Lubricants Market Report Scope & Overview:

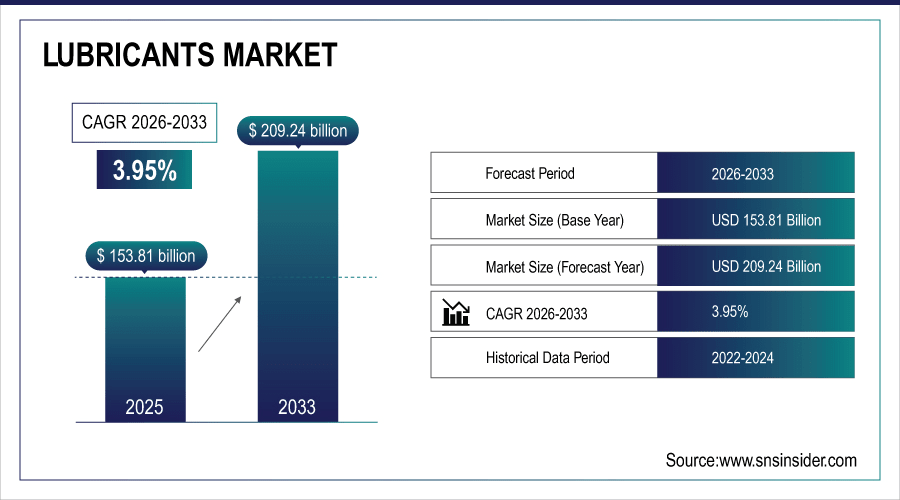

The Lubricants Market Size was valued at USD 153.81 Billion in 2025E and is projected to reach USD 209.24 Billion by 2033, growing at a CAGR of 3.95% during the forecast period 2026–2033.

Lubricants market analysis examines performance trends and growth across products, including engine oil, hydraulic fluid, gear oil, metalworking fluids, and grease. The market is categorized based on base oil, application in automotive, industrial, marine, aerospace & construction industry and distribution channels such as direct sales, OEMs and online. Increased industrialization, automotive sales, and development of synthetic and bio-based lubricants are fueling global growth and continuous demand in the market.

Engine oil accounted for around 45% of the Lubricants Market in 2025, primarily driven by automotive demand. Synthetic oils are witnessing faster adoption due to superior performance, fuel efficiency benefits, and environmental sustainability.

To Get More Information On Lubricants Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 153.81 Billion

-

Market Size by 2033: USD 209.24 Billion

-

CAGR: 3.95% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Lubricants Market Trends:

-

Demand for High performing engine oil is increasing on account of the automotive advancements and has led to an increased demand.

-

Industrial growth and mechanization are increasing demand for special purpose hydraulic gear oils in manufacturing and heavy industrial units.

-

There is a rise in use of synthetic and bio-based lubricants, primarily driven by compliance with environmental protocols throughout the globe.

-

E-commerce and direct-to-consumer outlets are helping to bring niche and high-quality lubricants to the small business or do-it-yourself market.

-

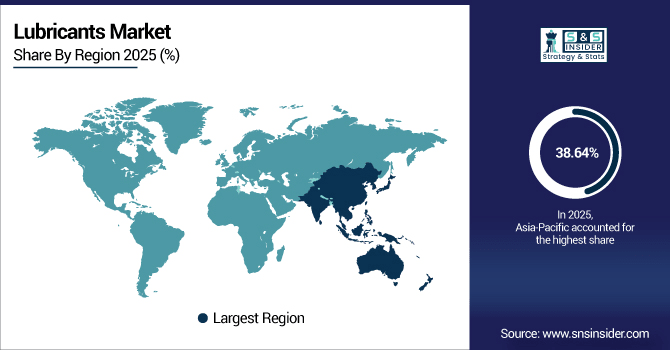

Asia-Pacific and developing markets are driving growth supported by growing vehicle ownership, industrial activities and infrastructure development.

