Liquid Ring Compressors Market Report Scope & Overview:

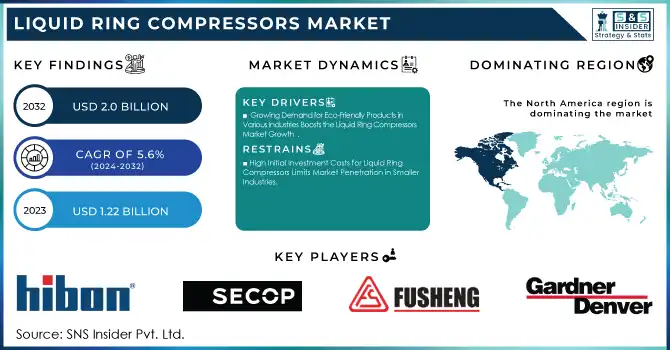

The Liquid Ring Compressors Market size was valued at USD 1.22 Billion in 2023 and is expected to reach USD 2.0 Billion by 2032 and grow at a CAGR of 5.6% over the forecast period 2024-2032.

Get More Information on Liquid Ring Compressors Market - Request Sample Report

Liquid ring compressors have experienced a remarkable growth rate over the past few years due to the rising demand for efficient and reliable compression systems in various industrial sectors. Liquid ring compressors are positive displacement machines where a liquid is used to form a sealing ring in the rotor, which then compresses gases. These compressors are widely known for their ability to handle wet and dirty gases and therefore are widely used in industries like chemical processing, petrochemicals, food and beverage, pharmaceuticals, wastewater treatment, and mining. Their versatility, cost-effectiveness, and operational reliability have led to their increased use worldwide.

The liquid ring compressors market is expected to grow significantly due to their increasing demand across industries. This sector is driven by the rising need for efficient gas compression systems capable of handling wet and dirty gases, growing at a steady pace. This growth is particularly notable in chemical processing, petrochemicals, wastewater treatment, and mining industries, which require reliable, cost-effective, and versatile compressors. The chemical industry alone is expected to hold a significant share of the market, accounting for more than 25% of total revenue by mid-2020s.

Liquid Ring Compressors Market Dynamics

Key Drivers:

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts the Liquid Ring Compressors Market Growth

Increasing attention towards sustainable operations and green practices in industrial sectors has added to the growth of the liquid ring compressors market. Industries, especially chemical, petrochemical, and wastewater treatment industries, are now seeking energy-efficient solutions with less environmental impact, which makes liquid ring compressors a popular choice. These compressors work with water or other liquids to make seals and can therefore process wet and dirty gases effectively, which favors a greener approach.

Increasing demand for eco-friendly products from across all industries, especially from the petrochemicals and chemical processing industries, in May 2024 will drive the liquid ring compressors market. Liquid ring compressors are preferred since they are capable of handling wet and dirty gases, thereby fitting applications that require efficiency with environmental and operational operations. Industry trends suggest that the global demand for petrochemicals is expected to double by 2050. As the chemical and petrochemical industries increasingly focus on energy-efficient and low-emission solutions, liquid ring compressors are gaining prominence as a viable option for achieving sustainability goals. Liquid ring compressors save up to 30% more energy than traditional compression systems and are now an essential part of green industrial practices.

-

Technological Advancements in Compressor Design and Efficiency Drive Liquid Ring Compressors Market Innovation

Technological innovations and the availability of advanced compressor design technology are some of the major factors driving the growth of the liquid ring compressor market. Advances in the modern engineering field of liquid ring compressors have opened up possibilities for improved, effective durable, and economical machines. Improvements in sealing technologies, rotor designs, or lubrication systems contribute to their enhanced hydraulic performance and service life and help to increase their appeal to end-users. Such technical advancements enhance energy efficiency while reducing maintenance costs along with downtime day, a critical consideration for industries featuring heavy operational demands, like petrochemicals, food & beverage, and pharmaceuticals.

In September 2024, liquid ring compressors played a significant role in increasing industrial adoption in sectors such as petrochemicals, pharmaceuticals, and food processing. To ensure operational demands are met in harsh conditions, the emphasis has been on improving the efficiency, durability, and cost-effectiveness of such compressors. For example, new sealing technologies, optimized rotor designs, and improved lubrication systems bring energy efficiency to about 15-30% more than the current models. Real-time performance monitoring, and predictive maintenance through smart technologies with IoT connectivity, bring downtime down by 25%. It increases reliability and reduces costs which is the reason why liquid ring compressors in the market are being adopted. As industries strive for sustainability and operational efficiency, technological advancement remains the most potential driver for the growth of the liquid ring compressor market.

