Simulation Software Market Report Scope & Overview:

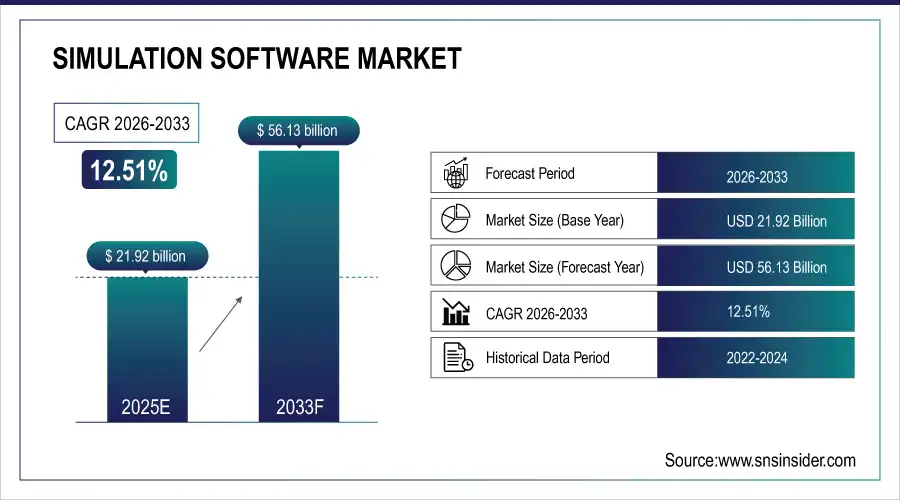

The Simulation Software Market Size was valued at USD 21.92 Billion in 2025E and is expected to reach USD 56.13 Billion by 2033 and grow at a CAGR of 12.51% over the forecast period 2026-2033.

The increasing demand for cost-effective and efficient product design, testing, and validation in industries such as automotive, aerospace & defense, healthcare, electronics, and others is the key factor driving the growth of the Simulation Software Market. Simulation tools have found their application in industries for a long time and are extensively adopted by a large number of companies to decrease the cost incurred on physical prototypes, increase the speed of getting to the market, and improve product quality. The increasing penetration of digital twins, artificial intelligence (AI), Internet of Things (IoT) with simulation software augment The Prediction Model, Monitoring, And Decision Making in Real Time, thereby augment demand for the Simulation Software Market. According to study, Use of simulation accelerates product development cycles organizations can achieve faster time-to-market by 20–40% compared to traditional methods.

Market Size and Forecast:

-

Market Size in 2025: USD 21.92 Billion

-

Market Size by 2033: USD 56.13 Billion

-

CAGR: 12.51% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Simulation Software Market - Request Free Sample Report

Simulation Software Market Trends

-

Increasing adoption of digital twins for real-time monitoring and virtual replication.

-

Rising use of AI and IoT-enabled simulation for predictive modelling and analysis.

-

Growing shift toward Industry 4.0 and smart manufacturing practices.

-

Expansion of cloud-based simulation platforms and SaaS models for scalability.

-

Enhanced collaboration and remote access through cloud simulation solutions.

-

Rising integration of high-performance computing (HPC) with simulation software for complex processes.

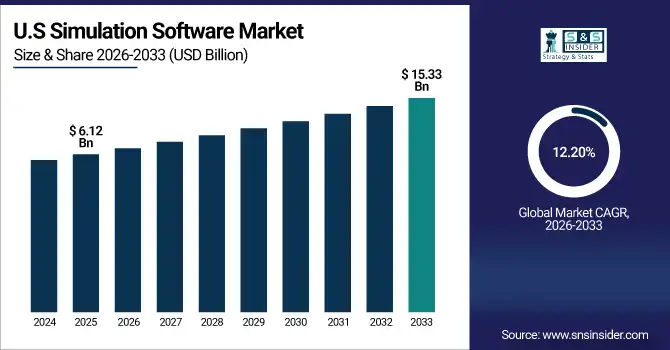

The U.S. Simulation Software Market size was USD 6.12 Billion in 2025E and is expected to reach USD 15.33 Billion by 2033, growing at a CAGR of 12.20% over the forecast period of 2026-2033, primarily driven by strong adoption across key industries, including automotive, aerospace, healthcare, and electronics.

Simulation Software Market Growth Drivers:

-

Digital Twins and AI Integration Propel Simulation Software Adoption Across Multiple Industries Rapidly

Growing penetration of digital twins, artificial intelligence (AI), and IoT that are integrated into the simulation software is a major factor fuelling the market growth. Businesses in industries ranging from automotive to aerospace to healthcare to electronics are using these technologies to improve product design, testing, and predictive maintenance. Digital twins allow businesses to monitor assets in real-time and virtually replicate physical processes, helping companies save money on physical prototyping, improve operational efficiency, and reduce time-to-market. Predictive modelling and scenario analysis powered by machine learning make simulation-based decision making and new forms of decision-driven design possible so that your enterprise can thrive. The increasing implementation of Industry 4.0 and smart manufacturing drive penetration of simulation solutions, within production and R&D workflows.

