Sterilized Packaging Market Report & Overview:

Get More Information on Sterilized Packaging Market - Request Sample Report

The Sterilized Packaging Market Share was valued at USD 31.78 Billion in 2023 and is expected to reach USD 50.27 Billion by 2032, growing at a CAGR of 5.24 % during 2024-2032.

Sterilized packaging includes disposable plastic shells, coverings, and different packing materials that are subjected to terminal sterilization to eradicate all Materials of microbial life, guaranteeing the safety and effectiveness of medical devices, instruments, and other items. This kind of packaging is crucial in preserving sterility by stopping contamination while being stored and transported. Per the International Organization for Standardization (ISO), ensuring patient safety relies heavily on sterilizing medical devices, making properly sterilized packaging crucial for infection control effectiveness. Sterilized packaging offers advantages to patients, manufacturers, and healthcare providers. For patients, the guarantee of cleanliness lowers the chance of infections and complications after surgery. Manufacturers gain improved market reputation and reduced liability, while healthcare providers gain confidence in products meeting strict safety standards. Aseptic packaging is crucial in the food market as it needs to retain its shape after sterilization to achieve expected benefits. It not only prolongs the shelf life of food products but also improves their portability, allowing for broader distribution and higher profits for processors by minimizing spoiling and waste. The increasing need for sterilized packaging in medical and food industries emphasizes its crucial role in ensuring quality, safety, and efficiency in contemporary supply chains, underscoring its significance in boosting consumer trust and operational efficiency.

The growing use of sterile and disinfected packaging in industries like medical device manufacturing, food and beverage, and pharmaceuticals is due to the increased cases of viral infections from non-sterile tools. As the recognition of the dangers associated with non-sterile products increases, there is also a rising need for sterilized packaging options. Sterilization not only guarantees the safety of medical tools and equipment but also prolongs their shelf life, particularly when using aseptic packaging techniques.The growing use of clean and sanitized packaging in various industries like medical device manufacturing, food and beverage, pharmaceuticals, is due to the increased occurrence of viral infections linked to non-sterile tools. With the increasing recognition of the dangers presented by non-sterile items, the need for sterilized packaging options is also on the rise. Sterilization not only guarantees the safety of medical devices and equipment but also prolongs their shelf life, particularly when aseptic packaging techniques are employed. The need for products that stay fresh for longer is a major factor driving the growth of this market, especially in the food and beverage market, as consumers prefer items with extended shelf life. The FDA stresses how crucial efficient packaging is for preserving the safety and quality of food items, highlighting the demand for advanced sterilized packaging options. The advancement of technology, including the creation of new sterilization methods and materials, has further supported the expansion of the market. For example, improvements in aseptic processing and packaging technologies enable manufacturers to create and package items in a clean environment, reducing the chances of contamination. Moreover, strict government rules about product safety and hygiene standards, particularly in healthcare and food industries, further strengthen the requirements.

Sterilized Packaging Market Dynamics

Drivers

-

The intersection of environmentally friendly practices and growth in the Sterilized Packaging market leads to sustainable solutions

The sterilized packaging market is set to experience substantial growth, in line with the increasing focus on eco-friendly packaging options and sustainability in the overall packaging sector. The rise is driven by a growing emphasis on safety and hygiene, especially in healthcare and food industries, as well as an increasing need for environmentally friendly packaging choices. Examples of companies such as Ecolean in Sweden demonstrate this change through the development of lightweight packaging that reduces the amount of raw materials used while still ensuring the quality of the product. Ecolean's method boosts production efficiency with sealed, sterilized packages while also cutting down on the carbon footprint linked to regular packaging methods. Utilizing environmentally-friendly materials and practices in sterilized packaging is in accordance with regulations like the EU Packaging and Packaging Waste Directive, which strives to advance sustainability in the packaging sector. With changing global trade dynamics, packaging system suppliers are adjusting their strategies to meet regulations, increasing the need for sterilized packaging solutions that are efficient and environmentally friendly. Additionally, the rise in e-commerce and the need for safe and green packaging choices are also contributing to the expansion of the market. The sterilized packaging market is growing because of increased health safety worries and a push for sustainability in the packaging market to lower carbon emissions and environmental effects, all while satisfying consumer demands for safety and quality.

