Magnetic and Optical Encoder ICs Market Report Scope & Overview:

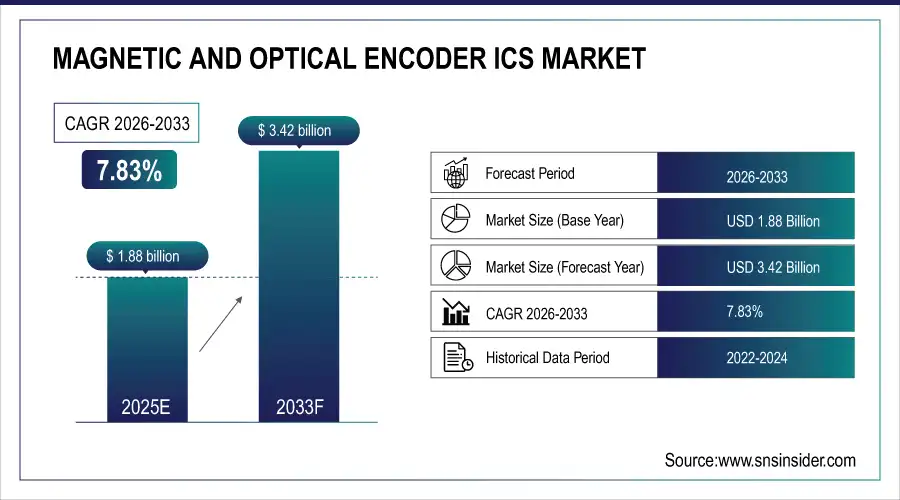

The Magnetic and Optical Encoder ICs Market size was valued at USD 1.88 Billion in 2025E and is projected to reach USD 3.42 Billion by 2033, growing at a CAGR of 7.83% during 2026-2033.

The market is growing due to rising industrial automation, robust demand for precision motion control, and increasing adoption of robotics across manufacturing, logistics, and healthcare. Expanding automotive electronics, EV powertrain systems, and advanced safety technologies further fuel adoption. Miniaturization of encoder ICs, improved resolution, and integration into smart consumer devices also boost market penetration across diverse end-use industries.

Market Size and Forecast:

-

Market Size in 2025E USD 1.88 Billion

-

Market Size by 2033 USD 3.42 Billion

-

CAGR of 7.83% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

To Get more information On Magnetic and Optical Encoder ICs Market - Request Free Sample Report

Key Magnetic and Optical Encoder ICs Market Trends

-

Rapid adoption of industrial automation and smart factories is driving demand for high-precision encoder ICs.

-

Increasing integration of robotics in automotive, electronics, logistics, and healthcare sectors requires advanced motion feedback solutions.

-

Growth of electric vehicles and autonomous transportation is creating demand for encoder-based sensing in motors, batteries, and drive-by-wire systems.

-

Expansion of renewable energy applications, including solar tracking and wind turbine control, boosts the need for robust encoder ICs.

-

Innovations in optical resolution, magnetic-field immunity, and on-chip signal processing are enabling new high-precision applications in medical, laboratory, and semiconductor equipment.

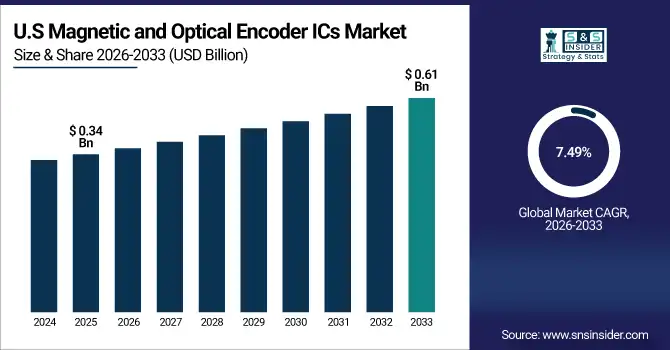

The U.S. Magnetic and Optical Encoder ICs Market size was valued at USD 0.34 Billion in 2025E and is projected to reach USD 0.61 Billion by 2033, growing at a CAGR of 7.49% during 2026-2033. Growth in the U.S. market is driven by strong investments in factory automation, robotics integration, and advanced semiconductor manufacturing. Expanding automotive innovation, aerospace motion-control needs, and rising adoption of high-precision sensing technologies support consistent demand for encoder ICs across industrial and defense sectors.

