Logistics Software Market Report Scope & Overview:

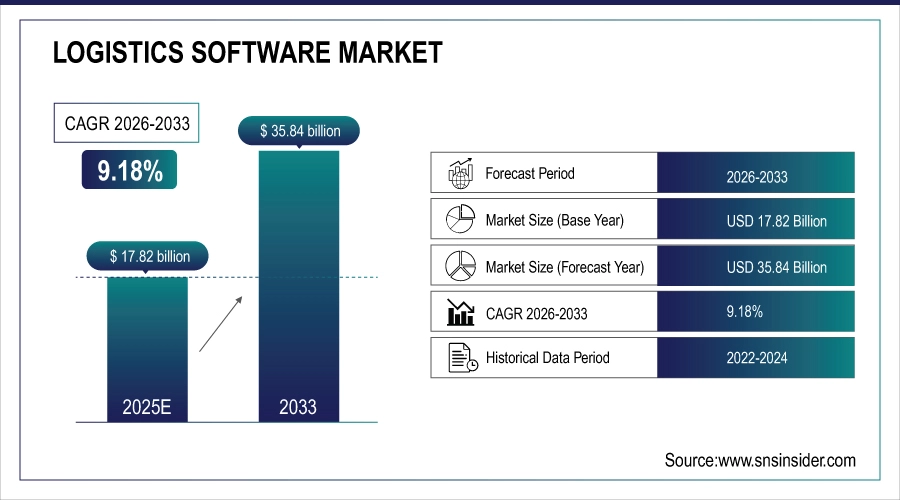

The Logistics Software Market is valued at USD 17.82 billion in 2025E and is expected to reach USD 35.84 billion by 2033, growing at a CAGR of 9.18% from 2026-2033.

The growth of the Logistics Software Market is driven by increasing demand for supply chain visibility, real-time tracking, and operational efficiency across global logistics networks. Rising e-commerce activity, omnichannel retail expansion, and growing cross-border trade are accelerating software adoption. Companies are investing in cloud-based logistics platforms, AI-driven analytics, and automation to reduce costs, improve delivery accuracy, and manage complex transportation operations more effectively.

In 2025, logistics software adoption surged as 78% of global operators leveraged cloud platforms and AI analytics—enhancing supply chain visibility, cutting delivery errors by 32%, and streamlining cross-border operations amid booming e-commerce and omnichannel demands.

Logistics Software Market Size and Forecast

-

Market Size in 2025E: USD 17.82 Billion

-

Market Size by 2033: USD 35.84 Billion

-

CAGR: 9.18% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Logistics Software Market - Request Free Sample Report

Logistics Software Market Trends

-

Rising adoption of cloud-based logistics software for real-time tracking, inventory management, and supply chain optimization

-

Growing integration of AI and machine learning to enhance route planning, demand forecasting, and operational efficiency

-

Increasing use of IoT-enabled devices for fleet monitoring, cargo tracking, and predictive maintenance in logistics operations

-

Expansion of e-commerce and last-mile delivery services driving demand for advanced transportation management systems

-

Rising focus on sustainability and carbon footprint reduction through software-enabled route optimization and resource planning

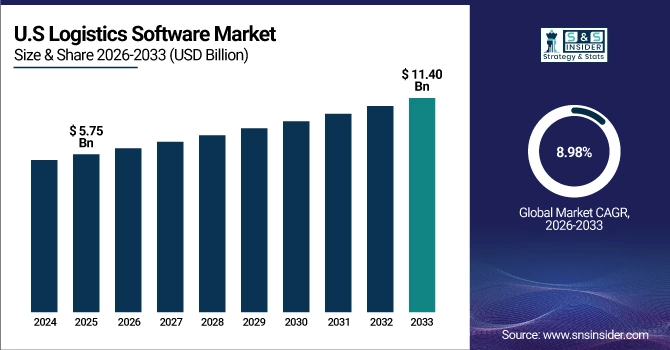

U.S. Logistics Software Market is valued at USD 5.75 billion in 2025E and is expected to reach USD 11.40 billion by 2033, growing at a CAGR of 8.98% from 2026-2033.

