Lithium Market Analysis & Overview:

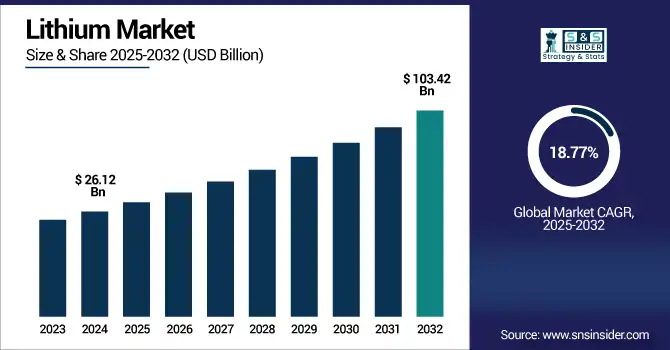

The Lithium Market size was valued at USD 26.12 billion in 2024 and is expected to reach USD 103.42 billion by 2032, growing at a CAGR of 18.77% over the forecast period of 2025-2032.

To Get more information on Lithium Market - Request Free Sample Report

Lithium market analysis indicates strong momentum driven by surging demand for energy storage solutions, particularly in electric vehicles (EVs), consumer electronics, and grid-scale batteries. With the global shift toward decarbonization, lithium is increasingly vital for high-performance battery technologies. Governments and industries are ramping up investments in lithium mining, refining, and recycling to secure long-term supply chains. As innovation in solid-state batteries and battery chemistries accelerates, the lithium market is positioned for sustained growth, supported by strategic policies and rising clean energy adoption worldwide, which drive the lithium market growth.

The U.S. Geological Survey (USGS) stated that in 2021, the consumption of lithium in the United States was approx. 2,000metric tons of lithium (equivalent to 11,000t lithium carbonate equivalent), mainly for batteries in electronics, industrial, and other applications. Additionally, according to USGS (2024), over 30% of lithium consumption in the U.S. is linked to batteries used in consumer electronics.

Lithium Market Drivers

-

Rising Demand from Electric Vehicles Drives the Market Growth

Lithium is at the core of most electric vehicles (EVs), and so one of the main forces behind the lithium market is the boom in EV production. There is a continued focus on carbon emissions and oil-fueled automobile consumer choices, which makes the auto manufacturers respond and move as fast as possible on the road to electric mobility. Top automakers are pouring big money into battery technologies in a bid to enhance range and minimize charging time. Consumer demand and tougher emission regulations around the world are further driving this trend. The energy density and long cycle life of lithium make the metal suitable for automotive applications. The diminishing price point of the models is another reason for the growing market share of EVs.

In 2023, Tesla revealed plans to expand its Texas Gigafactory by building a factory there to produce lithium hydroxide in-house to ensure it has a reliable source of the battery material.

Lithium Market Restrain

-

Supply Chain Constraints Costs May Hamper the Market Growth

As lithium is a key raw material in the production of batteries for electric vehicles, the geographic concentration of lithium reserves and extraction creates challenges for the lithium market to have a stable and sustainable supply chain. The lithium market is primarily made up of several nations, mainly Australia, Chile, and China, therefore making it susceptible to geopolitical pressures impacting trade. This means that the long lead times of lithium extraction and processing slow the responsiveness of supply to increasing levels of demand. Production expansion is also hampered because of environmental issues over water consumption and land disturbance where lithium is mined. Together, these elements drive risks to the supply side and price gyrations.

Lithium Market Opportunities

-

Battery Recycling and Circular Economy Initiatives Create an Opportunity in the Market

With the increasing adoption of lithium-ion batteries comes the increasing need for sustainable disposal and recycling solutions. While lithium is widely used in battery applications, using the lithium within spent batteries helps to alleviate supply chain pressure by minimizing environmental impact through establishing a secondary source of lithium. Recycling further reduces dependency on virgin resources and also helps to minimize the risk associated with geopolitical trading and concentration of resources. Better recycling technology is making it easier and more profitable to reclaim materials. Governments and private players are setting up, which is driving the lithium market trends.

In 2022, Redwood Materials (founded by the ex-CTO of Tesla) received USD 2 billion to build lithium-ion battery recycling facilities in the US.

