Big Data and Business Analytics Market Report Scope & Overview:

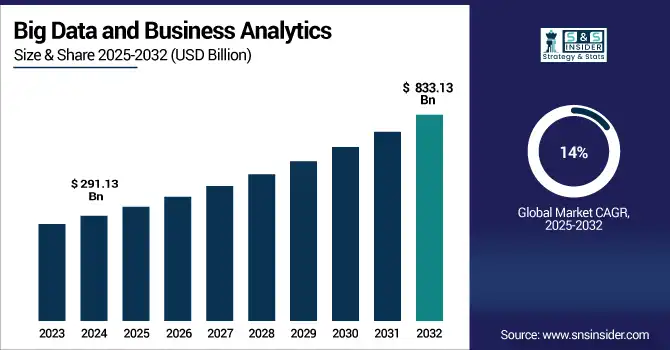

The Big Data and Business Analytics Market Size was valued at USD 291.13 billion in 2024 and is expected to reach USD 833.13 billion by 2032, growing at a CAGR of 14% over the forecast period of 2025-2032.

To Get more information on Big Data and Business Analytics - Request Free Sample Report

The Big Data and Business Analytics Market is experiencing robust global growth, with the Middle East & Africa and Latin America emerging as key regions. The Middle East & Africa and Latin America witnessed a rapid growth stage for the market. In MEA, the demand for analytics in Port, Oil and Gas, logistics, and Government will be driven by increasing digitisation across all sectors, investments around smart cities, and AI adoption. On the other hand, there are, Latin America is adopting more in response to banking, retail, and telecom, although the region is adjusting due to Internet-related penetration and mobile penetration. Both regions are building their digital infrastructure, as the demand for data-driven decisions is rising, so they will be a great part of future market growth.

According to resources, In 2024, Latin America's e-commerce grew 25% YoY, driven by behavioural analytics, while over 30% of UAE government services adopted AI for real-time decisions. Additionally, 45% of MEA and LATAM enterprises shifted to cloud-based analytics platforms.

The U.S Big Data and Business Analytics Market reached USD 79.97 billion in 2024 and is expected to reach USD 209.77 billion in 2032 at a CAGR of 12.81% from 2025 to 2032.

The U.S. leads the North American market because of its sophisticated IT infrastructure, extensive adoption of cloud, and early adoption of AI and machine learning technologies in most industries. High prevalence of top analytics companies, robust government and business investment in digital transformation, and a high data-driven culture reinforcement further establish leadership. Finance, healthcare, retail, and manufacturing top sectors continue to spearhead analytics innovation and demand.

Big Data and Business Analytics Market Dynamics

Drivers:

-

Increasing Data Generation Across Industries Due to Digitization and IoT Adoption Drives Market Expansion.

The growing transactional data creation through digital transformation, Internet of Things devices, and connected infrastructure is fuelling the increasing uptake of big data and business analytics across industries. Organisations are using data analytics for insights, better decision-making, and a competitive edge. There is strong indication for investment in real-time analytics from recent developments, with companies increasingly looking for solutions to enter unstructured data from Twitter, Facebook, mobile applications, and connected devices.

For example, in 2024, more than 60 % of the global enterprises incorporated advanced analytics platforms in an attempt to improve operational function and customer experience.

Restraints:

-

High Cost of Implementation and Data Integration Complexity Restrain Market Adoption Among Small Enterprises

High capital requirements for big data infrastructure, personnel, and integration with legacy systems remain considerable restraints, despite increasing demand. SMEs face stringent budget restrictions and a deficit of technical resources, which in turn hinders their ability to build and scale analytics solutions. In addition, bringing together different types of data from various sources introduces problems of data quality, consistency governance. The result is a more extended cycle for getting the deployment up and running, leading to excess costs for keeping the orchestration and its surrounding services going.

Opportunities:

-

Rising Adoption of Cloud-Based Analytics Solutions Among Enterprises Creates Significant Growth Potential.

The multi-pronged shift presents a rich opportunity for vendor and enterprise alike, and the increase in cloud-based analytics platforms presents a unique set of challenges. Key Big Data and Business Analytics Market Trends include the adoption of cloud-based platforms and real-time analytics integration. Important changes have unfolded recently that show an increase in demand for DaaS and AaaS models, especially in the world of mid-sized enterprises and start-ups. Big Data and Business Analytics Market Companies such as AWS, Google Cloud, and Microsoft Azure expanded their analytics, powered by AI and ML.

