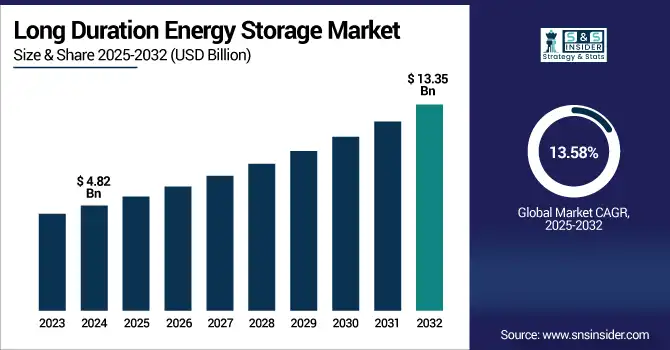

Long Duration Energy Storage Market Size & Growth:

The Long Duration Energy Storage Market size was valued at USD 4.82 Billion in 2024 and is projected to reach USD 13.35 Billion by 2032, growing at a CAGR of 13.58% during 2025-2032. The Long Duration Energy Storage (LDES) market is rapidly gaining momentum as energy systems worldwide transition toward renewable power. While short-duration lithium-ion batteries can only charge for about four hours, LDES technologies are capable of charging for eight hours or more, which are insights necessary to balance intermittent solar and wind generation. They provide grid stability, Less dependency on fossil fuel-based peaker plants, and increased energy resilience used in utilities, manufacturing, and data infrastructure.

To Get more information on Long Duration Energy Storage Market - Request Free Sample Report

The main reasons being more and more congested grids, the urgent need for retiring and reshaping of the old infrastructure, decarbonization goals, as well as increasing energy demand for electrification and digitalization trends. New large-scale, low-cost technologies like flow batteries, thermal storage, compressed air and gravity-based storage are coming on line, along with policy and market support as well as increasing investment for innovation in clean energy.

From XL BatteriesPrometheus Hyperscale Steps Up to Power U.S. Data Centers with Organic Flow Batteries for Added Energy Resilience and Range Zero Emissions: 333kW demo system in 2027, two 12.5MW/125MWh systems in 2028 and 2029

The U.S Long Duration Energy Storage market size was valued at USD 0.86 Billion in 2024 and is projected to reach USD 2.50 Billion by 2032, growing at a CAGR of 14.25%during 2025-2032. This Long Duration Energy Storage market growth reflects the increasing need for resilient, grid-independent storage options as the country speeds up its transition to clean energy. Renewables penetration, decaying grid infrastructure, decarbonization mandates and the need for long duration backup power in sectors such as data centers, the grid infrastructure and industrial use cases – are the main drivers. The continued acceleration of LDES growth across the U.S. energy landscape is also benefitting from technology improvements and beneficial energy policy.

The Long Duration Energy Storage (LDES) market Trends include the rapid shift from lithium-ion to alternative chemistries like flow batteries, iron-air, and thermal storage for enhanced safety and scalability. Increasing integration of intermittent renewables is driving demand for storage systems that can deliver energy over 8–100+ hours. There's growing adoption in data centers, microgrids, and utility-scale applications, alongside strong policy support and funding for decarbonization and grid resilience. Innovations in non-toxic, cost-effective materials and localized supply chains are also reshaping the competitive landscape of the LDES market.

Long Duration Energy Storage (LDES) Market Dynamics:

Drivers:

-

Strengthening Regulatory Compliance to Accelerate Residential LDES Adoption

As consumers increasingly adopt home energy storage systems for self‑consumption and emergency backup, stringent certification and safety standards have become pivotal. Higher regulatory requirements compel manufacturers to design reliable, compliant systems—integrating certified inverters and battery components that meet national safety benchmarks. This emphasis on safety-first product validation fosters consumer confidence, accelerates residential adoption, and enables deployment in regions with rigorous electrical regulations. In turn, it drives innovation in long-duration storage designs—such as hybrid inverters paired with advanced batteries—that support extended energy autonomy and resilient backup capabilities. Consequently, certified, safety-compliant systems are catalyzing broader LDES uptake in residential markets globally.

As it continues to secure a foothold in Japan's residential energy storage market with an emphasis on safety and compliance with local standards, GoodWe revealed the JET certification awarded to the EI Series hybrid inverter and Lynx Home F batteries (9.6/12.8kWh) in Japan.

