Perfume and Fragrance Market Report Scope & Overview:

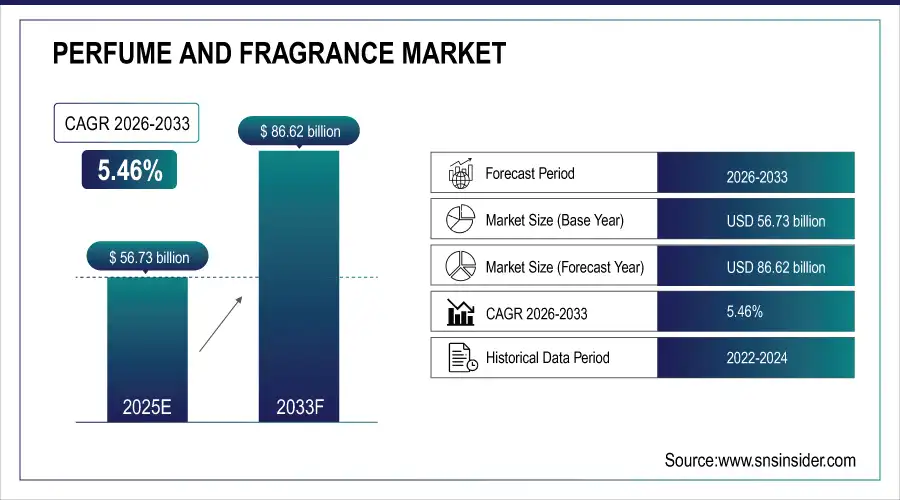

The Perfume and Fragrance Market was valued at USD 56.73 Billion in 2025E and is projected to reach USD 86.62 Billion by 2033, growing at a CAGR of 5.46% during the forecast period 2026–2033.

The Perfume and Fragrance Market analysis provides a comprehensive study of consumer and industry trends over time to understand the market’s growth rates. The market is classified by product type (perfumes, eau de toilette, body sprays), gender (men, women, unisex), end user (household, hospitality & hotels), and distribution channel (specialty stores, online retail, supermarkets & hypermarkets). Rising consumer preference for personal grooming, premium scents, and luxury experiences is driving the growth of the market.

Women’s fragrances represented 55% of the market in 2025, followed by unisex products at 30%, showing increasing adoption across different consumer groups.

Market Size and Forecast:

-

Market Size in 2025: USD 56.73 Billion

-

Market Size by 2033: USD 86.62 Billion

-

CAGR: 5.46% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Perfume and Fragrance Market - Request Free Sample Report

Perfume and Fragrances Market Trends:

-

Growing urbanization and fast-paced lifestyles are driving demand for ready-to-use, long-lasting fragrances, favoring sales across specialty stores and online channels.

-

Innovative packaging such as travel sprays, refillable bottles, and eco-friendly containers is enhancing convenience and promoting sustainable consumption.

-

Exotic and niche fragrance notes, including floral-woody and gourmand blends, are gaining popularity as consumers explore premium and international scent profiles.

-

Online retail platforms and subscription boxes are emerging as key channels, allowing brands to directly engage consumers with curated fragrance assortments.

-

Health and wellness trends promoting natural, organic, and allergen-free ingredients are encouraging manufacturers to expand clean and eco-conscious fragrance offerings.

U.S. Perfume and Fragrances Market Insights:

The U.S. Perfume and Fragrances Market is projected to grow from USD 12.50 Billion in 2025E to USD 18.45 Billion by 2033 at a CAGR of 5.01%, driven by rising demand for premium and long-lasting fragrances, increasing household consumption, innovative packaging, seasonal launches, and expanding adoption in hospitality and luxury retail channels, supporting market expansion across the country.

Perfume and Fragrances Market Growth Drivers:

-

Rising demand for premium, long-lasting fragrances is fueled by evolving personal grooming and luxury lifestyle trends.

The Perfume and Fragrances Market growth is driven by rising demand for premium, long-lasting scents amid evolving personal grooming trends. As of 2025, perfumes and eau de toilette account for 65% of total fragrance consumption, with adoption projected to grow steadily through 2033. Opportunities exist across developed and emerging markets, supported by innovative packaging, niche fragrance blends, and increasing investments by brands targeting urban, time-conscious, and luxury-focused consumers globally.