Lithium Market Segmentation Analysis:

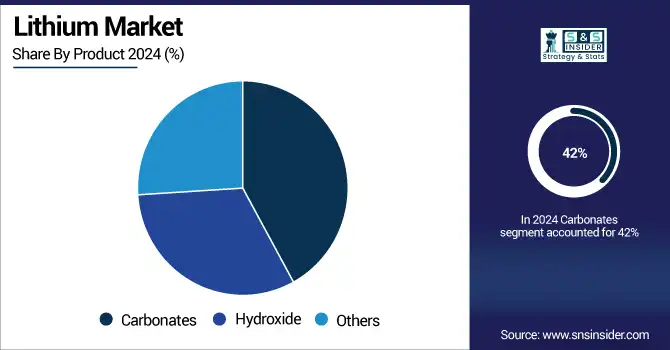

By Product

Carbonates held the largest lithium market share, around 42%, in 2024. It is owing to the widely used in the manufacture of lithium-ion batteries. It serves as one of the important precursors for producing cathode materials for numerous applications such as electric vehicle (EV) batteries, portable electronics, and energy storage systems. It is cheaper and easier to process than many other lithium compounds, making it the go-to compound for battery makers. Lithium carbonate is also used for many other applications, ranging from glass and ceramics, which further secures its leading position in the market. With EV production continuing to expand across the globe and governments globally advocating for cleaner energy technologies, demand growth for lithium carbonate is expected to remain robust, reinforcing its primary position in the lithium derivatives market.

Hydroxide held a significant lithium market share. It is owing to its growing role in high-performance lithium-ion battery chemistries, especially those found in electric vehicles (EVs). Nickel-rich cathodes, which provide greater energy density and longer working life for next-generation EVs, have made lithium hydroxide the preferred choice. With automakers and battery suppliers moving to these newer chemistries as a way to maximize driving range and figure out how to operate and get to lower costs, lithium hydroxide demand has taken off. In addition, many new battery gigafactories under development around the world are designed for lithium hydroxide versus carbonate, further cementing its growing position in the market. Therefore, lithium hydroxide is an important material supporting the clean energy transition through its use in long-range EVs and grid-scale ESS.

By Application

Automotive segment held the largest market share, around 54.23%, in 2024. It is owing to the global fuel switch towards electric mobility. Lithium-ion batteries have gained enormous prominence as the main power source for electric vehicles (EVs), due to their high energy density, extended cycle life, and great electrochemical performance that are necessary for EV applications. Governments tightening emissions regulations and pushing subsidies to switch to EVs have led global car giants to ramp up electric vehicle production, resulting in even more demand for lithium. Favorable consumer shifts toward clean transportation, technological improvements in battery materials, and growing charging infrastructures have reaffirmed automotive as the largest lithium end-use industry. And that is a trend that will not subside as the globe hastens toward sustainable mobility solutions.

Consumer electronics holds a significant market share in the lithium market. It is due to the high and growing adoption of lithium-ion batteries for devices, including smartphones, laptops, tablets, smartwatches, and wireless accessories. Such products demand lightweight, compact, and long-lasting sources of power; lithium-based batteries are the best fit here with their high energy density and rechargeability. An upsurge in digital connectivity, the emergence of contemporary remote work, and the use of smart devices have increased the need for dependable and efficient batteries even more. Moreover, as innovation continues in consumer technology, also pushing for more miniaturized designs, the prominence of lithium became even more marked in this segment.

Lithium Market Regional Outlook:

