Heat Transfer Fluids Market Report Scope & Overview:

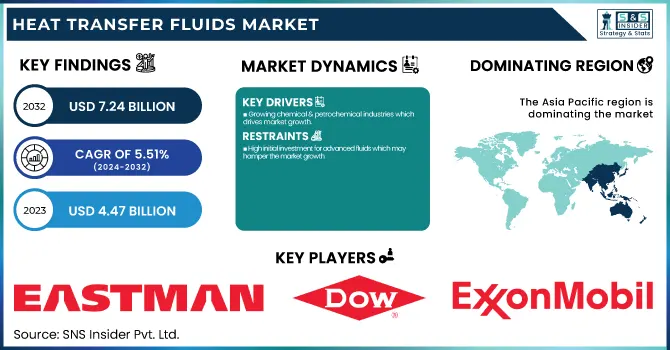

The Heat Transfer Fluids Market size was USD 4.47 Billion in 2023 and is expected to reach USD 7.24 Billion by 2032 and grow at a CAGR of 5.51% over the forecast period of 2024-2032. The report provides a comprehensive analysis of key market dynamics. It covers production capacity and utilization rates by type and region in 2023, highlighting supply-demand balance. The report delves into feedstock price trends across major economies, assessing cost fluctuations impacting market players. Regulatory impacts are analyzed, detailing country-specific policies affecting formulation and application. Environmental metrics, including emissions data, waste management, and sustainability initiatives, are evaluated to gauge industry compliance with green regulations. Additionally, the study explores R&D advancements in innovative formulations and performance enhancements. Lastly, insights into the adoption of digital monitoring and automation software in heat transfer systems provide a technological perspective on industry efficiency improvements.

To Get more information on Heat Transfer Fluids Market - Request Free Sample Report

Heat Transfer Fluids Market Dynamics

Drivers

-

Growing chemical & petrochemical industries which drives market growth.

Growth of the heat transfer fluids market is primarily attributed to the expansion of the chemical and petrochemical industries. Precise temperature control is crucial to many industrial processes including but not limited to the chemical synthesis, polymer production, refining, and distillation because the efficiency and product quality ultimately depend on stable thermal conditions. Heat transfer fluids are instruments in cooling, heating, and energy recovery systems that allow manufacturers to get the most out of their operations while simultaneously decreasing the energy being used. Increasing global demand for plastics, specialty chemicals, fertilizers, and pharmaceuticals are driving producer investments to expand and increase production capacities, resulting in growing requirement for advanced heat transfer solutions from producers. The growth of the global industry is being fueled by the recent rise in industrialization by developing nations, such as China, India and Brazil, as also initiatives by the government of various nations to promote chemical manufacturing industry. Also, the changeover in the production methods toward energy-efficient and sustainable methods has stimulated the use of high-performance, low-toxicity, and biodegradable heat transfer fluids to comply with strict government regulations related to the environment. Thus, top players are focusing on R&D to develop thermally stable, corrosion-resistant, and highly durable fluids for the extensive chemical and petrochemical sectors, to guarantee operational reliability in the long run.

Restraint

-

High initial investment for advanced fluids which may hamper the market growth.

One of the major restraints on the market growth for advanced heat transfer fluids is the high initial investment incurred, which is more significant to small and medium-sized enterprises. On these lines, synthetic and bio-based heat transfer fluid are premium products with high thermal stability, long service life and energy efficiency. Yet this makes them uneconomical for cost-sensitive industries, given their high production costs, expensive raw materials, and specialized maintenance requirements. Furthermore, novel alternatives are seeing costs associated with infrastructure upgrades when switching from traditional mineral fluids including system modifications and system compatibility to the advanced alternative. Instead, industries frequently select lower-cost options to overcome these economic hurdles, which ultimately hinders high-performance heat transfer fluids from seeing more mainstream use, despite providing far greater long-term value.

Opportunity

-

Rising popularity of district heating systems create an opportunity in the market.