Rising demand for premium and long-lasting fragrances drove consumption of 3.7 billion units in 2025, fueled by urban households, luxury retail, and hospitality sectors.

Perfume and Fragrances Market Restraints:

-

High prices and sensitivity to allergens are limiting adoption, especially among cost-conscious and health-aware consumers.

The market growth is constrained by high prices and allergen sensitivity. In 2025, around 32% of consumers reported avoiding perfumes due to skin irritation, while 27% preferred fragrance-free or natural alternatives for daily use. Additionally, 21% of millennials experimented with DIY or mixed-scent options to reduce exposure to synthetic chemicals. Even with rising interest in premium fragrances, these personal preferences and health concerns limit adoption, highlighting the challenge of balancing luxury appeal with safety and affordability.

Perfume and Fragrances Market Opportunities:

-

Rising demand for natural, allergen-free, and sustainably sourced fragrances creates opportunities for eco-conscious premium product launches.

Increasing demand for natural, allergen-free, and sustainably sourced fragrances is boosting the market. In 2025, over 1.2 billion units of eco-friendly and clean-label perfumes were purchased, with demand projected to exceed 2.8 billion units by 2033. Rising urban awareness of safe, chemical-free ingredients and environmentally conscious lifestyles is fueling growth, while innovative packaging and niche fragrance blends are making these products more appealing and convenient for households and hospitality sectors globally.

Natural, allergen-free, and sustainably sourced fragrances accounted for 18% of new fragrance product launches in 2025.

Perfume and Fragrances Market Segmentation Analysis:

-

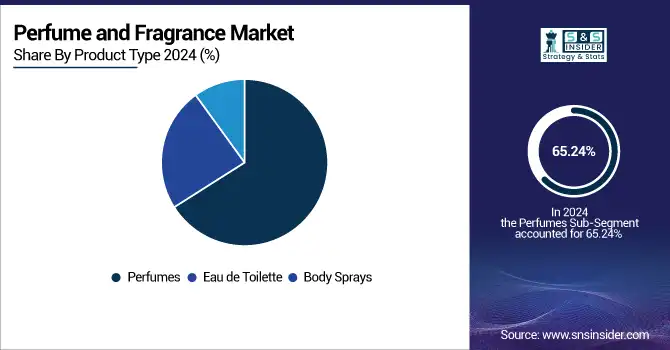

By Product Type, Perfumes held the largest market share of 65.24% in 2025, while Body Sprays are expected to grow at the fastest CAGR of 6.15%.

-

By Gender, Women dominated with a 54.88% share in 2025, while Unisex fragrances are projected to expand at the fastest CAGR of 6.38%.

-

By End User, Household segment held the largest share of 69.15% in 2025, while Hospitality & Hotels are expected to grow at the fastest CAGR of 6.05%.

-

By Distribution Channel, Specialty Stores dominated with a 38.56% share in 2025, while Online Retail is projected to record the fastest CAGR of 6.47%.

By Product Type, Perfumes Lead While Body Sprays Expand Rapidly:

Perfumes sector dominated the Product Type segment with 2.4 billion units consumed in 2025, driven by long-lasting scent, premium positioning, and strong demand among urban households. Eau de toilette followed closely for daily wear purposes. The Body Sprays sector is the fastest-growing Product Type segment in 2025, fueled by rising popularity among younger consumers, convenience for travel and gym usage, and social media-driven awareness of casual, layered fragrance options. Product innovations targeting affordability and portability are further driving growth.

By Gender, Women Lead While Unisex Expands Rapidly:

Women sector dominated the Gender segment with 1.8 billion units consumed in 2025, supported by increasing personal grooming trends, gifting culture, and seasonal launches. Men’s fragrances accounted for slightly lower consumption due to selective product usage patterns. Unisex sector emerged as the fastest-growing Gender segment, with 0.95 billion units consumed in 2025, reflecting evolving gender-neutral preferences, influencer-led promotions, and rising adoption in urban and international markets. Innovative blends catering to both genders are expanding market penetration.

By End User, Household Leads While Hospitality & Hotels Expand Rapidly:

Household sector dominated the End Users segment with 2.6 billion units consumed in 2025, driven by personal daily use, gifting, and home fragrance products. Demand remains strong across urban and semi-urban regions due to convenience and growing lifestyle awareness. Hospitality & Hotels sector is the fastest-growing End User segment, consuming 1.1 billion units in 2025, fueled by luxury hotel chains, spas, and premium resorts adopting signature scents. Increasing partnerships between fragrance brands and hospitality chains are further boosting segment growth.

