Spouted Pouch Market Report Scope And Overview:

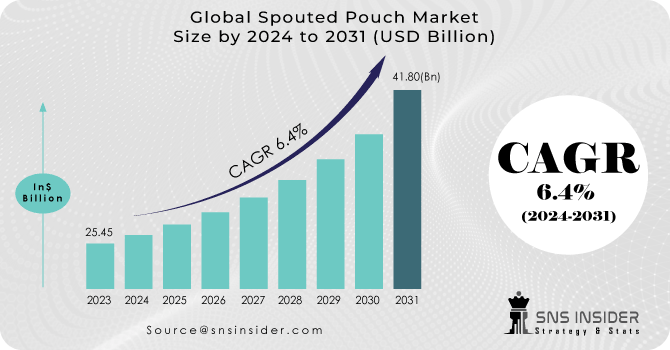

The Spouted Pouch Market size was USD 25.45 billion in 2023 and is expected to Reach USD 41.80 billion by 2031 and grow at a CAGR of 6.4% over the forecast period of 2024-2031.

One notable trend in the market is the movement towards environmentally friendly and sustainable packaging solutions. Furthermore, there is an increasing demand for personalized and inventive designs, tailored to meet the unique requirements of consumers and industries. The surge in online shopping and the proliferation of e-commerce platforms are projected to contribute to the growth in market revenue during the forecast period. In recent years, the e-commerce industry has witnessed rapid expansion as consumers increasingly opt for online shopping due to its accessibility and convenience. Spout pouches find widespread use in packaging various products, including fabric softeners, liquid detergents, and other household items, especially those available in bulk quantities through online channels.

Get More Information on Spouted Pouch Market - Request Sample Report

Government Regulations

Government regulations play a crucial role in ensuring the safety and quality of spouted pouches used for food packaging. The U.S. Food and Drug Administration (FDA) has implemented regulations to safeguard consumers by ensuring that spouted pouches meet food contact safety standards. The FDA's Food Safety Modernization Act (FSMA) enforces strict guidelines on the manufacturing and labeling of food products, including spouted pouches. The International Organization for Standardization (ISO) has developed standards for the manufacture, labeling, and performance of spouted pouches.

MARKET DYNAMICS

KEY DRIVERS:

-

Growing demand for spouted pouches in the food and beverage and pharmaceutical sectors.

The surge in health consciousness and rising per capita income has led to an increase in demand for packaged food and beverages, consequently fueling the market demand for spouted pouches. Spout pouches find applications in a wide range of products including cocktails, screenwash for petrol stations, baby food, energy drinks, and various others, particularly in children's food. Additionally, manufacturers are increasingly utilizing spouted pouches for fruit juice and vegetable puree products.

-

Increasing research and development activities are propelling the spout pouch market forward.

RESTRAIN:

-

Strict government regulations on packaging for nutraceuticals, pharmaceuticals, and food & beverage products are expected to hinder market growth as they are crucial for maintaining product quality and environmental compliance.

-

Production delays refer to situations where manufacturing processes take longer than planned, often resulting in postponed delivery dates or disruptions in supply chains

OPPORTUNITY:

-

There's a rising trend in the market characterized by a growing number of new product introductions, notably in the infant food segment.

The surge in launches by manufacturers focusing on sustainable and eco-friendly packaging stands out as a significant driver for market expansion. With rising awareness about the adverse environmental impacts of chemicals and plastics, there's a growing demand for sustainable packaging among consumers. This trend is expected to drive market growth, as customers increasingly embrace new packaging technologies designed for easy decomposition and reduced pollution, thereby supporting environmental conservation efforts.

CHALLENGES:

-

One of the key challenges in the market is striking a balance between cost efficiency and sustainability.

-

Environmental concerns and recycling challenges linked to the use of spouted pouches for packaging.

IMPACT OF RUSSIAN UKRAINE WAR

For companies supplied by Ukraine's packaging industry, the war is not expected to cause significant disruptions or shortages, considering the country's relatively minor presence in the global industry. Nonetheless, the decision of numerous businesses to withdraw from the Russian market presents a separate issue. Packaging companies that have been divested have managed to avoid significant consequences, but those heavily invested in Russia are expected to face considerable disruption. These companies are not only susceptible to the volatility of the Ruble and consequent increases in the costs of imported raw materials, but also face backlash due to negative perceptions towards businesses operating in Russia. Smurfit Kappa, an Irish corrugated packaging company, has declared its intention to withdraw from the Russian market. Similarly, Mondi has revealed that it is evaluating various options for its investments in Russia, which account for 12% of the packaging giant's revenues.