Adoption of simulation software allows companies to shorten development timelines by approximately 20–40%.

Simulation Software Market Restraints:

-

High Costs and Complex Implementation Limit Widespread Adoption of Simulation Software Solutions

The high cost of simulation software and its complex implementation, however, is a major restraint that is expected to negatively impact the growth of the Simulation Software Market. Enterprise level simulation platforms such as Ansys, Siemens Scenter and Dassault Systems do not only require high individual licenses but also high threshold of investment in hardware, training, and maintenance. These upfront costs are hard for small and medium enterprises (SMEs) to justify, leading to slower adoption. Moreover, the deployment cycle is prolonged and skilled workforce is needed to operate simulation software needs to be more skilled, hence limiting the broader market penetration due to high cost and complex integration of simulation software with the existing systems such as CAD, PLM, and ERP.

Simulation Software Market Opportunities:

-

Cloud-Based Simulation and SaaS Models Unlock Growth Potential Globally for Enterprises

The transition toward cloud-based simulation solutions and SaaS deployment models poses a formidable opportunity for growth. Cloud also minimizes the extent of heavy onsite legacy infrastructure and provides scalability, remote access, pricing with lower capex and quick implementation. Cloud simulation adoption is increasing for consolidated product design across teams, virtual prototyping and real-time analytics in the industry which give SME's access to advanced simulation tools without huge CAPEX. In addition, innovations in AI, machine learning, and high-performance computing (HPC) involving the cloud is expected to deliver new streams of revenue, improve predictive modelling capabilities, and further expand the overall global market footprint.

Cloud simulation facilitates collaborative product design, virtual prototyping, and real-time analytics, improving team efficiency by 15–25%.

Simulation Software Market Segmentation Analysis:

-

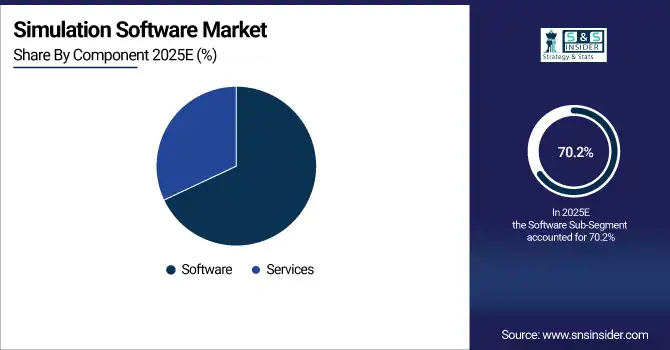

By Component: In 2025, Software led the market with share 70.2%, while Services are the fastest-growing segment with a CAGR 14.3%.

-

By Deployment: In 2025, On-Premise the market 61.06%, while Cloud fastest-growing segment with a CAGR 15.6%.

-

By Application: In 2025 Modelling & Simulated Testing led the market with share 34.16%, while AI Training & Autonomous Systems the fastest-growing segment with a CAGR 16.5%.

-

By End Use: In 2025, Automotive led the market with share 27.4%, while Healthcare is the fastest-growing segment with a CAGR 14.9%.

By Component, Software Leads Market While Services Fastest Growth

In the simulation software category for market, software is at the top due to the adoption of simulation software among the industries automotive, aerospace, healthcare, and electronics. Software solutions offer tried and tested functionalities that empower organizations with extensive features for product design and testing, digital twins, and predictive modelling, thus minimizing prototyping expenses and accelerating time-to-market. At the same time, Services is the fastest-growing segment, due to rising demand for consulting, integration, implementation, and support Services. Growing adoption of cloud solutions and the AI-enabled nature of simulations make service offerings vital to seamlessly introduce various industrial applications, customize them, and run them efficiently as an end-to-end solution across the cloud, edge, and on-premises, thereby bridging the gap between digital threads and wires.

By Deployment, On-Premise Leads Market While Cloud Fastest Growth

The On-Premise deployment segment in Simulation Software Market holds the highest market share as industries use this method to offer secure, well-controlled, well-customized environments; this can be particularly important for carrying out simulation in business environments in automotive, aerospace and defense Vertical. On the other hand, because of the need for scalable, flexible, and cost-effective solutions, the Cloud segment is expected to grow at a rapid pace. With the promise of remote collaboration, faster implementation and infrastructure access for advanced analytics, AI and high-performance computing, Cloud-based simulation is opening the door for global enterprise-class adoption and scale-up of simulation capabilities.

