Low Code Development Platform Market Report Scope & Overview:

Get more inforemation on Low Code Development Platform Market - Request Sample Report

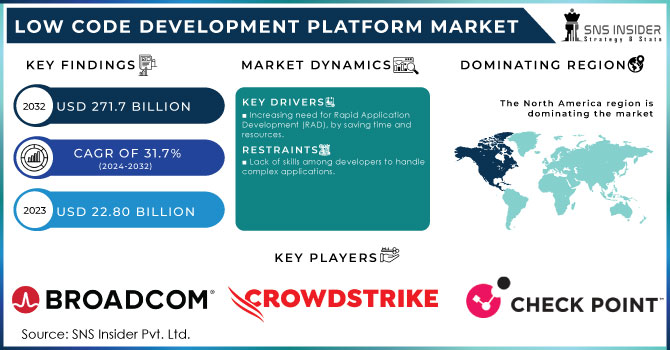

The Low Code Development Platform Market size was recorded at USD 22.80 Billion in 2023 and is expected to surpass USD 271.7 Billion by 2032, growing at a CAGR of 31.7% over the forecast period of 2024-2032.

Due to the Increasing prices of IT services, and high expenditure in hiring coders, enterprises in every industry are looking to update IT infrastructure by adopting the Low-code development platform to improve their operational efficiency and accountability, by reducing their technical debt. This allows fast application development and deployment with little or no coding experience required. As a result, this initiates the solutions to be delivered faster into production and at lower cost. The growing need for agility and flexibility in development processes has also encouraged me to ask more for low-code solutions. More companies are shifting to these platforms to speed the deployment of applications and updates, so they can more easily support evolving business requirements. For Instance, more than 75% of enterprises have adopted low-code for their business to increase their value and automation to work, by using lower resources as compared to traditional methods.

Moreover, Cloud is also one of the many factors that drive opportunities in the Low Code Development Platform Market. Cloud-based low-code platforms are infinitely scalable and can lead to a reduction in maintenance costs as well as offer improved accessibility for companies who have made the transition to hybrid or remote work. In 2023, over 500 million apps are services were developed using the Cloud-based approaches. Another big opportunity is AI/ML integrated into low-code platforms. They act as companions to low-code solutions, offering workflow automation processes and predictive analytics that can broaden the decision-making capabilities of certain platforms.

Trends in the past years show that the low-code platform has been rapidly adopted in such sectors as IT, health, and finance. The COVID-19 pandemic accelerated this trend, with most organizations having to develop digital capability to adapt to the new normal through remote work and changing consumer demand. Key market players like Microsoft with its Power Apps, OutSystems, and Appian, all developed leading-edge products for improving user experience while increasing functionality. For Instance, according to SNS Insider view, more than 80% of non-IT professionals will be able to develop technological-based apps and services using Low-code tools, by 2024.

In Addition, another major factor that is continuing to fuel the growth of low-code platforms includes the increasing number of citizen developers and growing demand for applications from business organizations. IT operations take place in dynamic environments that often require fast customization options in the software development process, and this is what low-code development platforms are trying to achieve. Hence, these platforms reduce time to market and backlogs, allowing earlier realization of value at a reduced cost for businesses. Retool, Zapier, and Airtable top the forays of key low-code/no-code platforms in internal apps.

Market Dynamics

Drivers

-

Increasing need for Rapid Application Development (RAD), by saving time and resources.

-

Expanding Digital Transformation among the enterprises.

Around 90% of organizations are engaged in digital projects, and by 2026, global spending is predicted to reach USD 3.4 trillion. According to a recent report on the mobile industry, 97% of enterprises stated that the COVID-19 pandemic accelerated their projects by an average of six years. This indicates that the plans were accelerated. The market's push, which led 51% of organizations to include it in their plan, and 74% of businesses' prioritization of operational efficiency are the main reasons. This is where low code platforms shine since they not only facilitate the rapid development of applications but also give businesses looking to innovate quickly and increase user engagement a competitive advantage.

The rising emphasis on improving company operations hastens corporate digital transformation. All businesses, regardless of industry, are providing digital tools to their employees and staff. Businesses use digital transformation to provide better services and boost revenue through simpler labor procedures. According to a market survey over the digital; transformation, in 2023, 8 out of 10 enterprises had advanced their digital transformation, using cloud-based services.

Restrains

-

Inadequate Software Integration and Customization Capabilities Will Limit Market Growth

-

Lack of skills among developers to handle complex applications.

Key Market Segmentation

The Low Code Development Platform Market is segmented into five types on the basis of By Component, By Deployment, By Solution Type, By End-user, and By Industry.

By Deployment Type

With almost 55% of the market, the cloud sector dominated the low code development platform industry. These two tools work together to provide businesses with opportunities for application development and deployment. Low-code platforms streamline enterprise app lifecycle management so businesses can create cutting-edge, scalable apps without requiring a lot of coding support. They also cut down on IT overhead and bottlenecks by speeding software through cloud resources. More than hundreds of different markets from healthcare to banking to IT are using these tools to improve customer relationships and higher scalability, with 24/7 services. Moreover, companies like Microsoft, salesforce, and Outsystem are investing in these tools and more than 65% of their services are based on cloud-based services.