Restraints:

-

High Upfront Costs and Long Payback Periods Limiting Widespread Adoption

The Long Duration Energy Storage (LDES) market faces significant barriers due to high initial capital costs and extended return-on-investment timelines. Many of these alternative technologies — flow batteries, compressed air, and thermal systems — require large capital investments in infrastructure, engineering, and integration upfront. This leads to hesitance among utility, commercial, and residential customers, especially in markets without strong economic incentives or subsidization. The long payback period, in particular, limits commercial viability even more when viewed against short-duration lithium-ion alternatives. Thus, this financial friction is not only stalling its large-scale deployment but also slowing down the adoption efforts since the market is not progressing as quickly as it should, especially with the increasing urgency and preparation for long-duration, sustainable energy solutions.

Opportunities:

-

Increasing Renewable Energy Penetration Driving Need for Long Duration Storage

As the share of variable renewable energy sources like solar and wind rises in global power grids, the need for reliable energy storage over extended durations becomes critical. Intermittent generation creates fluctuations in supply that short-duration batteries cannot fully address. This gap presents a major opportunity for Long Duration Energy Storage (LDES) solutions that can store and discharge energy for 8 to 24+ hours. Utilities, industries, and microgrids are actively seeking scalable technologies to ensure grid stability, minimize curtailment, and enhance energy security. As a result, the growing reliance on clean but variable energy sources is directly fueling demand for LDES, opening new avenues for deployment across utility-scale and distributed energy markets.

In this regard, Google has partnered with Energy Dome in July 2025 for global deployment of CO₂-based long-duration energy storage systems in line with its mission to attain carbon-free operations by 2030. The agreement incorporates a calculated value investment and joint ventures in Europe, Americas, and Asia Pacific.

Challenges:

-

Limited Technology Maturity and Infrastructure Slowing LDES Adoption

The Long Duration Energy Storage (LDES) market faces significant challenges due to immature technologies and underdeveloped infrastructure. Many storage solutions require further advancements in efficiency, cost reduction, and durability to meet the demands of large-scale deployment. In parallel, the lack of robust manufacturing ecosystems, skilled workforce, and standardized integration protocols complicates implementation across different grid environments. These gaps make it difficult to scale projects quickly or attract consistent investment. As a result, despite rising interest in clean and resilient energy storage, the pace of LDES adoption is constrained by the technical, logistical, and systemic hurdles that must be resolved for widespread, reliable deployment across energy networks.

Long Duration Energy Storage Market Segmentation Analysis:

By Technology

In 2024, the Mechanical Storage segment accounted for approximately 69% of the Long Duration Energy Storage Market share, due to its developed technology, high reliability and very cost effective scalability. In contrast, pumped hydro and compressed air systems still rule, since can store energy for long periods of time, more than 10 hours in a low loss manner. They are also suitable for large-scale grid applications due to their stable output and long life. The combination of an established infrastructure and reliable track record is likely to continue making these companies the chosen partner for utilities interested in an LDES to mitigate renewable intermittency and provide grid stability, solidifying their dominance in the growing LDES sector.

The Chemical Storage segment is expected to experience the fastest growth in Long Duration Energy Storage Market over 2025-2032 with a CAGR of 15.95%, fueled by rising demand for flexible, modular, and scalable energy solutions. Technologies such as flow batteries, metal-air systems, and other advanced chemistries are gaining traction for their ability to support extended discharge durations, improved efficiency, and site adaptability. Ongoing R&D efforts and material innovations are driving down costs while enhancing performance and safety. As decarbonization goals intensify and renewable integration grows, chemical storage solutions are increasingly seen as key to enabling distributed, resilient, and long-duration energy infrastructures across both developed and emerging markets.

By Duration

In 2024, the 8 to 24 Hours segment accounted for approximately 46% of the Long Duration Energy Storage Market share, due to the crucial role played by this segment in overcoming energy supply-demand imbalances occurring daily. This time frame is well centered to provide solar and wind integration, allowing it to support energy geared to late day peak loads and low generation times. This period covers heterogeneous techno-economics (almost everything from flow batteries to thermal storage, to various forms of CO₂ based systems); Technologies in this segment offer an attractive blend of capacity, efficiency and cost. They are versatile and can be well utilized for both utility-scale as well as commercial end use, especially in regions with higher renewable penetration. The demand for longer-term reliability without the overhead of ultra-long storage durations is reflected by the segment's strong share in mid-range LDES solutions.

The >36 Hours segment is expected to experience the fastest growth in Long Duration Energy Storage Market over 2025-2032 with a CAGR of 20.79%, driven by the growing need for multi-day energy resilience and deep grid decarbonization. This segment is increasingly important in addressing prolonged renewable energy shortfalls, extreme weather events, and seasonal storage requirements. Technologies capable of delivering storage beyond 36 hours such as hydrogen-based systems, CO₂ thermal cycles, and advanced mechanical storage are gaining traction in utility-scale applications. The sharp growth reflects a strategic shift toward ultra-long-duration solutions that provide backup across days, enhancing energy security and enabling reliable renewable supply in diverse grid conditions.

