Host Cell Protein Testing Market Size & Trends:

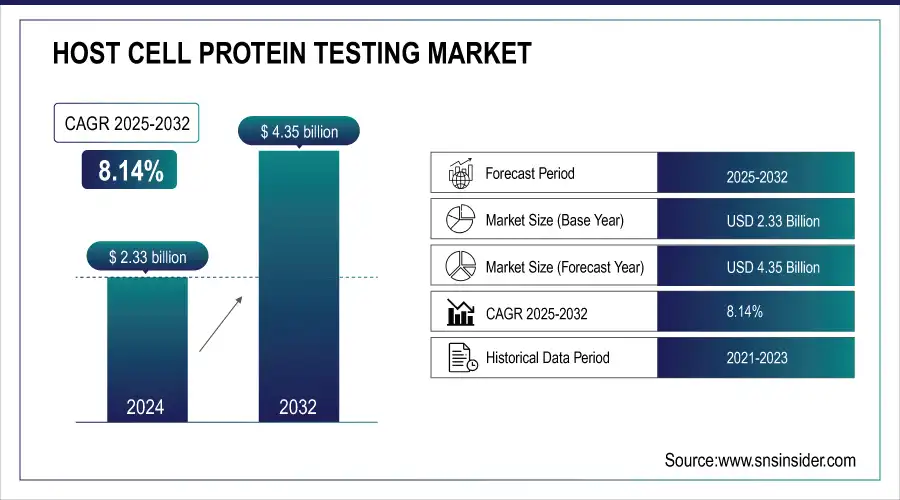

The Host Cell Protein Testing Market Size was valued at USD 2.33 billion in 2025E and is expected to reach USD 4.35 billion by 2033 and grow at a CAGR of 8.14% over the forecast period 2026-2033.

The global host cell protein (HCP) testing market will grow enormously during the forecast period. The factors driving the same include rising demand for biologics and biosimilars with rising chronic diseases, improvements in HCP testing technology, and accelerated adoption in the drug development process. The leading companies are actively investing in R&D and developing innovative solutions, which will further fuel the growth trajectory in this market.

Host Cell Protein Testing Market Size and Forecast:

-

Market Size (2025): USD 2.33 Billion

-

Market Size (2033): USD 4.35 Billion

-

CAGR (2026–2033): 8.14%

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Host Cell Protein Testing Market - Request Sample Report

The U.S. Host Cell Protein (HCP) Testing market size was valued at an estimated USD 0.85 billion in 2025 and is projected to reach USD 1.60 billion by 2033, growing at a CAGR of 7.6% over the forecast period 2026–2033. Market growth is driven by increasing biopharmaceutical production, rising demand for biologics and therapeutic proteins, and stringent regulatory requirements for impurity testing. The adoption of advanced analytical techniques for accurate detection and quantification of host cell proteins, coupled with growing emphasis on product safety and quality control, is accelerating market expansion. Additionally, continuous technological advancements, integration of high-throughput testing methods, and investments in contract testing services further support the strong growth outlook of the U.S. HCP testing market during the forecast period.

Increased investments in pharmaceutical stability and protein-based vaccines for viral and bacterial diseases have further amplified the demand for host cell protein testing. Also, the increasing prevalence of rare conditions such as paroxysmal nocturnal hemoglobinuria and factor VII and VIII deficiencies encourage more research into advanced therapeutic protein production methods. This opens substantial growth opportunities within the host cell protein testing market.

Increased regulation in the control of biotherapeutic quality and higher safety standards are set to spur growth in the global host cell protein testing market. The market is likely to grow exponentially during the forecast period based on this increasing demand from the biopharmaceutical industry and advances in analytical technologies. Higher demand for personalized medicine and the growing biopharmaceutical R&D activity are likely to add to the market growth. However, high costs and a scarcity of competent resources may comprise some of the challenges. Strong support for novel therapeutic development and advancements in testing methods mean that this market will be driven positively into the future.

Host Cell Protein Testing Market Highlights:

-

Rising investments in pharmaceuticals, protein-based vaccines, and biopharmaceutical R&D, along with increasing prevalence of rare diseases, are driving demand for host cell protein (HCP) testing.

-

Increasing use of monoclonal antibodies and advanced therapeutic proteins requires strict quality control, boosting HCP testing adoption.

