Low-Pressure Liquid Chromatography Market Report Scope & Overview:

Get more information on Low-Pressure Liquid Chromatography Market - Request Sample Report

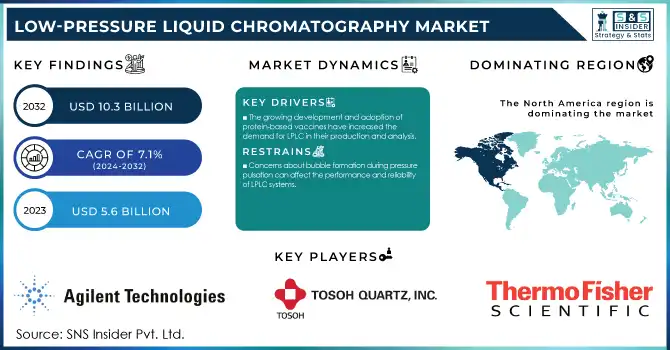

The Low-Pressure Liquid Chromatography Market Size was valued at USD 5.6 billion in 2023 and is expected to reach USD 10.3 billion by 2032 and grow at a CAGR of 7.1% over the forecast period 2024-2032.

Low-pressure Liquid chromatography (LPLC) systems are widely used in biotechnology research for protein purification and enzyme analysis, as protein purification and enzyme analysis are important for several applications in the scientific and industrial sectors. LPLC is used by researchers, especially those in drug development, diagnostic research, and academia, to separate, purify, and quantify biomolecules (like proteins and enzymes). In contrast to high-pressure systems LPLC provides a simple, cost-effective system providing access to small laboratories and research institutes making the operation much simpler. In addition, the ability to work with a wide range of resins and buffers made it possible to get accurate and reagent-free separation, while ensuring the structural integrity of sensitive biomolecules. With the growth of the biotechnology world, especially in monoclonal antibody production, vaccine development, and enzyme engineering, we will see increasing adoption of LPLC systems, particularly as the pursuit of high-purity biomolecular outputs is driven by reliance on technology with the appropriate efficiency capabilities.

Additionally, the rising usage of Low-Pressure Liquid Chromatography (LPLC) systems in biotechnology research for example in Protein purification and enzyme analysis is supported by several government-authenticated such as, the U.S. Department of Energy (DOE) has announced new awards totaling approximately $178 million for research efforts aimed at the innovative production of next-generation biofuels, bioproducts, and biomaterials from sustainable resources.

The growing need for biologics and biosimilars is one of the major factors contributing to the adoption of Low-Pressure Liquid Chromatography (LPLC), mainly in downstream processing. Biologics includes monoclonal antibodies, vaccines, and therapeutic proteins; these complex molecules are inherently sensitive and need to be purified in a manner that guarantees safety, efficacy, and stability function in downstream processes. LPLC is an important factor in this step as it offers an efficient to separate impurities, host cell proteins and other contaminants from the desired biomolecule in a manner that can be scaled. The increasing global healthcare demands alongside the ongoing breakthroughs in biotechnology have led to a compact increase in the output of biologics due to their superior target specificity for diseases. In 2022, biologics accounted for 40% of the total drug approvals by the U.S. Food and Drug Administration (FDA), marking the highest percentage in recent years. This indicates a significant rise in the development and approval of complex biological products.

Market Dynamics

Drivers

-

The growing development and adoption of protein-based vaccines have increased the demand for LPLC in their production and analysis.

-

Increased spending on research and development projects, particularly in the pharmaceutical and biotechnology sectors, is propelling the need for advanced chromatographic techniques like LPLC.

-

The incorporation of advanced technologies into clinical laboratories enhances the efficiency and capabilities of LPLC systems, driving market growth.

Low-Pressure Liquid Chromatography (LPLC) market is driven by the demand for protein-based vaccines. The vaccines range from those based on proteins, such as monoclonal antibodies and recombinant proteins, to those based on nucleotides and viruses and several other methods, the vaccines are a significant development area in the pharmaceutical and biotechnology industries. Analytics in drug development is essential for the purification and characterization of these proteins, maintaining their quality, safety, and efficacy. As an example, the need for vaccines to be quickly developed and produced was illustrated by the COVID-19 pandemic. Both the Pfizer-BioNTech and Moderna vaccines are based on messenger RNA (mRNA) but mRNA was only one of the key components that needed to be made and purified to yield the final product; LPLC systems were critical for separating and isolating just the right proteins. The use of monoclonal antibodies for diseases like cancer and autoimmune disease is another factor that is enhancing the need for accurate and reproducible protein purification.