By Application, Modelling & Simulated Testing Leads Market While AI Training & Autonomous Systems Fastest Growth

In the Simulation Software Market, Modelling & Simulated Testing is the largest market segment, as it continues to remain a core application across diverse industries such as automotive, aerospace, healthcare, and electronics. These tools are used within organizations for product design, testing and validation, and process optimization leading to reduced costs, enhanced quality, and a shorter time-to-market. On the other hand, the AI Training & Autonomous Systems segment accounts for the fastest growth, due to the increasing implementation of autonomous vehicles, robotics, and AI-based simulations. The applications in turn need complex predictive modelling, scenario analysis, and real-time testing capabilities, driving the need for advanced simulation platforms underpinning innovation, operational efficiency, and digital transformation across sectors.

By End Use, Automotive Leads Market While Healthcare Fastest Growth

The Automotive is the largest market by vertical in the Simulation Software Market as manufacturers widely utilize simulation for vehicle design, crash testing, and ADAS (advanced driver-assistance systems). These tools assist in decreasing the physical prototyping, shortening the development cycles, and enhancing product safety and performance. On the other hand, Healthcare is the fastest-growing segment, due to an increase in surgeons adopting simulation for surgical training and testing of medical instruments and digital twin use cases in hospitals and research centres. With the help of advanced simulations, you can conduct realistic, risk-free training and rehearsals in 3D; predictive modelling and other healthcare applications assist in delivering better patient outcomes. However, the demand from both mature as well as developing sectors keeps driving the growth of simulation software worldwide.

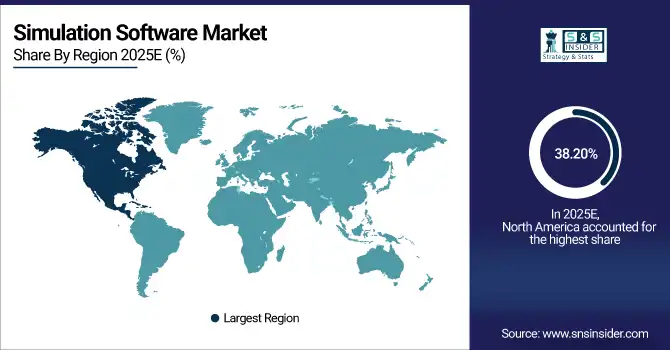

Simulation Software Market Regional Analysis:

North America Simulation Software Market Insights:

North America accounted for the largest share 38.20%of the Simulation Software Market in 2025, The North America Simulation Software Market is a dominant region, driven by the presence of major industry players, advanced technological infrastructure, and high adoption across automotive, aerospace, healthcare, and electronics sectors. The region benefits from significant investment in digital twins, AI-enabled simulations, and Industry 4.0 initiatives, enabling organizations to optimize product design, testing, and predictive maintenance. Strong R&D activities, coupled with favorable government policies and early technology adoption, further support market growth. Additionally, increasing deployment of cloud-based solutions and SaaS models is enabling scalability, remote collaboration, and operational efficiency, solidifying North America’s leadership in the global Simulation Software Market.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Dominates Simulation Software Market with Advanced Technological Adoption

The U.S. leads the Simulation Software Market, driven by early adoption of digital twins, AI-enabled simulations, Industry 4.0 initiatives, strong R&D, and widespread use across automotive, aerospace, healthcare, and electronics sectors.

Asia-Pacific Simulation Software Market Insights

In 2025, Asia-Pacific is the fastest-growing Simulation Software Market with a CAGR 13.59%, Rapid industrialization, the adoption of technology throughout various industries, and the growth of the manufacturing, automotive, aerospace, and healthcare sectors have propelled. The increasing investments into digital transformation, Industry 4.0 & smart manufacturing are expected to drive the demand for simulation solutions for optimizing design, & testing & operational efficiency. For example, market trends like cloud-based deployment models and AI-enabled simulations are being used more frequently, making it easier for SMEs to access advanced tools without significant capital investment. These include government mandates for R&D, innovation hubs, and infrastructure growth. Asia-Pacific remains a core area for organisations in simulation software with major expansion being driven by countries including China, Japan, India, and South Korea.

China and India Propel Rapid Growth in Simulation Software Market

China and India are driving rapid Simulation Software Market growth due to increasing industrialization, adoption of digital twins and AI-enabled simulations, expanding manufacturing sectors, and supportive government initiatives fostering technology innovation and smart manufacturing practices.

