Low-Calorie Food Market Report Scope & Overview:

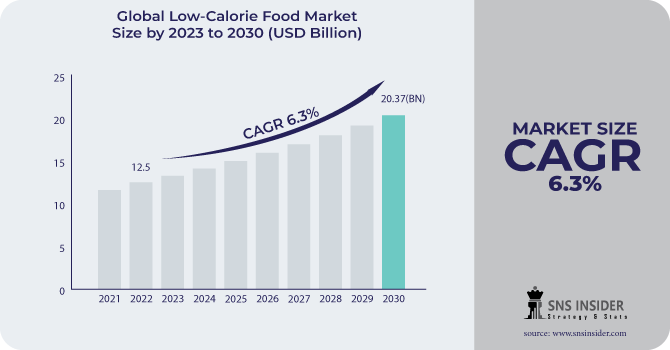

The Low-Calorie Food Market size was USD 12.5 billion in 2022 and is expected to Reach USD 20.37 billion by 2030 and grow at a CAGR of 6.3% over the forecast period of 2023-2030.

Obesity is a condition that affects all of the body's systems. It has ramifications for the heart, liver, kidneys, joints, and reproductive system. It causes a variety of noncommunicable diseases (NCDs), including type 2 diabetes, hypertension, cardiovascular disease, and stroke, as well as many types of cancer and mental health difficulties. Obesity affects more than one billion people globally, including 650 million adults, 340 million adolescents, and 39 million children. This figure is still rising. According to WHO, by 2025, about 167 million individuals - adults and children - will be less healthy due to being overweight or obese.

Rapid growth in urbanization and shifts in consumer behavior, particularly in emerging nations such as China, India, Brazil, and Mexico, are likely to be important market drivers. The growing retail sector, together with rising consumer disposable income, is expected to have a beneficial impact on the market.

Increasing demand for sugar replacements, along with an aging global population, is expected to drive demand for low-calorie foods during the next six years. Artificial sweeteners and packaged food processed food products, on the other hand, are recognized to pose possible health risks and are projected to hinder the market throughout the projection period.

MARKET DYNAMICS

KEY DRIVERS

-

A spike in the rates of obesity and other persistent illnesses

Obesity is a major public health concern since it is linked to a variety of chronic illnesses such as type 2 diabetes, heart disease, stroke, and various malignancies. By eating low-calorie foods, people can reduce their risk of getting certain diseases and lose weight. Consumers are becoming more aware of the importance of eating a balanced diet to maintain one's weight and overall health. Low-calorie foods are typically regarded as healthier alternatives to traditional diets.

RESTRAIN

-

Developing health problems as a result of a low-calorie diet

While low-calorie foods can be beneficial for weight loss and other health goals, it is important to consume enough calories to meet your body's needs. Eating too few calories can lead to several health problems, including Fatigue, Nutrient deficiencies, Muscle loss, Constipation, Increased risk of gallstones, Irregular heartbeat, and Eating disorders. Consumers are becoming more aware of the potential health risks associated with low-calorie diets. This is leading some consumers to be more cautious about eating low-calorie foods.

OPPORTUNITY

-

Rising demand in emerging markets for low-calorie foods

In the United States, approximately 35% of adults are considered obese, and within 15 years, this number is expected to reach about 50%. Fast food restaurants have received some of the blame since they frequently sell items that are heavy in calories, fats, sugars, and sodium but poor in vitamins and minerals. While these eateries might be a part of the average American's unhealthy diet, they are not the only culprit. Over 1.5 billion people in East Asia, including China, Japan, and South Korea, are affected by the worldwide health epidemic of obesity. The availability of processed foods and the Westernization of dietary trends following industrialization resulted in an estimated 40.9% overweight/obese prevalence among adults in the Asia-Pacific region, with an estimated economic impact of up to 12% of the total cost of healthcare on obesity or related diseases. As the population ages, this will only intensify.

CHALLENGES

-

High cost of Low-Calorie food

Low-calorie foods might be more expensive to produce than standard foods since they typically require specialized ingredients and manufacturing procedures. This is especially true for new, cutting-edge low-calorie products. Low-calorie foods are usually advertised as high-end items, which drives up prices even further. This is because people are typically willing to spend more for meals that are seen to be healthier.