The growth of the U.S. logistics software market is driven by rapid e-commerce expansion, rising demand for real-time shipment visibility, and the need for efficient warehouse and transportation management. Increased adoption of cloud-based platforms, automation, and AI analytics helps companies reduce costs, improve delivery speed, and optimize supply chain operations.

Logistics Software Market Growth Drivers:

-

Rising demand for real-time shipment tracking, route optimization, and warehouse management solutions is driving adoption of logistics software across global supply chains

Companies are increasingly seeking solutions to improve supply chain visibility, streamline operations, and reduce transportation costs. Logistics software enables real-time tracking of shipments, automated route planning, and efficient warehouse management, improving operational efficiency and delivery accuracy. Growing customer expectations for faster, transparent deliveries are pushing businesses to adopt these technologies. Additionally, integration with ERP and IoT systems allows predictive insights and better decision-making. These factors are driving widespread adoption of logistics software across industries, from retail and e-commerce to manufacturing and third-party logistics providers globally.

In 2025, 75% of global supply chain operators deployed logistics software for real-time tracking, dynamic route optimization, and smart warehouse management reducing transit times by 28% and improving inventory accuracy by over 35%.

-

Increasing e-commerce growth and complex supply chains are encouraging companies to implement advanced logistics software for efficiency, cost reduction, and improved customer satisfaction

The exponential growth of e-commerce has intensified the need for efficient supply chain management and timely deliveries. Logistics software solutions help companies handle complex multi-channel distribution, manage high-volume orders, and optimize inventory and transportation. By automating critical operations and reducing manual errors, these tools enhance operational efficiency, lower costs, and improve customer satisfaction. Businesses can also leverage analytics for demand forecasting and performance tracking. As e-commerce expands globally, logistics software becomes an essential tool for companies seeking competitive advantage, streamlined operations, and scalable solutions in increasingly dynamic supply chain environments.

In 2025, 72% of companies adopted advanced logistics software to manage e-commerce-driven complexity cutting delivery costs by 25%, improving on-time performance by 30%, and boosting customer satisfaction through real-time visibility and automation.

Logistics Software Market Restraints:

-

High implementation and maintenance costs of logistics software solutions can be prohibitive, particularly for small and medium-sized enterprises, limiting market adoption

Implementing logistics software requires substantial investment in software licenses, hardware infrastructure, training, and ongoing maintenance. Small and medium-sized enterprises (SMEs) often lack sufficient budgets to adopt comprehensive solutions, limiting their access to advanced technologies. High upfront costs, coupled with recurring subscription or support fees, make adoption challenging in cost-sensitive markets. As a result, SMEs may continue relying on manual processes or basic tools, which reduces overall market penetration. The financial barrier to entry slows adoption in emerging economies and restrains growth of logistics software providers targeting smaller businesses.

In 2025, 60% of SMEs avoided advanced logistics software due to high implementation and maintenance costs often exceeding USD50,000 annually restricting their ability to optimize supply chains and compete with larger, digitally enabled players.

-

Integration challenges with legacy systems and lack of technical expertise hinder smooth deployment of logistics software, slowing market growth

Many organizations rely on outdated IT infrastructure and legacy systems, making integration with modern logistics software complex and resource-intensive. Compatibility issues, data migration challenges, and insufficient IT expertise can lead to implementation delays, operational disruptions, and suboptimal software utilization. Lack of skilled personnel to manage and maintain advanced logistics platforms further complicates adoption. These challenges discourage organizations from investing in logistics software, especially in developing regions. Consequently, integration complexities and technical skill shortages remain significant restraints, limiting the market’s expansion potential and slowing the uptake of logistics software solutions globally.

In 2025, 65% of logistics companies faced delays in software deployment due to legacy system incompatibility and a shortage of skilled personnel slowing digital transformation and limiting ROI from advanced logistics platforms.