Europe Simulation Software Market Insights

The growth of Europe Simulation Software Market is believed to be stable owing to various industries such as automotive, aerospace and defense industrial sectors and the healthcare sector which provides a positive sign for the growth of software simulation market here. This drive in the region is rooted in advanced R&D as well as a focus on digital twin adoption, AI-enabled simulations, and Industry 4.0 initiatives which advance product design and testing and improve operational efficiency. Countries like Germany, the U.K., and France are substantial players, investing heavily in smart manufacturing, simulation-based training, and virtual prototyping. Simulation is further adopted for compliance, safety and environmental efficiency due to stringent regulatory standards and sustainability initiatives. The combination of cloud solutions and artificial intelligence technology is also another factor that is solidifying Europe position in the global Simulation Software Market.

Germany and U.K. Lead Simulation Software Market Expansion Across Europe

Germany and the U.K. drive Europe’s simulation software growth through strong industrial sectors, advanced R&D, adoption of digital twins, AI-enabled simulations, smart manufacturing initiatives, and investment in virtual prototyping and regulatory-compliant product development.

Latin America (LATAM) and Middle East & Africa (MEA) Simulation Software Market Insights

In the LATAM and MEA Simulation Software Markets, both are emerging regions with steady growth owing to modernizing industries, excess of digital technology solutions, and immense demand for cost-effective design, testing, and virtual prototyping solutions. Brazil and Mexico are investing in automotive, aerospace, and manufacturing sectors in LATAM, enabled by favorable government initiatives and improved infrastructure, which facilitate technology adoption. In MEA, the market is anticipated to witness growth due to increasing smart manufacturing, oil & gas, aerospace, and defense sectors focus, in addition, the adoption of more cloud-based deployment and AI-enabled simulations. These two regions offer rich opportunities for simulation software vendors looking for new growth avenues.

Simulation Software Market Competitive Landscape

Ansys is a global leader in simulation software, providing solutions for structural, thermal, fluid, and Multiphysics analysis. Its platforms, including Ansys Fluent and Mechanical, enable companies across automotive, aerospace, healthcare, and electronics industries to optimize product design, reduce physical prototyping, and accelerate time-to-market with high-performance, accurate simulations.

-

In September 2024, Ansys integrated support for AMD Instinct MI200 and MI300 accelerators into its Fluent CFD solver, significantly enhancing simulation efficiency and power data.

Siemens offers comprehensive simulation solutions through its Simcenter portfolio, integrating AI, digital twins, and real-time production data. The software supports manufacturing, automotive, aerospace, and energy sectors by enabling predictive modelling, process optimization, and virtual testing, helping organizations enhance operational efficiency, product quality, and innovation across the product lifecycle.

-

In July 2025, Siemens introduced AI-powered copilots, low-code interfaces, and real-time production data connectivity into its manufacturing simulation tools, enabling more accessible and efficient simulation processes across the manufacturing lifecycle.

Altair Engineering provides advanced simulation platforms such as HyperWorks, combining Multiphysics analysis, AI-driven workflows, and optimization tools. Its solutions enable industries like automotive, aerospace, and industrial equipment to streamline product development, improve performance, reduce costs, and implement digital twin and virtual prototyping strategies for faster, smarter engineering.

-

In July 2024, Altair released HyperWorks 2024, offering a unified user experience across various physics and complexities, incorporating AI-embedded workflows and photorealistic graphics to enhance product development from design to in-service stages.

Simulation Software Market Key Players:

Some of the Simulation Software Market Companies are:

-

Ansys

-

Dassault Systems

-

Siemens

-

Altair Engineering

-

Autodesk

-

The MathWorks

-

Bentley Systems

-

Hexagon AB

-

Rockwell Automation

-

Honeywell International

-

Schneider Electric

-

ESI Group

-

Simulations Plus

-

GSE Systems

-

SimScale

-

PTC

-

AspenTech

-

AVEVA Group

-

Keysight Technologies

-

COMSOL

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 21.92 Billion |

| Market Size by 2033 | USD 56.13 Billion |

| CAGR | CAGR of 12.51% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment (Cloud, On-Premise) • By Application (Engineering, Research, Modeling & Simulated Testing, Gaming & Immersive Experiences, High Fidelity Experiential 3D Training, AI Training & Autonomous Systems, Manufacturing Process Optimization, Planning and Logistics Management & Transportation, Cyber Simulation) • By End Use (Automotive, Industrial, Electronics & Semiconductor, Aerospace & Defense, Healthcare, Transportation & Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Ansys, Dassault Systèmes, Siemens, Altair Engineering, Autodesk, The MathWorks, Bentley Systems, Hexagon AB, Rockwell Automation, Honeywell International, Schneider Electric, ESI Group, Simulations Plus, GSE Systems, SimScale, PTC, AspenTech, AVEVA Group, Keysight Technologies, COMSOL., and Others. |