Restraints

-

The difficulties of plastic waste in the Sterilized Packaging market pose a challenge when navigating the environmental dilemma.

The increasing worries about the environment are expected to hinder the expansion of the sterilized packaging Market in the upcoming years. The healthcare sector significantly impacts environmental pollution, making up around 4 to 5 percent of worldwide greenhouse gas emissions, with supply chains contributing 82% of this amount. The significant use of disposable polypropylene for sterilizing surgical instruments creates a large amount of plastic waste, with an approximate annual production of 115 million kilograms in the U.S. alone. Frequently utilized packaging materials, such as PET, PE, and PP, are frequently combined with barrier materials like oPA and EVOH, which play a part in this problem. Items constructed from polyethylene are usually utilized just once, which worsens waste issues due to their decomposition period of over 400 years. Regrettably, just around ten percent of polyethylene is recycled, causing substantial pollution and damage to wildlife habitats. In addition, the manufacture of polypropylene results in an astonishing 1.3 billion tons of carbon dioxide being released into the atmosphere. Therefore, although sterilized packaging is essential for safety and cleanliness, the use of plastics creates major obstacles in balancing sterility needs with sustainability objectives, increasing the need to tackle carbon emissions and climate change.

Sterilized Packaging Market Segmentation Overview

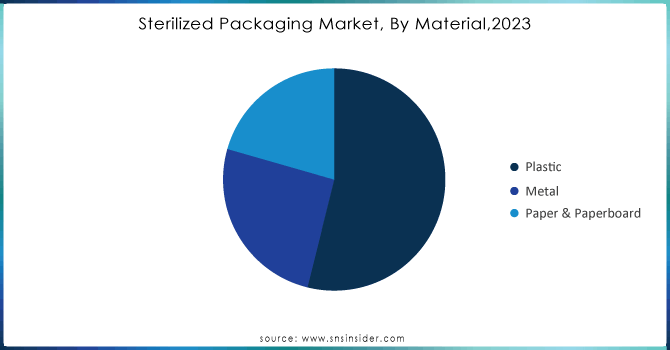

By Material

In 2023, plastic became the primary material in the sterilized packaging market, representing a significant 53.89% of the total revenue. The main reason for plastic's extensive use is its versatility, lightweight qualities, and ability to act as a barrier, which is perfect for preserving the sterility of medical devices and food items. Top companies are constantly coming up with new ideas in this area. For example, Amcor introduced its Eco-Tite® range, which has advanced barrier features and sustainable designs to meet the increasing need for eco-friendly packaging options. Likewise, Sealed Air Corporation launched its Bubble Wrap® brand with added antimicrobial features for increased defense against contamination while in transit and in storage. The Cardinal Health brand has broadened its product range by introducing specially designed sterile, single-use polyethylene packaging for surgical instruments, meeting safety and hygiene requirements in healthcare environments. These advancements highlight the market's move to more effective and secure plastic packaging options that also adhere to strict regulatory requirements. With the increasing need for sterilized packaging, particularly in healthcare and food industries, plastic will continue to be a crucial material that fuels innovation and progress in sterilized packaging technologies.