Challenges:

-

Shortage of Skilled Workforce in Data Science and Analytics Limits Adoption and Effective Utilisation.

One of the most pressing challenges facing the industry is the ongoing scarcity of talent with data science, machine learning, and business analytics skills. Organisations battle with finding and keeping qualified personnel who can adequately manage elaborate data environments and unlock valuable insights. The increasing number of tools for big data problems, which are developing rapidly, leads to increasing demand for big data professionals working with multiple tools like Hadoop, Python, R, and Spark, while their supply becomes rare.

Big Data and Business Analytics Market Segment Analysis

By Component

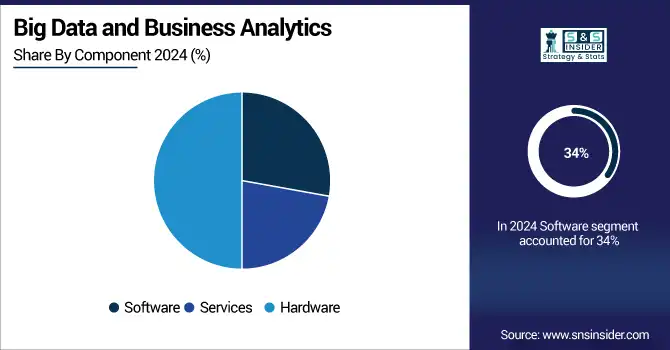

In 2024, the software segment continues to hold the largest revenue of 34% as demand rises for sophisticated data processing and real-time analytics solutions. Increased use of real-time analytics instruments to improve decision-making and business performance. Enterprises like Oracle and SAP have developed scalable tools that address how to effectively manage and analyse massive data sets.

The services segment is experiencing significant growth, with a CAGR of 14.8%. This growth is due to the increased need for consulting, system integration, and support services for the implementation and management of big data and analytics solutions. As companies crave the experience, they recognize they need help navigating the all-too-complicated big data technologies to maximize performance and their return on investment.

By Deployment Model

Cloud deployment model is the market leader, capturing 57.34% of revenue share in 2024. Cloud-based Big Data and Business Analytics Solutions are increasingly favored for their scalability and lower costs. Cloud solutions' scalability, flexibility, and cost savings have made them popular across a range of industries. Cloud platforms allow companies to consume and analyse vast amounts of data without a huge upfront investment in infrastructure, enabling real-time insights and decision-making.

The on-premise deployment model is expected to grow at the fastest CAGR of 14.6%. This expansion is fueled by the needs of enterprises that must meet robust data security and compliance obligations, like those operating in healthcare and financial industries. Increasing demand by industries with strict regulatory requirements for improved data privacy, protection, and control. For businesses dealing with sensitive information, the ability to fine-tune access to data and systems is key, and on-premises solutions deliver that.

By Organization Size

The Large Enterprise segment represents the largest Big Data and Business Analytics Market share at 67% in 2024, due to large budgets and the requirement of handling huge quantities of data. with a focus on investing in advanced analytics to improve efficiencies and remain competitive. These organizations invest massive amounts of funds in big data and analytics to optimize their operations, improve customer experience, and achieve a competitive advantage.

The SME segment is likely to see fastest growth, with a CAGR of 10.5%. Increased cloud adoption and low-cost analytics solutions designed for small businesses. The growing affordability and availability of big data and analytics solutions, especially cloud-based solutions, allow SMEs to use data-driven insights for business growth and competitiveness.

By Application

Customer analytics is the top application segment, with a 26.61% revenue share in 2024. Increasing need for personalization and predictive analysis to maximize customer interaction. Companies leverage customer analytics to gain insight into consumer behaviour, tastes, and trends, facilitating one-to-one marketing and enriched customer experiences.

The Risk and Credit Analytics is expected to grow highest with this segment growing at a CAGR of 15.4%. Rising complexities in business processes, coupled with a high need for risk management strategies, are expected to fuel the risk and credit analytics market. Advanced analytics help organizations in reducing deterrents, ensuring correct decisions when it comes to credit.

By End User

In 2024, the retail segment is dominated by retail with a revenue share of 24.41%. They gain the benefits of big data and analytics to improve their inventory management, personalize customer experience, and make their supply chain efficient. Using analytics in retail to drive sales and customer satisfaction. Increased emphasis on omnichannel and real-time consumer behaviour tracking.

