Specialty Gas Market Report Scope & Overview:

Get E-PDF Sample Report on Specialty Gas Market - Request Sample Report

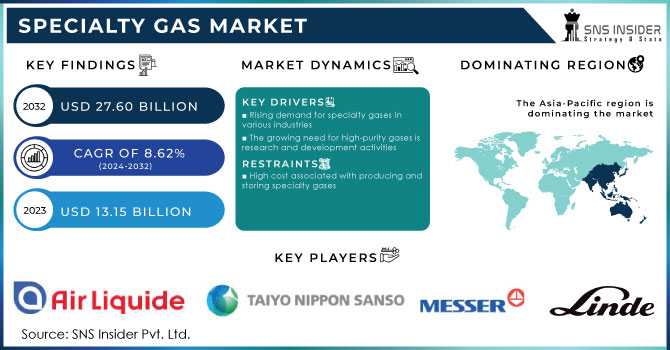

The Specialty Gas Market size was valued at USD 13.15 Billion in 2023. It is expected to grow to USD 27.60 Billion by 2032 and grow at a CAGR of 8.62% over the forecast period of 2024-2032.

The Specialty Gas Market has been growing considerably, with increased requirements of specialty gases across the healthcare industry. It contains these gases which are important to anesthesia, respiratory therapy, and many types of surgery. They lend themselves as well to the calibration of equipment used in medical settings absolutely necessary for precise and compliant measurements essential to patient care. This is stimulating the focus of key players in the market to expand their product offerings and invest in innovation to capitalize on this market demand.

For example, in 2022, Air Products intensified its special gas production capacity to cater to the burgeoning demands of the pure-play healthcare industry. These trends underline the increasing focus on improving the accessibility and quality of special gases, especially for medical usage, which is likely to further boost market expansion.

Furthermore, the manufacturing sector benefits greatly from specialty gases, as they are utilized in various industrial processes. For example, they are crucial for welding, heat treatment, and metal fabrication, ensuring superior product quality and operational efficiency. In the case of scientific research, specialty gases are indispensable tools for conducting experiments and analysis. They are used in laboratories worldwide for applications such as chromatography, spectroscopy, and environmental testing. The exceptional purity and accuracy of these gases enable researchers to obtain precise and reliable results.

The consumption of specialty gases is also growing significantly in manufacturing & industrial and auto/transport, chemical & electronics as well as food & beverages. Utilization of specialty gases like argon, nitrogen, and carbon dioxide is imperative to carry out the welding cuttings and insulation in the automotive sector. Moreover, the food and drink industries also utilize gases like nitrogen, and carbon dioxide for packaging and preservation by means of distribution systems for longer shelf life to ensure consumer safety which drive the market growth. The chemicals industry also requires specialty gases for chemical synthesis and refining processes with the U.S. chemicals manufacturing sector accounting for over USD 550 billion to the economy in 2023, according to The U.S. Bureau of Economic Analysis. The demand for specialty gases continues to rise in major end-use applications, underpinned by robust economic contributions and initiatives of governing bodies as highlighted by the study.

Drivers

-

Rising demand for specialty gases in various industries

-

The growing need for high-purity gases in research and development activities

The advancements in scientific research and technological innovations have led to a greater emphasis on precision and accuracy. As a result, researchers and developers require gases with extremely high levels of purity to ensure reliable and consistent results. These high-purity gases are essential in various industries such as pharmaceuticals, electronics, and aerospace, where even the slightest impurities can have detrimental effects on the final product or experiment. Moreover, the rising awareness regarding environmental concerns has prompted the adoption of cleaner and greener technologies. Specialty gases play a crucial role in this transition by enabling the development of eco-friendly alternatives. For example, in the automotive industry, specialty gases are used in the production of electric vehicle batteries, reducing the reliance on fossil fuels and contributing to a more sustainable future. Furthermore, the increasing focus on healthcare and medical research has further fueled the demand for specialty gases. These gases are utilized in medical imaging, diagnostics, and therapeutic applications, where precision and purity are of utmost importance. The continuous advancements in medical technology and the growing need for accurate diagnosis and treatment options have created a significant market for specialty gases.

Restraint

-

High costs associated with producing and storing specialty gases hamper the market growth.

One of the major challenges for the market is the high cost involved in specialty gases, which could have an adverse impact on their production and storage as well. The purity of these gases is often made by very elaborate and expensive processes, so to manufacture them in order they are pure enough for the final application can require very high-level production technology. The manufacturer must also invest in the necessary infrastructure to ensure safe storage, transportation, and handling, which results in additional operating costs. All of these factors combine to make specialty gases more expensive than standard industrial gases, which can dampen their use, especially in price-sensitive markets.

Opportunities

-

Growing demand for eco-friendly specialty gases

-

Expanding applications of specialty gases in emerging industries

Specialty Gas Market Segmentation Overview

By Product

The carbon gas segment dominated the specialty gas market with the highest market share of about 31.6% in 2023. Carbon gases are extensively utilized in various medical equipment, including nuclear magnetic resonance imaging, magnetic resonance imaging, and ophthalmology, among others. The demand for carbon gases remains consistently high across sectors such as electronics, manufacturing, healthcare, and chemicals. The expanding range of applications for carbon gases, particularly in instrument calibration, is driving the surge in demand for these gases.

