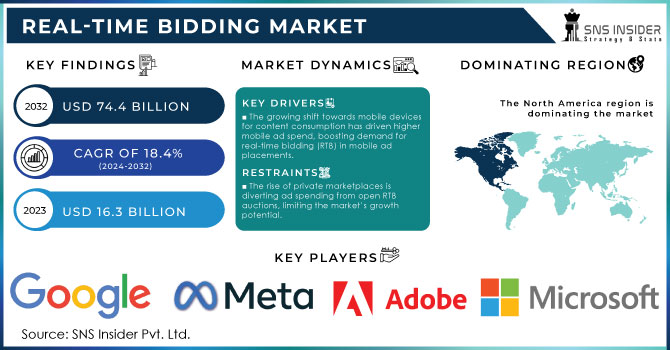

Real-Time Bidding Market Size & Overview:

Get More Information on Real-Time Bidding Market - Request Sample Report

Real-Time Bidding Market Size was valued at USD 16.3 Billion in 2023 and is expected to reach USD 74.4 Billion by 2032, growing at a CAGR of 18.4% over the forecast period 2024-2032.

The real-time bidding market has achieved remarkable growth due to the expansion of digital advertising spend and the investments in digital infrastructure policies supported by government policies. As the U.S. Bureau of Economic Analysis states, digital advertising appeared to play a substantial role in the contribution to the economic output of the country in 2023. It proves the increased appetite for the automated purchase and sale of the ads. At the same time, The European Union’s Digital Strategy 2023 established laws that provide a framework that improves digital advertising transparency and competition supporting the adoption of the RTB. Moreover, as the India Ministry of Electronics and Information Technology says, as a part of the Digital India program people have started massively adopting online platforms with a 25% rise in digital payments and transactions. Such acquisitions facilitated the further spread of the real-time bidding market where marketers and businesses purchase the ad spaces at the right time directly on the auction. The substantial governmental efforts together with the development of novel technologies, such as AI and machine learning, are the basis of the market growth as they help to cut the expenses on the ads by making the purchase more efficient and improving the targeting of advertisements.

Real-Time Bidding Market dynamics

Drivers

-

The growing shift towards mobile devices for content consumption has driven higher mobile ad spend, boosting demand for real-time bidding (RTB) in mobile ad placements.

-

Advanced algorithms in AI and machine learning are enhancing ad targeting accuracy, leading to greater efficiency and personalization in RTB campaigns.

-

The global rollout of 5G technology is accelerating mobile internet speeds, enabling more real-time interactions and boosting the RTB market’s growth.

One of the prominent drivers in the Real-Time Bidding market is the significant increase in mobile ad spending. A growing shift to mobile devices is observed due to increasing human mobility and the necessity to stay connected. According to the International Telecommunication Union, in 2023, more than 5.3 billion people used mobile devices for internet access, which is up by 7% in comparison with the previous year. Since the majority of devices used and go-to platforms for internet surfing are mobile devices, they have become the primary platform for connecting advertisers with users through real-time bidding. The amount of time, as well as occasions, spent on mobile devices has been ever-increasing, surged by the rise of social media and gaming applications, which are both rich in possibilities for advertising placement. In 2023, an average user spends 4.6 hours on mobile apps daily, mainly focusing on social media and gaming, which provides advertisers abundant chances to access their target users. Real-time bidding allows advertisers to bid dynamically for mobile ad spaces and ensure that their target ad is placed in front of the appropriate viewer at the most relevant, in-context time point.

Furthermore, an increased interest in mobile internet usage is also supported by government-mandated programs, such as the Indian government’s efforts to enhance mobile internet access under the BharatNet project. India has experienced a 25% growth in mobile internet usage in 2023, which propelled real-time bidding activities and will continue to do so, as expanding mobile internet usage penetration will increase the demand for such activity.

Restraints:

-

Stringent regulations like GDPR and CCPA are limiting data accessibility, making it harder for advertisers to effectively target users in RTB environments.

-

The prevalence of ad fraud and lack of transparency in the bidding process are creating trust issues among advertisers, restraining RTB adoption.

-

The rise of private marketplaces is diverting ad spending from open RTB auctions, limiting the market’s growth potential.

