Low-Speed Vehicle (LSV) Market Report Scope & Overview:

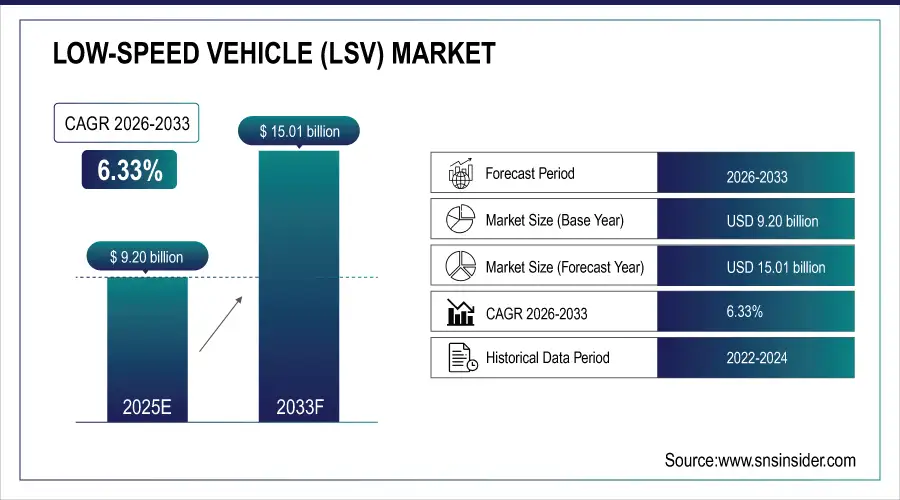

The Low-Speed Vehicle (LSV) Market Size was valued at USD 9.20 Billion in 2025E and is expected to reach USD 15.01 Billion by 2033 and grow at a CAGR of 6.33% over the forecast period 2026-2033.

The Low-Speed Vehicle (LSV) Market analysis, driven by the rising need for environment-friendly and affordable modes of transportation in golf courses, hotels & resorts, real estate companies, industries and communities. Increased use of electric motorisation and advanced battery technologies making systems more efficient and greener.

According to study, Electric LSVs accounted for approximately 45–50% of new vehicle sales in 2025, reflecting rising demand for low-emission transportation.

Low-Speed Vehicle (LSV) Market Size and Forecast:

-

Market Size in 2025: USD 9.20 Billion

-

Market Size by 2033: USD 15.01 Billion

-

CAGR: 6.33% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get More Information on Low-Speed Vehicle Market - Request Sample Report

Low-Speed Vehicle (LSV) Market Trends:

-

Rising electric LSV adoption driven by environmental sustainability and lower operational costs.

-

Advanced lithium-ion batteries improve range, efficiency, and reliability of electric LSVs.

-

High upfront costs and infrastructure requirements restrain market growth in emerging regions.

-

Government incentives and regulations promote adoption of low-emission LSVs globally.

-

Integration of autonomous features enhances safety, efficiency, and fleet management capabilities.

-

Connected LSVs with telematics enable real-time monitoring and predictive maintenance opportunities.

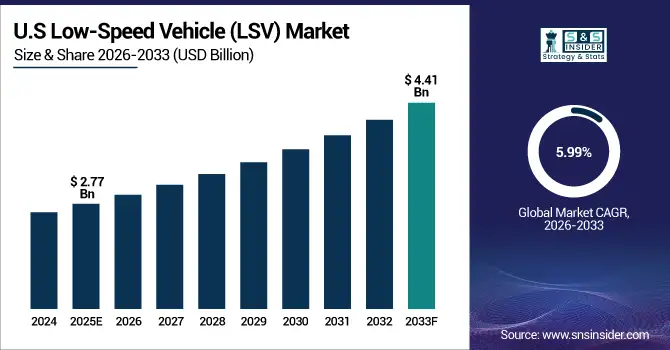

The U.S. Low-Speed Vehicle (LSV) Market size was USD 2.77 Billion in 2025E and is expected to reach USD 4.41 Billion by 2033, growing at a CAGR of 5.99% over the forecast period of 2026-2033, driven by high adoption in golf courses, resorts, and industrial facilities, supported by government incentives, established infrastructure, technological advancements, and growing demand for eco-friendly, efficient, and low-maintenance transportation solutions.