-

Regulatory compliance, higher safety standards, and technological advancements in testing and automation support market growth.

-

HCP testing is critical across diseases like cancer, autoimmune disorders, infectious diseases, metabolic, hormonal, and genetic disorders.

-

Challenges include high costs, complex procedures, stringent regulatory requirements, and scarcity of skilled personnel.

-

Strong support for novel therapeutics and continuous innovation in testing methods ensure positive future market growth.

| Disease | Description | Prevalence (Approx.) |

|

Cancer |

HCP testing is essential in the development of monoclonal antibodies for cancer therapies. |

Varies by type; overall ~19 million new cases globally per year (2020). |

|

Autoimmune Diseases |

Used to assess therapies for diseases like rheumatoid arthritis and lupus. |

~50 million people are affected in the U.S. |

|

Infectious Diseases |

Important in vaccine development and therapeutic proteins for diseases like HIV and Hepatitis. |

~37 million people living with HIV globally (2021); ~290 million with Hepatitis B. |

|

Metabolic Disorders |

Utilized in the development of enzyme replacement therapies for conditions like Fabry disease. |

~1 in 40,000 for Fabry disease (varies by disorder). |

|

Hormonal Disorders |

Important for assessing recombinant hormones used in treatments like diabetes (insulin). |

~463 million people with diabetes globally (2019). |

|

Genetic Disorders |

Essential for gene therapy products targeting genetic disorders such as cystic fibrosis. |

~1 in 2,500 for cystic fibrosis (varies by disorder). |

Host Cell Protein Testing Market Drivers:

-

Rising Biopharmaceutical Production and Regulatory Compliance Fuel Growth in Global Host Cell Protein (HCP) Testing Market

One of the most recent and rapidly emerging trends that has become a primary driving force for the global host cell protein testing market is the increasing production of biopharmaceuticals. In biopharmaceutical manufacturing, as production increases, the demand for strict testing procedures also increases to ensure the quality and safety of the products. These products contain impurities, contaminants, and other potential issues that may lead to the compromise of safety and efficacy, and that is why HCP testing is considered quite a critical process in biopharmaceutical production. This increased demand for extensive testing has strongly stimulated the growth of the global HCP testing market.

There has been acceptance in the biopharmaceutical industry for the use of monoclonal antibodies (mAbs) in the treatment of diseases such as cancer. Consequently, there is a growing demand for HCP testing. There is also the need for high-quality controls on monoclonal antibodies since they have to do with the quality of therapeutic agents and safety. This is why HCP testing is on the rise inside mAb production.

Other drivers for market growth are growing healthcare industries in emerging markets, advances in testing technologies and automation, and an increase in the focus on quality control and safety in the biopharmaceutical market. Increasing demands for regulatory compliance along with a need for safe biopharmaceutical products have induced investment in HCP testing technologies, further driving market growth. All these elements drive the host cell protein testing market towards new growth trajectories.

Host Cell Protein Testing Market Restraints:

-

Host cell protein testing is a complex and costly procedure, often with testing expenses surpassing the raw material costs.

Host cell protein (HCP) testing is a critical quality control process in biopharmaceutical production, designed to detect residual proteins from host cells that could affect product safety and efficacy. The procedure is highly complex, requiring sophisticated analytical techniques such as ELISA, Western blotting, or mass spectrometry to ensure accurate detection and quantification. Due to its technical demands, stringent regulatory requirements, and the need for specialized reagents and skilled personnel, HCP testing can be expensive, with costs often exceeding those of the raw materials used in production. Despite the high expense, it remains essential for ensuring therapeutic safety and regulatory compliance.

