Global Biosimilars Market Size & Trends:

To Get More Information on Biosimilars Market - Request Sample Report

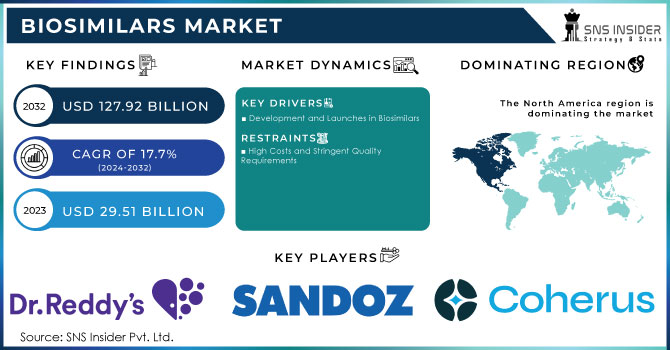

The Biosimilars Market Size was valued at USD 29.51 Billion in 2023 and is expected to reach USD 127.92 Billion By 2032 and grow at a CAGR of 17.7% over the forecast period of 2024-2032.

The global biosimilars market has blossomed with the increasing demand for affordable alternatives to biological therapy. Most of the biologic drugs that are now coming off patent in the U.S. have created huge interest among manufacturers to start working on biosimilars that are as efficacious and potent as the original biologics. The adoption of biosimilars has been slow so far in the U.S. because of patent disputes, reimbursement complexities, and physician/patient acceptance issues; however, the market in the U.S. is expected to grow at a rapid pace in the coming years. A total of 35 biosimilars have been approved by the FDA up to April 2022. Of these, 21 are commercially available. The number of biosimilars approved reached 40 as of December 2022, of which 25 have already been launched.

Other chronic diseases, including cancer and autoimmune disorders, are on the rise, representing one of the strong platforms for further acceptance of biosimilars that provide clinical equivalence at significantly lower prices. For example, biosimilars like Ziextenzo, which treat neutropenia, are around 37% cheaper compared to their biologic counterparts. While major biologic blockbusters are set to lose patent protection, the use of some USD 60 billion worth of annual peak sales will increasingly become vulnerable to biosimilar competition and start new opportunities for market players. Among them, such key launches as Samsung Bioepis and Merck's trastuzumab biosimilar, Ontruzant, began the wave of biosimilar entries to the U.S. market.

Though great promise has been shown by biosimilars, manufacturing complexities are a huge barrier. Biosimilars need to have fuller clinical trials and post-approval safety monitoring as compared to original biologics. Biggies like Amgen have a competitive advantage with such a huge cost run-up of USD 100–250 million for a manufacturing facility and the expertise needed in the production of biologics.

In emerging markets, including Asia Pacific, Latin America, and Middle Eastern markets, which are less demanding in terms of regulation, growth opportunities are considerable as the development of biosimilars can advance. China and India have become developing centers for the research and development of biosimilars, mainly due to lower labor and manufacturing costs. The threat of competition from originator companies launching second-generation biologics or reformulated products hurts the market share of biosimilar companies.

Biosimilars Market Dynamics

Drivers

-

Development and Launches in Biosimilars

The high growth in the biosimilars market is being driven by the intense focus of major players in the industry on developing and obtaining regulatory approvals for biosimilars. As of December 2022, the U.S. FDA had approved 40 biosimilars, with 25 launched in the U.S. market. Even the COVID-19 pandemic was a temporary roadblock in the approval process as seven new biosimilar approvals were seen in 2022. All of the biosimilars approved in 2022 were based on previously approved reference products, and no completely new reference product had been included. The year was also marked by the approval of four new products, including the first two biosimilars for Lucentis, as well as the FDA's designation of two new interchangeable biosimilars: Rezvoglar, referencing Lantus, and Cimerli, referencing Lucentis.

Although the number of biosimilars approved between 2020 and 2021 decreased slightly, the number of development programs participating in the FDA Biosimilar Development Program has been steadily growing. Today, it is estimated that around 60-70 biosimilars stand somewhere in the pipeline. About half of these should be launched within the next three to four years. This product pipeline continues to expand and is likely to witness a massive increase in the market due to increasing entry levels of biosimilars, with more entering the market providing cheaper alternatives to biologics and thereby increasingly creating competition within the healthcare sector. Biosimilar development continues to shape the market as they continue gaining approvals, allowing expanding access of patients to affordable therapies of biologics.

Restraints

-

High Costs and Stringent Quality Requirements

The development of biosimilars is complex and expensive, requiring substantial investments, advanced technical expertise, robust clinical trial capabilities, and strict adherence to high-quality standards.