By Distribution Channel, Specialty Stores Lead While Online Retail Expands Rapidly:

Specialty Stores sector dominated the Distribution Channel segment with 1.45 billion units sold in 2025, offering in-store experiences, expert consultations, and premium sampling opportunities. Supermarkets and hypermarkets followed, catering to bulk purchases and promotional discounts. Online Retail sector is the fastest-growing channel, with 1.03 billion units sold in 2025, driven by convenience, home delivery, and curated subscription boxes. Social media marketing and direct-to-consumer platforms are increasingly attracting younger, urban buyers, making online retail a key growth avenue.

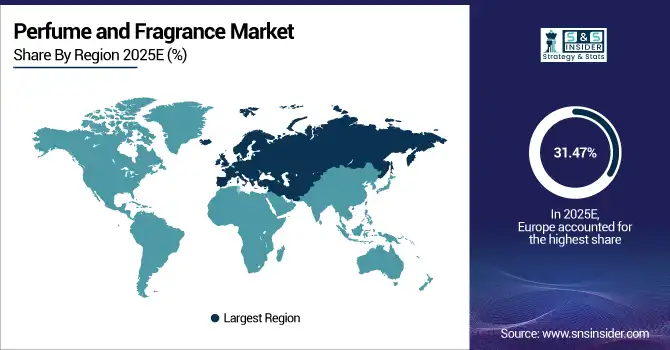

Perfume and Fragrances Market Regional Analysis:

Europe Perfume and Fragrances Market Insights:

Europe Perfume and Fragrances Market dominated with 31.47% market share in 2025, led by high consumption in France (0.42 billion units), Germany (0.39 billion units), and the UK (0.33 billion units). Household use accounted for 1.1 billion units, driving overall demand, followed by hospitality & hotels at 0.45 billion units. Increasing preference for premium, long-lasting scents, seasonal launches, and curated gifting options are supporting growth across the regional market.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

France Perfume and Fragrances Market Insights:

In 2025, France consumed 0.42 billion perfume units, including 0.25 billion units for household use and 0.17 billion units in hospitality & hotels. Perfumes dominated the segment. Rising demand for premium, long-lasting fragrances, innovative packaging, gifting options, and increasing influence of luxury retail chains are driving market growth across the country.

North America Perfume and Fragrances Market Insights:

North America led the Perfume and Fragrances Market in 2025, with consumption of 1.35 billion units, primarily in the US (1.05 billion units) and Canada (0.30 billion units). Household usage accounted for the majority, followed by hospitality and hotels. Rising urbanization, busy lifestyles, and increasing demand for premium, long-lasting fragrances are key market drivers. Innovative packaging, seasonal launches, and gifting options are further boosting adoption across households and luxury retail channels.

-

U.S. Perfume and Fragrances Market Insights:

In 2025, the U.S. consumed around 1.05 billion perfume units, with 0.70 billion for households and 0.35 billion in hospitality. Growth is driven by demand for premium, long-lasting fragrances, innovative packaging, gifting, and adoption in luxury retail and hotels, supported by urban lifestyles and rising personal grooming trends.

Asia-Pacific Perfume and Fragrances Market Insights:

Asia-Pacific is the fastest-growing region of the Perfume and Fragrances Market with a CAGR of 6.26%, driven by rising urban middle-class populations, increasing disposable incomes, and growing preference for premium and long-lasting scents. In 2025, India consumed 0.48 billion units and China 0.62 billion units. Niche, designer, and natural fragrances are gaining popularity, supported by innovative packaging, gifting culture, and expanding adoption in households and hospitality sectors.

-

China Perfume and Fragrances Market Insights:

In 2025, China consumed 0.62 billion perfume units, with 0.40 billion for households and 0.22 billion in hospitality. Rapid urbanization, rising middle-class incomes, and growing preference for premium, long-lasting fragrances are driving market growth, while innovative packaging, designer launches, and gifting culture are further enhancing adoption across urban and luxury segments.

