Luxury Apparel Market Report Scope & Overview:

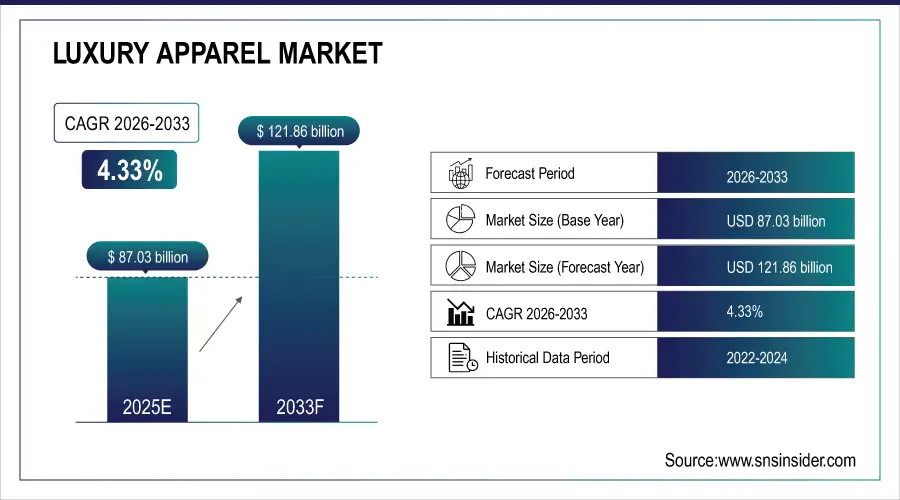

The Luxury Apparel Market Size is valued at USD 87.03 Billion in 2025E and is projected to reach USD 121.86 Billion by 2033, growing at a CAGR of 4.33% during the forecast period 2026–2033.

The Luxury Apparel Market analysis report is a particular guided in the right direction for offering in-depth information of the market. Additionally, increasing disposable income in developing countries has led to an increase in E-commerce resulting in surge in demand for designer and sustainable luxury wear and is further expected to drive the market growth over the coming years.

Luxury apparel sales reached 612 million units in 2025, fueled by rising premium fashion demand and expanding online luxury retail.

Market Size and Forecast:

-

Market Size in 2025: USD 87.03 Billion

-

Market Size by 2033: USD 121.86 Billion

-

CAGR: 4.33% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Luxury Apparel Market - Request Free Sample Report

Luxury Apparel Market Trends:

-

Increasing preference for sustainable and socially responsible luxury fashion is changing brand tactics and the way materials are gathered.

-

Online sale of luxury garment is growing with a rapid pace due to virtual storefronts and enhanced digitalization.

-

Growing partnerships between luxury labels and influencers are exposing the market to more consumers.

-

Growth of circular fashion and resale platforms is driving interest in second-hand designer clothing.

-

More widespread use of AI-based personalization and virtual fitting solutions are changing what the luxury shopping experience even means.

-

More widespread use of AI-based personalization and virtual fitting solutions are changing what the luxury shopping experience even means.

U.S. Luxury Apparel Market Insights:

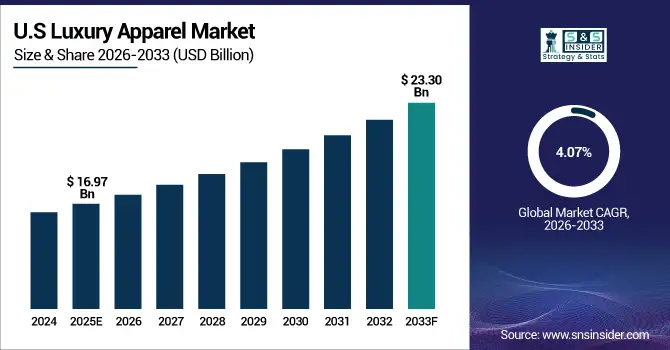

The U.S. Luxury Apparel Market is projected to grow from USD 16.97 Billion in 2025E to USD 23.30 Billion by 2033, at a CAGR of 4.07%. Growth is driven by strong consumer demand for luxury fashion, manipulated digital retail presence and the move toward ethically and sustainably made luxury wear in most metropolitan markets.