One of the significant restraints in the real-time bidding (RTB) market is the increasing impact of data privacy regulations. With the establishment of the General Data Protection Regulation and the California Consumer Privacy Act, proper rules have been put into place concerning the collection and use of personal data for promotional purposes. One of the main features of the legislation is the limitations that it imposes on the extent to which advertisers may collect user information which is vital as a foundation for the use of real-time bidding. Advertisers are now expected to provide their users with an agreement that allows them to track online activity and collect information to establish a user profile. In most cases, however, users are not apt to provide full consent which ultimately leads to significantly reduced data access. As a result, advertisers cannot divide their audiences into segments that can be adequately targeted. Non-compliance with these regulations also carries hefty fines, pushing companies to adopt stricter data handling practices, which can hinder the efficiency of real-time bidding.

| Component | Role in RTB | Benefits | Challenges | Impact on Advertisers & Publishers |

|---|---|---|---|---|

| Demand-Side Platform (DSP) | Allows advertisers to bid on ad inventory in real-time | Access to diverse ad inventory, real-time analytics | Complex integration, competition for premium inventory | Enables advertisers to reach target audiences efficiently |

| Supply-Side Platform (SSP) | Helps publishers manage, sell, and optimize ad space | Maximizes revenue, controls ad placements | Risk of low bids, inventory quality management | Allows publishers to monetize unsold ad inventory |

| Ad Exchange | Acts as a digital marketplace for buying/selling ad inventory | Facilitates transparent transactions, large reach | Ad fraud, data privacy concerns | Connects advertisers and publishers for efficient trading |

| Data Management Platform (DMP) | Collects and analyses data for targeted advertising | Enhances targeting accuracy, data-driven insights | Data privacy regulations, integration complexity | Provides advertisers with audience insights for better targeting |

Real-Time Bidding Market Segment analysis

By Auction Type

In 2023, open auction was the dominant segment in the RTB markets, with 32% of the revenue share. Open auctions are preferable because they are accessible and transparent. While for private auctions, certain advertisers are normally invited, in the case of open auctions, a wider pool of operators can participate. As a result, the competition for the space is increased and the bids become “more aggressive”. As a result, publishers benefit the most from bidding wars. In addition, the demands of the government to enforce the high degree of competition in digital markets help open auctions succeed. As a part of these efforts, the European Union has adopted the Digital Markets Act and this measure has led to fairness in competition, increasing even more interest in open auctions. Additionally, the number of advertisers who can participate in the open auction has increased due to the elevated penetration of mobile internet into emerging markets. Moreover, the data is more transparent and follows governmental regulations that impose data protection. In the EU, it is the GDPR. Overall, these factors allow the open auction segment to remain at a dominant market share.

By Device

In 2023 mobile devices segment dominated the market with the largest revenue share. The dominating mobile devices segment is primarily due to the tremendous rise in mobile internet consumption and governmental campaigns promoting mobile digital infrastructure. In the United States, mobile broadband subscriptions increased by 15% compared to the previous year, according to the U.S. Federal Communications Commission. The statistics claim that approximately 84% of the United States population uses the internet with smartphones or other mobile devices. On a global scale, mobile internet user statistics show a 27% increase, supported by governmental policies such as the Indian BharatNet initiative. According to the mission statement of the government-led directive, BharatNet plans to develop mobile high-speed internet infrastructure in rural Indian regions. The steady growth of mobile device user statistics shows the amplified importance of mobile platforms in the digital advertising market landscape. Thus, as consumer content consumption patterns shift toward mobile devices, so too do the advertisers who seek to target users in real-time using RTB. High-performance rates and user convenience are the prevailing characteristics of mobile devices that make the phones a primary platform. Additionally, governmental policies in the Southeast Asia region, which received significant investment in 5G technology, further cultivate mobile devices.

By Application

The RTB market was dominated by the gaming segment in 2023. Mobile and online gaming platforms were the industries’ primary drivers, both experiencing explosive growth. In the U.S., the gaming industry contributed to nearly $97 billion of the national economy. Specifically, the mobile sector made up 41% of the aggregate market. Moreover, globally, the gaming sector experienced a 20% year-on-year revenue increase per the World Economic Forum data. The major driving factor was considered to be government initiatives that stimulated the public to use digital games for entertainment and educational purposes.

An example is provided by China, as the country’s 14th Five-Year plan supports the reactive dynamism of gaming and pursues the development of digital content. The uptick in mobile gaming prompted the government to provide protection for this industry. High levels of customer engagement cement interest in these individuals as target audiences for advertisers. In this scenario, RTB is an optimal strategy as it allows for direct advertisement interactions with individuals who might consider the content personally relevant. In addition, gaming platforms frequently have extensive pools of information to draw from, contributing to more accurate targeting. Notably, the RTB market share for this gaming stood at 35% in 2023.

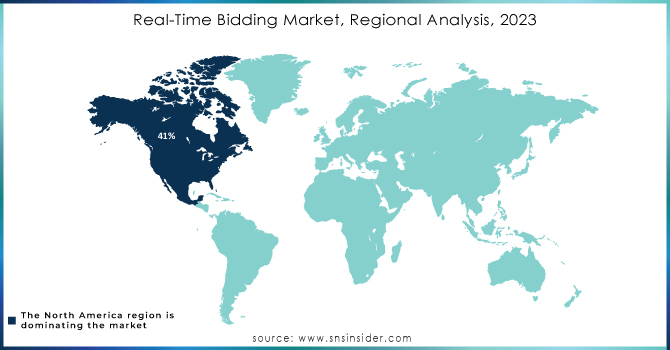

Regional Insights

In 2023, the real-time bidding market was dominated by North America, as it accounted for 41% of the global revenue. This is a result of the region’s well-developed digital infrastructure, high rate of technology adoption, as well as robust and advanced regulations that support the transparent and competitive digital ad ecosystem. The U.S. specifically has been a prominent player, with the government’s statistics by the Federal Trade Commission showing a 22% increase in digital ad spending, which was attributed to the booming e-commerce and social media sectors. Furthermore, the growth of the RTB market has been supported by Canada’s Digital Charter Implementation Act, which has excelled transparency and consumer trust in the digital market.