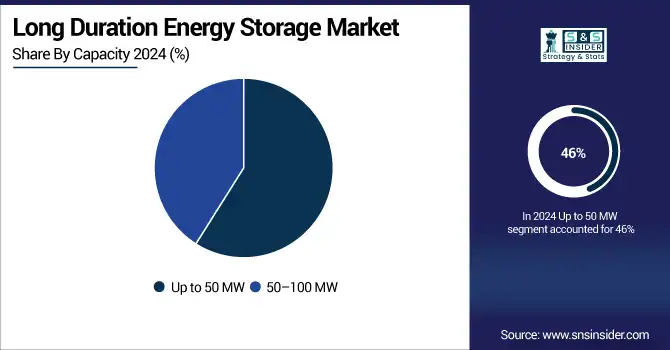

By Capacity

In 2024, the Up to 50 MW segment accounted for approximately 46% of the Long Duration Energy Storage Market share, driven by its suitability for mid-scale applications such as commercial facilities, microgrids, and smaller utility projects. This segment is favored for its flexibility, faster deployment timelines, and lower upfront costs compared to larger-scale systems. It supports renewable integration, backup power, and load shifting in distributed energy environments, making it attractive to municipalities, industrial users, and remote installations. The dominance of this segment reflects a growing trend toward modular and decentralized storage solutions that offer scalable performance while meeting localized energy reliability and sustainability needs.

The >100 MW segment is expected to experience the fastest growth in Long Duration Energy Storage Market over 2025-2032 with a CAGR of 17.54%, driven by increasing demand for grid-scale energy storage solutions. This segment is critical for stabilizing national grids, managing large-scale renewable integration, and supporting peak load demands. Utilities and energy providers are investing in high-capacity systems to enhance grid resilience, reduce curtailment, and replace aging fossil fuel-based infrastructure. The rapid growth reflects a shift toward centralized, large-format LDES projects that can deliver multi-hour to multi-day storage, enabling a reliable, low-carbon power supply for urban centers and industrial hubs.

By Application

In 2024, the Renewable Energy Integration segment accounted for approximately 40% of the Long Duration Energy Storage Market share, and expected to be the fastest growing over the forecast period 2025-2032 wirh CAGR 16.06%. This growth is propelled by the switch globally to intermittent renewable energy sources like solar and wind, which need long-duration storage solutions to maintain power supply and limit curtailment. In this segment, LDES solutions are essential for grid flexibility, load balancing, and dispatchable energy. Demand for storage systems that deliver reliable, consistent clean energy 24/7 is intensifying as countries ramp up their renewable energy targets, making this sector a building block of future energy systems.

By End User

In 2024, the Utilities segment accounted for approximately 43% of the Long Duration Energy Storage Market share, owing to the increasing utilities sector for grid stability, peak load, and renewable integration. Utilities are also ramping up LDES deployments to seamlessly replace peaker plants, inherit conventional fossil fuel dependencies, and securities and securities applications during periods when demand increases or an outage occurs. They provide multi-hour to multi-day energy dispatch capability to utilities helping them comply with regulatory mandates as well as decarbonization targets. As winds of greater renewable capacity and aging infrastructure blow through the face of utility, scalable long-duration storage is emerging as the beating heart of grid modernization and energy security—arguably the most important use and growth driver and early-stage adopter the sea of emerging LDES market has seen thus far.

The Transportation & Mobility segment is expected to experience the fastest growth in Long Duration Energy Storage Market over 2025-2032 with a CAGR of 15.00%, driven by the sector’s shift toward electrification and zero-emission infrastructure. As electric buses, rail systems, and charging stations expand, there is a rising need for reliable, long-duration storage to manage fluctuating demand, ensure uninterrupted operations, and support off-grid mobility solutions. LDES technologies offer high-capacity, resilient power that can complement intermittent renewable energy sources, reducing reliance on conventional fuels. This rapid growth reflects the growing role of LDES in enabling clean, efficient, and sustainable transport systems across urban and intercity networks.

