Magnesium Metal Market Report Scope & Overview:

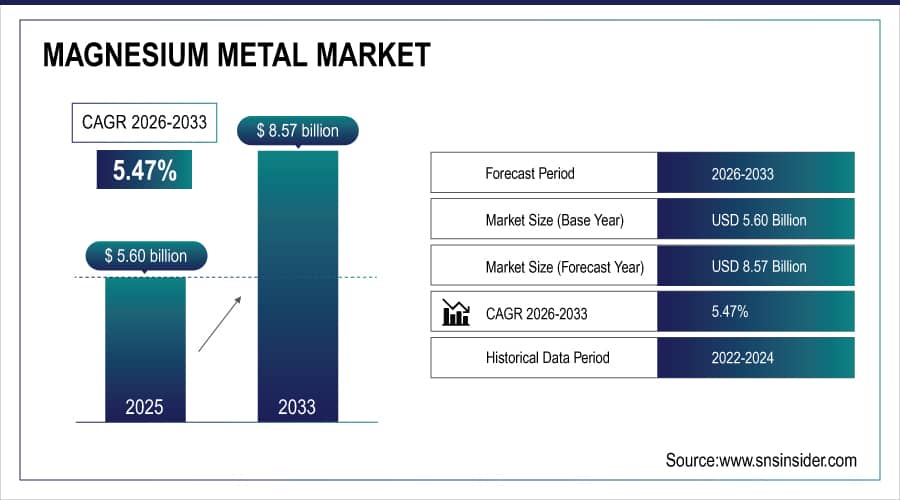

The Magnesium Metal Market Size is valued at USD 5.60 Billion in 2025E and is expected to reach USD 8.57 Billion by 2033 and grow at a CAGR of 5.47% over the forecast period 2026-2033.

The Magnesium Metal Market analysis, driven by increasing demand from the automotive, aerospace, and electronics industries, where magnesium’s lightweight and high strength‑to‑weight ratio help improve fuel efficiency and performance. In automotive manufacturing, the trend toward lightweighting to meet stricter emissions regulations and improve electric‑vehicle range is boosting use of magnesium alloys in structural components, housings, and interior parts.

According to study, electronics and consumer device usage represents 10–12%, driven by casings, heat-dissipation components, and other small hardware applications.

To Get More Information On Magnesium Metal Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 5.60 Billion

-

Market Size by 2033: USD 8.57 Billion

-

CAGR: 5.47% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Magnesium Metal Market Trends:

-

Lightweight magnesium alloys increasingly used in electric vehicles to improve efficiency.

-

Aerospace industry adoption growing for fuel efficiency and structural performance.

-

Advances in corrosion-resistant magnesium alloys expanding applications in electronics and machinery.

-

3D printing using magnesium alloys gaining traction in prototyping and lightweight components.

-

Asia-Pacific emerging as the largest market due to industrial growth and automotive demand.

-

Research in eco-friendly extraction processes reducing energy consumption and production costs.

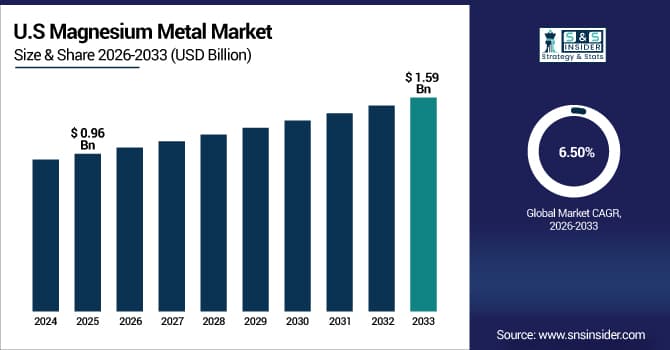

The U.S. Magnesium Metal Market size is USD 0.96 Billion in 2025E and is expected to reach USD 1.59 Billion by 2033, growing at a CAGR of 6.50% over the forecast period of 2026-2033,

The U.S. magnesium metal market is growing steadily due to rising demand in automotive lightweighting, aerospace, defense, and electronics industries. Adoption of high-strength, corrosion-resistant alloys, coupled with technological advancements, recycling initiatives, and industrial modernization, drives market expansion and strengthens the country’s position.

