Light Fidelity [LiFi] Technology Market Report Scope & Overview:

The Light Fidelity [LiFi] Technology Market was valued at USD 0.62 billion in 2023 and is expected to reach USD 35.62 billion by 2032, growing at a CAGR of 57.04% from 2024-2032. This report covers key aspects, including adoption rates of emerging technologies, investment trends, energy efficiency statistics, and user demographics. The rising demand for high-speed, secure, and energy-efficient communication is driving market growth, with healthcare emerging as a dominant sector. Increasing investments in Li-Fi applications and expanding user adoption across industries further highlight its potential to revolutionize wireless data transmission.

![Light Fidelity [LiFi] Technology Market Revenue Analysis](/images/1741755045-Light-Fidelity-LiFi-Technology-Market.webp)

Get more information on Light Fidelity [LiFi] Technology Market - Request Sample Report

Market Dynamics

Drivers

-

Growing Data Consumption Drives the Need for Faster, More Efficient Internet Solutions with LiFi Technology

With data consumption on the rise across the globe, the need for faster and more reliable internet solutions is on the rise. Traditional Wi-Fi networks are being stretched to their limits due to bandwidth constraints and interference. LiFi technology, which transmits data using light, has an attractive advantage of offering higher speeds and capacity. The need for speed and efficiency can effectively be met using this innovation in high-density spaces such as offices, public, and smart cities. LiFi's ability to provide high performance internet in an environment where a traditional network finds it difficult gives it a big future in connecting the digital world.

Restraints

-

Limited Range and Infrastructure Requirements Pose Challenges to Widespread Adoption of LiFi Technology

LiFi technology has challenges that are mainly presented by its low range and the dependency on line-of-sight communication. The signals in LiFi are unlike Wi-Fi because they cannot go through walls, furniture, and even people to transmit data, thus presenting limitations in coverage in larger spaces or environments where frequent signal blockages occur. The installment cost is also high because of specialized infrastructure-LED lights with Li-Fi transmitters, meaning that Li-Fi is less accessible for widespread use. Most of these factors can postpone LiFi technology adoption, especially in regions or industries that strictly consider the cost and comprehensive coverage for that service.

Opportunities

-

Smart City Development, IoT Expansion, and Healthcare Needs Drive LiFi Technology Growth Opportunities

The growing shift towards smart city development offers a significant avenue for LiFi technology, as urban areas increasingly rely on fast, secure, and efficient communication systems. LiFi can support smart city applications like traffic management, public safety, and environmental monitoring by providing reliable, high-speed connectivity. Additionally, the expansion of IoT presents another growth prospect, as LiFi’s high bandwidth and low latency are ideal for powering connected devices in smart homes, healthcare, and industrial automation. Furthermore, healthcare environments, where secure communication is critical, can greatly benefit from LiFi’s ability to provide uninterrupted, interference-free connectivity. As emerging markets seek affordable, high-speed internet solutions, LiFi has the potential to meet these demands effectively and cost-efficiently.

Challenges

-

Infrastructure Requirements and Limited Range Are Key Barriers to Widespread Adoption of LiFi Technology

The significant barrier that leads to not fully adopting the LiFi technology is the specific kind of infrastructure requirement. This means that specific kind of LED lighting systems which is supplied in transmitter form. Hence, for a business entity, it needs an up-gradation of an already installed system. This upgradation can cost the business as well as an individual a tremendous amount of money initially, therefore making the system underinvestment. Another challenge is the range of LiFi. It works efficiently only in direct line-of-sight, and signals are obstructed by walls, furniture, and other structures. This has limited its potential for broader applications, especially across large or complex spaces. Issues such as lack of standardization and public awareness readily pose further problems in this area, which altogether slows down the growth and adoption of the market for LiFi technology

Segment Analysis

By Component

The LED segment accounted for the highest revenue share of about 42% in 2023 in the Light Fidelity (LiFi) technology market, primarily due to the wide-scale adoption of energy-efficient LED lighting systems, which form an integral part of LiFi. On the other hand, the microcontrollers segment is expected to grow at the fastest CAGR of about 61.63% from 2024-2032 by virtue of a critical role in powering LiFi devices, enabling efficient data processing, and seamless integration with various applications, including IoT and smart devices.

By End Use

The healthcare segment dominated the Light Fidelity (LiFi) technology market with the highest revenue share of about 28% in 2023 due to LiFi’s ability to provide secure, high-speed, and interference-free communication, which is critical in medical environments. The retail segment is expected to grow at the fastest CAGR of about 60.43% from 2024-2032, driven by the increasing demand for enhanced customer experiences, personalized services, and seamless, high-speed connectivity in stores, improving in-store navigation and digital interactions.