By Organization Size

In this segmentation, Large enterprises held the dominant position with a market share of more than 55% in 2023. The Low Code Development Platform Market is primarily driven by the developments to ease development, and since these platforms provide a rapid application development environment they have a higher adoption rate. Low code platforms allow companies to rapidly develop and deploy customized applications, shortening the time-to-market cycle while also allowing them flexibility in their requirements. Companies such as Coca-Cola, Adidas, and Hyundai Motor America have used Microsoft's Power Platform, Salesforce Lightning, and Oracle to adopt the low code tools to improve operations and customer experience. As low-code adoption increases, corporations are increasingly using them to drive digital transformation and keep pace-leading.

By End-Use

In 2023, the market was headed by the BFSI segment, which held a revenue share of over 26%. Because of the growing emphasis on digital transformation, regulatory compliance, and improving the customer experience, this market is predicted to maintain its dominance. Because they handle large amounts of consumer data that need to be secure and optimized through cloud-based services, the BFSI sectors can be more trusted with this low code. For example, this industry uses low-code platforms like Cretio, Mendix, Appzillon, etc., which aids in a variety of areas like customer relationship management, sales, and marketing. Moreover, various giant players in the banking sector such as CITI Bank, and BNY Mellon had invested more than USD 20 million in a low-code platform called Genesis.

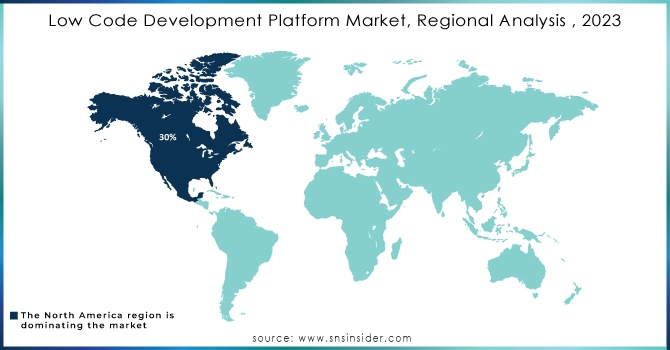

Regional Analysis

Because it is an early user of digital and intelligent technologies, North America dominates the low code development platform market with more than 30% of the revenue share in 2023. The United States will obtain the most market share in the area. The growing number of small and medium-sized businesses in the country, as well as their digital expenditures, will drive platform demand. For Instance, in July 2024, Microsoft announced its partnership with OpenAI and significant Investment in AI, to establish its leadership in the Omida Universe.

During the predicted period, Asia Pacific is expected to increase at an astounding rate. According to the 2023 Asia Pacific Software Survey, more than half of the region's top executives are confident in deploying the minimal code platform throughout their organizations. IT developers in China are being urged to use low-code platforms for more effective workflow processes. According to the Mendix Survey, 8.7% of IT professionals approve of the platform. Because of the current Atmanirbhar Bharat program, India is predicted to expand significantly.

Need any customization research on Low Code Development Platform Market - Enquiry Now

Key Players:

-

Appian

-

LANSA

-

Pegasystems Inc.

-

AgilePoint

-

Oracle

-

Betty Blocks

-

Mendix Technology BV

-

Microsoft

-

OutSystems

-

Salesforce, Inc.

-

ServiceNow

-

Zoho Corporation Pvt. Ltd.

-

Quickbase

-

Creatio

Recent development

-

In January 2024, at the core of ServiceNow Disputes Management, Built with Visa is done by a strategic partnership between ServiceNow and Visa. It uses of low code technology and is targeted towards making dispute resolution as smooth for the issuer while looking at how low-code platforms can be used to fix unique industry issues.

-

In December 2023, EY and Appian teamed up to speed up businesses' digital transformation. The merger unites EY's industry acumen with Appian low code, underscoring the upsurge in strategic alliances within the market for evening enterprise processes.

-

In November 2023, Oracle Corporation released a new version of its low-code platform, Oracle APEX 23.2, powered by advanced features for developing enterpriseworthy, scalable applications. This includes collaborative development tools, enhanced process automation, and refreshed user interface components. It is exactly these very innovations that underscore the ongoing evolution of the Low Code Development Platform Market and major technology providers' continuous efforts to move their offerings forward.

| Report Attributes | Details |

| Market Size in 2023 | US$ 22.80 Bn |

| Market Size by 2032 | US$ 271.7 Bn |

| CAGR | CAGR of 31.7 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Deployment Type • By Organization Size • By Application Type • By End-Use |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Appian, LANSA, Pegasystems Inc., AgilePoint, Oracle, Betty Blocks, Mendix Technology BV, Microsoft, OutSystems, Salesforce, Inc., ServiceNow, Zoho Corporation Pvt. Ltd., Quickbase, and Creatio |

| Key Drivers |

• Increasing need for Rapid Application Development (RAD), by saving time and resources. • Expanding Digital Transformation among the enterprises. |

| Market Opportunities | • The IT industry is undergoing a rapid digital revolution. • Rising need for robust solutions to maximize process visibility and control |