Host Cell Protein Testing Market Segment Analysis:

By Type

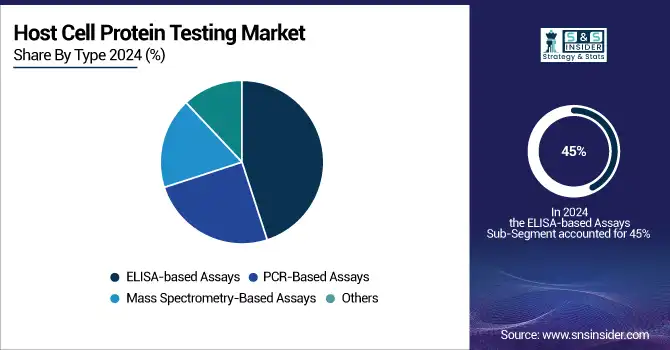

In the year 2025, ELISA-based assays dominated the market under the category of host cell protein testing with their share over 45%. It is so because these assays hold good sensitivity and specificity and are highly prevalent in the detection of host cell proteins in biopharmaceutical products. These assays have a long history of proven success in the testing of HCPs and offer a very reliable tool in the quality control processes in the industry. The convenience of their use, cost-efficiency, and consistency in large-scale testing have further solidified their position as the market's leading segment.

The mass spectrometry-based assay segment, which comprises Liquid Chromatography-Mass Spectrometry (LC-MS), is expected to attain the highest market growth rate in the forecast period 2026-2033. This segment is expected to grow by more than 12% from 2023 onwards. The recent trend of increasing preferences for mass spectrometry-based assays can be explained by the fact that these provide highly detailed and accurate quantitative data-including the identification of multiple HCPs in a single run. Better sensitivity, reduced testing time, and more precise results from LC-MS and MS/MS technologies have considerably expedited their application in biopharmaceutical quality control than traditional methods.

By End User

In 2025, the biopharmaceutical companies were the biggest contributors towards the end-users with a share of approximately 60% of the overall market of host cell protein testing. In light of the growing biologics, and biosimilarity, along with stringent regulations that put more focus on the safety and efficacy of products from these companies, they have raised their spending on HCP testing exponentially. These companies require strict testing to ensure that the regulatory guidelines are followed strictly, which would help augment the quality of the products as well as accelerate the process of drug development. The increasing pipeline of biopharmaceuticals adds further justification for the need for thorough testing among the HCPs in this sector.

Contract Research Organizations would be leading the growth pace with around 11% CAGR through the forecast period. This is attributed to increased reliance on outsourcing R&D and testing activities by small and medium-sized biopharmaceutical companies mainly to contract research organizations. All of these provide expertise, sophisticated testing facilities, and cost-effectiveness so that pharmaceutical companies can concentrate on core activities while HCP testing remains top-quality. This trend will continue to grow further in the coming years, making CROs the fastest-growing end-user segment.

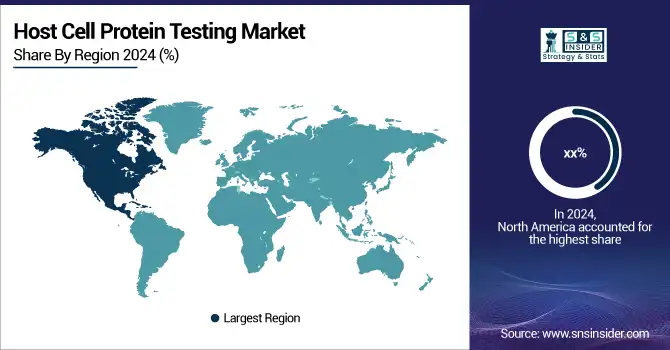

Host Cell Protein Testing Market Regional Analysis:

North America Host Cell Protein Testing Market Trends:

The North American host cell protein (HCP) testing market held the largest share in 2025, driven by factors such as the growing number of clinical trials, rising demand for innovative treatments for chronic diseases, and increasing research in gene and cell therapy. The presence of major industry players like Enzo Life Sciences, Inc. (US), Bio-Rad Laboratories, Inc. (US), Abcam plc (UK), and Thermo Fisher Scientific Inc. (US) has further bolstered market growth. These companies are actively advancing HCP testing technologies to meet customer demand, with Thermo Fisher Scientific offering a comprehensive portfolio of research and HCP testing products. Such a strong regional industry presence has significantly contributed to the dominance of the North American market.

Need any customization research on Host Cell Protein Testing Market - Enquiry Now

Europe Host Cell Protein Testing Market Trends:

Europe emerged as the second-largest market for HCP testing, supported by the rising number of clinical trials in countries like Germany and France, and the widespread adoption of advanced technologies in the biopharmaceutical industry. Contract research organizations in the region are also playing a vital role in driving market growth. Within Europe, Germany led the market with the largest share, while France is expected to experience the fastest growth in the coming years.