However, the Asia-Pacific region is the fasted growing segment and is expected to grow at a significant CAGR from 2024 to 2032. Across the region, governments, including China’s Digital Economy Development Plan and India’s Digital India, have been critical in creating favourable conditions for digital advertising. More specifically, the infrastructure investments in 5G connectivity in China have advanced mobile advertising, which has been a key driver of growth in the RTB market. At the same time, the rapid growth of the internet and smartphone use across India, Indonesia, and Vietnam has been critical in advancing the RTB solution in the APAC market.

Need any customization research on Real-Time Bidding Market - Enquiry Now

Latest News in the Real-Time Bidding Market

July 2024, The U.S. Federal Communications Commission released new guidelines aimed toward increasing transparency of digital advertisement practices. These guidelines were to enhance transparency in any transactions of programmatic advertisement, such as real-time bidding, thus ensuring consumer privacy and fair competition. This event has become a significant step in controlling the RTB market and compliance with privacy laws.

April 2024 – SpotX has announced an update for the server-to-server bidding product, which will allow including yield management into media owners’ operation. The new technologies of ad serving now include the server-side and client-side header bidders with cloud-based solutions.

June 2024: The European Union published a report on the impact of the Digital Markets Act (DMA) on the digital advertising landscape. The report highlighted that since the DMA came into effect, there has been a 15% increase in open auction participation, reflecting the law’s success in fostering competition in the RTB market. The report also pointed to an improvement in ad pricing transparency, benefiting both advertisers and consumers.

Key Players

-

Google (DoubleClick, Google Ads)

-

Meta (Facebook Audience Network, Instagram Ads)

-

Adobe (Adobe Advertising Cloud, Marketo Engage)

-

Amazon (Amazon DSP, Amazon Advertising Platform)

-

Microsoft (Microsoft Advertising, Xandr Invest)

-

The Trade Desk (TD7, Koa)

-

MediaMath (TerminalOne, Source)

-

Criteo (Criteo Dynamic Retargeting, Criteo Retail Media)

-

Smaato (Smaato Publisher Platform, Smaato Demand Platform)

-

Rubicon Project (Prebid, EMX)

-

Verizon Media (Verizon Media DSP, Yahoo Native Ads)

-

AppNexus (Prebid, Xandr Curate)

-

PubMatic (OpenWrap, PubMatic Marketplace)

-

OpenX (OpenX Exchange, OpenX Ad Server)

-

SpotX (SpotX Platform, SpotX Video DSP)

-

Amobee (Amobee DSP, Amobee Analytics)

-

Zeta Global (Zeta DSP, Zeta Marketing Platform)

-

Quantcast (Quantcast Platform, Quantcast Measure)

-

Choozle (Choozle DSP, Choozle Data Marketplace)

-

Centro (Basis, Centro DSP) and others

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 16.3 Billion |

| Market Size by 2032 | USD 74.4 Billion |

| CAGR | CAGR of 18.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Auction Type (Open Auction, Private Auction, Preferred Deals, Programmatic Guaranteed) • By Device(Mobile, Desktop, Smart TV, Others) • By Advertisement Format (Display Ad, Video Ads, Mobile Ads, Social Media Ads, Native Ads) • By Application (Media & Entertainment, Retail and E-commerce, Games, Travel & Luxury, Mobile Applications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Google, Meta, Adobe, Amazon, Microsoft, The Trade Desk, MediaMath, Criteo, Smaato, Rubicon Project, AppNexus, PubMatic, OpenX |

| Key Drivers | • The growing shift towards mobile devices for content consumption has driven higher mobile ad spend, boosting demand for real-time bidding (RTB) in mobile ad placements. • Advanced algorithms in AI and machine learning are enhancing ad targeting accuracy, leading to greater efficiency and personalization in RTB campaigns The global rollout of 5G technology is accelerating mobile internet speeds, enabling more real-time interactions and boosting the RTB market’s growth. |

| RESTRAINTS | •Stringent regulations like GDPR and CCPA are limiting data accessibility, making it harder for advertisers to effectively target users in RTB environments. The prevalence of ad fraud and lack of transparency in the bidding process are creating trust issues among advertisers, restraining RTB adoption. |