subject to stringent regulations due to their potential dual use in both commercial and military applications. |