Magnetic Sensor Market Report Scope And Overview:

The Magnetic Sensor Market Size was valued at USD 4.73 billion in 2023 and is expected to reach USD 9.16 billion by 2032 and grow at a CAGR of 7.65% over the forecast period 2024-2032.

The Magnetic Sensor Market is growing well, with key contributions from nations like Japan, China, the USA, France, Germany, and India. This sensor is being widely utilized in automotive, industrial, consumer electronics, and medical applications. For example, a position sensor such as Infineon Technologies' XENSIV TLI5590-A6W, which came to the market in 2023, for industrial as well as consumer appliances highlighted miniaturization as a focus area and increased performance. Melexis, meanwhile, broadened its MLX9042x series of compact automotive systems with increasing demand for safety and efficiency improvements.

Get E-PDF Sample Report on Magnetic Sensor Market - Request Sample Report

Governments are crucial to determining the market. Policies on the adoption of electric vehicles, such as a subsidy in China and Germany, spur the demand for magnetic sensors applied in battery management and navigation systems. The "Make in India" initiative encourages Indian production of sensor technologies with a focus on reducing dependency on import. Japan and the USA significantly invest in R&D into high-precision sensors applicable in robotics and IoT industries.

Advances in GMR and TMR technologies make technological innovations accessible in electric mobility and data centers. In the industry 4.0 and factory automation domain, the rising trends encourage even greater use of magnetic sensors for robotics and position sensing. Newer prospects would be from harnessing IoT integration and adding on the application fields like medical, which will be using wearable devices to monitor real-time. Innovations in the industry look to gain greater momentum as investments increase by both the public and private sectors worldwide.

MARKET DYNAMICS

KEY DRIVERS:

-

Rising EV Adoption Fuels Demand for Magnetic Sensors in Motor Control and Safety Systems.

The push for the adoption of EVs heavily drives the demand for magnetic sensors, especially in motor control and navigation systems. In China, as of 2023, sales of EVs have increased by more than 50% compared to the previous year, while magnetic sensors are part of the battery management system. Germany's policies to encourage adoption of EVs include substantial subsidies, which has led to a similar increase in Europe. Sensors also ensure accurate measurement and safety in regenerative braking systems. Current governments' drive to lower their respective carbon footprints continues this trend.

-

Magnetic Sensors Drive Innovation in Consumer Electronics, IoT, and Automation

The consumer electronics market, which is worth billions of dollars globally, uses magnetic sensors for purposes such as motion detection and augmented user interfaces. In 2023, more than 65% of new smartphones contained sophisticated sensors for orientation and gaming. Furthermore, the spread of IoT links magnetic sensors to smart homes and wearables. For example, in Japan, sensor-based devices have increased by 20% for automation purposes. All these developments indicate the consumer's need for innovative, efficient technologies.

RESTRAIN:

-

High Production Costs and R&D Challenges Hinder Widespread Adoption of Advanced Magnetic Sensors

Magnetic sensor production involves high costs due to complex semiconductor processes and specialized materials like TMR layers. For small and medium enterprises (SMEs), these costs can be prohibitive. Additionally, while innovations enhance sensor functionality, they require significant R&D investment, often deterring new market entrants. In 2023, production costs for high-end magnetic sensors rose by around 10% due to increasing raw material prices and energy costs, especially in the USA and Europe. These factors may limit wider penetration despite strong demand.

KEY MARKET SEGMENTS

By Type

The Hall Effect Sensor segment accounted for 49% in 2023. The high versatility and cost-effectiveness in automotive speed sensing, industrial machinery, and consumer electronics are reasons for their widespread usage. The sensor is also a core part of electric vehicles because it helps manage the battery, thereby playing a key role in the growing use of regenerative braking.

The fastest-growing segment is Magneto resistive Sensors, which comprises AMR, TMR, and GMR. This segment is estimated to grow at the rate of 8.56% during the period from 2024 to 2032 due to high-precision applications in robotics, navigation, and medical devices. The TMR technology advances are rapidly accelerating with a more sensitive and low-power solution. Squid and Fluxgate Sensors, although niche, play a significant role in scientific and military applications as they can detect ultra-weak magnetic fields.

By End-use Industry

Automotive segment dominated in 2023 with 38% market share because of the increased use of sensors in cars for safety, convenience, and efficiency features such as anti-lock braking systems and electric power steering. The growing electric vehicle market also increases the need for magnetic sensors.

Consumer electronics segment is expected to be the fastest-growing application at an estimated CAGR of 8.43% during 2024-2032, owing to the growing adoption of IoT and smart devices. The application areas of smartphones, wearables, and gaming devices are significantly dependent on magnetic sensors for precise positioning and user interaction. The healthcare industry also opens great opportunities that utilize magnetic sensors in diagnostic equipment and wearable health monitoring devices, driven by the demand for non-invasive and real-time medical solutions.