Latin America Perfume and Fragrances Market Insights:

Latin America consumed 0.09 billion perfume units in 2025, led by Brazil (0.04 billion units), followed by Argentina (0.03 billion units) and Chile (0.02 billion units). Household usage accounted for 0.06 billion units, while hospitality and hotels used 0.03 billion units. Rising demand for premium and long-lasting fragrances, innovative packaging, and gifting culture is driving adoption across urban households and luxury retail, stimulating regional market growth.

Middle East and Africa Perfume and Fragrances Market Insights:

The Middle East & Africa Perfume and Fragrances Market is projected to consume approximately 0.06 billion units in 2025, with the UAE (0.02 billion units) and South Africa (0.015 billion units). Household usage accounted for 0.035 billion units and hospitality for 0.025 billion units. Rising demand for luxury scents, gifting, and innovative packaging is driving regional growth.

Perfume and Fragrances Market Competitive Landscape:

LVMH dominates the perfume and fragrances market with brands such as Dior, Guerlain, and Fenty Beauty. Its leadership is supported by over 6,300 retail stores, consistent product innovation, and strong luxury branding. Seasonal launches, premium fragrances, and strategic collaborations drive consumer engagement. The company’s ability to combine heritage with modern marketing and curated experiences has cemented its position as a top fragrance player across key markets.

-

In April 2025, Guerlain launched the Muguet 2025 Millésime, a limited-edition fragrance produced in a series of just 4,225 bottles globally. This creation combines Guerlain's centuries-old tradition with avant-garde artistry, featuring a bottle designed by Yann Philippe using artificial intelligence.

Estée Lauder holds a leading position in the fragrance market with brands including Jo Malone, Le Labo, and KILIAN PARIS. Its dominance is driven by strong digital channels, luxury retail presence, and strategic brand expansions. Exclusive launches, innovative fragrance collections, and targeted marketing to high-income urban consumers reinforce consumer loyalty, ensuring Estée Lauder remains a top competitor in the perfume and fragrances industry.

-

In September 2025, Estée Lauder introduced two new fragrances: Beautiful Magnolia Fleur and Aerin Amber Musk Vanille Eau de Parfums. These additions reflect the company's focus on expanding its fragrance portfolio with fresh, appealing scents.

L’Oréal maintains a strong presence in the perfume and fragrances market with brands such as Yves Saint Laurent, Lancôme, and Giorgio Armani. Its dominance is supported by retail reach, innovation in premium and niche fragrances, and expansion into emerging markets. Continuous R&D, brand diversification, and luxury positioning allow L’Oréal to sustain market leadership and consistently drive growth, catering to evolving consumer preferences and lifestyle trends.

-

In August 2025, L’Oréal debuted Miu Miu's first fragrance, Miutine, under its exclusive license with Prada. The scent features a chypre structure with a modern twist, and is promoted by actress Emma Corrin.

Perfume and Fragrances Market Key Players:

Some of the Perfume and Fragrances Market Companies are:

-

LVMH Moët Hennessy Louis Vuitton

-

Estée Lauder Companies

-

L'Oréal S.A.

-

Coty Inc.

-

Chanel S.A.

-

Procter & Gamble Co.

-

Puig S.L.

-

Unilever

-

Givaudan

-

Symrise AG

-

International Flavors & Fragrances (IFF)

-

Firmenich

-

Shiseido Co., Ltd.

-

Revlon Inc.

-

Avon Products Inc.

-

Hermès International S.A.

-

Kering S.A.

-

Richemont

-

Estée Lauder Companies

-

Kao Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 56.73 Billion |

| Market Size by 2033 | USD 86.62 Billion |

| CAGR | CAGR of 5.46% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Perfumes, Eau de Toilette, Eau de Cologne, Body Sprays, Colognes, Niche Fragrances, Others) • By Gender (Women, Men, Unisex) • By End User (Household, Hospitality & Hotels, Personal Care Centers, Retailers, Others) • By Distribution Channel (Specialty Stores, Online Retail, Department Stores, Duty-Free Shops, Supermarkets & Hypermarkets, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | LVMH Moët Hennessy Louis Vuitton, Estée Lauder Companies, L'Oréal S.A., Coty Inc., Chanel S.A., Procter & Gamble Co., Puig S.L., Unilever, Givaudan, Symrise AG, International Flavors & Fragrances (IFF), Firmenich, Shiseido Co., Ltd., Revlon Inc., Avon Products Inc., Hermès International S.A., Kering S.A., Richemont, Estée Lauder Companies, Kao Corporation |