Logistics Software Market Opportunities:

-

Growing adoption of cloud-based, AI-driven, and IoT-enabled logistics software provides opportunities to enhance operational efficiency and predictive decision-making

Technological advancements in cloud computing, artificial intelligence, and the Internet of Things are transforming logistics operations. Cloud-based solutions reduce infrastructure costs and enable scalability, while AI facilitates predictive analytics for demand forecasting, route optimization, and inventory management. IoT-enabled sensors and connected devices provide real-time visibility into shipments and warehouse operations. These innovations help companies reduce costs, improve operational efficiency, and make data-driven decisions. Logistics software providers can leverage these technologies to develop advanced solutions, attract new clients, and expand their service offerings across diverse industries, creating significant growth opportunities.

In 2025, 70% of logistics firms adopted cloud-based, AI-driven, and IoT-enabled software improving route optimization by 35%, reducing delivery times by 28%, and enabling predictive analytics for inventory and demand planning.

-

Expansion of emerging markets and digital transformation initiatives in supply chain operations present significant growth potential for logistics software providers

Emerging economies are investing in modern infrastructure and technology-driven supply chain solutions to support economic growth and global trade. Businesses in these regions increasingly adopt digital tools to improve efficiency, reduce operational costs, and enhance customer service. Logistics software providers can tap into these expanding markets by offering localized, scalable, and affordable solutions. Government initiatives promoting digitalization, smart logistics, and Industry 4.0 adoption further encourage investment in software solutions. As awareness of technology benefits grows, emerging markets represent a substantial opportunity for logistics software vendors to increase adoption and revenue.

In 2025, logistics software providers saw a 38% increase in demand from emerging markets, driven by digital transformation in supply chains enabling real-time tracking, inventory optimization, and seamless cross-border coordination for SMEs and large enterprises alike.

Logistics Software Market Segment Highlights

-

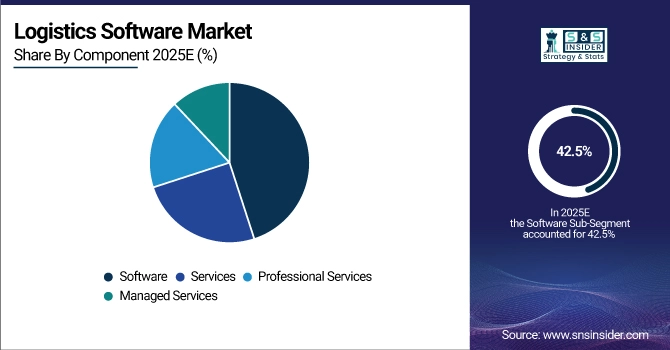

By Component: Software led with 42.5% share, while Managed Services is the fastest-growing segment with CAGR of 13.4%.

-

By Deployment Mode: Cloud-Based led with 47.3% share, while Hybrid is the fastest-growing segment with CAGR of 12.8%.

-

By Application: Transportation Management System led with 38.9% share, while Fleet Management System is the fastest-growing segment with CAGR of 13.1%.

-

By End-User: Retail and E-commerce led with 36.7% share, while Healthcare is the fastest-growing segment with CAGR of 12.9%.

Logistics Software Market Segment Analysis

By Component: Software led, while Managed Services is the fastest-growing segment.

Software dominates the logistics market due to its critical role in automating supply chain, warehouse, and transportation operations. It enables real-time tracking, route optimization, and data-driven decision-making, reducing operational costs and improving efficiency. Adoption across large enterprises and SMEs is high, driven by growing demand for digital transformation, integration with IoT and AI, and compliance with regulatory standards. These factors sustain software as the largest revenue-generating component in logistics solutions.

Managed Services are growing rapidly as companies seek outsourced support for implementation, monitoring, and maintenance of complex logistics software. Providers deliver end-to-end solutions, including cloud management, cybersecurity, system updates, and operational analytics. This reduces capital expenditure, improves scalability, and allows organizations to focus on core business. The rising need for seamless integration of logistics operations, combined with demand for cost-effective, flexible IT support, is driving the high CAGR in this segment.

By Deployment Mode: Cloud-Based led, while Hybrid is the fastest-growing segment.

Cloud-based deployment leads as it provides flexibility, scalability, and remote access for logistics operations. Organizations benefit from reduced infrastructure costs, seamless updates, and integration with IoT, AI, and analytics platforms. Cloud solutions support real-time visibility, collaborative management, and multi-location supply chain monitoring. Enterprises increasingly prefer cloud deployment for improved efficiency, lower IT overhead, and faster implementation timelines, making it the most widely adopted deployment mode globally.