The healthcare segment is predicted to grow at a CAGR of 15.09%. Analytical advancements enabling predictive diagnostics and providing patient-centric care, thereby increasing its demand. Big data and analytics are becoming more common in healthcare, enabling providers to deliver higher-quality patient care, better operational efficiency, and even research breakthroughs. Analytics allow healthcare providers to make data-based decisions for improved health outcomes and cost reductions.

Regional Analysis

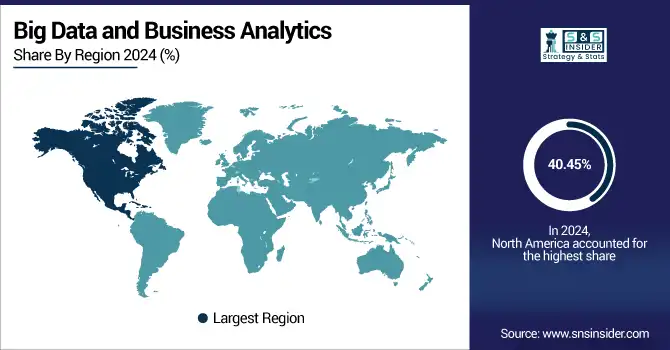

North America shares the largest market of 40.45% of the Big Data and Business analytics Market in 2024. This region has a mature digital ecosystem, accelerated cloud adoption, and demands from sectors such as BFSI, healthcare, and retail. The market is growing significantly due to the advanced analytical platforms and early adoption of AI and machine learning tools.

The United States is the dominant country in this region due to its tech ecosystem, its mega-investments in data analytics, and legacy companies like IBM, Microsoft, and Oracle.

Europe depicts consistent growth in the market with the help of stringent data privacy legislation, a robust manufacturing foundation, and higher demand for data-centric business strategies. The nations of the region are increasingly spending on digital transformation across industries such as banking, retail, and public administration.

Germany leading nation of this region, propelled by its developed manufacturing sector and extensive use of Industry 4.0 solutions through big data analytics.

Asia Pacific is expected to lead the Big Data and Business Analytics Market Growth, with a CAGR of 15.19%. Industrialisation, growth in e-commerce, and digital initiatives by the government are driving market growth. The growing adoption of analytics in China and India is one of the major growth drivers.

China leads the region because of its expanding tech infrastructure, huge population base that creates enormous datasets, and government backing for AI and big data initiatives.

Middle East & Africa and Latin America are emerging in the analytics sector because of increased digitization across industries such as oil and gas, logistics, government, banking, retail, and telecom. Smart city initiatives, adoption of AI, expansion of internet penetration, and the need for data-driven decision-making are propelling market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major key players for the Big Data and Business Analytics Market are SAP SE, Amazon Web Services, Inc., SAS Institute Inc., IBM Corporation, Microsoft Corporation, TIBCO Software Inc., Teradata Corporation, Oracle Corporation, Hewlett Packard Enterprise Development LP, Fair Isaac Corporation and others.

Key Developments:

-

In April 2025, Hewlett Packard Enterprise (HPE) partnered with the Olivia Newton-John Cancer Research Institute to deploy advanced data analytics and AI technologies, aiming to accelerate cancer research and improve personalised treatment approaches.

-

In April 2025, Teradata unveiled enhanced capabilities for its ClearScape Analytics platform, designed to help enterprises optimize AI/ML investments, streamline workflows, and boost overall analytics productivity.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 291.93 Billion |

| Market Size by 2032 | USD 833.13 Billion |

| CAGR | CAGR of 14% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Hardware, Software, Services) •By Deployment Model (On-premises, Cloud) •By Organization Size (SME, Large Enterprises) •By Application (Customer Analytics, Pricing Analytics, Spatial Analytics, Supply Chain Analytics, Workforce Analytics, Risk and Credit Analytics, Transportation Analytics, Others) •By End-user (BFSI, Healthcare, Retail, IT & Telecom, Government & Public Sector, Manufacturing, Media & Entertainment, Energy & Utilities, Transportation & Logistics, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | SAP SE, Amazon Web Services, Inc., SAS Institute Inc., IBM Corporation, Microsoft Corporation, TIBCO Software Inc., Teradata Corporation, Oracle Corporation, Hewlett Packard Enterprise Development LP, Fair Isaac Corporation. |