U.S. Lubricants Market Insights:

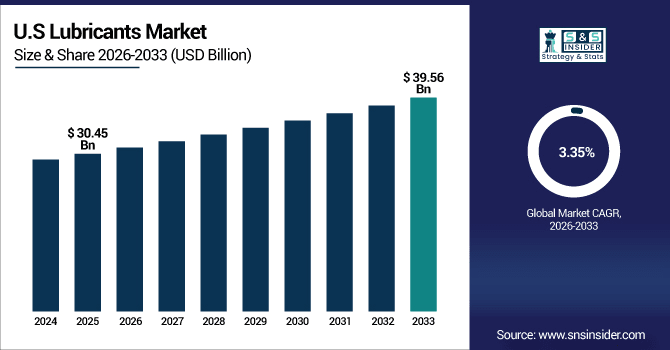

The U.S. Lubricants Market is projected to grow from USD 30.45 billion in 2025E to USD 39.56 billion by 2033, at a CAGR of 3.35%, driven by rising automotive production, industrial demand, and adoption of synthetic and eco-friendly lubricants. Expanding direct and online channels and stricter emission regulations further support market growth.

Lubricants Market Growth Drivers:

-

Rising automotive production and industrialization are boosting demand for high-performance and specialty lubricants globally.

The Lubricants Market is growing due to rising automotive production and growing industrialization across emerging and developed economies. Worldwide lubricants usage is expected to rise to 50 million kilotons by 2025 due to growing vehicle fleets and demand for industrial machineries and infrastructure projects. This increasing tendency is based on the use of high performance and synthetic lubricants, tight environmental regulations and technological progresses that result in enhanced efficiency as well as outstanding durability of automotive and industrial ends.

Rising automotive production and industrialization drove nearly 42% of global lubricant demand in 2025, led by engine oils and hydraulic fluids.

Lubricants Market Restraints:

-

Fluctuating crude oil prices and stringent environmental regulations restrict lubricant production and global market growth.

However, fluctuation in crude oil and base oil prices that make up 28% of production cost fluctuation across globe present severe challenge to Lubricants Market. More stringent environmental legislations and emission restrictions in Europe, Americas etc means that specific traditional lubricants cannot be used. Small and local/ regional level players also have some impact in the market but their share is limited, while growth of green substitutes and synthetic alternatives coupled with supply chain disruptions restrain overall market gains.

Lubricants Market Opportunities:

-

Growing adoption of synthetic, bio-based, and eco-friendly lubricants offers significant global market expansion opportunities.

Growing untapped opportunities in the Lubricants Market with synthetic, bio-based and eco-friendly lubricants gaining traction. By 2025, more than 35% of new formulates will target low-emission, biodegradable, high-performance synthetic grades designed to help society meet environmental regulations and sustainability goals. Strengthening industrialization, automotive manufacturing, e-commerce distribution opportunities is boosting accessibility, while specialty and environmentally-friendly lubricants are anticipated to complement global market sales through 2033.

Introduction of synthetic, bio-based, and eco-friendly lubricants accounted for nearly 35% of global product launches in 2025.

Lubricants Market Segmentation Analysis:

-

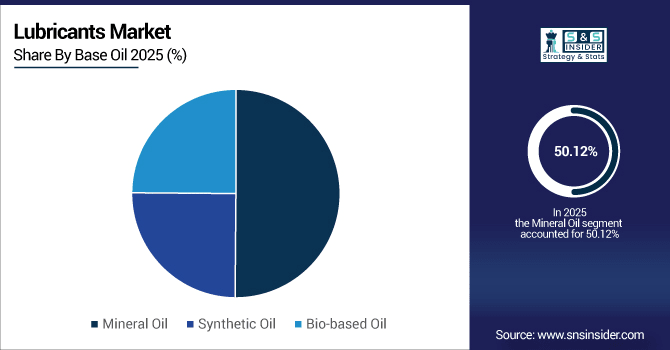

By Base Oil, Mineral Oil dominated with a 50.12% share in 2025, while Synthetic Oil is projected to expand at the fastest CAGR of 6.14%.

-

By Product Type, Engine Oil held the largest market share of 44.25% in 2025, while Grease is expected to grow at the fastest CAGR of 5.87%.

-

By Application, Automotive accounted for the highest market share of 42.78% in 2025, and Marine is projected to record the fastest CAGR of 5.92%.

-

By Distribution Channel, Direct Sales held the largest share of 46.33% in 2025, while Online Retail is expected to grow at the fastest CAGR of 7.01%.

By Base Oil, Mineral Oil Dominates While Synthetic Oil Grows Fast:

Mineral oil consumption in 2025 dominated at 25 million kilotons, attributed foremost to its affordability and heavy use within traditional automotive and industrial settings. About 8.7 million kilotons of synthetic oil were used, showing fast-growing demand because of its superior performance, fuel efficiency, and extended replacement interval. The adoption of high-performance engines and regulations focusing on sustainability has been driving the market for synthetic & speciality lubricants in major markets around the world.