Hybrid deployment is growing quickly as companies adopt a combination of on-premises and cloud systems to balance data security and accessibility. It allows sensitive information to remain on local servers while leveraging cloud benefits for analytics, scalability, and remote collaboration. Industries with complex or regulated supply chains, such as healthcare and automotive, are adopting hybrid solutions for better flexibility, cost management, and disaster recovery, driving strong growth in this deployment model.

By Application: Transportation Management System led, while Fleet Management System is the fastest-growing segment.

Transportation Management Systems (TMS) dominate due to their critical role in planning, executing, and optimizing shipment operations. They enable route optimization, carrier selection, freight cost management, and real-time tracking. High adoption by logistics providers, retailers, and e-commerce platforms is driven by increasing supply chain complexity and the need to reduce operational costs. Integration with IoT devices, predictive analytics, and AI further strengthens TMS as the leading application in the logistics software market.

Fleet Management Systems are the fastest-growing application segment as organizations aim to optimize vehicle performance, reduce downtime, and lower fuel costs. Adoption is rising across transportation, delivery, and logistics service providers seeking real-time telematics, route tracking, and predictive maintenance. Integration with GPS, IoT, and cloud-based analytics enables proactive fleet operations. The increasing demand for efficiency, regulatory compliance, and sustainable operations drives rapid market expansion for fleet management solutions.

By End-User: Retail and E-commerce led, while Healthcare is the fastest-growing segment.

Retail and e-commerce dominate due to high volumes of orders requiring efficient supply chain, warehousing, and last-mile delivery solutions. Logistics software helps optimize inventory, shipping, returns, and real-time order tracking. Rising online shopping, customer expectations for fast delivery, and integration with automated warehouses have reinforced software adoption. E-commerce giants and retail chains increasingly rely on analytics, TMS, and WMS solutions, maintaining this end-user segment as the leading revenue contributor in the logistics software market.

Healthcare is the fastest-growing end-user segment as hospitals, pharmaceutical companies, and medical distributors adopt logistics software to ensure timely, safe, and compliant delivery of medical supplies and drugs. Real-time tracking, cold chain monitoring, and inventory optimization are critical for sensitive products. Increasing regulatory compliance, growth in pharmaceutical logistics, and digital transformation initiatives in healthcare supply chains are driving rapid adoption of transportation, warehouse, and fleet management solutions, resulting in strong CAGR for this segment.

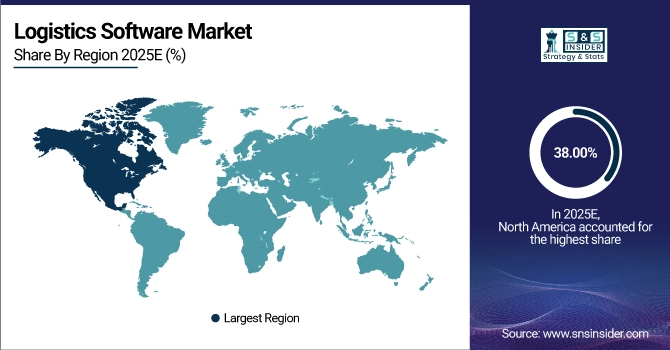

Logistics Software Market Regional Analysis

North America Logistics Software Market Insights:

North America dominated the Logistics Software Market with a 38.00% share in 2025 due to advanced supply chain infrastructure, high adoption of digital logistics solutions, and strong presence of leading software providers. Growing demand for real-time tracking, warehouse automation, and AI-driven route optimization further strengthened the region’s market leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Logistics Software Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 11.12% from 2026–2033, driven by rapid e-commerce expansion, rising manufacturing activities, and increasing adoption of cloud-based and AI-enabled logistics solutions. Growing investments in smart supply chains, infrastructure modernization, and demand for efficient freight management systems are accelerating the region’s logistics software market growth.

Europe Logistics Software Market Insights

Europe held a significant share in the Logistics Software Market in 2025, supported by well-established transportation networks, high adoption of advanced supply chain technologies, and the presence of major logistics service providers. Increasing demand for real-time visibility, warehouse automation, and integrated software solutions strengthened Europe’s position in the market.