By Application

In the specialty gas market, the electronics sector is currently leading in terms of demand and growth. Specialty gases such as nitrogen, argon, and fluorine are essential in semiconductor manufacturing processes, including etching, doping, and wafer cleaning. The rapid expansion of the electronics industry, driven by the growing adoption of advanced technologies like 5G, artificial intelligence (AI), and the Internet of Things (IoT), has significantly boosted the demand for ultra-high purity gases. Additionally, stringent purity standards in electronics manufacturing make specialty gases indispensable for ensuring product quality, further solidifying the sector's dominance over other applications like healthcare, manufacturing, and institutional use.

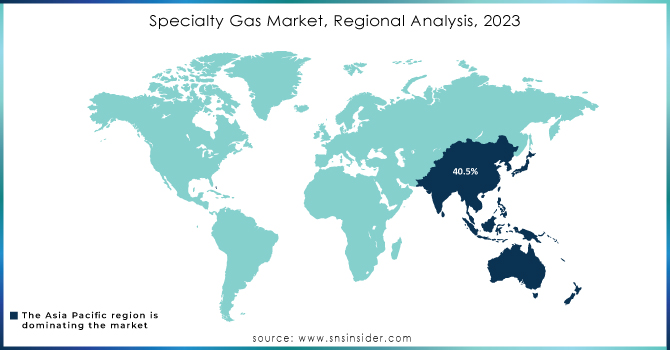

Specialty Gas Market Regional Analysis

Asia Pacific dominated the Specialty Gas Market with the highest revenue share of about 40.5% in 2023. This region boasts numerous electronic manufacturing hubs located in China, Japan, and India. Moreover, local governments are actively promoting the expansion of various end-use industries, including consumer electronics, oil and gas, manufacturing, and healthcare, through initiatives such as Production-Linked Incentives (PLI), subsidies, and favorable Foreign Direct Investment (FDI) policies. These factors collectively contribute to the remarkable growth and dominance of the specialty gas industry in the Asia Pacific region.

Europe held a significant revenue share of the Specialty Gas Market and is expected to grow with a CAGR of about 8.4% during the forecast period. The region is actively focusing on expanding its production capacity to meet the increasing demand from various end-use industries. Furthermore, the healthcare and pharmaceutical sectors are witnessing substantial investments, which are expected to further drive the demand for specialty gases in the region. For example, the French government announced a public funding plan of USD 8.33 billion in June 2021, aimed at advancing the healthcare system within the country. Europe, being the second largest chemical producer globally, boasts advanced healthcare technologies and facilities. However, it lags behind in the semiconductor industry. Nevertheless, certain European countries, including the Netherlands, Germany, France, and the U.K., are witnessing a surge in demand for electronic gases. By enhancing production capacity and capitalizing on investments in the healthcare and pharmaceutical sectors, Europe is poised to maintain its strong position in the Specialty Gas Market. Additionally, the growth potential in the semiconductor industry presents an opportunity for European countries to bridge the gap and further diversify their specialty gas market.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Air Liquide (ALPHAGAZ™ Specialty Gases)

-

Norco Inc. (AIRZERO)

-

Linde plc (HiQ Specialty Gases)

-

Air Products and Chemicals, Inc. (Experis Specialty Gases)

-

Praxair, Inc. (StarFlame Cutting Gases)

-

Matheson Tri-Gas, Inc. (SEMICORE Semiconductor Gases)

-

Messer Group GmbH (Messer SpecPure Gases)

-

Iwatani Corporation (Specialty Helium Gas)

-

MESA Specialty Gases & Equipment

-

Taiyo Nippon Sanso Corporation (Nippon Sanso PurityPlus® Gases)

-

Showa Denko K.K. (Specialty Fluorinated Gases)

-

Advanced Specialty Gases, Inc. (Ultra-High Purity Nitrogen)

-

Electronic Fluorocarbons LLC (EFC’s Ultra High-Purity Gases)

-

Yingde Gases Group (High-Purity Oxygen)

-

Hyosung Corporation (Specialty Hydrogen Gas)

-

SICGIL India Limited (Specialty Carbon Dioxide)

-

Weldstar

-

Iceblick Ltd. (Neon and Krypton Mixtures)

-

Matheson Gas (Ultra-Pure Argon)

-

Coregas Pty Ltd (Coregas LaserGAS)

-

The Linde Group (RENEW Specialty Gases)

-

Praxair Technology, Inc. (Praxair Grab 'n Go Oxygen)

-

Central Welding Supply (Ultra-High Purity Acetylene)

Recent Development:

-

In May 2023, Messer, a specialist in industrial gases acquired the joint venture Messer Industries, making them the sole owner. This joint venture includes Messer's companies in North and South America, as well as Western Europe.

-

In April 2023, Linde announced its plans to expand the capacity of its on-site facility in Tangjeong, South Korea.

-

In January 2023, Taiyo Nippon Sanso Corporation revealed its establishment of a business site and a logistics site for specialty gases in Kumamoto, Japan. This move is intended to enhance its logistics activities for specialty gases in the Kyushu area.

| Report Attributes | Details |

| Market Size in 2023 | US$ 13.15 Billion |

| Market Size by 2032 | US$ 25.21 Billion |

| CAGR | CAGR of 8.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Noble Gases, Ultra-high Purity Gases, Carbon Gases, Halogen Gases, and Others) • By Application (Manufacturing, Healthcare, Electronics, Institutions, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Air Liquide, Norco Inc., Messer Group GmbH, Air Products and Chemicals, Inc., Taiyo Nippon Sanso Corp., Showa Denko K. K., MESA Specialty Gases & Equipment, Linde plc., Coregas, Weldstar |

| Key Drivers | • Rising demand for specialty gases in various industries • The growing need for high-purity gases in research and development activities |

| Market Opportunity | • Growing demand for eco-friendly specialty gases. • Expanding applications of specialty gases in emerging industries |