Restrain:

-

High Initial Investment Costs for Liquid Ring Compressors Limits Market Penetration in Smaller Industries

Although liquid ring compressors present several advantages, including energy effectiveness and flexibility in handling damp or dirty gases, initial high investment costs are considerable inhibitors for smaller industries. Sufficient capital outlay could be required for the purchase of and installation of liquid ring compressors, which becomes problematic for smaller businesses with lean budgets or start-up projects. Besides the initial investment, such systems usually require installation and maintenance services due to technicality, therefore raising their entire cost.

The liquids ring compressors require a high investment at the outset and this can greatly limit its adoption mainly by small industries. The liquid ring compressor can vary between USD20,000 and USD100,000 depending on the model and application; installation and maintenance add to the total cost. These systems offer long-term efficiency and energy-saving benefits but the capital outlay is indeed a barrier for most small to medium-sized enterprises. The payback period for such investments may range from 3 to 5 years, which is a long-term commitment for small businesses with limited budgets. SMEs in food and beverage, mining, and pharmaceuticals, where budgets are tight, tend to focus on low initial costs, hence slow adoption of advanced technologies like liquid ring compressors.

Liquid Ring Compressors Market Segments Analysis

By Type

In 2023, the Two-stage liquid ring compressors segment holds the highest market share at 54% in the market. The market for this segment is expanding due to an increasing demand for high-efficiency compressors for handling larger volumes of wet and dirty gases. This type of compressor is apt for industries that require heavy-duty performance over a wide range of operating conditions, like chemical processing, petrochemicals, and wastewater treatment. Recent developments in products in companies Busch Vacuum Solutions and Gardner Denver companies emphasized increased effectiveness and operational reliability of the product, particularly of two-stage compressors.

The Single-Stage liquid ring compressors segment is expected to grow at the fastest CAGR of 6.16% during the forecast period 2024-2032. This growth is primarily driven by their cost-effectiveness, simplicity, and ability to handle low to moderate-pressure applications in food and beverage, pharmaceutical, and mining industries. Ingersoll Rand and Atlas Copco have recently released new models of single-stage compressors focused on energy efficiency and ease of maintenance. These developments have made single-stage compressors more viable for more small-scale operations and applications that require fewer complex systems.

By Material Type

The Stainless-Steel segment dominated the liquid ring compressors market in 2023, accounting for 44% of the total market share. It has been preferred in industries for its corrosion resistance, durability, and ability to handle aggressive gases. Its applications have been in the petrochemical industry, pharmaceutical, and even wastewater treatment industries. Busch Vacuum Solutions and Gardner Denver have introduced more stainless-steel products as they improved compressor models for higher efficiency and longer service life. Stainless steel's strength and pressure resistance make it a popular choice for high-demand applications, which is why it is still the leader in the market. With an increasing need for reliability and durability in compressor systems, stainless-steel liquid ring compressors will continue to have a steady demand.

The Cast Iron segment of the liquid ring compressors market is projected to grow at the fastest CAGR of 6.99% over the forecast period. Cast iron compressors are priced affordably, and robust with general-purpose suitability for the food and beverage, mining, and manufacturing industries. Recent product innovations by Atlas Copco and others focus on the efficiency and life cycles of cast iron compressors. Although cast iron models are not as corrosion-resistant as stainless steel, they are highly in demand because of their cost-effectiveness and reliability for moderate-duty applications. This material is gaining traction in emerging markets, where price sensitivity and a need for robust, lower-cost compressors drive adoption.

Liquid Ring Compressors Market Regional Analysis

In 2023, North America dominated the liquid ring compressors market, holding a significant market share of 34%. This can be attributed to advanced industrial infrastructure in the region, high demand from various segments like petrochemicals, pharmaceuticals, food processing, and technological innovations in compressor design. The region's focus on sustainability and energy efficiency has further driven the adoption of liquid ring compressors and reinforces its market leadership, further strengthened by innovation led by companies like Busch Vacuum Solutions and Gardner Denver in North America. The energy-saving strategies for compressed air systems. It highlights potential savings of up to 50% by improving part-load capacity control, fixing leaks, and reducing artificial demand. Key strategies include using variable speed drive control, optimizing air storage, and improving pressure flow control, which helps minimize waste.