Magnesium Metal Market Growth Drivers:

-

Rising Demand for Lightweight Metals in Automotive and Aerospace Industries

A major driver for the magnesium metal market growth is the growing demand for lightweight materials to improve fuel efficiency, reduce emissions, and enhance performance in automotive and aerospace applications. Magnesium is one of the lightest structural metals, offering excellent strength-to-weight ratio, corrosion resistance, and machinability. As governments worldwide implement stricter fuel efficiency and emission standards, automakers and aircraft manufacturers are increasingly substituting heavier metals like steel and aluminum with magnesium alloys. This trend is further reinforced by the rising adoption of electric vehicles (EVs), where weight reduction directly improves battery efficiency and driving range, significantly boosting magnesium demand.

Substitution of steel and aluminum with magnesium alloys projected to grow at 6–7% CAGR.

Magnesium Metal Market Restraints:

-

High production costs and limited raw material availability restrict magnesium adoption

A key restraint for the magnesium metal market is the high cost of production and scarcity of high-quality magnesium ores. The extraction and processing of magnesium from sources like dolomite, magnesite, and seawater involve energy-intensive processes, leading to higher manufacturing costs compared to aluminum or steel. Additionally, fluctuations in raw material supply, limited availability of magnesium-rich minerals, and dependence on specific geographic regions for mining increase market vulnerability. These factors make it difficult for manufacturers to scale production efficiently, especially in price-sensitive industries, and can slow market growth despite increasing demand.

Magnesium Metal Market Opportunities:

-

EVs, electronics, and 3D printing create significant growth opportunities for magnesium

A major opportunity lies in the expansion of magnesium metal applications beyond traditional automotive and aerospace sectors. The rising production of electric vehicles, lightweight electronics, laptops, smartphones, and 3D-printed components is driving demand for high-purity magnesium alloys. Advances in alloying technology, casting methods, and surface treatments are improving magnesium’s corrosion resistance and mechanical properties, making it suitable for broader industrial use. Emerging markets in Asia-Pacific, Latin America, and the Middle East are investing heavily in lightweight metal adoption, offering significant growth potential for magnesium manufacturers and suppliers.

Lightweight electronics, laptops, and smartphones may account for nearly 15–20% of magnesium consumption.

Magnesium Metal Market Segmentation Analysis:

-

By Product Type: In 2025, Magnesium Alloys led the market with a share of 46.80%, while Magnesium Compounds is the fastest-growing segment with a CAGR of 7.20%.

-

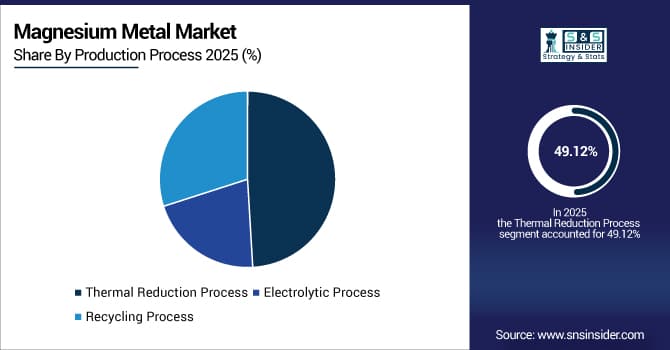

By Production Process: Thermal Reduction Process led the market with a share of 49.12%, while Electrolytic Process is the fastest-growing segment with a CAGR of 6.90%.

-

By Form: In 2025, Ingots led the market with a share of 38.60%, while Sheets & Plates is the fastest-growing segment with a CAGR of 6.70%.

-

By End Use: In 2025, Automotive & Transportation led the market with a share of 44.50%, while Aerospace & Defense is the fastest-growing segment with a CAGR of 7.02%.

By Product Type, Magnesium Alloys Lead Market and Magnesium Compounds Fastest Growth

In 2025, Magnesium alloys dominate the market, due to their lightweight, high strength, and corrosion-resistant properties. They are widely used in automotive, aerospace, and electronics sectors for structural components, contributing to fuel efficiency and performance improvements.

Meanwhile, Magnesium compounds are the fastest-growing segment, driven by rising demand in pharmaceuticals, agriculture, and chemical industries. These compounds are used in fertilizers, additives, and health supplements, fueling rapid growth.

By Production Process, Thermal Reduction Process Leads Market and Electrolytic Process Fastest Growth

In 2025, Thermal Reduction Process dominates, as it is the most established method for large-scale magnesium production. Its cost-effectiveness and widespread industrial adoption ensure continued dominance in output.