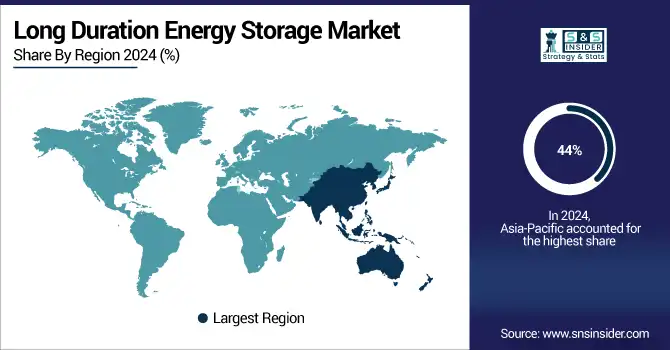

Long Duration Energy Storage (LDES) Market Regional Outlook:

In 2024 Asia-Pacific dominated the Long Duration Energy Storage Market and accounted for 44% of revenue share, due to fast industrialization, good government encouragement to clean energy generators and growing clean power infrastructure. The investors in grid modernization and massive renewable integration with which long-duration storage would make a perfect partner include China, India, Japan and South Korea. Driven by cost-competitive manufacturing, high energy security concerns, and beneficial policy frameworks, the technology deployment of flow batteries, pumped hydro, and thermal storage is accelerating in the region. The leadership of Asia-Pacific in LDES indicates the growing strategic priority on energy resilience and decarbonization in both the utility and industrial sectors.

North America is expected to witness the fastest growth in the Long Duration Energy Storage Market over 2025-2032, with a projected CAGR of 15.35%, due to clean energy targets, grid modernization focuses and wider renewable energy penetration. Aging fossil fuel infrastructure, the desire for greater energy resilience and the need for decentralized power systems are all driving investments in long-duration U.S. and Canadian decarbonization solutions. A rigorous set of policy incentives—such as tax credits and storage innovation funding—are catalyzing commercial-scale deployments across utilities, data centers and microgrids. This acceleration of LDES adoption highlights the strategic value for North America to develop a low-carbon future of reliable power enabled by scalable and flexible LDES technologies.

In 2024, Europe emerged as a promising region in the Long Duration Energy Storage Market, supported by solid policies, ambitious decarbonization targets, and the growing share of variable renewable energy sources. The region was also home to much of the new pilot projects and policy-led investments related to grid stability and independence. Countries such as Germany, the UK and Italy are leading the move towards demonstration-scale and commercial LDES deployments to lessen reliance on fossil fuels and achieve net-zero objectives by 2050. EU Green Deal and Horizon programmes are also strategically funding innovation in post lithium and long duration storage technologies making Europe a zone of responsibility for the global energy transition.

LATAM and MEA are experiencing steady growth in the Long Duration Energy Storage Market, given the rising shift towards renewable energy, the need for energy access, and grid modernization. Countries such as Chile and Brazil in LATAM are now pouring money into LDES to enable mega solar and mega wind projects and stability in remote areas. In MEA, efforts in energy diversification — especially in GCC countries — are creating demand for long-duration storage to firm up variable renewables. Both regions remain somewhat nascent, but supportive energy transition policies and partnership networks are beginning to catalyze LDES deployment.

Get Customized Report as per Your Business Requirement - Enquiry Now

Long Duration Energy Storage Companies are:

The Key Players in Long Duration Energy Storage Market are Sumitomo Electric Industries, ESS Tech, Eos Energy Enterprises, Invinity Energy Systems, Energy Vault, MAN Energy Solutions, Highview Power, Primus Power, CMBlu Energy, Malta Inc., RheEnergise, QuantumScape Battery, Form Energy, SFW, GKN Hydrogen, Alsym Energy, Ambri Inc., VFlowTech, VoltStorage, MGA Thermal. and Others.

Recent Developments:

-

In July 2025, Sumitomo Electric received its third consecutive order for 1,000 kW × 8h redox flow batteries in Kashiwazaki, expanding total capacity to 24,000 kWh. The systems support local renewable integration, energy trading, and decarbonization goals.

-

In Jul 2024, QuantumScape expanded its partnership with Volkswagen’s PowerCo, securing up to $131M and advancing its solid-state battery tech. It also introduced the Cobra process and formed new collaborations to accelerate commercialization.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.82 Billion |

| Market Size by 2032 | USD 13.35 Billion |

| CAGR | CAGR of 13.58% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Mechanical Storage, Thermal Storage, Electrochemical Storage and Chemical Storage) • By Duration(8 to 24 Hours, 24 to 36 Hours and >36 Hours), By Capacity(Up to 50 MW, 50–100 MW, >100 MW) • By Application(Grid Management, Power Backup, Renewable Energy Integration and Off Grid & Micro Grid System) • By End User(Residential & Commercial, Transportation & Mobility, Utilities and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Long Duration Energy Storage Market Companies are Sumitomo Electric Industries, ESS Tech, Eos Energy Enterprises, Invinity Energy Systems, Energy Vault, MAN Energy Solutions, Highview Power, Primus Power, CMBlu Energy, Malta Inc., RheEnergise, QuantumScape Battery, Form Energy, SFW, GKN Hydrogen, Alsym Energy, Ambri Inc., VFlowTech, VoltStorage, MGA Thermal. and Others |