Luxury Apparel Market Growth Drivers:

-

Rising disposable incomes and expanding middle class, driving increased spending on premium and designer fashion apparel.

Rising disposable incomes and the expansion of the middle class are major drivers of Luxury Apparel Market growth. Growing consumer purchasing power in emerging markets has led to rising preference for premium and designer wear. The rise of aspiration lifestyles, increased penetration of brands and access to digital retail are only adding to this. Luxury is capitalizing on this demographic sea change with tailor-made shopping, private collections and personalized experiences to cultivate brand loyalty and expand the market.

Synthetic metalworking fluid sales grew 6.8% in 2025, driven by expanding precision machining and rising automation in automotive and aerospace manufacturing.

Luxury Apparel Market Restraints:

-

High product costs, counterfeit luxury goods and fluctuating consumer spending patterns are restricting consistent growth of the Luxury Apparel Market.

High product costs, counterfeit goods, and fluctuating consumer spending are key restraints for the Luxury Apparel Market. Pricing at a premium price precludes access for middle class consumers and the proliferation of fake products undermines brand equity and consumer confidence. Economic instabilities and changing consumer spend priorities can also drive decreased discretionary spending on luxury clothing, leading to sales volatility. Combined, those obstacles prevent the market from scaling and force brands to weigh exclusivity versus wider access strategies.

Luxury Apparel Market Opportunities:

-

Growing demand for sustainable and digital luxury fashion presents opportunities for innovation in materials, design, and retail.

Growing demand for sustainable and digital luxury fashion presents a major opportunity for market expansion. The luxury consumer is becoming more and more vigilant about what they’re buying, tracking the ethical nature and the source of materials of everything that goes into their purchases. Meanwhile, digital e-commerce, virtual fashion shows and AI-driven personalization enhance customer engagement and entitlement. In the meantime, sustainability innovation-focused companies and digital-friendly transformation-focused & high-touch experience-centric companies continue wrestling for loyalty and user share, setting the pace of premium fashion.

Sustainable luxury apparel accounted for 27% of new product launches in 2025, driven by rising consumer demand for eco-conscious and ethically produced fashion.

Luxury Apparel Market Segmentation Analysis:

-

By Product Type, Casual Wear held the largest market share of 32.45% in 2025, while Sportswear is expected to grow at the fastest CAGR of 6.12% during 2026–2033.

-

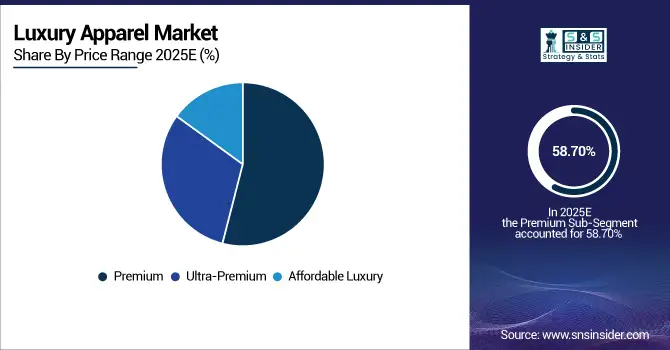

By Price Range, the Premium segment dominated with a 58.70% share in 2025, while Affordable Luxury is projected to expand at the fastest CAGR of 6.25% during the forecast period.

-

By End User, Women accounted for the highest market share of 54.30% in 2025, while the Unisex category is anticipated to record the fastest CAGR of 6.05% through 2026–2033.

-

By Distribution Channel, Offline Retail held the largest share of 47.80% in 2025, while Online Retail is expected to grow at the fastest CAGR of 9.40% during 2026–2033.

By Price Range, Premium Segment Dominates While Affordable Luxury Expands Rapidly:

Luxury segment dominated the market as consumers still have faith in traditional exclusivity, premium quality and timeless designs. Older names have been able to maintain brand loyalty with whole collections that are exclusive and a nostalgic value Affordable Luxury is the fastest growing segment is targeting potential customers by using quality and brand to covers the timeless being affordable. In 2025, over 420 million affordable luxury apparel units were purchased, highlighting rising demand across emerging economies and digital-first buyers.