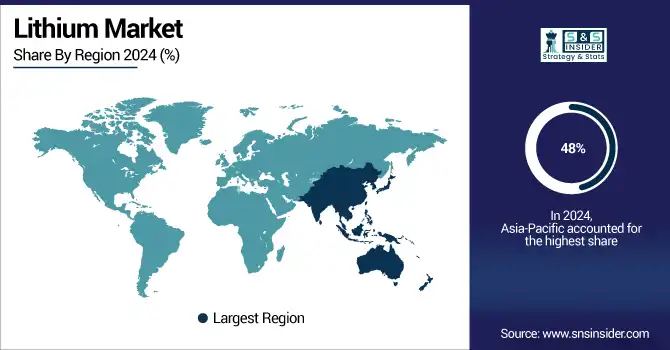

Asia-Pacific lithium market held the largest market share, around 48%, in 2024. It is due to its unrivaled manufacturing capabilities, high demand for EV market and a strong base of consumer electronics. China, Japan, and South Korea not only produce the lion's share of lithium-ion batteries but also host the most advanced battery supply chains. In particular, China has a strategic advantage in terms of global supply due to its dominant share of the world lithium processing capacity. At the same time, the region is strengthened by solid government support for clean mobility, with sales in the millions for both electric vehicles and two-wheelers. Moreover, the enormous population and the rising income levels are favoring the higher demand for consumer electronics, which in turn causes more lithium usage and a rise in the lithium battery market, which drives the lithium market.

In early 2025, China reported a major drop in lithium carbonate prices, signaling a temporary oversupply. However, this also shows the depth of the region’s production capacity and how it can influence global market dynamics, particularly in pricing and exports.

North America lithium market held a significant market share and is the fastest-growing segment in the forecast period. It is owing to high electric vehicle (EV) adoption, large battery manufacturing-scale investments, and a desire for closer domestic mineral sourcing. The U.S. and Canada both have enacting policies to bolster independence in critical minerals and lessen dependence on imported lithium. While the U.S. government rolls out funding programs to support mining, refining, and battery plant construction here, Canada is cementing its position as the brain behind these operations and a major lithium supplier via exploration and joint ventures. The hub is also home to the big EV/tech players that are ramping up their in-house lithium sourcing to protect supply chains.

The U.S. Lithium market size was USD 4.15 billion in 2024 and is expected to reach USD 17.45 billion by 2032 and grow at a CAGR of 19.67% over the forecast period of 2025-2032. It is due to colossal policy support, an emerging electric vehicle drive, and aspirational attempts for a complete lithium industrial chain Critical mineral independence has become a priority for the federal government the first under the Defense Production Act and the second under the Inflation Reduction Act, which offers tax credits and other funding to boost domestic lithium mining and battery production. To achieve its ambitious sustainability and economic goals, American automakers such as Tesla, Ford, and GM are ramping up EV production while pouring money into building domestic battery plants.

Europe held a significant market share in the forecast period. It is due to the large electric vehicle manufacturers and battery firms located in the region. Lithium is considered a critical raw material by the EU, and the bloc has been boosting domestic mining, refining, and recycling in order to cut imports, most notably from China. But Europe has hurdles of its own, such as a scarcity of lithium at home, slow permitting processes, and costly electricity. Still, lithium development is gaining momentum in those countries with very significant governmental and private support, like Germany, Portugal, and the Czech Republic. Sustainability is also a focus in Europe, which includes recycling and green extraction technologies.

In 2025, AMG Lithium inaugurated the first lithium hydroxide processing plant in Europe, representing an important step in establishing a fully localized and independent battery supply chain for Europe as a whole, albeit challenged by regulatory and economic issues.

Get Customized Report as per Your Business Requirement - Enquiry Now

Lithium Market Companies are:

The major lithium companies are 3M, DuPont, Toray Industries, SUEZ, Koch Separation Solutions, Pentair, Pall Corporation, Hydranautics, Asahi Kasei, GE Water & Process Technologies

Recent Development:

-

In June 2025, Chevron USA acquired 125,000 acres in Texas and Arkansas to target the lithium-bearing Smackover Formation via Direct Lithium Extraction (DLE) technology. It is the largest step by a traditional oil and gas major into the lithium space, and the aim is to build a supply chain on a home scale.

-

In May 2025, Rio Tinto joint venture with Codelco, Rio Tinto unveiled that it would be investing up to USD 900 million in the Maricunga lithium project in Chile.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 26.12 Billion |

| Market Size by 2032 | USD 103.42 Billion |

| CAGR | CAGR of 18.77% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Carbonates, Hydroxide, and Others) •By Application (Water & Wastewater Treatment, Industry Processing, Food & Beverage Processing, Pharmaceutical & Medical, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | 3M, DuPont, Toray Industries, SUEZ, Koch Separation Solutions, Pentair, Pall Corporation, Hydranautics, Asahi Kasei, GE Water & Process Technologies |