Magnetic Separator Market Report Scope & Overview:

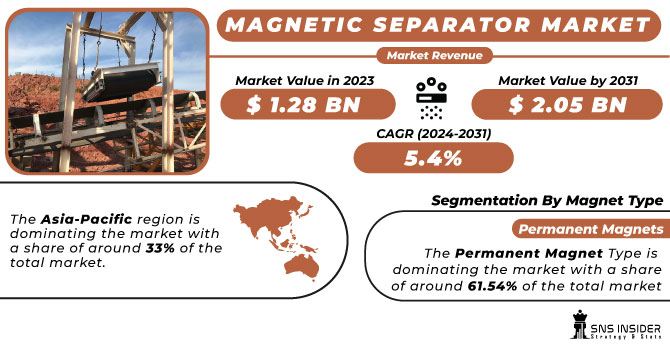

The Magnetic Separator Market size was valued at USD 1.28 Billion in 2023 and is now anticipated to grow to USD 2.05 Billion by 2031, displaying a compound annual growth rate (CAGR) of 5.4% during the forecast Period 2024 - 2031.

The magnetic separator market is growing at a significant rate due to factors like rising industrial expansion, growing demand for high-quality products, rigorous regulations, technical improvements, and expanding applications which in turn increases the demand for magnetic separators.

Get More Information on Magnetic Separator Market - Request Sample Report

Also, the magnetic separator market is expanding due to positive reviews from various end-use industries like food and waste disposal. Globalization and urbanization in developing countries throughout the globe are also helping in the expansion of the magnetic separator market. Demand for sanitary food, pharmaceuticals, and beverages is rapidly increasing throughout the globe which is supporting the magnetic separator market., the government is also empowering to boost the recycling sector will help drive the demand for magnetic separators. These driving factors are helping in the growth of the magnetic separator market.

Market Dynamics

Drivers

-

Growing focus on resource recovery, recycling, and sustainability is driving the demand for the market.

Strict environmental regulations and the growing importance of sustainability are driving the demand for Magnetic separators which can effectively separate ferrous metal from waste, which is enabling the recovery of material and reducing reliance on direct extraction of resources from nature.

-

Growing focus on circular economy emphasizing minimizing waste and maximizing resource recovery driving the growth of the magnetic separator market.

Restraints

-

The complexity of choosing the right separator makes it a restraint for growth.

Selection of an appropriate magnetic separator for a specific application can be complex and requires consideration of factors like feeding material properties, separation size, and capacity. This complexity can be a restraint for companies unfamiliar with magnetic separation technology which may lead to inefficiencies or poor performance.

-

Lack of standardized design and key performance indicators for magnetic separators can be a restraint in implementing existing processing lines.

Opportunities

-

Rising demand from emerging countries creates opportunities for magnetic separator manufacturers to fill the growing demand for waste management and recycling in these economies.

-

Integration of Artificial Intelligence & Machine Learning with separators thereby creating opportunities for predictive maintenance & process optimization.

Challenges

-

Competition from existing separation technologies (like filtration, centrifugation, and classification) can be a challenge in the market's growth.

-

Designing magnetic separators that can handle the physical properties of different materials at the same time integrating with existing process lines can be challenging.

Impact of Russia-Ukraine War

The Russia-Ukraine war heavily impacted the magnetic separator market. It impacted both supply and demand of the magnetic separator. Logistical problems are led to shortages of equipment’s required for the manufacturing, causing delays and raising equipment costs. Companies may also find alternative source for suppliers, impacting quality or delivery times. The war will make a temporary dip in demand. Economic instability could affect specific sectors that rely on magnetic separators which could further decrease demand. But, on the other side, the war may encourage some countries in prioritizing domestic manufacturing of magnetic separators. This might create long-term opportunities for local manufacturers establishment of production capabilities might take some time.

Impact of Economic Slowdown

Economic slowdowns have a huge impact on magnetic separator market. It is impacting both the demand and growth of the market. with, tighter budgets and delayed capital projects can lead to a decline in demand for magnetic separators. Also, some sectors might prioritize their investments in recycling or resource efficiency during this slowdown. However, the economic slowdown can also create opportunity for magnetic separators by offering environmental and economic advantages in helping material recovery and purification. Moreover, companies might shift towards maintaining and upgrading existing magnetic separators instead of buying new ones. The economic slowdowns could also lead to merging & acquisition within the market, with smaller manufacturers being acquired by larger manufacturers reshaping the market landscape and potentially lead to more efficient and innovative magnetic separator designs in the long run.