By Product Type, Engine Oil Leads While Grease Expands Rapidly:

The consumption of engine oil in 2025 dominated at around 18 million kilotons, with majority of the demand coming from the rise in automotive fleet across the globe. Grease consumption, in contrast, was nearly 4.5 million kilotons and is fast-growing as it became more widely used in industrial machinery and construction equipment as well as specialized uses. Growth is being pushed by increasing automobile production, mechanization, and industrialisation, with the most rapid advances in Asia-Pacific and North America.

By Application, Automotive Leads While Marine Shows Rapid Growth:

The consumption of lubricants in automotive applications in 2025 dominated at approximately 21 million kilotons, supported by growing production of passenger vehicles and increasing commercial fleets. About 2.5 million kilotons were used for marine applications, which is fast-growing due to larger shipping fleets and offshore industrial operations. Rising demand for eco-friendly and high-performance lubricant to increase engine life, minimize emissions, and meet international maritime regulations is another growth driver.

By Distribution Channel, Direct Sales Dominate While Online Retail Expands Quickly:

In 2025, 14 million kilotons were sold directly on contract, dominating mainly through OEMs and industrial contracts (its largest channel by far). Online retail made up roughly 3.2 million kilotons, showing fast-growing adoption in small businesses, workshops, and by end users who want convenience. The prevalence of online platforms and liberalized logistics and availability is supporting consistent growth in specialty and synthetic lubricants across urban and semi-urban markets worldwide.

Lubricants Market Regional Analysis:

Asia-Pacific Lubricants Market Insights:

The Asia-Pacific Lubricants Market accounted for 38.64% of global consumption in 2025, supplying 21 million kilotons, led by China (9 million) and India (5 million). Consumption remained led by engine and mineral oils, while industrial lubricants also posted growth in production hubs. A rise in vehicle production, industrialization, and rising demand for synthetic and environment-friendly lubricants among the megacities has accelerated market growth in these regions.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Lubricants Market Insights:

China used about 9 million kilotons of oil for lubricants in 2025, including usage of engine oils and mineral oils. About 6 million kilotons of that was through direct sales and the balance comprised online retail and aftermarket channels. Growth is influenced by increasing automotive manufacturing, industrialization and growth in adoption of synthetic & eco-friendly lubricants across the country.

North America Lubricants Market Insights:

The market demand of lubricants in North America continues to grow steadily and will reach 13 million kilotons in the year of 2025, especially for motor oil engine and hydraulic fluid. Demand is being fuelled by increasing vehicle production and industrial machinery growth, strict emission and environmental regulations. Rising sales via e-commerce and aftermarket outlets provides enhanced accessibility, as synthetic and environment-friendly lubricants gain favor among consumers, regional markets in the US, Canada and Mexico to generate revenue all over 2023.

U.S. Lubricants Market Insights:

in 2025, the U.S. yielded about 8.5 million kilotons of lubricant among more than 120 various major brands. Approximately 5.2 million kilotons of the total were sold directly, and about 3.3 million kilotons through online and aftermarket channels. The increase is attributed to the increasing demand for lubricants in automotive production and industries, and higher preference for green/sustainable lubricants.

Europe Lubricants Market Insights:

Europe’s Lubricants Market in 2025 was estimated to be about 8.5 million kilotons, of which Germany was the largest at 2.4 million kilotons, followed by the UK (2.1 million) and France (1.8 million). Direct sales were responsible for 4.5 million kilotons, with online and aftermarket about 2.3 million kilotons. Growth is spurred by increasing automobile production, demand for industrial machinery, substitution to synthetic and bio-based lubricants and strict emission & environmental regulations in the region.

Germany Lubricants Market Insights:

In 2025, Germany used 2.4 million kilotons of lubricants, between one third and two thirds for engine oils, the rest were industrial lubricants. 1.5 million kilotons of tires were sold in direct sales, 0.9 in online and aftermarket channels. Growth is fuelled by rising automotive manufacturing, industrial applications, and increased sales of synthetic and environmentally friendly lubricants.

Middle East and Africa Lubricants Market Insights:

Middle East & Africa Lubricants Market size was at 1.2 million kilotons in 2025, up from 0.7 million kilotons for direct sales and 0.5 million as online sales and aftermarket channels depending on vendor and customer requirements. Growth will be led by increasing automotive fleets, industrialization and infrastructure investment. The market is expected to grow at a CAGR of 6.77% during the forecast period, 2019–2033.