Middle East & Africa and Latin America Logistics Software Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Logistics Software Market in 2025, driven by expanding e-commerce, rising trade activities, and growing adoption of cloud-based logistics solutions. Investments in transportation infrastructure, increasing demand for supply chain efficiency, and government initiatives to modernize logistics operations supported the regions’ emerging market presence.

Logistics Software Market Competitive Landscape:

SAP SE

SAP SE is a global leader in enterprise software, offering comprehensive logistics and supply chain solutions through SAP S/4HANA and SAP Supply Chain Management. Its logistics software supports transportation management, warehouse operations, inventory optimization, and real-time visibility across complex global networks. SAP’s solutions are widely adopted by large enterprises to streamline operations, reduce costs, and improve decision-making. Strong integration with ERP systems, advanced analytics, and growing cloud-based deployments position SAP as a key player in the global logistics software market.

-

June 2024, SAP launched the SAP Logistics Business Network, a cloud-based platform enabling real-time freight collaboration between shippers, carriers, and logistics service providers.

Oracle Corporation

Oracle Corporation provides robust logistics and supply chain software through Oracle Supply Chain Management Cloud. Its solutions cover transportation management, warehouse management, order fulfillment, and logistics analytics, enabling end-to-end supply chain visibility. Oracle’s cloud-first approach helps organizations enhance scalability, automation, and data-driven decision-making. The company serves a broad range of industries, supporting global logistics operations with AI-enabled insights, real-time tracking, and seamless integration with enterprise applications, making it a prominent provider in the logistics software market.

-

October 2023, Oracle enhanced its Fusion Cloud Supply Chain & Manufacturing (SCM) with Global Trade Intelligence, a suite of AI-powered logistics and compliance tools.

Manhattan Associates

Manhattan Associates specializes in supply chain and logistics software, focusing on warehouse management, transportation management, and omnichannel fulfillment solutions. The company is known for its advanced cloud-native platforms that enhance operational efficiency, inventory accuracy, and order visibility. Manhattan Associates serves retailers, manufacturers, and logistics providers worldwide, helping them manage complex distribution networks. Its emphasis on innovation, automation, and real-time data enables customers to improve service levels, reduce costs, and adapt to evolving logistics demands.

-

February 2025, Manhattan Associates launched Manhattan Active Logistics, a next-generation cloud-native logistics platform featuring autonomous fulfillment orchestration.

Logistics Software Market Key Players

Some of the Logistics Software Market Companies

-

SAP SE

-

Oracle Corporation

-

Manhattan Associates

-

BluJay Solutions

-

Descartes Systems Group

-

WiseTech Global

-

Blue Yonder Group

-

Samsara Inc.

-

Ramco Systems

-

PTV Group

-

4flow

-

Alpega TMS

-

Magaya Supply Chain

-

LogiNext Mile

-

HighJump (Körber)

-

Infor

-

3GTMS

-

Kinaxis Inc.

-

Epicor Software Corporation

-

JDA Software (Blue Yonder)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 17.82 Billion |

| Market Size by 2033 | USD 35.84 Billion |

| CAGR | CAGR of 9.18% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services, Professional Services, Managed Services) • By Deployment Mode (Cloud-Based, On-Premises, Hybrid) • By Application (Transportation Management System, Warehouse Management System, Supply Chain Planning, Fleet Management System, Freight Management System, Others (Order Management System, etc.)) • By End-User (Oil and Gas, Automotive, Healthcare, IT and Telecom, Retail and E-commerce, Manufacturing, Government, Others (Aerospace and Defense, etc.)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | SAP SE, Oracle Corporation, Manhattan Associates, BluJay Solutions, Descartes Systems Group, WiseTech Global, Blue Yonder Group, Samsara Inc., Ramco Systems, PTV Group, 4flow, Alpega TMS, Magaya Supply Chain, LogiNext Mile, HighJump (Körber), Infor, 3GTMS, Kinaxis Inc., Epicor Software Corporation, JDA Software (now part of Blue Yonder) |