MARKET SEGMENTATION

by Type

-

Sugar substitutes

-

Sugar alcohol substitutes

-

Nutrient-based substitutes

by Application

-

Dairy products

-

Dietary beverages

-

Healthcare

-

Bakery products

-

Snacks

-

Others

.png)

Segmentation Analysis

By Type Analysis

Based on type the low-calorie food market is segmented into sugar substitutes, sugar alcohol substitutes, and nutrient-based substitutes. The sugar substitute segment is expected to witness the highest growth rate in 2022. Low-calorie sugar substitutes are sweeteners that have fewer calories than sugar, or none at all. They are often used to sweeten foods and beverages without adding a lot of calories. Some examples of artificial sweeteners are Aspartame, Stevia, Saccharin, and Sucralose Sugar substitutes offer health-conscious clients benefits such as weight control and diabetes treatment. Artificial sweeteners have no carbs and hence do not raise blood sugar levels. Sugar substitutes have essentially no calories, compared to about 15 calories for a teaspoon of sugar.

By Application Analysis

The application segments include Dietary beverages, Dairy products, Healthcare, Snacks, Bakery products, and Others. The dairy products segment is the fastest-growing segment during the forecast period. Due to the numerous health advantages of dairy-based goods, low-calorie dairy-based products are in high demand. Consumption of dairy products is a key factor in the market's growth because of increased consumer demand for a healthy lifestyle, which has prompted the industry to create low-calorie dairy products.

REGIONAL ANALYSIS

North America has significant market growth for the market. Increasing health-conscious consumers drives the adoption of a healthier lifestyle. The demand for low-calorie food is growing due to an increase in the number of obesity, and cardiovascular diseases due to unhealthy lifestyles. Roughly out of three, two adults are overweight. The low-calorie food market in the United States is expected to be the world's largest.

Europe is the second largest market for the low-calorie food market. People in the United Kingdom and Germany have embraced the vegan or vegetarian diet trend. However, Europe's nutritional trends have paralleled those of many other developed and developing countries, with a shift away from a complex carbohydrate-based diet and toward one high in fat and added sweets. Germany's market was worth USD 1.2 billion in 2022 and increased at a 6.3% CAGR over the predicted period. The country's market development is being driven by rising cases of obesity and diabetes, as well as consumers' growing interest in living a healthy lifestyle.

Asia Pacific region is the fastest growing market as China's low-calorie food market is predicted to reach USD 1.59 billion by 2029, growing at a 6.8% CAGR. China currently has the biggest population of diabetes in the world with over 116 million people. Low-calorie sweeteners are increasingly being positioned as useful products for addressing various lifestyle diseases as a result of this rising popularity, which is helping the market growth in the nation. At a CAGR of 6.5% from 2023 to 2030, the low-calorie food industry in India is anticipated to reach USD 1.18 billion by 2029.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Low-Calorie Food Market are Archer Daniels Midland Company, DSM, Beneo GmbH, Bernard Food Industries, Dansico A/S, The Coca-Cola Company, Tate & Lyle, Ajinomoto Co. Inc, Nestle, Cargill Incorporated, PepsiCo, Ingredion Inc., and other key players.

Archer Daniels Midland Company-Company Financial Analysis

RECENT DEVELOPMENTS

In August 2023, Tate & Lyle company increased its stevia range in response to consumer demand for 'natural' sugar substitutes. Tate & Lyle's Tasteva Sol sweetener is based on stevia, as the ingredients giant attempts to capitalize on the growing demand for sugar substitutes.

In July 2023, Ingredion announced PureCircle Clean Taste Solutions, a product line of stevia solutions suited to specific food & beverage applications. In various categories, including dairy, tea, coffee, drinks, sauces, savory, bakery, confectionery, sports nutrition, and dressings, PureCircle Clean Taste Solutions seeks to decrease sugar and deliver sweetness. For better performance, the new solutions make use of more stevia plant material.

In April 2023, Ingredion released a five-part video series to assist food and beverage makers in utilizing stevia to lower the sugar level of their goods. The series investigates how stevia offers an organic substitute to artificial sweeteners, addressing customer desire for healthier meals and allowing claims such as "plant-based" to be made on product labeling. It also discusses how the discovery of novel steviol glycosides enables a more regulated, sugar-like sweetness with no bitter aftertaste.

| Report Attributes | Details |

| Market Size in 2022 | US$ 12.5 Billion |

| Market Size by 2030 | US$ 20.37 Billion |

| CAGR | CAGR of 6.3 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Sugar alcohol substitutes, Sugar substitutes, Nutrient-based substitutes) • By Application (Dietary beverages, Dairy products, Healthcare, Snacks, Bakery products, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Archer Daniels Midland Company, DSM, Beneo GmbH, Bernard Food Industries, Dansico A/S, The Coca-Cola Company, Tate & Lyle, Ajinomoto Co. Inc, Nestle, Cargill Incorporated, PepsiCo, Ingredion Inc. |

| Key Drivers |

• A spike in the rates of obesity and other persistent illnesses |

| Market Restrain |

• Developing health problems as a result of a low-calorie diet |