The Asia Pacific region is the fastest-growing liquid ring compressor market, with a robust growth outlook. The region is expected to register a significant CAGR of 7.24% from 2024 to 2032. Liquid ring compressors are in heavy demand due to high demand sectors of industrialization in countries such as China, India, and Japan. This sector also is in the growth mode of various sectors like chemicals, petrochemicals, and manufacturing. There is a higher demand for efficient, energy-saving technologies in this growing sector. Regional growth contributed by China's reopening and surging consumption comprises nearly 70% of the growth of liquid ring compressors worldwide. With the economic growth of the region and the increasing demand for sustainable solutions, the Asia Pacific liquid ring compressors market is expected to grow in the future, supporting industries that are focused on efficiency and minimal environmental impact.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in the Liquid Ring Compressors Market are:

-

Nash (2BG Two-Stage Liquid Ring Compressor, 2BK Single-Stage Liquid Ring Compressor)

-

Gardner Denver (Elmo Rietschle VLR Series, L-BV Series)

-

Fusheng (LRS Series Liquid Ring Compressors, A-Series Water Ring Compressors)

-

Secop (K-Series Liquid Ring Compressors, NLU Series)

-

Nanjing Huade Vacuum Pump Factory (2BV5 Liquid Ring Vacuum Pumps, 2SY Series Compressors)

-

DUNN SYSTEM (DLRC Series Liquid Ring Compressors, DSX Model)

-

ANHUI JIAXIN VACUUM PUMP (JX-LR Two-Stage Liquid Ring Compressor, JX-VR Series)

-

Pfeiffer Vacuum (Dolphin Series Liquid Ring Compressors, Varodry-Liquid Ring Hybrid)

-

Busch Vacuum Pumps and Systems (Dolphin LC Series, Dolphin LX Series)

-

Shandong Weifang Huaxin (H2BV Series Liquid Ring Pumps, H2SY Series)

-

Atlas Copco (ZL Two-Stage Liquid Ring Compressor, AWS Series)

-

Kaeser (Omega Liquid Ring Compressors, DV Series)

-

HIBON (CSL Series Compressors, HG-Series)

-

Rietschle Thomas (Liquid Ring Pump Series L-BV2, Liquid Ring Series L-VH)

-

Shandong Huaiyin Compressor (HY-LR Series Liquid Ring Compressors, HY-V Series)

-

Tuthill Corporation (Liquid Ring Compressor TR Series, Vacuum Systems LR Series)

-

PPI Pumps Pvt. Ltd. (PPS Series, MP Series Liquid Ring Compressors)

-

DEKKER Vacuum Technologies, Inc. (AquaSeal Compressors, AquaRing Series)

-

Graham Corporation (Heliflow Liquid Ring Compressor, G-LR Compressors)

Recent Trends

-

In 2024, Gardner Denver began offering GARO Liquid Ring Compressors, including chlorine gas compression with improvement in safety and efficiency, designed to combat corrosion and extend compressor service life.

-

In Jan 2024, Nash launched its Vectra XL Liquid Ring Compressors. Geared toward high-performance applications in industries like chemical processing, these compressors are available in capacities from 195 to 8,900 m³/h.

-

In 2024 March, Fusheng launched the new FVS Liquid Ring Compressor series. The series is proposed for high-flow applications, including energy-efficient solutions for the chemical and pharmaceutical industries.

-

In February 2024, Secop designed an innovative line of green liquid ring compressors with a lower noise level and energy consumption tailored for industrial use, including food and automotive sectors, among others.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.22 Billion |

| Market Size by 2032 | USD 2.0 Billion |

| CAGR | CAGR of 5.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Single-stage, Two-stage) • By Material Type (Cast Iron, Stainless Steel, Others) • By Flow Rate (25–600 M3H, 600–3,000 M3H, 3,000–12,000 M3H, Over 12,000 M3H) • By Application (Petrochemical & Chemical, Pharmaceutical, Food Manufacturing, Aircraft, Automobile, Water Treatment, Oil & Gas, Power Generation, EPS and Plastics, Pulp & Paper, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nash, Gardner Denver, Fusheng, Secop, Nanjing Huade Vacuum Pump Factory, DUNN SYSTEM, ANHUI JIAXIN VACUUM PUMP, Pfeiffer Vacuum, Busch Vacuum Pumps and Systems, Shandong Weifang Huaxin, Atlas Copco, Kaeser, HIBON, Rietschle Thomas, Shandong Huaiyin Compressor, Tuthill Corporation, PPI Pumps Pvt. Ltd., DEKKER Vacuum Technologies, Inc., Graham Corporation. |

| Key Drivers | • Growing Demand for Eco-Friendly Products in Various Industries Boosts the Liquid Ring Compressors Market Growth • Technological Advancements in Compressor Design and Efficiency Drive Liquid Ring Compressors Market Innovation |

| Restraints | • High Initial Investment Costs for Liquid Ring Compressors Limits Market Penetration in Smaller Industries |