Magnetic and Optical Encoder ICs Market Growth Drivers:

-

Industrial Automation And Robotics Adoption Drive Global Magnetic And Optical Encoder ICs Market Expansion

The global Magnetic and Optical Encoder ICs market is propelled by the rapid expansion of industrial automation, where factories increasingly depend on precision position and motion-control systems to optimize productivity. Encoder ICs are essential for ensuring accuracy in motors, actuators, conveyors, and CNC machinery, making them foundational components of advanced manufacturing. The growing adoption of robotics across automotive, electronics, logistics, and healthcare industries is also accelerating demand, as encoders enable high-resolution feedback and precise joint movement. Rising penetration of smart factories, supported by Industry 4.0, predictive maintenance, and connected machinery, further stimulates encoder usage.

According to the International Federation of Robotics (IFR), 542,076 industrial robots were installed worldwide in 2024 marking the fourth straight year with more than 500,000 installations annually.

Magnetic and Optical Encoder ICs Market Restraints:

-

High Installation Costs Environmental Sensitivity And Supply Challenges Restrain Global Magnetic And Optical Encoder Market Growth

Market growth is restrained by high installation costs, sensitivity of optical encoders to dust and environmental contaminants, and performance limitations in extreme industrial conditions. Complex integration requirements, increased competition from alternative sensing technologies, and pricing pressure in mass-market applications also pose challenges. Additionally, supply chain disruptions and semiconductor component shortages can delay production and slow global adoption.

Magnetic and Optical Encoder ICs Market Opportunities:

-

Rapid Digitalization Robotics Adoption And Electrified Mobility Create High Value Opportunities For Encoder ICs

Significant opportunities are emerging from the rapid digitalization of manufacturing and the growing shift toward collaborative, service, and mobile robots. As robotics adoption deepens, the need for high-precision feedback solutions with enhanced durability and performance is expected to surge. The transition toward electrified mobility and autonomous transportation opens another high-value opportunity, as EV motors, battery systems, inverters, and drive-by-wire systems require accurate encoder-based sensing. Emerging applications in renewable energy such as solar tracking, wind turbine pitch control, and grid automation create additional demand for robust encoder ICs capable of operating in harsh environmental conditions. Innovations in optical encoder resolution, magnetic-field immunity, and on-chip signal processing will also enable new uses in medical devices, laboratory automation, and semiconductor manufacturing equipment.

Worldwide electric-vehicle (EV) adoption is surging. According to a 2024–2025 forecast, by end of 2025 there will be about 85 million EVs globally in use up strongly from 2024.

Magnetic and Optical Encoder ICs Market Segment Analysis

-

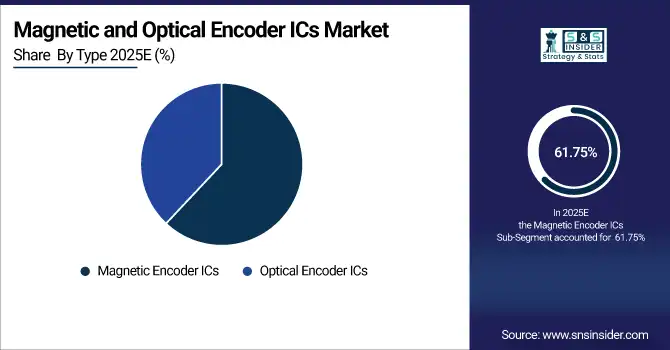

By Type, Magnetic Encoder ICs dominated with 61.75% in 2025E, and Optical Encoder ICs is expected to grow at the fastest CAGR of 8.14% from 2026 to 2033.

-

By Signal Output, Incremental dominated with 56.86% in 2025E, and Absolute is expected to grow at the fastest CAGR of 8.19% from 2026 to 2033.

-

By Application, Industrial Automation dominated with 38.97% in 2025E, and Robotics is expected to grow at the fastest CAGR of 8.41% from 2026 to 2033.

-

By End User, Manufacturing dominated with 37.44% in 2025E, and Electronics & Semiconductor is expected to grow at the fastest CAGR of 8.19% from 2026 to 2033.