Need any customization research on Sterilized Packaging Market - Enquiry Now

By End User

In 2023, the Medical & Pharmaceutical was the leading sector in the sterilized packaging market, contributing to an impressive 54.44% of the overall revenue. The rise is fueled by the growing need for safety, cleanliness, and adherence to regulations in medical and pharmaceutical fields. Major corporations are actively engaging in innovation to address these demands. BD has recently released a new series of BD Vacutainer® blood collection tubes, which include improved sterile packaging for safe sample collection and transport. At the same time, AptarGroup, Inc. launched its Pharma Pack solutions, created to enhance drug safety and effectiveness through offering packaging that is tamper-evident and resistant to moisture. Moreover, Cardinal Health broadened its range of products with SureSeal™ sterile barrier packaging for medical devices, highlighting the significance of preserving sterility while in transit and storage. Medline Industries has also been driven by the emphasis on sustainable practices to offer eco-friendly sterilized packaging options in line with environmental objectives. With the healthcare market changing due to new technologies and more regulations, the need for advanced sterilized packaging options for medical and pharmaceutical uses will help maintain its position as a top choice, guaranteeing the safety and efficacy of important healthcare items.

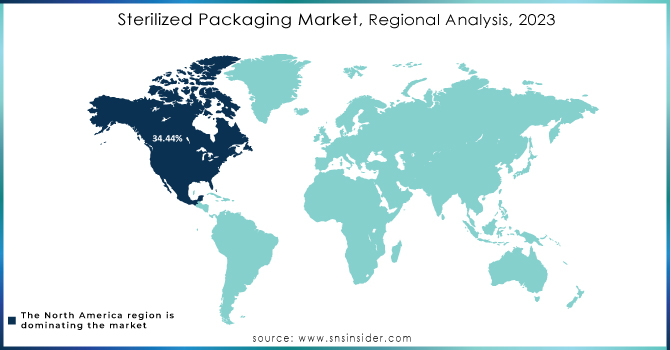

Sterilized Packaging Market Regional Analysis

In 2023, North America dominated the sterilized packaging market, securing a substantial 34.44% of the revenue. The region's sophisticated healthcare facilities, strict regulations, and growing focus on safety and cleanliness in medical and pharmaceutical uses are responsible for this expansion. Businesses in North America are making significant advancements in product innovation in order to meet this growing demand. As an example, Amcor, a top provider of eco-friendly packaging solutions, introduced the Amcor Rigid Plastics range, specifically catering to sterile packaging for pharmaceuticals and medical devices to improve safety and prolong shelf life.Sterigenics, a well-known company offering sterilization services, has enlarged its operations in the United States to meet the growing need for sterilized medical goods by increasing its ethylene oxide sterilization capabilities. West Pharmaceutical Services, a company specializing in pharmaceutical packaging solutions, unveiled its new *Westar® sterilized packaging products with upgraded barrier properties. These products are crafted to adhere to the strict standards set by the FDA and other regulatory authorities. The increase in investments in sterilized packaging technologies is being driven by the U.S. government's efforts to enhance healthcare safety and compliance, as well as the growing elderly population. North America's positioning as its innovative product releases and supportive regulatory environments strengthen a key player in the global sterilized packaging market, leading to sustained growth and development in the region.

By 2023, the Asia-Pacific region had become the top market for sterilized packaging due to quick industrial growth, a growing healthcare market, and rising consumer interest in safe and clean products. Nations such as China, India, and Japan are leading the way in this growth, driven by the growth in pharmaceutical manufacturing capabilities and an increased emphasis on healthcare safety standards. China has seen notable progress, with companies such as Daiichi Sankyo introducing cutting-edge sterilized packaging solutions designed for biologics and injectable, guaranteeing conformity with strict regulatory standards. Furthermore, Amcor grew its presence in the Indian market by launching a new range of sterile flexible pouches for food and pharmaceutical use, catering to the demand for safe and convenient packaging.Sundaram Medical Devices in India introduced the Steripak™ line of sterilized packaging for surgical tools, focusing on simplicity and improved safety during surgeries. Moreover, Sealed Air Corporation has advanced in the area by improving its Bubblestone™ packaging solutions for the medical device market, with a focus on boosting protection from contamination.