REGIONAL ANALYSIS

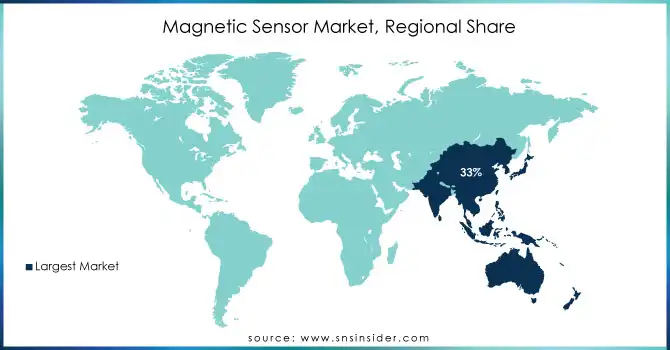

In 2023, North America led the way with 34% of the market, due to huge advancements in automotive technologies and strong investments in industrial automation and aerospace applications. The focus of the region on R&D has also increased demand for high-precision magnetic sensors leading to growth of Magnetic Sensor Market.

Asia Pacific is expected to grow the fastest with a CAGR of 8.73% from 2024 to 2032, driven by rapid industrialization, growing consumer electronics markets, and government policies promoting the adoption of EVs in countries such as China, Japan, and India. The region has a strong base of semiconductor manufacturing, which adds further competitiveness to its profile and positions it as the key growth driver for Magnetic Sensor Market.

KEY PLAYERS

Some of the major players in the Magnetic Sensor Market are

-

Infineon Technologies (Hall-effect sensors, current sensors)

-

Honeywell International (magnetoresistive sensors, Hall-effect sensors)

-

NXP Semiconductors (magnetic position sensors, speed sensors)

-

STMicroelectronics (3D magnetometer sensors, Hall-effect ICs)

-

Texas Instruments (proximity sensors, magnetic position sensors)

-

Allegro MicroSystems (linear magnetic sensors, current sensors)

-

Crocus Technology (TMR sensors, MRAM solutions)

-

Analog Devices (magnetic position sensors, angular sensors)

-

TE Connectivity (magnetic rotary encoders, Hall-effect switches)

-

TDK Corporation (TMR sensors, inductor products)

-

Murata Manufacturing (MEMS sensors, magnetic components)

-

Melexis NV (automotive magnetic sensors, temperature sensors)

-

NVE Corporation (GMR sensors, isolators)

-

Omron Corporation (Hall-effect switches, MEMS-based sensors)

-

Sony Semiconductor Solutions (image sensors, magnetic MEMS)

-

QST Corporation (3D magnetometer, motion sensors)

-

Panasonic Corporation (magnetic proximity sensors, optical sensors)

-

Robert Bosch GmbH (automotive Hall-effect sensors, MEMS solutions)

-

AMS OSRAM (magnetic position sensors, light sensors)

-

Sensitec GmbH (GMR sensors, AMR sensors)

MAJOR SUPPLIERS (Components, Technologies)

-

Hitachi Metals

-

Shin-Etsu Chemical Co.

-

Nippon Steel Corporation

-

VacuumSchmelze GmbH

-

Tosoh Corporation

-

BASF SE

-

LG Chem

-

3M Company

-

Dow Inc.

-

ArcelorMittal

MAJOR CLIENTS

-

Hitachi Metals

-

Shin-Etsu Chemical Co.

-

Nippon Steel Corporation

-

VacuumSchmelze GmbH

-

Tosoh Corporation

-

BASF SE

-

LG Chem

-

3M Company

-

Dow Inc.

-

ArcelorMittal

Get Customized Report as Per Your Business Requirement - Request For Customized Report

RECENT TRENDS

November 2024: Infineon is finally unveiling of a gaming controller built on its PSoC 6 microcontroller system-on-chip platform, intended to be used as a showcase for its XENSIV magnetic switches and joysticks. "The XENSIV Bluetooth game controller integrates advanced Infineon products in an innovative design," the company boasts of its handiwork.

August 2024: TDK has been developing the ultra-sensitive magnetic sensor component sensitive enough to measure the minuscule biomagnetic field. In 2024, the company was able to measure cardiac activity outside a magnetically shield room using this ultra-sensitive magnetic sensor.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.73 Billion |

| Market Size by 2032 | US$ 9.16 Billion |

| CAGR | CAGR of 7.65 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Magneto resistive Sensor (Anisotropic Magnetoresistance (AMR), Tunnel Magnetoresistance (TMR), Giant Magnetoresistance (GMR)), Hall Effect Sensor, Squid Sensor, and Fluxgate Sensor), • By Range (Less than 1 Micro Gauss, 1 Micro Gauss-10 Gauss, More than 10 Gauss), • By Application (Navigation & Electronic Compass, Position Sensing, Speed Sensing, Proximity Detection, Flow Rate Sensing, and Others), • By End-Use Industry (Consumer Electronics, Transportation, BFSI, Aerospace & Defense, Automotive, Healthcare, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Infineon Technologies, Honeywell International, NXP Semiconductors, STMicroelectronics, Texas Instruments, Allegro MicroSystems, Crocus Technology, Analog Devices, TE Connectivity, TDK Corporation, Murata Manufacturing, Melexis NV, NVE Corporation, Omron Corporation, Sony Semiconductor Solutions, QST Corporation, Panasonic Corporation, Robert Bosch GmbH, AMS OSRAM, Sensitec GmbH. |

| Key Drivers | • Rising EV Adoption Fuels Demand for Magnetic Sensors in Motor Control and Safety Systems. • Magnetic Sensors Drive Innovation in Consumer Electronics, IoT, and Automation |

| Restraints | • High Production Costs and R&D Challenges Hinder Widespread Adoption of Advanced Magnetic Sensors |