Biosimilars Segmentation Analysis

by Type:

Monoclonal antibodies contributed 27.4% of the market share in 2023, as monoclonal antibodies found significant applications in a variety of fields, such as oncology, autoimmune diseases, and infectious diseases. There were three main reasons for the leading position: their mechanism of action, high efficacy, and specificity in treatment, and continued advancement in the process of developing it. Granulocyte-Colony Stimulating Factor is growing the fastest because it plays a major role in the management of chemotherapy-induced neutropenia and other related blood disorders. Gaining popularity with more patients diagnosed with cancer and more frequent use of more than one kind of cancer treatment demand for G-CSF hails in this drug which is growing rapidly in the market.

by Application:

Blood disorders possess the highest market share, 37.2% in 2023, due to prevalent diseases like anemia, hemophilia, and other hematological diseases. Advanced treatments currently under development and awareness of the disorders are working to build up the momentum for the latter application area. Oncology diseases have shown the fastest growth rate as a segment, led by an increase in cancers globally, and higher developments in cancer treatment. This has also been seen to progress rapidly due to the growing emphasis on personal medicine and targeted therapies involving new treatments for all types of cancer.

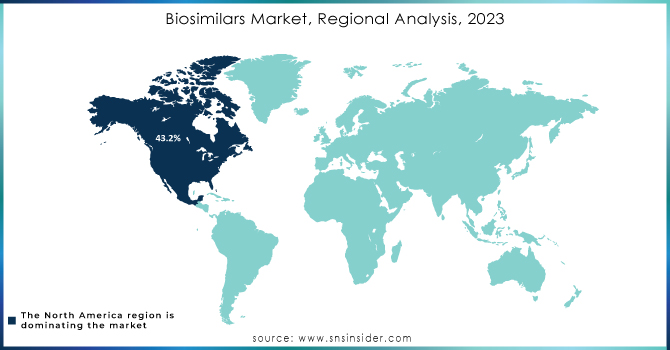

Biosimilars Market Regional Outlook

North America was the dominant force in the region accounting for 43.2% market share in 2023, setting the foundation for the development and adoption of biosimilars, led by the U.S. and Canada. Very strong regulatory framework with approval from many of the biosimilars in the U.S. However, despite a few challenges related to patent disputes, reimbursement complexity, and physician/patient hesitation, the growth in the market is slow. Despite this, the region has remained a significant player in the biosimilars market as efforts are being continued to eradicate such barriers and to spur wider acceptance.

Conversely, the Asia-Pacific region encompassing countries like China, India, South Korea, and Japan would likely be a significant growth opportunity for biosimilars. These countries have growing healthcare requirements, increasing prevalence of chronic diseases, and the need for more and more cost-effective biologic therapies. The regional regulatory framework is undergoing a transformation where the central theme of standardization is propelling this change, making the acceptance process faster and upgrading local manufacturing skills. Large patient populations, the huge expenditure on health care, and government initiatives to enhance access to biological therapies are the most significant drivers of the Asia-Pacific biosimilar market. Biosimilars will be an integral part of affordable healthcare solutions in these countries, and hence, the region is expected to have significant growth.

Do You Need any Customization Research on Biosimilars Market - Enquire Now

Major Biosimilars Companies

-

Dr. Reddy’s Laboratories

-

Sandoz

-

Coherus Biosciences

-

Viatris

-

Intas Pharma

-

Celltrion

-

Zydus Cadila

-

Lupin Pharma

-

Samsung Bioepis

-

Pfizer

-

Apobiologix

-

Amgen

-

Teva Pharmaceuticals

-

Fresenius Kabi

-

Biocon Ltd

-

Biocad and others.

Recent Development

In September 2024, the European Medicines Agency (EMA) announced that its Committee for Human Medicinal Products (CHMP) recommended the approval of eight new medicines, including two biosimilars for the treatment of age-related macular degeneration. Additionally, extended indications were granted for 12 other drugs, covering treatments for cancer, hemophilia, and meningococcus.

In September 2024, OPUVIZ, a biosimilar referencing Eylea1 (aflibercept), became Samsung Bioepis and Biogen's second ophthalmology biosimilar to receive a marketing authorization recommendation from the European Medicines Agency.

In May 2023, Boehringer Ingelheim obtained U.S. FDA approval for the Cyltezo Pen, a new autoinjector option for Cyltezo (adalimumab-album), which is an FDA-approved interchangeable biosimilar to Humira.

| Report Attributes | Details |

| Market Size in 2023 | US$ 29.51 Billion |

| Market Size by 2032 | US$ 108.8 Billion |

| CAGR | CAGR of 17.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Human growth hormone, Erythropoietin, Monoclonal antibodies, Insulin, Granulocyte-Colony Stimulating Factor, Others) • By Application (Blood disorders, Oncology diseases, Chronic and autoimmune diseases, Others) |

| Regional Analysis/Coverage |

North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Dr. Reddy’s Laboratories, Sandoz, Coherus Biosciences, Viatris, Bio-Thera Solutions, Reliance Life Sciences, Intas Pharma, Celltrion, Zydus Cadila, Lupin Pharma & Others |

| Key Drivers |

• Development and Launches in Biosimilars |

| Market Restraints |

• High Costs and Stringent Quality Requirements |