Key Market Segmentation

By Type

-

Equipment

-

Drum

-

Roller

-

Overband

-

Eddy Current Separators

-

-

Standalone Magnetic Separators

-

Bars & Rods

-

Plate

-

Grates

-

Drawers

-

Pulleys

-

Filters

-

Chute& Humps

-

Others

-

By Magnet Type

-

Electromagnets

-

Permanent Magnets

The Permanent Magnet Type is dominating the market with a share of around 61.54% of the total market. They do not need a continuous supply of electricity to maintain magnetic fields, so in case of a failure of power supply, the magnets will still work. Permanent magnets are less expensive, lightweight, and maintenance-free compared to electromagnets. Also, they offer advantages like a strong magnetic force, long service life and convenient installation.

By Cleaning Type

-

Manual

-

Automatic

The Automatic Cleaning Type is dominating the segment and might remain dominant. They avoid the requirement of manual cleaning of magnetic separators and which in fact increases the efficiency of the production processes. They are safer as compared to manual cleaning types as the metal contaminants are removed automatically.

By Industry

-

Recycling

-

Mining

-

Chemical & Pharmaceutical

-

Ceramics, Paper, and Plastics

-

Food & Beverages

-

Glass & Textile

-

Others

Regional Analysis

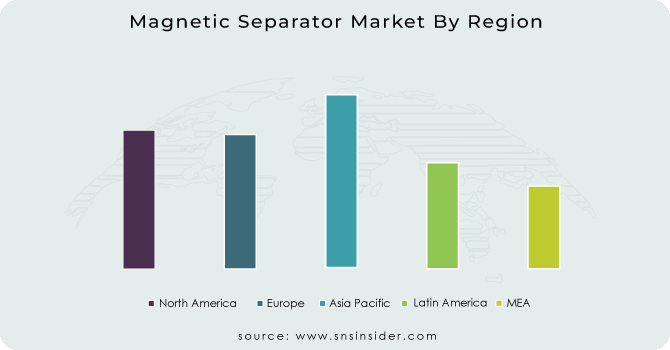

The Asia-Pacific region is dominating the market with a share of around 33% of the total market. The reason for its dominance is because of growing demand for hygienic packaged foods, pharmaceuticals, beverages, and the increasing reuse & recycling of products. As a result, there are many magnetic separator manufacturers across the region.

North America is the fastest growing region next to Asia-Pacific because of the ongoing technological advancements in the region.

Need any customization research on Magnetic Separator Market - Enquiry Now

Regional Outlook

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major players are Henan Caesar Heavy Machinery Co. Ltd, GIAMAG Technologies AS, Eclipse Magnetics, Malvern Engineering, Permanent Magnets, Nippon magnetics, Bunting Magnetics, Eriez Manufacturing Co, industrial Magnetics, STEINERT Elektromagnetbau GmbH and others.

Henan Caesar Heavy Machinery Co. Ltd-Company Financial Analysis

Recent Developments

-

In January 2023, Vermeer launched the newly developed Vermeer CS3500 contaminant separator, which will be used to minimize the amount of labor required for organic material recycling. It includes shaker tables, grizzly screens, vacuums, an air manifold, a magnetic pulley, and vacuum pumps to remove different types of contaminants. Recycling operations are reported to produce high quantities of quality compost and mulch with CS3500.

-

In March 2023, Wardell Armstrong acquired a Bunting WHIMS and became one of the world's leading mining and mineral processing consultancies. Wardell Armstrong has increased its testing and research capabilities at Truro with the acquisition of the laboratory WHIMS.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.28 Billion |

| Market Size by 2031 | US$ 2.05 Billion |

| CAGR | CAGR of 5.4 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Equipment Type, Drum, Roller, Overband, Eddy Current Separators) • By Magnet Type (Electromagnets, Permanent Magnets) • By Material Type (Wet, Dry) • By Industry (Recycling, Mining, Chemical & Pharmaceutical, Ceramics, Paper, And Plastics, Food & Beverages, Glass & Textile, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henan Caesar Heavy Machinery Co. Ltd, GIAMAG Technologies AS, Eclipse Magnetics, Malvern Engineering, Permanent Magnets, Nippon magnetics, Bunting Magnetics, Eriez Manufacturing Co, industrial Magnetics, STEINERT Elektromagnetbau GmbH |

| Key Drivers | • Growing focus on resource recovery, recycling, and sustainability is driving the demand for the market. • Growing focus on circular economy emphasizing minimizing waste and maximizing resource recovery driving the growth of the magnetic separator market. |

| Restraints | • The complexity of choosing the right separator makes it a restraint for growth. • Lack of standardized design and key performance indicators for magnetic separators can be a restraint in implementing existing processing lines. |