IMPACT OF ECONOMIC SLOWDOWN

Economic slowdowns can disrupt supply chains, leading to delays in the production and delivery of spouted pouches. This can result in inventory shortages or increased lead times for manufacturers and consumers. Companies might delay investments in new packaging technologies like spouted pouches due to budgetary constraints during an economic slowdown. As businesses look to cut costs and improve profitability during economic downturns, they may negotiate lower prices with suppliers, including spouted pouch manufacturers. This can lead to downward pressure on prices and margins in the spouted pouch market.

KEY MARKET SEGMENTS

By Product

-

Beverages

-

Syrups

-

Cleaning Solutions

-

Oils

By Color

-

Green

-

Red

-

Black

-

Blue

-

Silver

By Component

-

Cap

-

Straw

-

Film

With the largest market share, the caps segment is predominantly driven by the pivotal role they play in guaranteeing the functionality and integrity of pouches. In contrast, although smaller in size compared to the caps segment, the film segment of the market holds significant importance in shaping the overall quality and attractiveness of pouches.

By Layer

-

Four

-

Three

-

Two

By Pouch Size

-

Less Than 200 Ml

-

200 Ml To 500 Ml

-

500 Ml To 1000 Ml

-

More Than 1000 Ml

The segment for pouches containing less than 200 ml dominates the market, primarily propelled by their extensive utilization in single-serve or sample-sized products. Pouches ranging from 200 to 500 ml accommodate a wide array of products, spanning beverages, sauces, and home care items. This size range is preferred for its convenience in everyday consumption while remaining portable. The segment of pouches ranging from 500 to 1000 ml meets the requirements of consumers desiring larger quantities without the bulk and inconvenience associated with traditional large packaging.

By Filling Process

-

Standard

-

Aseptic

-

Retort

-

Hot- Filled

By Material

-

Plastic

-

Aluminium

-

Paper

The plastic segment holds a dominant position in the market, leveraging the material's versatility, durability, and affordability. This segment encompasses a range of plastics, such as polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC), each providing distinct advantages in terms of flexibility, strength, and scalability. The aluminum segment serves products necessitating exceptional barrier properties, particularly against light and oxygen infiltration. Although representing a smaller portion of the market, the paper segment is experiencing increased interest owing to its environmental advantages.

By Application

-

Food

-

Beverages

-

Home & Personal Care

-

Automotive

-

Pharmaceutical

-

Others

The food and beverages segment holds the largest share in the market, propelled by the convenience, flexibility, and efficiency of the packaging. Within the cosmetics and personal care industry, pouches are esteemed for their combination of aesthetic appeal and functionality. The automotive sector employs these pouches to package lubricants, oils, and other fluids, benefiting from their capacity to dispense accurate quantities, thereby minimizing waste and spillage.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS

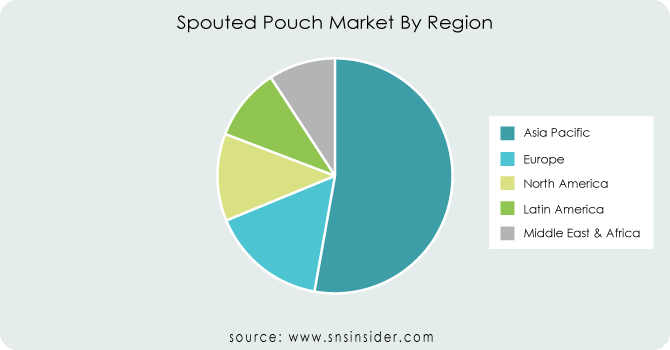

The Asia Pacific region dominates the global market, primarily driven by rapid industrial expansion, rising consumer expenditure, and a preference for convenient packaging solutions in densely populated nations like China and India. This dominance is reinforced by a multitude of manufacturers and a substantial consumer base seeking cost-effective and inventive packaging for various consumer goods including food and beverages.