By Product Type, Casual Wear Dominates While Sportswear Expands Rapidly:

Casual Wear segment dominated the market on account of increasing trend of comfort based trendy fashion. Luxury brands are combining sophistication with everyday wear in an effort to attract the casual luxury segment, which remains a cornerstone for growth. Fast-paced urbanization and hybrid work habits are driving this demand. Sportswear is the fastest growing segment, capturing through athleisure trends and celebrity collaborations. In 2025, over 310 million luxury sportswear pieces were sold, reflecting its expanding influence.

By End User, Women Dominate While Unisex Apparel Expands Rapidly:

The Women segment dominated the market on account of continual in designs, seasonal launch for junior and high purchasing capacity of women. The collections and runway trends of women’s fashion brand is mainly luxury. Unisex is the fastest growing segment as unisex fashion continues to become more mainstream and inclusivity, becoming a leading marketing factor. In 2025, more than 120 leading luxury brands introduced gender-fluid collections, reinforcing this transformative trend in premium fashion.

By Distribution Channel, Offline Retail Dominates While Online Retail Expands Rapidly:

The Offline Retail segment dominated the market due to the immersive in-store experiences, personalized assistance, and prestige of flagship boutiques. Brick and mortar remain an important part of brand storytelling, offering physical touchpoints and unique product drops to engage people with the brand. Online retail is the fastest growing segment with an increase in virtual innovation, digital showrooms and influencer-marketing. In 2025, luxury brands hosted over 2,800 virtual fashion events, highlighting the digital retail boom.

Luxury Apparel Market Regional Analysis:

Europe Luxury Apparel Market Insights:

The Europe Luxury Apparel Market dominated the landscape with a 37.42% market share in 2025, driven by a strong heritage of fashion excellence and premium brand presence. The world of fashion such as France, Italy, and UK determines the trends in luxury. Growing preference for sustainable textiles, superior workmanship, and elite collections is driving demand across the market in Europe through a competitive retail landscape defined by strong consumer purchasing power which is cementing Europe’s place as the epicenter of the luxury fashion industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

France Luxury Apparel Market Insights:

France is another critically important region in the Luxury Apparel Market, with a legacy of fashion houses and some highly skilled craftsmen. Growth greater is due to strong consumer demand for designer wear, rising environmental sustainability production and robust tourism-driven retail. Increasing digital fashion innovation and brand influence are also contributing to France maintaining its lead in luxury fashion.

Asia-Pacific Luxury Apparel Market Insights:

The Asia-Pacific Luxury Apparel Market is the fastest-growing region, projected to expand at a CAGR of 5.33% during 2026–2033. Growth is driven by higher disposable incomes, growing urban populations and heightened fashion consciousness in China, Japan, India and South Korea. The explosion of e-commerce platforms, digital marketing and younger consumers leaning toward premium and sustainable brands are driving quick uptake. There are also increasing regional production capacities, and emerging luxury collections in the region continue to support APAC’s market vibrancy.

China Luxury Apparel Market Insights:

China Luxury Apparel Market is driven by rising disposable incomes, digital retail expansion, and growing consumer appetite for premium fashion. Growing prevalence of international luxury brands and strong local designer presence drive the market growth. China plays a key part in the luxury fashion industry in Asia-Pacific thanks to its e-commerce, sustainability and social media activities.

North America Luxury Apparel Market Insights:

The North America Luxury Apparel Market is growing with the proliferation of consumer expenditure and increase in digital retail channels. Rising demand for sustainable and ethically produced clothing is prompting a wave of new strategies among brands in the U.S. and Canada. Prominence of luxury e-commerce sites and celebrity endorsements and evolving consumer tastes toward customisation have been helping brand engagement, while design innovation at the retail level is reinforcing North America’s market clout.

U.S. Luxury Apparel Market Insights:

The U.S. Luxury Apparel Market is heavily rooted in the popularity of premium and sustainable fashion, celebrity endorsements, and growth in online luxury retail. Digital shopping experiences, personalized products and eco-friendly materials are moving the needle in terms of innovation around brand strategy, while collaboration and limited editions amplify the country’s high-end fashion scene.