Japan's strict emphasis on safety rules has resulted in a higher need for cutting-edge sterilized packaging technologies. Mitsubishi Chemical Holdings has launched the innovative Mitsubishi SteriPack, which uses advanced barrier materials to preserve sterility during the supply chain process.with the growing healthcare demands, government support, and more investments in innovative packaging technologies, the Asia-Pacific region is becoming a key player in the global sterilized packaging market, ensuring ongoing growth and progress in the future.

Key Players in Sterilized Packaging Market

Some of the key players in the sterilized packaging market, along with their notable products & Offering:

-

Amcor (Flexibles for medical devices and pharmaceuticals)

-

DuPont (Tyvek® medical packaging)

-

Placon Corporation (Thermoform packaging for medical devices)

-

Wipak (Wipak Medical – sterile barrier packaging)

-

TekniPlex (Tekni-Fil™ sterile barrier packaging)

-

Wihuri Group (Wipak’s sterile flexible packaging solutions)

-

SteriPack Contract Manufacturing (Custom sterile packaging solutions)

-

Riverside Medical Packaging Ltd (Bespoke sterilization packaging)

-

Anqing Kangmingna Packaging Co., Ltd. (Plastic sterile packaging solutions)

-

Nelipak Healthcare Packaging (Custom rigid and flexible packaging solutions)

-

West Pharmaceutical Services, Inc. (Westar® and NovaPure® packaging solutions)

-

MediPak (Sterilization pouches and wraps)

-

Schott AG (Pharmaceutical vials and syringes)

-

Berry Global, Inc. (Medical packaging products including bags and pouches)

-

BASF (High-performance polymer films for medical packaging)

-

Klockner Pentaplast (KP Films for sterile medical packaging)

-

CSP Technologies, Inc. (Active packaging solutions for pharmaceuticals)

-

Sealed Air Corporation (Bubble wrap and other cushioning materials)

-

SABIC (Sterilization-grade materials for medical devices)

-

Huhtamaki Group (Protective packaging for the food and healthcare sectors), Others

Recent Development

-

On May 2024 Sharp Services has announced the expansion of its Macungie, PA site to increase production capacity for sterile injectables secondary packaging. This move supports rising demand in the sterilizable packaging market, enhancing Sharp’s ability to serve pharmaceutical clients with advanced sterile packaging solutions.

-

On April 2024 – SIG has officially launched the Prime 55 In-Line Aseptic, a cutting-edge filling machine specifically designed for pre-made, spouted aseptic pouches. This innovative system offers in-line sterilization, streamlining the supply chain and significantly reducing production costs.

-

June 2023 - Oliver Healthcare Packaging, a supplier of sterile barrier flexible packaging, acquired EK-Pack Folien, a foil and film technology manufacturer. The acquisition gives excellent control over the supply chain and allows the company to innovate new products to meet customer needs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 31.78 Billion |

| Market Size by 2032 | USD 50.27 Billion |

| CAGR | CAGR of 5.24% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Metal, Paper & Paperboard) • By Type (Trays, Pouches, Clamshell, Others) • By End User (Medical & Pharmaceutical, Cosmetic & Personal Care, Food & Beverage) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amcor, DuPont, Placon Corporation, Wipak, TekniPlex, Wihuri Group, SteriPack Contract Manufacturing, Riverside Medical Packaging Ltd, Anqing Kangmingna Packaging Co., Ltd., Nelipak Healthcare Packaging, West Pharmaceutical Services, Inc., MediPak, Schott AG, Berry Global, Inc., BASF, Klockner Pentaplast, CSP Technologies, Inc., Sealed Air Corporation, SABIC, and Huhtamaki Group & Others |

| Key Drivers | • The intersection of environmentally friendly practices and growth in the Sterilized Packaging market leads to sustainable solutions |

| RESTRAINTS | • The difficulties of plastic waste in the Sterilized Packaging industry pose a challenge when navigating the environmental dilemma. |