Low-Speed Vehicle (LSV) Market Drivers:

-

Electric Propulsion Drives LSV Market Growth Across Multiple Applications Globally

The Low-Speed Vehicle (LSV) Market growth is primarily driven by the rising demand for dissociative anesthetics, shift from ICE vehicles to electric LSVs and increasing risk factors from industries. Electric vehicles are green and cost-effective they produce no tailpipe gases, consume less expensive energy compared to ICEs, and need only trivial maintenance. Increasing awareness regarding environment sustainability and stringent government emissions regulations are also contributing to electric LSV adoption. In addition, with the lithium-ion battery technology improvements in vehicle range, reliability and charge efficiency, electric LSVs are becoming a popular choice for golf courses and resorts, industrial facilities and urban mobility demand.

Range Improvement Advanced batteries enable electric LSVs to achieve 50–70 kilometres per full charge, suitable for commercial and recreational use.

Low-Speed Vehicle (LSV) Market Restraints:

-

High Initial Investment Costs Limit Adoption Of Low-Speed Vehicles

Despite their long-term operational benefits, Low-Speed Vehicle are offered at higher prices up front, especially in their electric version compared to ICE vehicles. The high purchase price is influenced by the battery, the sophisticated telematics and the integration of self-driving features which can hamper adoption particularly for small commercial users or from emerging markets. Expensive investment at the same time high costs for charging infrastructure, repairs shops are additional hurdles to make a start at all.

Low-Speed Vehicle (LSV) Market Opportunities:

-

Autonomous And Connected Features Present Significant Opportunities For LSV Market

The increasing incorporation of autonomous driving capabilities and telematics presents a significant growth opportunity. Autonomous LSVs can be used to better manage fleets, lower labor costs, and provide a safer environment in controlled spaces like airports, resorts and industrial settings. Integrated capabilities, such as GPS tracking, real-time diagnostics, and proactive fleet maintenance scheduling enhance efficiency, scheduled maintenance and end user satisfaction. Benefits for manufacturers as the acceptance of technology increases, manufactures can also offer those type LSVs that are premium with full features available in them which further opens up large revenue streams and aesthetically differentiates their product offerings in an era of fierce competition.

Fleet Efficiency Improvement Integration of telematics and smart management systems can increase fleet utilization by 15–18% annually.

Low-Speed Vehicle (LSV) Market Segmentation Highlights:

-

By Vehicle: In 2025, Golf Carts led the market with a share of 41.20%, while Personal Mobility Vehicles is the fastest-growing segment with a CAGR of 8.04%

-

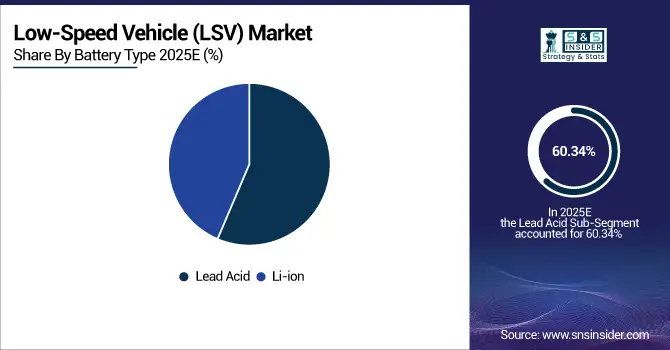

By Battery Type: In 2025, Lead Acid led the market with a share of 60.34%, while Li-ion is the fastest-growing segment with a CAGR of 9.10%

-

By Propulsion: In 2025, ICE led the market with a share of 55.20%, while Electric is the fastest-growing segment with a CAGR of 7.60%

-

By Application: In 2025, Golf Courses led the market with a share of 42.30%, while Industrial Facilities is the fastest-growing segment with a CAGR of 9.20%.

Low-Speed Vehicle (LSV) Market Segmentation Analysis:

By Battery Type, Lead Acid Lead Market and Li-ion Fastest Growth

The Lead Acid lead the market in 2025, due to their low cost and easy availability for charging and maintenance. They are still a preferred choice for golf carts, commercial utility vehicles and industrial LSV. Meanwhile, Li-ion batteries are the fastest-growing segment, due to their higher energy density, longer duration of use, more efficient charging and discharging rates and reduced need for maintenance. The growing adoption of electric LSVs and increasing emphasis on eco-friendly and economic solutions is boosting the demand for Li-ion technology in both urban mobility and commercial applications.

By Vehicle, Golf Carts Lead Market and Personal Mobility Vehicles Fastest Growth

The Golf Carts lead the market in 2025, are widely used in golf courses, resorts, gated communities and large commercial properties. They are simple to operate, low maintenance and best for short range travel use others ideal as recreational vehicles or for commercial purposes. Meanwhile, Personal Mobility Vehicles are the largest growing segment, due to rising urbanization, need for compact and environmentally friendly transportation options, and technology developments such as electric propulsion, connected features and advanced battery capacity which enable greater uptake in both residential and commercial settings.