Latin America Luxury Apparel Market Insights:

The Latin America Luxury Apparel Market is on the rise due to urbanization; the middle-class people are earning more and they are getting associated with international fashion. Demand is supported by increased domestic production and retail expansions in Brazil, Mexico and Argentina. The growth of E-commerce, sustainability campaigns and partnerships with international luxurious brands are driving the regional market.

Middle East and Africa Luxury Apparel Market Insights:

The Middle East & Africa Luxury Apparel Market is growing with the increasing disposable incomes, surge in tourism and preference toward international fashion labels. Robust retail investments, store openings and taking luxury into the digital era are driving demand. Growth & modernization being led by powerhouse markets including Saudi Arabia, UAE and South Africa.

Luxury Apparel Market Competitive Landscape:

Louis Vuitton, headquartered in Paris, France, is the world’s leading luxury fashion house known for its timeless craftsmanship and iconic monogram designs. One of LVMH’s powerhouse brands, it reigns supreme over luxury fashion with its heritage, innovation and exclusivity. They specialize in ready-to-wear, leather and accessories combining traditional with contemporary outfits. Strategic celebrity tie-ups, limited-edition collections and good brand stories are all continuing to solidify Louis Vuitton’s position at the top end of the luxury fashion sector.

-

In August 2025, Louis Vuitton launched La Beauté Louis Vuitton, a luxury makeup line featuring lipsticks, balms, and eyeshadow palettes in refillable packaging. Developed with Pat McGrath, it showcases sustainable ingredients and marks the brand’s strategic expansion into high-end cosmetics.

Hermès, founded in 1837 and headquartered in Paris, France, is renowned for its artisanal excellence, premium materials, and timeless elegance. Its timeless luxury wear is influenced by its rich history, while still being innovative and futuristic. The key to the company’s success is exclusivity, low volume and a priority on quality over quantity. Hermès continues to exercise authority due to iconic products, such as the Birkin and Kelly bags and its clothing lines that attract savvy shoppers looking for low-key luxury and a more authentic product.

-

In March 2025, Hermès introduced its Spring-Summer 2025 collection featuring new silk mesh apparel and 11 innovative handbag designs. The launch highlighted fresh color palettes and refined craftsmanship, reinforcing Hermès’ dominance in timeless elegance and modern creativity across luxury fashion and accessories.

Chanel, headquartered in Paris, France, remains a symbol of classic luxury, elegance, and modern femininity. Famed for its haute couture, ready-to-wear and signature fragrance line 'The brand is ever-evolving. Such authority has been built in part on the steely legacy of innovation left by Coco Chanel and on a continuous dedication to creativity from visionary designers. Strategic marketing, exclusivity and an impeccable fusion of its heritage in modern design reinforce Chanel’s position as one of the world leaders in upscale fashion.

-

In May 2025, Chanel expanded its beauty and fragrance portfolio by debuting on India’s Nykaa platform, enhancing digital accessibility. The brand’s Spring-Summer 2025 collection emphasized light silhouettes and modern femininity, strengthening Chanel’s influence in contemporary luxury fashion and beauty.

Luxury Apparel Market Key Players:

Some of the Luxury Apparel Market Companies are:

-

Louis Vuitton

-

Hermès

-

Chanel

-

Gucci

-

Prada

-

Burberry

-

Dior

-

Valentino

-

Armani

-

Dolce & Gabbana

-

Versace

-

Ralph Lauren

-

Coach

-

Balenciaga

-

Fendi

-

Bottega Veneta

-

Loro Piana

-

Moncler

-

Brunello Cucinelli

-

Kate Spade

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 87.03 Billion |

| Market Size by 2033 | USD 121.86 Billion |

| CAGR | CAGR of 4.33% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Formal Wear, Casual Wear, Sportswear, Outerwear, Lingerie, Others) • By Price Range (Premium, Ultra-Premium, Affordable Luxury) • By End User (Men, Women, Unisex) • By Distribution Channel (Offline Retail, Online Retail, Specialty Stores, Department Stores, Boutiques, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Louis Vuitton, Hermès, Chanel, Gucci, Prada, Burberry, Dior, Valentino, Armani, Dolce & Gabbana, Versace, Ralph Lauren, Coach, Balenciaga, Fendi, Bottega Veneta, Loro Piana, Moncler, Brunello Cucinelli, Kate Spade |