Mechanically Separated Meat Market Report Scope And Overview:

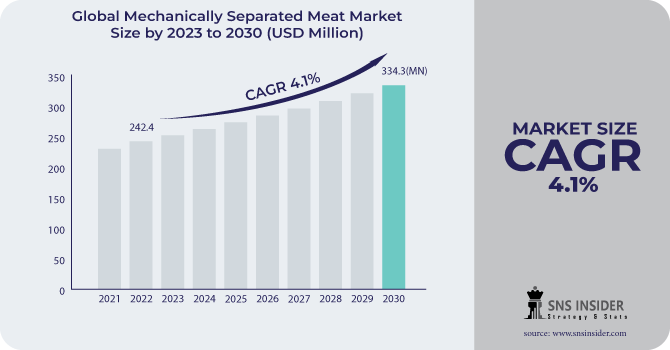

The Mechanically Separated Meat Market size was USD 242.4 million in 2022 and is expected to Reach USD 334.3 million by 2030 and grow at a CAGR of 4.1% over the forecast period of 2023-2030.

Mechanically separated meat (MSM) is a paste-like meat product made by passing pureed or ground beef, hog, mutton, turkey, or chicken through a sieve or similar device under high pressure to remove the edible flesh tissue from the bone. It is frequently referred to as white slime as an analogy to meat-additive pink slime and meat retrieved by modern meat recovery systems, which are both distinct processes.

Based on type, the market is segmented into poultry, beef, and pork. The poultry segment, which is presently valued at USD 145.9 Mn, is predicted to have a market value share of 62% in 2032. This is because mechanically separated poultry is less expensive to produce than beef and pork. Because of its perceived health benefits, poultry is becoming a more popular meat choice among consumers.

MARKET DYNAMICS

KEY DRIVERS

-

Rising demand for value-added MSM products

MSM product is high in protein and other nutrients and low in fat content. Value-added MSM products are more enticing to consumers than standard MSM products, which are frequently utilized as filler additives. The shifting dietary patterns of consumers are driving the demand for value-added MSM products. Consumers are increasingly looking for quick and inexpensive dining options. MSM products with added value can be utilized to make a variety of easy and economical meals, such as burgers, meatballs, and sausages. MSM is used in several recipes in many ethnic cuisines, including Asian and Latin American cuisines. As these cuisines gain popularity, so does the demand for MSM products.

-

Increasing demand for processed meats

RESTRAIN

-

Stringent government regulations

MSM is frequently associated with food safety concerns. MSM can be contaminated with bone fragments and other foreign matter, which can endanger customers' health. Another reason for the stringent rules is that MSM is occasionally made from low-quality beef trimmings. This can result in MSM products with lesser nutritional value and greater fat and cholesterol levels. Some governments have set severe limitations on the manufacturing and usage of MSM. These requirements can make MSM manufacturers' operations complex and costlier.

OPPORTUNITY

-

Market expansion of MSM in the application sector

MSM can be used to make strong and long-lasting adhesives and binders. These adhesives and binders have numerous industrial applications, including building, manufacturing, and packaging. MSM can be utilized to make moisturizing and anti-aging cosmetics and personal care products. Some sunscreens contain MSM to help protect the skin from damaging UV radiation. MSM is also being studied for its potential use in a variety of other industrial applications, including bioplastics, fire retardants, and metalworking lubricants. Furthermore, mechanically separated meat research and development activities boost growth during the projection period.

CHALLENGES

-

Negative consumer perception of MSM

Some customers are concerned about MSM's safety and quality. They consider MSM to be a low-quality beef product manufactured from discarded scraps and trimmings. MSM is frequently used as a filler in processed meats. As a result, people may feel that MSM is a low-quality component that should not be consumed. Another consideration is that MSM is extracted mechanically from meat, bones, and other connective tissue. This method can occasionally produce meat contaminated with bone pieces and other extraneous materials. This could harm MSM's reputation even worse.

-

Competition from other meat products

IMPACT OF RUSSIA UKRAINE WAR

The war between Russia and Ukraine had a substantial influence on the market for mechanically separated meat (MSM). Because Russia and Ukraine are key producers of MSM, the war has interrupted the worldwide supply chain. This disruption is anticipated to raise MSM pricing and reduce MSM product availability. According to a United Nations Food and Agriculture Organization estimate, Russia and Ukraine account for 28% of global pork exports and 16% of global poultry exports. According to the IMS, the Russia-Ukraine conflict might lower worldwide MSM production by 10%.

IMPACT OF ONGOING RECESSION

The global mechanically separated meat (MSM) market has grown in importance as a result of the recession. Because MSM is a crucial ingredient in many processed meats, a decrease in demand for processed meats may result in a decrease in demand for MSM. In 2023, global MSM consumption is predicted to fall by 2.5%. This is due to a variety of issues such as decreased consumer expenditure, rising prices, and supply chain disruptions. MSM shipments from major producers such as the United States and Brazil are predicted to fall by 10% in 2023.

MARKET SEGMENTATION

By Type

-

Poultry

-

Beef

-

Pork

By Form

-

Frozen

-

Fresh

By Application

-

Foodservice

-

Retail Stores

-

Industrial

.png)

REGIONAL ANALYSIS

The Europe region dominate the MSM market in 2022. This expansion is being spurred by the region's increased demand for halal and kosher meat products. Germany now has a larger market value than the rest of the European Union ($13.97 million), but Russia is expected to climb rapidly in the coming years.

The North American MSM market is estimated to have a 29% market share during the forecast period. This expansion is being spurred by the region's increased demand for processed meats. North America holds a major chunk of the mechanically separated meat industry, with the United States currently possessing 88.7% of the global market.

The Asia-Pacific MSM market is estimated to have a 16% market share during the forecast period. This expansion is being driven by increasing demand for processed meats in developing countries such as India and China. China has the most valuable property in East Asia, with an estimated value of US$ 18.25 million; it is expected to grow at a CAGR of 6.5% to USD 34.35 million by 2032.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Mechanically Separated Meat Market are Belwood Foods, Damaco Group, Tyson Foods, Inc., Favid, DTS Meat Processing NV, J.A. ter Maten B.V., Polskamp Meat Industry, Terranova Foods, Valmeat, Krak-Tol Meat Deboning Plant, Trinity GMBH, and other key players.

Belwood Foods-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023, Marcos extended tariff reductions on deboned poultry meat till 2024. Following the signing of Executive Order (EO) 13 by President Marcos, importers of meat will benefit from an extended reduced rate of tariffs on mechanically deboned meat (MDM) of chicken and turkey for an additional two years.

| Report Attributes | Details |

| Market Size in 2022 | US$ 242.4 Million |

| Market Size by 2030 | US$ 334.3 Million |

| CAGR | CAGR of 4.1 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Poultry, Beef, Pork) • By Form (Frozen, Fresh) • By Application (Foodservice, Retail, and Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Belwood Foods, Damaco Group, Tyson Foods, Inc., Favid, DTS Meat Processing NV, J.A. ter Maten B.V., Polskamp Meat Industry, Terranova Foods, Valmeat, Krak-Tol Meat Deboning Plant, Trinity GMBH |

| Key Drivers | • Rising demand for value-added MSM products • Increasing demand for processed meats |

| Market Opportunity | • Market expansion of MSM in the application sector |