Pharmaceutical and biotechnology firms are dependent on chromatographic techniques such as LPLC because these products need regulatory standards to guarantee the safety of these biopharmaceutical products. With protein-based therapeutics on the rise, LPLC is increasingly important to ensure the high purity of these therapeutically critical compounds. Consequently, this increasing dependence on LPLC systems in vaccine and protein drug development is creating significant traction for the growth of the market.

Restraints:

-

Concerns about bubble formation during pressure pulsation can affect the performance and reliability of LPLC systems.

-

The substantial costs associated with LPLC equipment and maintenance may limit its adoption, especially among smaller research institutions.

-

The intricate nature of LPLC systems requires specialized training, which can be a barrier to widespread implementation.

The high cost of operating equipment and maintenance is a major hindrance to the growth of the Low-pressure Liquid Chromatography (LPLC) market. While LPLC systems are state-of-the-art, implementing them is an ongoing investment. These include high initial acquisition costs for necessary components (pumps, detectors, columns) that may be too expensive for some smaller research labs or institutions on a limited budget. Furthermore, these systems require maintenance to maintain accuracy and avoid breakdowns, which increases operating costs. In addition to the amortization of equipment or facilities, consumables like solvents, reagents, and materials needed throughout the process are also part of the continuous costs. This financial burden can hinder the widespread adoption of LPLC by laboratories that either operate on a shoestring budget or do not have a high-throughput chromatography demand. As a result, it becomes a challenge for some entities to justify the investment in such systems, hindering market growth in certain segments.

Segment analysis

By Application

In the Low-Pressure Liquid Chromatography (LPLC) type market, the instruments segment has continuously led the market and acquired a large revenue share of 40% In 2023. The overwhelming dominance of this segment can be explained by the importance of instruments (pumps, detectors, columns, and flow cells) in chromatographic separations. Essential for the functioning of the LPLC systems, these components facilitate accurate and efficient biomolecule analysis and purification. These instruments find extensive applications in several industries such as pharmaceuticals, biotechnology, and research laboratories, which is primarily propelling the high demand for these instruments. The instruments segment remains a key player in the market, driven by the increased demand for advanced and reliable chromatography instruments as these sectors continue to grow and evolve.

Moreover, technological development along with more advanced and user-friendly devices have also found their way in further increasing their adoption rates to increase revenue generation in this segment. One of the largest consumers of LPLC instruments, the global pharmaceutical sector continues to integrate more automation and integrated systems that produce improved laboratory workflows. The reduced cost in the overall operations of LPLCs and increased accuracy in testing also reflect the intention of the government with the innovative work policies that were devised to aid innovative research & development in the healthcare and pharmaceutical sectors. As such devices become increasingly specialized, demand for their use is projected to remain high, further spurring growth in the market.

By End-User

The Low-Pressure Liquid Chromatography (LPLC) market was led by pharmaceutical companies, which contributed to 28% of the market revenue in 2023. The driving factor for the LPLC market is the requirement for accurate and efficient analytical tools to detect small quantities of substances for drug discovery, development, and quality control in the pharmaceutical industry. LPLC systems are widely used by pharmaceutical companies to assess the purity, potency, and stability of drug compounds. The growing complexity of drug formulations has driven the pharmaceutical industry to be one of the biggest consumers of chromatography technologies. In addition, the rigorousness of regulatory standards related to drug quality and safety is getting stricter, which will, in turn, propel the demand for LPLC systems for pharmaceutical and biotechnology applications. The U.S. Food and Drug Administration's (FDA) heightened focus on quality control and validation in new drug production further supports the demand for reliable and advanced testing equipment such as LPLC systems.

Furthermore, an increase in biopharmaceutical production, due to the use of LPLC for protein purification, has propelled the growth of this market. Biopharmaceutical making is a technologically advancing field, with projects funded by the U.S. Department of Health and Human Services (HHS) and the National Institutes of Health (NIH) continuing to progress its stages. Chromatography technologies are becoming an increasingly important component in drug production. Such impressive impetus provided by government organizations to facilitate biopharmaceutical development has led to favourable conditions for the extensive utilization of LPLC systems in pharmaceutical companies.

