Phase-Transfer Catalyst Market Report SIze & Overview:

Get More Information on Phase-transfer Catalyst Market - Request Sample Report

The Phase-transfer Catalyst Market size was valued at USD 1.1 Billion in 2023. It is expected to grow to USD 1.81 Billion by 2032 and grow at a CAGR of 5.7% over the forecast period of 2024-2032.

Phase-transfer catalysts are chemical compounds used in facilitating reactions between different phases of the reactants such as solid-liquid, liquid-liquid and gas-liquid systems. In this regard PTCs work by enhancing mass transfer of the reactants across phase boundaries. Indeed, this capacity to significantly increase the rate and yield of reactions helps industries reduce costs while optimizing efficiency in the production of several products, through processes that would be otherwise slow or impossible. Apparently, they become of high importance, and one of the key components of different industries such as chemicals, pharmaceuticals, polymers, agrochemicals, foods, and cosmetics.

The agrochemical sector serves a pivotal role in the expansion of the phase-transfer catalysts market. Phase-transfer catalysts are essential for increasing the synthesis of several agricultural chemicals, which include herbicides, insecticides, and fungicides. Generally, PTCs serve as a bridge between immiscible phases to facilitate chemical reaction by increasing the reactivity between water-soluble and oil-solubility reactants. This becomes essential in agrochemical synthesis given many active ingredients are either hydrophilic or lipophilic and direct reactions ultimately end up being inefficient. In light of the demand to produce agricultural produce sustainably in light of growing population worldwide, agrochemicals have become a desired demand

According to the U.S. Environmental Protection Agency (EPA), the adoption of organic chemistry practices, which includes the use of safer chemicals like sodium hydroxide in place of hazardous alternatives, can result in cost savings of up to 20-30% in chemical manufacturing due to reduced handling and disposal costs, as well as improved worker safety.

Industries are increasingly using phase-transfer catalysts, as they comply with the best practices of green chemistry. These catalysts make it possible for chemical reactions to proceed under milder conditions and with fewer or no hazardous solvents, which are potentially dangerous for human health and the environment.

The phase-transfer catalyst helps to reduce the toxicity of reactions between fewer reactants and thus consume less energy. Currently, this step is timely, as environmental and safety organizations of different countries, like the Environmental Protection Agency in the US, the European Chemicals Agency, and any others, enforce the use of organic processes with no waste and artefacts. These agencies genuinely attempt to reduce the ecological footprint of human activities and improve workplace safety.

In 2022, Nippon Chemical unveiled a customized phase-transfer catalyst for the polymer industry that reduces the need for hazardous solvents and enhances reaction conditions to minimize energy usage. This innovation helps manufacturers meet environmental and safety standards set by regulatory bodies worldwide.

Market Dynamics

Drivers

-

Enhanced Reaction Rates and Yields which Drives the Market Growth.

Phase transfer catalysts considerably increase the velocity of reactions. This speed-up is because the catalysts are allowed to bring into close contact reactants from different phases, for example, aqueous and organic, which at normal circumstances, would either be slow to juxtapose one another, or in some instances totally unreactive. For this reason, allowing the phases to react will increase reaction times boosting output. Therefore, the industries such as the pharmaceuticals, agrochemicals, specialty chemicals which thrive on high production and minimum wastes have therefore been in consideration. In waste production, a 20-30% reduction is realized when the efficiency of reactions is increased by catalysts for example PTCs. Therefore, the industries are able to conform to environmental regulations which have tightened in the recent past and provide sustainable production processes.

Evonik Industries AG introduced a bio-based PTC in 2023 that not only improves reaction rates but also supports sustainable chemical processes by using renewable resources. This development reflects the industry's commitment to both environmental and operational efficiency, addressing the growing need for faster, cleaner, and more cost-effective chemical processes that align with regulatory requirements and market demands.

Restraint

-

Cost of implementation hampers market growth.