Meanwhile, Electrolytic process is the fastest-growing segment, supported by its ability to produce high-purity magnesium efficiently. Growing demand in aerospace, electronics, and specialty applications is driving rapid adoption of electrolytic production methods.

By Form, Ingots led the market and Sheets & Plates fastest growth

In 2025, Ingots dominate market, being the most common form for transport, storage, and industrial use. They are preferred by manufacturers for casting, alloy production, and other downstream applications.

Meanwhile, Sheets & plates are the fastest-growing segment, driven by the automotive and aerospace industries, which increasingly require lightweight, high-strength materials for structural components and body panels. Expansion of lightweight engineering applications accelerates this growth.

By End Use, Automotive & Transportation led the market and Aerospace & Defense is the fastest growth%.

In 2025, Automotive & transportation dominate market, as magnesium alloys and metals are extensively used for lightweight components to improve fuel efficiency and reduce emissions. The sector ensures high-volume, consistent demand.

Meanwhile, Aerospace & defense are the fastest-growing segment, fueled by demand for lightweight, high-strength metals in aircraft, defense equipment, and space applications. Increasing focus on performance optimization, fuel efficiency, and advanced engineering is accelerating magnesium adoption in these industries.

Magnesium Metal Market Regional Analysis:

Asia Pacific Magnesium Metal Market Insights:

The Asia Pacific dominated the Magnesium Metal Market in 2025E, with over 48.16% revenue share, due to extensive production capacities, high demand from automotive, aerospace, electronics, and construction sectors, and abundant availability of raw materials. Rapid industrialization, lightweight material adoption, and increasing use of magnesium in alloys for energy-efficient applications drive growth. Expansion in manufacturing, technological advancements, and integration in green and sustainable industries strengthen market dominance. Rising investments in infrastructure, electronics, and automotive lightweighting further contribute to Asia Pacific’s leading position in the magnesium metal market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China and India Magnesium Metal Market Insights

China and India dominate magnesium metal production and consumption due to rapid industrialization, automotive and aerospace manufacturing, and construction sector growth. Rising adoption of lightweight, corrosion-resistant alloys, along with investments in technology and infrastructure, drives strong market expansion in both countries.

North America Magnesium Metal Market Insights:

The North America region is expected to have the fastest-growing CAGR 6.54%, driven by increasing adoption in automotive lightweighting, aerospace, electronics, and defense industries. Rising demand for corrosion-resistant, lightweight, and high-strength alloys accelerates growth. Technological advancements in magnesium production, recycling initiatives, and R&D investments support expansion. Growing use in electric vehicles, industrial applications, and energy-efficient manufacturing enhances market adoption. Increasing awareness of sustainability, lightweight material benefits, and strategic partnerships with supplier’s further fuel North America’s rapid growth in the magnesium metal market.

U.S. and Canada Magnesium Metal Market Insights

The U.S. and Canada show fast magnesium metal market growth, fueled by demand in automotive lightweighting, aerospace, defense, and electronics industries. Adoption of high-strength, corrosion-resistant alloys, along with recycling initiatives and technological advancements, supports market expansion across manufacturing and industrial applications.

Europe Magnesium Metal Market Insights

Europe maintains steady growth in the magnesium metal market, supported by demand from automotive, aerospace, electronics, and construction industries. Emphasis on lightweight, corrosion-resistant, and high-strength materials drives adoption. Investments in R&D, sustainable production, and magnesium recycling contribute to market expansion. Regulatory support for energy-efficient materials, industrial modernization, and increasing use of magnesium alloys in structural applications further strengthen Europe’s market position in the magnesium metal industry.

Germany and U.K. Magnesium Metal Market Insights

The Germany and the U.K. maintain steady magnesium metal market growth, supported by automotive, aerospace, and industrial demand. Focus on lightweight, durable, and corrosion-resistant materials, combined with sustainable production practices and R&D investments, strengthens adoption and long-term market potential in both countries.

Latin America (LATAM) and Middle East & Africa (MEA) Magnesium Metal Market Insights

Latin America and the Middle East show steady growth in the magnesium metal market, driven by industrialization, automotive production, aerospace, and construction sector expansion. In Latin America, Brazil and Mexico lead adoption, supported by infrastructure development, manufacturing growth, and awareness of lightweight, durable, and corrosion-resistant magnesium materials. In the Middle East, the UAE and Saudi Arabia drive demand through industrial diversification, aerospace applications, and investments in production facilities and technology upgrades. Strategic partnerships, energy-efficient applications, and government initiatives further enhance market potential, positioning both regions as promising markets for magnesium metal in automotive, electronics, and industrial sectors.