Increasing popularity of district heating systems creates a lucrative opportunity for growth of heat transfer fluids market. District heating systems provide centralized heating to residential, commercial and industrial buildings and are becoming popular for their energy efficiency, lower carbon emissions and cost saving benefits. With governments around the world encouraging sustainable energy alternatives and investing in wide-ranging heating systems, there is a growing need for high-performing heat transfer fluids. They are essential to provide thermal conductivity and proper functioning for district heating pipelines. In addition, the introduction of renewable energy sources like biomass, geothermal and solar thermal into district heating networks increases the practical demand for heat transfer fluids with applications in a variety of temperature range [U.S. National Renewable Energy Laboratory].

Challenges

-

Thermal degradation and fluid breakdown may challenge the market growth.

One of the key challenges to the growth of the market for Heat Transfer Fluids is thermal degradation along with breakdown of fluid. Repeatedly operating under high temperature will degrade fluids, causing thermal efficiency to drop, as well as raising viscosity while also creating sludge or carbon deposits. The decline in heat transfer performance leads to increased maintenance costs, more regular fluid replacement, and the possibility of system break up. Similar to processes that have been effectively cooled with water they tend to run too hot and requiring expensive monitoring and filtration systems to pretend to work around this poses an issue for industries like chemical processing, manufacturing and renewable energy reliant on heat transfer fluids. This, in turn, is resulting in more robust and resilient fluid formulations with an increasing preference for high-performance synthetic substitutes, but, at a relatively high price point, restricts market growth.

Heat Transfer Fluids Market Segmentation Analysis

By Product Type

Minerals Oil held the largest market share around 56% in 2023. It is owing to their easy availability across the industries, lower capital cost, and high-temperature range of applications. Mineral Oil-based heat transfer fluids mineral oil-based heat transfer fluids are commonly used in several industries such as chemical processing, manufacturing, food & beverage, and HVAC systems because of their superior thermal stability, high heat capacity, and lower cost than synthetic alternatives. Moreover, the familiarity of mineral oils with the established supply chains and compatibility with existing heat transfer systems make it a better choice for the industry as it needs to achieve the right balance between performance and cost. Even as synthetic and bio-based alternatives are gaining traction, mineral oil remains king of the castle, thanks to its efficiency in medium-temperature applications and low maintenance needs.

By End Use Industry

Chemical & Petrochemicals segment has the largest share around 28% in 2023. It is because of the high demand of heat transfer fluids in several processes such as distillation, polymer processing, refining and specialty chemical manufacturing. HTFs are essential for reacting temperature control in reactors, heat exchangers, and storage units to operate efficiently while maintaining product specification. Thermal fluids have been employed across the industry because they are the most trusted temperate heat transfer solution that is either energy-efficient or stable that the industry requires for high-temperature processes. Moreover, the swift growth of the chemical and petrochemical industries, especially in developing markets, has also increased the demand. Moreover, industrial hit manufacturers are changing with high-performance synthetic and green heat transfer fluids due to the rising legislative emphasis on process safety and sustainability, enabling the expansion of the market.

Heat Transfer Fluids Market Regional Outlook

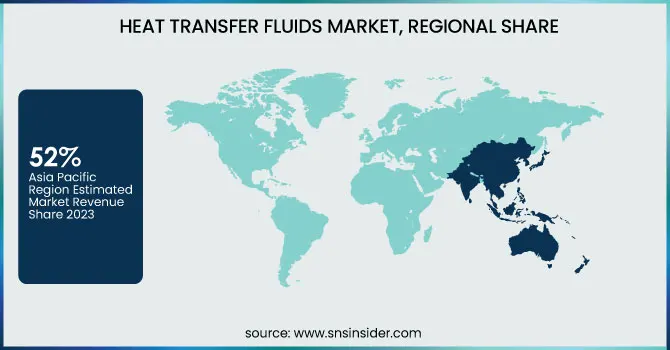

Asia Pacific held the largest market share around 52% in 2023. It was determined that, Asia, with rapid industrialization, growing chemical and petrochemical sectors and increased investment in manufacturing and renewable energy was responsible for the largest market share. The immense growth of industries, including, oil & gas, chemical processing, automotive, and HVAC, in India, China, and Japan is spurring the demand for high-quality heat transfer fluids for effective thermal management. Moreover, the region has been a major hub for solar power projects which include concentrated solar power (CSP) plants, in turn fuelling demand for high performance thermal fluids. Asia is the market leader as the new government policies, increasing FDI, and cost-effective production capabilities have made their power suitable. The region will continue to be a leader in the coming years, as it will witness infrastructure development along with increasing focus on energy efficiency and sustainability.