The largest disadvantage of Phase-Transfer Catalysts is the cost of implementation. While the utilization of PTC should decrease the operational costs for companies across multiple industries and improve effectiveness over time, and it required investments in these solutions for them to be integrated. This includes the costs of experimental and theoretical research, that will be necessary for formulating new processes on the premise of these catalysts. They will also require employees to undergo training to safely and effectively operate these new systems in the company’s production processes. Furthermore, for smaller companies or larger companies with limited funding, it can be difficult to justify such an investment, especially if there are no major flaws in their already existing catalysts utilization process or if implementing PTC does not provide immediate benefits. Additionally, the costs of pilot testing and scaling up to a production scale that will be big enough to be worthy of these investments can further complicate the financial situation of such companies.

Market Segmentation Analysis

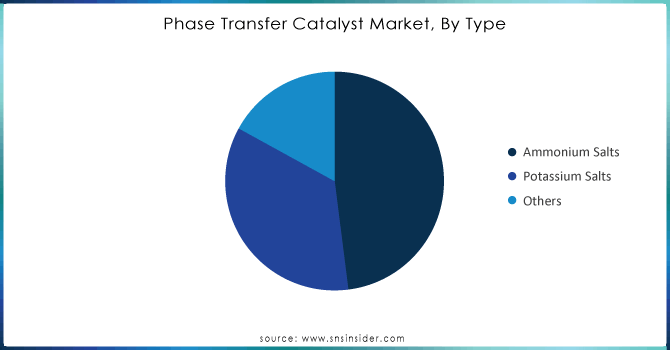

By Type

The ammonium salts held the largest market share around 50% in 2023. The reason for this is that ammonium salts are important reagents in the chemical and polymers industry. The chemical industry uses ammonium salts to help the transfer of anions from the organic phase to the aqueous phase in reactions like the synthesis of alkyl halides from alcohols. In the polymer industry, ammonium salts are used to help the transport of reactive species between two phases which differ in their affinity to these species, such as monomers.

Potassium salts, is also growing in market with a significant growth. It has the ability to form stable, water-soluble complexes and are often used for halogenation and esterification reactions. In the agrochemical industry, potassium salts are critical for the production of herbicides, insecticides, and pesticides. Importantly, the Food & Drug Administration has declared potassium salts to be ideal for chemical processes and industries. They are eco-friendly and safe to use in such processes, being non-toxic in nature.

Need Any Customization Research On Phase-Transfer Catalyst Market - Inquiry Now

By End-Use

Pharmaceuticals was the largest end-use segment, accounting for over 40% market share in 2023. In the drug formulation, synthesis, research & development, and other applications, the industry uses phase transfer catalysts. Tighter restrictions in Europe and North America with regard to use of harmful compounds have resulted to higher penetration of phase transfer catalysts. Due to restraining use of organic solvents.

Chemicals is a major consumer of PTCs as they increase the overall quality of chemical reactions, employing more control over its reaction rate. Additionally, these materials allow reactions to proceed in mild conditions and simple work-up procedures, facilitating their utilization in large-scale industrial applications. The main use of PTCs in the chemicals industry is for the production of specialty chemicals, such as the creation of crown ethers from the extraction and separation of aqueous solution salts.

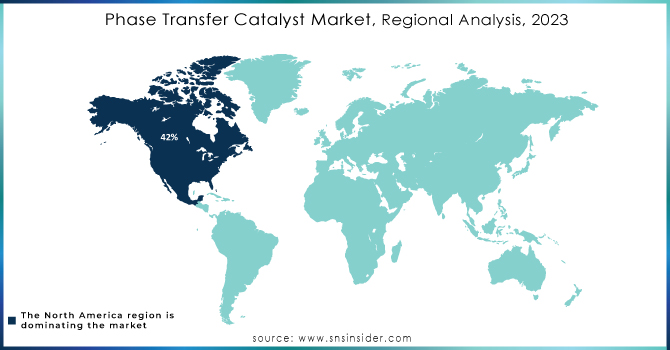

Regional Analysis

North America held the highest market share around 42% in 2023. It is due to advanced industrial infrastructure and a well-developed regulatory framework; the country provides a strong emphasis on research and development in chemical processes. The well-established pharmaceutical and agrochemical industries in this region are active markets for PTC; PTC is used to enhance reaction efficiency and comply with the environmental regulations of these developed countries. According to the US Environmental Protection Agency, the implementation of green chemistry technologies, including the use of PTC, has largely contributed to the 30% reduction in hazardous waste generation. Second, a well-established network of academic institutions and research organizations forms a competent force of scientists in the field of catalysis. Therefore, in 2021, the size of the development of the use of phase-transfer catalysts in various applications is positively affected in the short term by the themes of environmental friendliness.