Latin America Lubricants Market Insights:

In 2025, lubricant demand was around 1.15 million kilotons in Latin America, with the largest markets being Brazil (500,000 kilotons), followed by Mexico (420,000 kilotons) and Argentina (200,000 kilotons). About 750,000 kilotons were sold directly and via industrial agreements, while another 400,000 kilotons came from online and aftermarket sales as automotive use and industry picked up.

Lubricants Market Competitive Landscape:

Shell runs the world’s leading lubricant business, selling more than 3.5 million kilotons of lubricants to consumers in over 100 countries every year for over 18 years. Its product range includes Shell Helix, Shell Rimula and Shell Gadus for automotive, commercial and industrial use. With presence in more than 100 countries, Shell has developed synthetic oils and high-performance lubricants to help millions of machines run more efficiently enabling Shell to hold its leadership position throughout the world.

-

In August 2025, Shell introduced a new Shell Helix Ultra engine oil that met the 2025 API SQ standard, and increased power by 1.8% and throttle response by 3.4%. New packaging was designed to improve on-shelf visibility and make the product selection easier for consumers.

ExxonMobil is responsible for 2.8 million kilotons of lubricant each year under the Mobil brand, which includes Mobil 1 synthetic oils and Mobil Delvac heavy-duty products. The company’s customers operate in the automotive, industrial and marine sectors across over 90 countries. With ongoing research and development, sustained commitment to advanced technology and product innovation, ExxonMobil maintains its leadership position driving advances in lubricant technology through long-standing relationships with equipment builders and end users working across companies.

-

In September 2025, ExxonMobil has commercially introduced its EHC 340 MAX™ base stock in Singapore, processing lower value molecules into premium, finished lubricant and fuel base stocks. It adds value to products for use in automotive and industrial work worldwide.

BP’s Castrol brand makes more than 2.1 million kilotons of lubricants a year, including engine oils, transmission fluids and greases. Castrol serves the automotive, industrial and EV sectors with its high performance and sustainable products. Having its product range distributed in over 80 countries, and working closely with major car manufacturers to respond to the increasing challenges of advanced lubricants, the company enjoys authority on the global stage.

-

In July 2025, Castrol introduced its MHP marine lubricant line, which is API CF approved and endorsed by the OEMs Wärtsilä and MAN Energy Solutions. The lubricants are for two-stroke engines of diesel or gas with diesel operation in large ports throughout the world.

Lubricants Market Key Players:

Some of the Lubricants Market Companies are:

-

Shell plc

-

ExxonMobil Corporation

-

BP p.l.c. (Castrol)

-

Chevron Corporation

-

TotalEnergies SE

-

PetroChina Company Limited

-

China Petroleum & Chemical Corporation (Sinopec)

-

Fuchs Petrolub AG

-

Valvoline Inc.

-

Idemitsu Kosan Co., Ltd.

-

Lukoil

-

Phillips 66 Company

-

Petronas Lubricants International

-

Repsol S.A.

-

Hindustan Petroleum Corporation Limited (HPCL)

-

Indian Oil Corporation Limited (IOCL)

-

JX Nippon Oil & Energy Corporation

-

Klüber Lubrication

-

WD-40 Company

-

Lucas Oil Products

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 153.81 Billion |

| Market Size by 2033 | USD 209.24 Billion |

| CAGR | CAGR of 3.95% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Engine Oil, Hydraulic Fluid, Gear Oil, Metalworking Fluid, Grease, Others) • By Base Oil (Mineral Oil, Synthetic Oil, Bio-based Oil) • By Application (Automotive, Industrial, Marine, Aerospace, Construction, Others) • By Distribution Channel (Direct Sales, Online Retail, OEMs, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Shell plc, ExxonMobil Corporation, BP p.l.c. (Castrol), Chevron Corporation, TotalEnergies SE, PetroChina Company Limited, China Petroleum & Chemical Corporation (Sinopec), Fuchs Petrolub AG, Valvoline Inc., Idemitsu Kosan Co., Ltd., Lukoil, Phillips 66 Company, Petronas Lubricants International, Repsol S.A., Hindustan Petroleum Corporation Limited (HPCL), Indian Oil Corporation Limited (IOCL), JX Nippon Oil & Energy Corporation, Klüber Lubrication, WD-40 Company, Lucas Oil Products |