By Propulsion, ICE Lead Market and Electric Fastest Growth

The ICE leads the market in 2025, owing to its established use and lower purchase price and readily available fueling infrastructure. ICE LSV are commonly used in commercial, industrial, and recreational applications where familiarity and reliability are prioritized. Meanwhile, the Electric propulsion is fastest growing segment due to growing environmental concerns and government incentives for low-emission vehicles due to improvement in lithium-ion battery technology and reduced operating cost. Momentum toward electric LSVs is especially pronounced in urban mobility, resorts and industrial venues searching for energy-efficient transportation that also helps their bottom line.

By Application, Golf Courses Lead Market and Industrial Facilities Fastest Growth

The Golf Courses leads the market in 2025, driven by increasing use of LSVs for carrying players player equipment & staff around large golf courses places has led to high utilisation rate for these vehicle types. They are easy to operate, require little maintenance and are perfect for short distance commutes in leisure places. Meanwhile, Industrial Facilities is fastest growing segment, fulled by rising use of LSVs for material handling, employee transportation and intra-facility logistics. Increasing automation, need to ensure performance and eco-friendly alternatives are further driving the adoption of LSVs across warehouses, factories and large industrial plants.

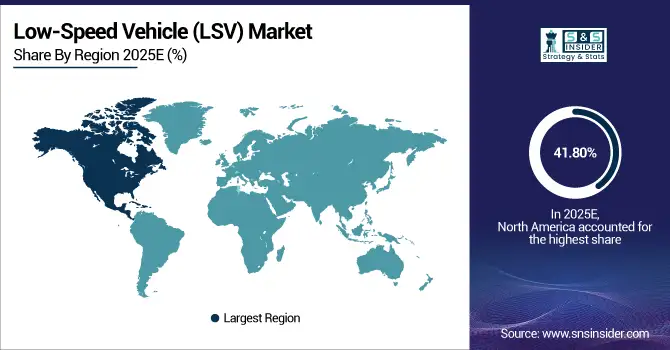

Low-Speed Vehicle (LSV) Market Regional Analysis:

North America Low-Speed Vehicle (LSV) Market Insights:

The North America dominated the Low-Speed Vehicle (LSV) Market in 2025E, with over 41.80% revenue share, due to the strong presence of key manufacturers such as Club Car, Polaris, and Textron. High adoption of golf carts, commercial utility vehicles, and personal mobility vehicles across golf courses, resorts, industrial campuses, and urban areas drives market growth. Supportive government regulations, incentives for electric LSVs, and increasing awareness of eco-friendly transportation solutions further boost adoption. Technological advancements, including telematics and autonomous features, are enhancing operational efficiency and safety, solidifying North America’s leadership in the global LSV market.

Request for Segment Customization as per your Business Requirement: Segment Customization Request

U.S. Low-Speed Vehicle (LSV) Market Insights

The U.S. and Canada lead the Low-Speed Vehicle (LSV) Market due to widespread adoption in golf courses, resorts, and industrial facilities, supported by well-established infrastructure, government incentives for electric vehicles, technological advancements, and growing demand for eco-friendly, efficient, and low-maintenance transportation solutions.

Asia Pacific Low-Speed Vehicle (LSV) Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 7.17%, driven by high urbanisation rate, expanding commercial and recreational infrastructure facilities and increasing need for environment friendly mode of transportation. Electric LSV's is encouraged by government policies towards low emission vehicles and sustainable transportation. Growing investment in lithium-ion battery technology, smart fleet management and connected LSV features are also boosting the market growth. The use of LSVs in industrial premises, resorts and urban mobility projects is growing rapidly making the Asia Pacific a high growth market with huge potential for manufacturers and technology providers in several countries.

China and India Low-Speed Vehicle (LSV) Market Insights

China and India are the fastest-growing Low-Speed Vehicle (LSV) markets due to rapid urbanization, increasing industrial and commercial infrastructure, rising demand for eco-friendly transportation, government support for low-emission vehicles, and growing adoption of electric LSVs with advanced battery and connected technologies.

Europe Low-Speed Vehicle (LSV) Market Insights:

Europe holds a significant market position due to the widespread adoption of electric and eco-friendly LSVs across commercial, recreational, and industrial applications. Heavy environmental mandates as well government incentives for low-emission vehicles, are forcing the move from ICE to electric LSVs. The move was part of a broader trend toward increasing the scope of technology, such as telematics, connected capabilities and smarter battery systems to improve productivity, safety and availability. Increasing need for eco-friendly urban mode of conveyance, resort & industrial facility transportation fuels the market growth and presents a significant opportunity for LSV manufacturers and service providers in Europe.