Asia-Pacific Host Cell Protein Testing Market Trends:

The Asia-Pacific HCP testing market is projected to witness significant growth from 2026 to 2033. The region's expanding biopharmaceutical industry, coupled with increasing investments in research and development (R&D) and a surge in clinical trials, is fueling market expansion. China is anticipated to hold the largest share of the Asia-Pacific market, while India is forecasted to be the fastest-growing market, reflecting the region's growing emphasis on biopharmaceutical research and innovation.

Latin America Host Cell Protein (HCP) Testing Market Trends:

Latin America is witnessing steady growth in HCP testing, driven by increasing biopharmaceutical investments, supportive regulatory initiatives, and a growing number of clinical trials in Brazil and Mexico. The region is gradually adopting advanced testing technologies, with Brazil leading the market and Mexico showing promising growth potential.

Middle East & Africa Host Cell Protein (HCP) Testing Market Trends:

The Middle East & Africa market is emerging steadily due to rising healthcare investments, increasing biopharmaceutical research activities, and growing awareness of quality control in therapeutics. Saudi Arabia and the UAE are the primary contributors to the market, with expanding clinical trials and adoption of modern HCP testing technologies fueling growth.

Host Cell Protein Testing Market Key Players:

-

Enzo Life Sciences, Inc – Enzo Host Cell Protein ELISA Kits

-

Abcam plc – Abcam HCP Assay Kits

-

Thermo Fisher Scientific Inc – Thermo Scientific HCP ELISA Kits

-

Cytiva (GE Healthcare Life Sciences) – Cytiva HCP Detection Kits

-

Bio-Rad Laboratories, Inc – Bio-Rad HCP ELISA Kits

-

Biogenes GmbH – HEK293 HCP ELISA Kit

-

Cisbio Bioassays – Cisbio HCP Assays

-

Cygnus Technologies, LLC – Cygnus HCP ELISA Kits

-

Rockland Immunochemicals, Inc – Rockland HCP Detection ELISA Kits

-

Agilent Technologies, Inc – Agilent HCP Analysis Kits

-

Charles River Laboratories – HCP Testing Services

-

Eurofins Scientific – HCP Testing Services

-

MilliporeSigma (Merck KGaA) – HCP Testing Solutions

-

Lonza Group – HCP Testing in CDMO services

-

Promega Corporation – HCP Testing Products and Kits

-

SGS Life Sciences – HCP Assay Services

-

WuXi Biologics – HCP Testing Services

-

ProteinSimple (Bio-Techne Brand) – Analytical Instruments for HCP

-

Alphalyse – Mass Spectrometry-based HCP Analysis

-

BioOutsource (Sartorius) – HCP Contract Testing Services

Host Cell Protein Testing Market Competitive Landscape:

BioGenes GmbH was founded in 1992 in Berlin, Germany. With over 30 years of expertise, the company specializes in custom antibody and immunoassay development, including host cell protein (HCP) testing. BioGenes offers tailored solutions for the pharmaceutical and biotech industries, providing services such as monoclonal and polyclonal antibody development, ELISA kit production, and HCP assay services. Their commitment to quality is reflected in their ISO 9001:2015 certification.

- June 2023: Biogenes GmbH introduced the HEK293 HCP ELISA kit. This kit serves as a valuable tool for process development, enabling the effective monitoring of host cell contaminant removal, as well as being suitable for routine testing of final product releases.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.33 Billion |

| Market Size by 2033 | USD 4.35 Billion |

| CAGR | CAGR of 8.14% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Enzo Life Sciences, Inc, Abcam plc, Thermo Fisher Scientific Inc, Cytiva (GE Healthcare Life Sciences), Bio-Rad Laboratories, Inc, Biogenes GmbH, Cisbio Bioassays, Cygnus Technologies, LLC, Rockland Immunochemicals, Inc, Agilent Technologies, Inc, Charles River Laboratories, Eurofins Scientific, MilliporeSigma (Merck KGaA), Lonza Group, Promega Corporation, SGS Life Sciences, WuXi Biologics, ProteinSimple (Bio-Techne Brand), Alphalyse, BioOutsource (Sartorius) |