By Type, Magnetic Encoder ICs Lead Market While Optical Encoders Drive Future High Precision Automation Growth

Magnetic Encoder ICs dominate the market in 2025E due to their robustness, cost-effectiveness, and strong adoption in industrial motors, automotive systems, and machinery requiring reliable position feedback. Optical Encoder ICs are expected to grow at the fastest pace from 2026–2033 as demand rises for high-resolution, high-precision motion control in robotics, semiconductor tools, and advanced automation environments.

By Signal Output, Incremental Encoders Lead Market While Absolute Encoders Drive Future Growth in High Precision Applications

Incremental encoders dominate in 2025E because of their widespread use in factory machinery, conveyor systems, stepper motors, and general-purpose automation needing simple, cost-efficient feedback. Absolute encoders are expected to grow fastest from 2026–2033 as industries shift toward smarter equipment requiring exact position tracking, improved safety, and higher accuracy particularly in robotics, medical systems, and advanced industrial automation.

By Application, Industrial Automation Dominates Market While Robotics Emerges As Fastest Growing High Precision Encoder Segment

Industrial Automation leads the market in 2025E as manufacturing lines increasingly rely on precise motion control, CNC systems, automated material handling, and smart factory operations. Robotics is expected to grow at the fastest rate from 2026–2033, driven by rapid adoption of industrial robots, collaborative robots, service robots, and autonomous systems needing high-precision encoder ICs for movement, navigation, and joint control.

By End User, Manufacturing Leads Market Growth While Electronics and Semiconductor Drive Future High Precision Encoder Demand

Manufacturing dominates the market in 2025E due to the extensive deployment of automated production lines, robotics, motors, and motion-control systems requiring encoder ICs for accuracy and efficiency. Electronics & Semiconductor is set to grow fastest from 2026–2033 as chip fabrication, display manufacturing, and precision assembly demand high-resolution sensing, miniaturized encoder ICs, and advanced feedback systems for ultra-precise equipment.

Magnetic and Optical Encoder ICs Market Report Analysis

North America Magnetic and Optical Encoder ICs Market Insights

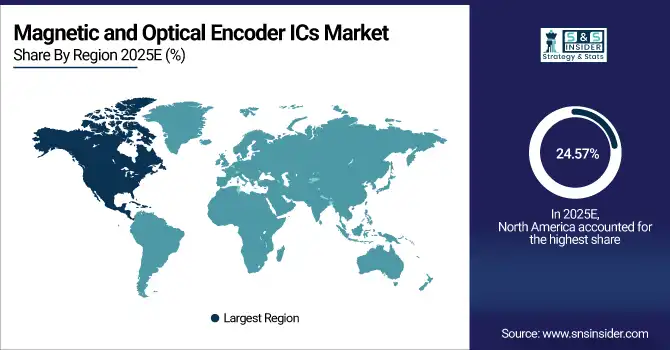

The North American Magnetic and Optical Encoder ICs market holds a 24.57% share in 2025E, driven by advanced industrial automation, robotics adoption, and the growing presence of semiconductor and automotive manufacturing hubs. High investments in smart factories, EV development, aerospace applications, and precision machinery continue to boost demand for reliable, high-performance encoder ICs across manufacturing, electronics, and defense sectors.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Magnetic and Optical Encoder ICs Market Insights

The United States dominates the North American Magnetic and Optical Encoder ICs market, driven by its strong industrial base, advanced robotics and automation adoption, robust semiconductor manufacturing, electric vehicle innovations, and high investments in aerospace, defense, and precision motion-control applications.

Europe Magnetic and Optical Encoder ICs Market Insights

Europe holds a 21.35% share of the Magnetic and Optical Encoder ICs market in 2025E, fueled by advanced industrial automation, robotics deployment, and automotive innovation. Strong investments in smart factories, renewable energy projects, and precision machinery, along with the presence of leading encoder IC manufacturers, support growth across manufacturing, automotive, aerospace, and electronics sectors in the region.

Germany Magnetic and Optical Encoder ICs Market Insights

Germany dominates the European Magnetic and Optical Encoder ICs market, driven by its strong industrial manufacturing base, advanced automation and robotics adoption, leadership in automotive and machinery sectors, and significant investments in precision engineering, smart factories, and high-tech industrial applications.