Magnesium Metal Market Competitive Landscape:

China Magnesium Corporation is a leading producer of high-purity magnesium metal and alloys, serving automotive, construction, and electronics industries. With vertically integrated operations and strong mining resources, the company ensures stable supply and cost efficiency. Its focus on lightweight materials supports growing demand for energy-efficient vehicles and industrial applications. Continuous technology upgrades and sustainable practices enhance its competitiveness in the global magnesium market.

-

In April 2025, the International Magnesium Association (IMA) and the China Magnesium Association (representing China Magnesium Corporation interests) signed a strategic MOU partnership to share industry data, host seminars, and promote global magnesium innovation and sustainable applications.

Magontec Limited is a global supplier of magnesium alloys and corrosion protection technologies, serving automotive, aerospace, and industrial sectors. The company operates advanced production facilities in Europe and Asia, emphasizing high-quality casting alloys and recycled magnesium. Magontec's strong technical expertise, customer-focused R&D, and commitment to sustainability enable it to meet rising demand for lightweight materials as industries shift toward improved fuel efficiency and performance.

-

In February 2025, Magontec held an Extraordinary General Meeting addressing its shareholder settlement with Qinghai Salt Lake Magnesium Co Ltd (QSLM) as part of ongoing strategic collaboration on magnesium alloy supply, reflecting continued corporate cooperation in the magnesium market.

RIMA Group, based in Brazil, is one of the world’s majors fully integrated magnesium producers, offering primary magnesium, alloys, and related chemical products. With strong control over mining, processing, and refining, RIMA ensures consistent supply and high product quality. The company supports automotive, steel, and electronics industries seeking lightweight, high-strength materials. Its sustainability-driven operations and innovation in magnesium alloys strengthen its role in the global market.

-

In February 2025, RIMA Group strengthened its market presence via a partnership with SIMPAC for high‑purity ferro silicon, renewable energy collaboration with Casa dos Ventos, and maintained ISO 9001, ISO 14001, ISO 45001, IATF 16949 certifications.

Magnesium Metal Market Key Players:

Some of the Magnesium Metal Market Companies

-

China Magnesium Corporation

-

US Magnesium LLC

-

Magontec Limited

-

RIMA Group

-

Timeless Metallurgical

-

Sunstone Metals

-

Dead Sea Magnesium Ltd.

-

AMG Advanced Metallurgical Group

-

Kaiser Aluminum Corporation

-

AE Magnesium Internationale GmbH

-

Henan Jingu Magnesium Industry Co., Ltd.

-

Jiangsu Yongxiang Magnesium Co., Ltd.

-

Magnesium X Energy Corp

-

Nova Magnesium Inc.

-

Valdi Magnesium Ltd.

-

Mg Ingots Ltd.

-

SeAH Magnesium Co., Ltd.

-

Eastern Magnesium Corp

-

Shandong Yuyuan Industrial Co., Ltd.

-

Western Magnesium Corp

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 5.60 Billion |

| Market Size by 2033 | USD 8.57 Billion |

| CAGR | CAGR of 5.47% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Pure Magnesium, Magnesium Alloys, Magnesium Compounds, Powder & Granules) •By Production Process (Thermal Reduction Process, Electrolytic Process, Recycling Process) •By Form (Ingots, Billets, Slabs, Wires, Sheets & Plates) •By End Use (Automotive & Transportation, Steel & Metallurgy, Aerospace & Defense, Construction, Industrial & Machinery, Electronics & Consumer Goods, Energy & Power, Medical & Healthcare, Sustainable Consumer Products) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | China Magnesium Corporation, US Magnesium LLC, Magontec Limited, RIMA Group, Timeless Metallurgical, Sunstone Metals, Dead Sea Magnesium Ltd., AMG Advanced Metallurgical Group, Kaiser Aluminum Corporation, AE Magnesium Internationale GmbH, Henan Jingu Magnesium Industry Co. Ltd., Jiangsu Yongxiang Magnesium Co. Ltd., Magnesium X Energy Corp, Nova Magnesium Inc., Valdi Magnesium Ltd., Mg Ingots Ltd., SeAH Magnesium Co. Ltd., Eastern Magnesium Corp, Shandong Yuyuan Industrial Co. Ltd., and Western Magnesium Corp |