Germany and U.K. Low-Speed Vehicle (LSV) Market Insights

The U.K. and Germany are driving growth in the Low-Speed Vehicle (LSV) Market due to strict environmental regulations, increasing adoption of electric LSVs, technological advancements such as telematics and autonomous features, and rising demand for sustainable transportation solutions in commercial, recreational, and industrial sectors.

Latin America (LATAM) and Middle East & Africa (MEA) Low-Speed Vehicle (LSV) Market Insights:

The Latin America (LATAM) and Middle East & Africa (MEA) are emerging regions showing steady growth, driven by rising use of electric and eco-friendly LSVs for commercial, recreational and industrial use. Increasing infrastructure, resort and commercial sector investment combined with the growing cognizance toward sustainable transportation are fostering the industry growth. In-car improvements such as lithium-ion batteries, linked capabilities and telematics are improving efficiency, safety and reliability. In addition, government programs encouraging decreased emissions from vehicles and more fuel-efficient transport continue to drive the adoption of LSVs in these locations, which provide favorable growth opportunities for industry companies.

Low-Speed Vehicle (LSV) Market Competitive Landscape:

Club Car, under Ingersoll Rand, has established a strong foothold in the LSV Market with its Onward series. The all-new Onward LSV combines performance, safety, and modern design, catering to urban mobility, resorts, and recreational use. With enhanced battery efficiency, advanced safety features, and customizable options, Club Car focuses on providing reliable, eco-friendly, and technologically advanced solutions, reinforcing its leadership and competitiveness in the global low-speed vehicle segment.

-

In October 2025, Club Car launched the all-new Onward LSV, combining performance with safety features tailored for urban mobility and recreational use, featuring enhanced battery efficiency and a modern design for improved user experience.

The Toro Company strengthens its position in the LSV Market through the introduction of its 16 new Classic Edition models. These vehicles enhance utility, durability, and operator comfort for commercial, industrial, and recreational applications. By integrating improved performance features and reliable power systems, Toro addresses the growing demand for efficient and versatile low-speed vehicles. The company’s focus on quality and innovation continues to drive its market presence globally.

-

In February 2025, Toro introduced 16 new Classic Edition models, enhancing its utility vehicle lineup with improved features for various applications, including better load capacity, durability, and operator comfort.

Yamaha Motor Co., Ltd. has been actively expanding its Low-Speed Vehicle (LSV) offerings, focusing on electric and efficient mobility solutions. With the launch of five-seater electric golf carts such as the G30Es and G31EPs, the company emphasizes eco-friendly transportation for recreational and commercial applications. Advanced battery technology, improved range, and enhanced safety features position Yamaha as a key player in providing sustainable and reliable LSV solutions across various markets.

-

In March 2025, Yamaha announced the launch of the new five-seater electric golf carts, G30Es and G31EPs, in Japan, expanding its electric vehicle offerings with upgraded motors, longer battery life, and advanced safety features.

Low-Speed Vehicle (LSV) Market Key Players:

-

Textron Inc.

-

Deere & Company

-

Polaris Industries Inc.

-

Club Car (Ingersoll Rand)

-

The Toro Company

-

Yamaha Motor Co., Ltd.

-

American LandMaster

-

Columbia Vehicle Group Inc.

-

Moto Electric Vehicles

-

Waev Inc.

-

KUBOTA Corporation

-

Xiamen Dalle Electric Car Co., Ltd.

-

Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd.

-

Star EV Corporation

-

Bradshaw Electric Vehicles

-

Garia

-

VinFast

-

Ligier Group

-

Bintelli Electric Vehicles

-

E-Ride Industries

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 9.20 Billion |

| Market Size by 2033 | USD 15.01 Billion |

| CAGR | CAGR of 6.33% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle (Golf cart, Commercial utility vehicle, Industrial utility vehicle, Personal mobility vehicle) • By Battery Type (Li-ion, Lead acid) • By Propulsion (ICE, Electric) • By Application (Golf courses, Hotels & resorts, Airports, Industrial facilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Textron Inc., Deere & Company, Polaris Industries Inc., Club Car (Ingersoll Rand), The Toro Company, Yamaha Motor Co., Ltd., American LandMaster, Columbia Vehicle Group Inc., Moto Electric Vehicles, Waev Inc., KUBOTA Corporation, Xiamen Dalle Electric Car Co., Ltd., Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd., Star EV Corporation, Bradshaw Electric Vehicles, Garia, VinFast, Ligier Group, Bintelli Electric Vehicles, E-Ride Industries, and Others. |