Asia Pacific Magnetic and Optical Encoder ICs Market Insights

Asia Pacific dominates the Magnetic and Optical Encoder ICs market with a 41.23% share in 2025E and is expected to grow at the fastest CAGR of 8.32% from 2026–2033. Growth is driven by rapid industrial automation, expanding robotics adoption, increasing electric vehicle production, and the rise of smart factories in China, Japan, South Korea, and India. Strong manufacturing infrastructure and technological advancements further fuel market expansion across automotive, electronics, and industrial sectors.

China Magnetic and Optical Encoder ICs Market Insights

China dominates the Asia Pacific Magnetic and Optical Encoder ICs market, driven by its massive industrial base, rapid adoption of automation and robotics, leading electric vehicle production, smart factory initiatives, and strong investments in electronics manufacturing and precision motion-control technologies.

Latin America (LATAM) and Middle East & Africa (MEA) Magnetic and Optical Encoder ICs Market Insights

The Latin America and Middle East & Africa Magnetic and Optical Encoder ICs market is growing steadily, driven by expanding industrial automation, renewable energy projects, and infrastructure development. Key sectors such as automotive, manufacturing, and energy are adopting advanced motion-control and sensing technologies, while investments in robotics, smart factories, and precision machinery further support regional market growth.

Competitive Landscape for Magnetic and Optical Encoder ICs Market:

Broadcom Inc. is a leading global semiconductor company offering a wide range of products, including magnetic and optical encoder ICs, sensors, and connectivity solutions. The company serves industrial automation, automotive, robotics, and data-center markets. Its focus on high-performance, reliable, and precision motion-control components positions Broadcom as a key player in the growing encoder IC market worldwide.

- In March 2024, Broadcom unveiled expanded optical‑interconnect solutions including 200 G/lane DSP & SerDes, 400G optics, and PCIe Gen6‑over‑optics aimed at enabling next‑gen AI clusters.

ams OSRAM, a global leader in sensor and photonics technologies, provides magnetic and optical encoder ICs, optical sensors, and illumination solutions for industrial automation, automotive, robotics, and consumer electronics. The company focuses on high-precision, compact, and energy-efficient components, enabling advanced motion control, position sensing, and feedback applications, making it a prominent player in the global encoder IC market.

- In May 2024, ams OSRAM showcased its latest sensing and illumination solutions including new products under its OSIRE™, EVIYOS™, and SYNIOS™ lines at the Automotive Engineering Exposition 2024 in Yokohama, Japan.

Magnetic and Optical Encoder ICs Market Key Players:

Some of the Magnetic and Optical Encoder ICs Market Companies

- Broadcom Inc.

- AMS OSRAM (formerly AMS AG)

- TE Connectivity

- New Japan Radio Co., Ltd.

- IC-Haus GmbH

- SEIKO NPC Corporation

- RLS d.o.o.

- PREMA Semiconductor GmbH

- Hamamatsu Photonics K.K.

- Texas Instruments Incorporated

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Allegro MicroSystems, LLC

- Honeywell International Inc.

- STMicroelectronics N.V.

- Sensata Technologies Holding plc

- Analog Devices, Inc.

- Melexis NV

- ROHM Semiconductor

- Bourns, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.88 Billion |

| Market Size by 2033 | USD 3.42 Billion |

| CAGR | CAGR of 7.83% From 2026 to 2033 |

| Base Year | 2024 |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Magnetic Encoder ICs, and Optical Encoder ICs) • By Signal Output (Incremental, and Absolute) • By Application (Industrial Automation, Robotics, Automotive, and Consumer Electronics) • By End User (Manufacturing, Electronics & Semiconductor, Automotive & Transportation, and Aerospace & Defense) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Broadcom Inc., AMS OSRAM, TE Connectivity, New Japan Radio Co., Ltd., IC-Haus GmbH, SEIKO NPC Corporation, RLS d.o.o., PREMA Semiconductor GmbH, Hamamatsu Photonics, Texas Instruments, NXP Semiconductors, Infineon Technologies, Allegro MicroSystems, Honeywell International, STMicroelectronics, Sensata Technologies, Analog Devices, Melexis, ROHM Semiconductor, Bourns Inc. |