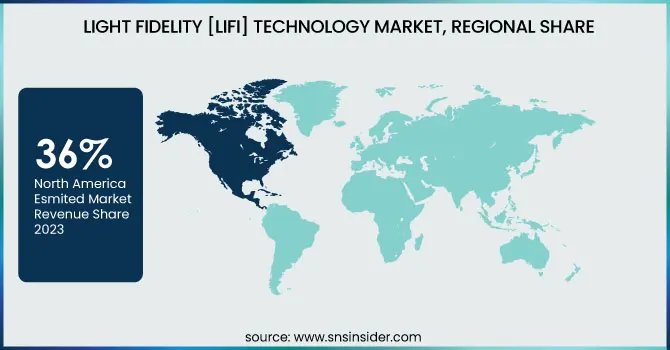

Regional Analysis

North America dominated the LiFi technology market with about 36% in terms of revenue share for 2023. This significant percentage domination has been due to strong technological infrastructure, adoption rates of advanced communication system penetration, and high demands for high-speed secure internet in different sectors across healthcare, smart cities, and retail. Notably, advanced research and development investments in North America further increased the LiFi market domination.

Asia Pacific is expected to grow at the fastest CAGR of about 59.49% from 2024-2032. The rapid urbanization and increasing digitalization in countries like China, India, and Japan are driving the demand for high-speed internet and smart city infrastructure. This, paired with the area's emphasis on cost-effective as well as energy-efficient technologies combined with the application of IoT in increasing numbers is going to create this as yet another very ideal space for adopting LiFi in Asia Pacific into the coming future.

Need any customization research on Light Fidelity [LiFi] Technology Market - Enquiry Now

Key Players

-

PureLiFi (LiFi-XC, LiFi-X)

-

Oledcomm (Oledcomm LiFi, LiFiMAX)

-

Signify Holding (Trulifi 4001, Trulifi 802.11b)

-

VLNComm (Li-Fi System, VLNComm Li-Fi Kit)

-

Velmenni (Velmenni Li-Fi, Velmenni Light Communication)

-

Wipro Lighting (Wipro Li-Fi, Li-Fi Solutions)

-

LiFiComm (LiFiComm LIFi-5000, LiFiComm LIFi-2000)

-

Lucibel (Lucibel Li-Fi, Lucibel LifiComm)

-

Zero1 (Zero1 Li-Fi, Zero1 Wi-Fi Extender)

-

Panasonic Corporation (Panasonic LiFi, Panasonic LiFi Solutions)

-

Qualcomm Technologies, Inc. (Qualcomm LiFi, Qualcomm Snapdragon LiFi)

-

Koninklijke Philips NV (Philips LiFi, Philips Light Fidelity)

-

IBSENtelecom Ltd. (IBSENtelecom LiFi, IBSENtelecom LiFi Receiver)

-

Renesas Electronics Corporation (Renesas LiFi, Renesas Light Communication)

-

General Electric (GE LiFi, GE Lighting Solutions)

-

PureLiFi Ltd. (LiFi-XC, LiFi-X)

-

Oledcomm S.A.S. (Oledcomm LiFi, LiFiMAX)

-

Lvx System (Lvx Li-Fi, Lvx Light Communication)

-

Panasonic Corporation (Panasonic LiFi, Panasonic LiFi Solutions)

-

Acuity Brands (Acuity LiFi, Acuity Light Solutions)

Recent Developments:

-

In February 2024, pureLiFi unveiled next-generation LiFi technologies at Mobile World Congress (MWC) in Barcelona, introducing innovations like the LiFi Cube and SkyLite, designed to enhance wireless connectivity across various applications

-

In December 2024, Qualcomm discussed 6G technology and spectrum needs, highlighting innovations like Giga-MIMO, SBFD, and AI-driven beam management to unlock next-generation wireless connectivity

| Report Attributes | Details |

| Market Size in 2023 | USD 0.62 Billion |

| Market Size by 2032 | USD 35.62 Billion |

| CAGR | CAGR of 57.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (LED, Photodetector, Microcontrollers, Others) • By End-use (Automotive, Retail, Healthcare, Aerospace & Defense, Government, Transportation, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PureLiFi, Oledcomm, Signify Holding, VLNComm, Velmenni, Wipro Lighting, LiFiComm, Lucibel, Zero1, Panasonic Corporation, Qualcomm Technologies, Inc., Koninklijke Philips NV, IBSENtelecom Ltd., Renesas Electronics Corporation, General Electric, PureLiFi Ltd., Oledcomm S.A.S., Lvx System, Acuity Brands |