Regional Analysis

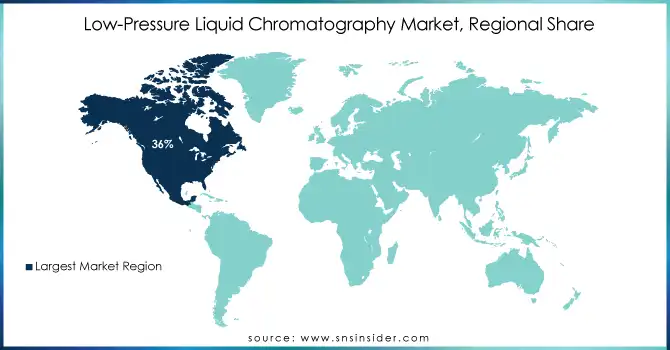

The Low-Pressure Liquid Chromatography (LPLC) market was led by North America in 2023, with the largest market share of 36%. That market dominance in the region is due to the large number of pharmaceutical firms, research facilities, and a supportive government for life sciences research. As a region, the U.S. hosts many major pharmaceutical manufacturers and biotech companies, thus creating significant demand for sophisticated chromatographic systems. Additionally, the stronghold of FDA and NIH in the region strengthens such need by strict regulations making companies difficult to comply with without proper testing technology such as LPLC.

On the other hand, Asia-Pacific (APAC) to witness the fastest growth during the forecast period states the report suggesting that, with the increasing use of peptides in the pharmaceutical and biotechnology industry in countries such as China and India, there will be an increase in demand for different customizable sets of peptides in the near future. In 2023, the APAC region's share in the global market was noteworthy owing to the growing focus on the best practices around healthcare improvements and various government-driven initiatives in these countries to improve the quality-of-life sciences research along with healthcare products can be expected to propel the LPLC market over the region during the forecast period. And thanks to a rapidly growing domestic pharmaceutical market and government-backed healthcare reform programs, China is ready to take the lead on LPLC adoption. The China National Pharmaceutical Group (Sinopharm) confirms that the Chinese pharmaceutical industry has developed rapidly in recent years, with an average annual growth rate of 8-10%. The growing adoption of more stringent regulatory standards for drug production and quality control in the country is likely to boost demand for advanced chromatography instrument segmentation.

Need any customization research on Low-Pressure Liquid Chromatography Market - Enquiry Now

Recent Developments

-

In September 2023, Thermo Fisher Scientific launched its new line of automated low-pressure liquid chromatography systems designed to enhance high-throughput analysis in pharmaceutical laboratories. The product was introduced at the American Chemical Society’s fall meeting, where it was noted for its improved scalability and precision.

-

In May 2023, Agilent Technologies unveiled an upgraded version of its LPLC system, featuring advanced detection technology aimed at improving the efficiency and accuracy of pharmaceutical testing. The new system is specifically designed to meet the stringent demands of regulatory authorities such as the FDA and EMA.

Key Players

Key Service Providers/Manufacturers

-

Agilent Technologies (InfinityLab Prep SEC system, 1260 Infinity II LC System)

-

Tosoh Bioscience (TSKgel SW3 series, TSKgel G4000SWXL)

-

Thermo Fisher Scientific (Dionex UltiMate 3000, Vanquish Flex UHPLC)

-

GE Healthcare Life Sciences (ÄKTA pure, ÄKTA Avant)

-

Waters Corporation (ACQUITY UPLC, XBridge BEH Column)

-

PerkinElmer (Flexar LC, UV-Vis Spectrophotometer)

-

Bio-Rad Laboratories (NexPrep, BioLogic LP)

-

LEWA GmbH (LEWA ecoflow, LEWA C-Flow)

-

Novasep (Modular LPLC System, BioSep™ LPLC Columns)

-

Merck Millipore (MilliporeSigma LPLC Systems, Chromabolt Columns)

Key Users

-

Pfizer

-

Novartis

-

Johnson & Johnson

-

Roche

-

Sanofi

-

Bayer

-

AbbVie

-

GlaxoSmithKline (GSK)

-

Bristol-Myers Squibb

-

Eli Lilly and Company

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.6 Billion |

| Market Size by 2032 | USD 10.4 Billion |

| CAGR | CAGR of 7.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Instruments, Consumables, Services) • By End User (Pharmaceutical Companies, Biotechnology Companies, Research Laboratories, Academic Institution) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Agilent Technologies, Tosoh Bioscience, Thermo Fisher Scientific, GE Healthcare Life Sciences, Waters Corporation, PerkinElmer, Bio-Rad Laboratories, LEWA GmbH, Novasep, Merck Millipore. |

| Key Drivers | • The growing development and adoption of protein-based vaccines have increased the demand for LPLC in their production and analysis. • Increased spending on research and development projects, particularly in the pharmaceutical and biotechnology sectors, is propelling the need for advanced chromatographic techniques like LPLC. |

| Restraints | • Concerns about bubble formation during pressure pulsation can affect the performance and reliability of LPLC systems. • The substantial costs associated with LPLC equipment and maintenance may limit its adoption, especially among smaller research institutions. |