North America held a significant market share in 2023. The rising adoption of advanced thermal management solutions. High demand from chemical processing, oil & gas, HVAC, and food & beverage industries in the region, where effective temperature control is essential for operational efficiency, is contributing to the regional dominance. In addition to this, newly developed concentrated solar power (CSP) projects, growing pharmaceutical production, and tough energy efficiency guidelines are supporting the use of high-performance heat transfer fluids. North America remains a favorable market for heat transfer fluids, owing to the presence of various leading manufacturers, along with consistent investments in research & development of sustainable and synthetic heat transfer fluids. The region was engulfed with the increasing emphasis on renewable power generation and better industrial automation to maintain its pivotal contribution to the overall heat transfer fluids industry size.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Eastman Chemical Company (Therminol 55, Therminol 66)

-

Dow Chemical Company (DOWTHERM A, DOWTHERM RP)

-

Exxon Mobil (Mobiltherm 603, Mobiltherm 605)

-

Royal Dutch Shell Plc (Shell Thermia B, Shell Thermia C)

-

Chevron Corporation (Chevron Heat Transfer Oil, Chevron Thermia)

-

BASF SE (Glaciertherm, Hytherm 500)

-

Huntsman Corporation (Jeffcool E100, Jeffcool P150)

-

British Petroleum (BP) (BP Transcal N, BP Transcal LT)

-

Phillips 66 (Thermoflow D-12, Thermoflow S)

-

LANXESS AG (Diphyl THT, Diphyl DT)

-

Sasol Limited (Sasol Therm L, Sasol Therm S)

-

Indian Oil Corporation Ltd. (IOCL) (Servo Therm 32, Servo Therm 46)

-

Hindustan Petroleum Corporation Ltd. (HPCL) (HP Thermic 32, HP Thermic 46)

-

Schultz Chemicals (Schultz S700, Schultz S750)

-

Radco Industries Inc. (Xceltherm 600, Xceltherm MK1)

-

Dynalene, Inc. (Dynalene HC-40, Dynalene MV)

-

KOST USA, Inc. (Thermoflow FG, Thermoflow LT)

-

Solventis (ThermaCool, ThermaFlow)

-

Arteco (Freecor EV, Havoline XLC)

-

Clariant (Antifrogen N, Antifrogen L)

Recent Development:

-

In September 2023, Valvoline broadened its product portfolio by investing in a European heat transfer fluid manufacturer, enhancing its ability to serve global consumers more effectively.

-

In May 2023, ORLEN Południe marked the first anniversary of its BioPG plant, which transforms glycerol into renewable propylene glycol. The project involved collaboration with BASF for BioPG technology and Air Liquide Engineering & Construction for licensing and engineering support.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.47 Billion |

| Market Size by 2032 | USD 7.24 Billion |

| CAGR | CAGR of 5.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Mineral Oil, Synthetic Fluids, Glycol-based Fluids, Others) • By Application (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Birla Carbon, Cabot Corporation, Orion Engineered Carbons, Phillips Carbon Black Limited (PCBL), Himadri Specialty Chemical Ltd., Continental Carbon, Tokai Carbon Co., Ltd., OMSK Carbon Group, China Synthetic Rubber Corporation (CSRC), Mitsubishi Chemical Holdings Corporation, Asahi Carbon Co., Ltd., Lion Specialty Chemicals Co., Ltd., Denka Company Limited, Geotech International B.V., Klean Industries Inc., Black Bear Carbon B.V., Beilum Carbon Chemical Limited, Jiangxi Black Cat Carbon Black Inc., Longxing Chemical, Atlas Organic Pvt. Ltd. |