In North America, market growth is propelled by cutting-edge manufacturing technologies, heightened consumer awareness, and rigorous regulations governing food and product safety. Both the United States and Canada exhibit a notable inclination towards flexible packaging solutions, particularly in the food and beverage as well as personal care industries.

Europe's market prioritizes sustainability, quality, and adherence to stringent regulatory requirements. The region's commitment to minimizing plastic waste and enhancing recycling rates complements the uptake of environmentally friendly solutions. Furthermore, European consumers' inclination towards premium and superior-quality products fuels the demand for innovative and visually appealing packaging.

The Latin American market is experiencing growth, driven by urbanization, increasing disposable incomes, and the expansion of the retail industry. Brazil and Mexico play pivotal roles in driving market expansion in this region, particularly witnessing heightened demand in sectors such as food and beverages and personal care. Additionally, the market's growth is shaped by the region's commitment to sustainable packaging practices. The Middle East and Africa market is emerging, fueled by urbanization, evolving lifestyles, and a burgeoning retail sector.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Major players in Spouted Pouch Market are Clifton Packaging Group Limited, Glenroy Inc., Amcor plc, Mondi plc, Logos Packaging, Guala Pack S.p.A., Printpack Inc., Constantia Flexibles, Scholle IPN India Packaging Pvt. Ltd. (SIG Combibloc Group AG), ProAmpac and others.

Clifton Packaging Group Limited- Company Financial Analysis

RECENT DEVELOPMENT

-

On November 06, 2023, Amcor plc unveiled the latest generation of its Medical Laminates solutions. This recent innovation enables the creation of recyclable all-film packaging within the polyethylene stream.

-

On November 03, 2023, Glenroy Inc. disclosed its intention to acquire a tandem adhesive laminater. The company expects its packaging capacity to increase upon the full implementation of the new equipment this spring.

-

On July 31, 2023, Wendel entered into an agreement to divest Constantia Flexibles to a subsidiary of One Rock Capital Partners for an expected sum that would yield net proceeds of approximately €1,097 million.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 25.45 Billion |

| Market Size by 2031 | US$ 41.80 Billion |

| CAGR | CAGR of 6.4 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

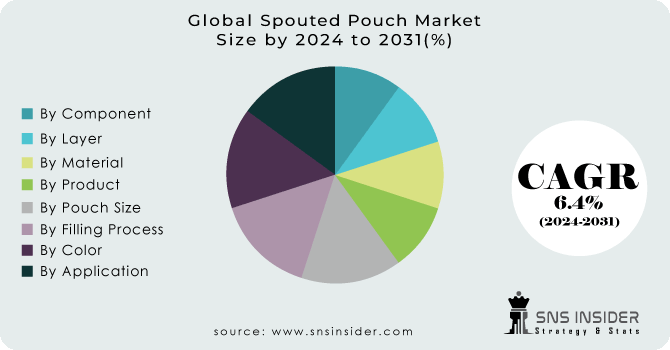

| Key Segments | • By Product(Beverages, Syrups, Cleaning Solutions, Oils) • By Color(Green, Red, Black, Blue, Silver) • By Component(Cap, Straw, Film ) • By Layer(Four, Three, Two) • By Pouch Size(Less Than 200 Ml, 200 Ml To 500 Ml, 500 Ml To 1000 Ml, More Than 1000 Ml) • By Filling Process(Standard, Aseptic, Retort, Hot- Filled) • By Material(Plastic, Aluminium, Paper) • By Application(Food, Beverages, Home & Personal Care, Automotive, Pharmaceutical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Clifton Packaging Group Limited, Glenroy Inc., Amcor plc, Mondi plc, Logos Packaging, Guala Pack S.p.A., Printpack Inc., Constantia Flexibles, Scholle IPN India Packaging Pvt. Ltd. (SIG Combibloc Group AG), ProAmpac |

| Key Drivers | • Growing demand for spouted pouches in the food and beverage and pharmaceutical sectors. • Increasing research and development activities are propelling the spout pouch market forward. |

| Restraints | • Strict government regulations on packaging for nutraceuticals, pharmaceuticals, and food & beverage products are expected to hinder market growth as they are crucial for maintaining product quality and environmental compliance. • Production delays refer to situations where manufacturing processes take longer than planned, often resulting in postponed delivery dates or disruptions in supply chains |