Key Players

-

BASF SE (Aliquat 336)

-

Merck KGaA (Triton B)

-

Tokyo Chemical Industry Co., Ltd. (TCI) (TBAB - Tetrabutylammonium Bromide)

-

Central Drug House (CDH) (Tetraethylammonium Bromide)

-

SACHEM, Inc. (QUAB)

-

Tatva Chintan Pharma Chem Ltd. (Methyltrioctylammonium Chloride)

-

Kantons AG (Crown Ether)

-

Strem Chemicals, Inc. (18-Crown-6)

-

Alfa Aesar (A Thermo Fisher Scientific Brand) (Tetrabutylammonium Hydrogen Sulfate)

-

Nippon Chemical Industrial Co., Ltd. (Tetrahexylammonium Bromide)

-

Apollo Scientific Ltd. (Tetraphenylphosphonium Bromide)

-

Dishman Group (Benzyltriethylammonium Chloride)

-

Heraeus Holding GmbH (Methyltricaprylammonium Chloride)

-

Solvay S.A. (Cyphos IL 101)

-

Tokyo Kasei Kogyo Co., Ltd. (Tetrabutylammonium Iodide)

-

Yokoyama Kogyo Co., Ltd. (Aliquat 336)

-

S.D. Fine-Chem Ltd. (Tetrabutylammonium Fluoride)

-

Eastman Chemical Company (Triethylbenzylammonium Chloride)

-

Pfaltz & Bauer, Inc. (Tetraoctylammonium Bromide)

-

Spectrum Chemical Manufacturing Corp. (Tetramethylammonium Bromide)

Recent Developments

-

In 2023, BASF introduced a new range of environmentally friendly phase-transfer catalysts aimed at reducing energy consumption during chemical synthesis. This development reflects the growing demand for sustainable and efficient catalysts in various industries.

-

In 2023, Evonik launched a bio-based phase-transfer catalyst as part of its sustainability initiative. The new catalyst is derived from renewable resources, addressing the increasing regulatory pressure to minimize the environmental impact of chemical processes.

-

In 2022, Solvay expanded its product portfolio by adding a high-performance phase-transfer catalyst specifically designed for the pharmaceutical industry. This catalyst enhances reaction rates and yield, supporting the development of complex chemical processes in drug manufacturing.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.1 Billion |

| Market Size by 2032 | US$ 1.8 Billion |

| CAGR | CAGR of 5.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Ammonium Salts, Potassium Salts, and Other) • By End-Use (Pharmaceuticals, Agriculture, Chemical, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Merck KGaA, Tokyo Chemical Industry Co., Ltd. (TCI), Central Drug House (CDH), SACHEM, Inc., Tatva Chintan Pharma Chem Ltd., Kantons AG, Strem Chemicals, Inc., Alfa Aesar (A Thermo Fisher Scientific Brand), Nippon Chemical Industrial Co., Ltd., Apollo Scientific Ltd., Dishman Group, Heraeus Holding GmbH, Solvay S.A., Tokyo Kasei Kogyo Co., Ltd., Yokoyama Kogyo Co., Ltd., S.D. Fine-Chem Ltd., Eastman Chemical Company, Pfaltz & Bauer, Inc., Spectrum Chemical Manufacturing Corp and Others |

| Key Drivers | • Green Chemistry and Environmental Regulations • Enhanced Reaction Rates and Yields which Drives the Market Growth. |

| RESTRAINTS | • Cost of implementation hampers market growth |