Medical Coding Market Report Scope & Overview:

Get more information on Medical Coding Market - Request Sample Report

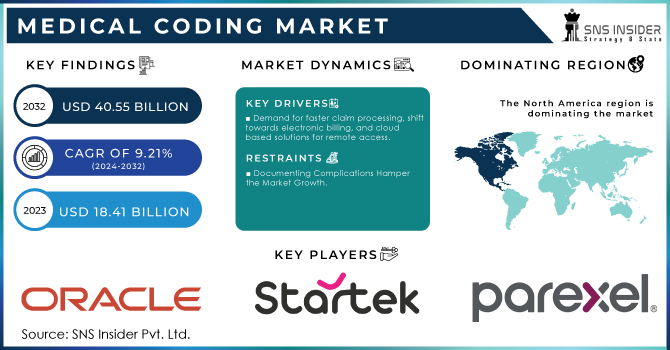

The Medical Coding Market, valued at USD 18.41 billion in 2023, is anticipated to achieve a valuation of USD 40.55 billion by 2032, experiencing a compound annual growth rate of 9.21% over the forecast from 2024 to 2032.

The medical coding market is booming due to the advancements in healthcare infrastructure and increasing demand for accurate medical billing. The global need for medical coders has been spurred by the digitalization of both these things. This trend is likely to endure as governments spend on hospitals and research facilities up to snuff.

A key driver for medical coding market growth is the increase in hospital admissions. In 2024, there have already been about 34 million admissions in the US alone. This surge leads to the requirement of great medical coders for effective billing.

Increased efficiencies in coding and billing solutions are another element of contributing to growth. The Association of American Medical Colleges states that the population is getting older because more people are living longer. In response to this increasing demand, the Bureau of Labor Statistics observes an 8% uptick in medical records and health information technician jobs through 2032.

This is an important part of providing standardization across healthcare facilities but also shows how medical coding can solve the problem. This enables the administrators to examine how well treatments work and how often they need them, a vital task in large institutions. Developments within coding software mean that functionality is becoming greater. Amazon Web Services launched a service that uses AI to autogenerate clinical documentation to speed up the coding process.

While these four sub-markets have doubled in value over the last 12 months, several major players are taking advantage by introducing innovative new solutions. One example of these advancements is CorroHealth's PULSE platform, which was built to automate coding and accelerate revenue recovery for health organizations. There's also a rise in investment within the medical billing and coding software space, including companies like CodaMetrix becoming funded to create AI frameworks that support self-driving systems for medical coding.

The medical coding market is growing majorly due to increased demand from hospitals, stand-alone diagnostic centers, and physicians’ clinics seeking cost-effective billing procedures with faster turnaround times through competency in ICD codes so that they can focus on improving patient satisfaction. Despite being faced with challenges relating to regulation changes and data security, the general trajectory of the medical coding market boasts a positive outlook for years ahead.

MARKET DYNAMICS

Drivers

-

Demand for faster claim processing, shift towards electronic billing, and cloud-based solutions for remote access

Increased prevalence of chronic diseases and the geriatric population is responsible for driving demand for sophisticated medical billing systems as more people rely on regular checkups and treatment, the need for a reliable billing system is increasing. Billing systems should be configured to facilitate the creation of claims and reduce denials since each healthcare provider uses different billing systems. This enables them to get their payments back on time. Demand for Electronic billing systems is being driven by the following trends such as EHRs (Electronic Health Records) gaining popularity. It makes claims processing, tracking, and paperwork low. Users can leverage cloud technology which gives them remote access to medical billing data thereby, increasing accessibility and management of data.

This has been emphasized by several programs additionally, Blue Shield of California teamed up with Google Cloud to use AI and bring instant online reimbursement data for patients facilitating the billing process between providers and patients. Delhi government in India is also adopting a cloud-based health management system to facilitate easier access for patients.

When combined with the rising need for billing solutions that are both able to scale and provide improved ROI, this white space represents several large market opportunities that will move medical coding RFID systems toward mainstream applications.

Medical coding is historically dependent on experts to understand medical procedures and diagnoses in human language and translate them into standardized codes. However, the developments are happening at an accelerated pace right now with a more prominent role of artificial intelligence (AI) in the industry.

According to an article published in July 2024, the Certified AI Medical Coder (CAIMC(R)) credential is one such example of this advancement. Provided by the Professional Medical Billers Association LLC and MEDESUN Prime, this certification allows medical coders to learn how they can start using AI in their coding practices.

Restraints

-

Documenting Complications Hamper the Market Growth

Medical billing systems have made significant strides, the major challenge is the insufficient documentation that stems from healthcare providers. With the latest release protection that is based on weak comparisons can get a mismatch of records, false program coding, and so forth. These are not only an insult to the image of a company but also affix with overall quality in functionality of the billing system. Solving this problem is now more important than ever for the sustainability of the medical coding market.

Key Segmentation

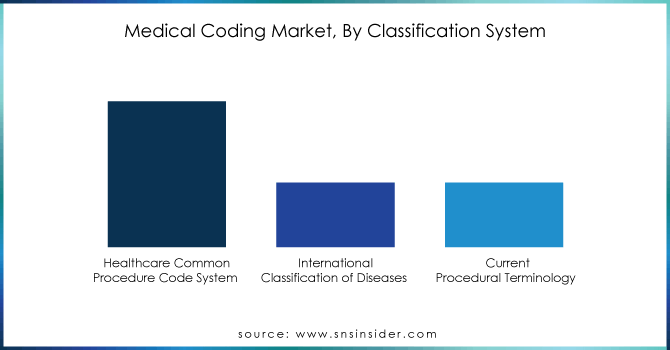

By Classification System

-

Healthcare Common Procedure Code System

-

International Classification of Diseases

-

Current Procedural Terminology

The most frequently cited classification system is HCPCS with 53.02% market share in 2023. The dual utility in this case is billing and the clinical. These codes are also important to healthcare providers and insurance companies who rely on them for billing purposes sending the billable information needed with procedure and service quality or quantity as validation to absorb costs properly. In another aspect, it is a cornerstone for public health initiatives by helping with disease trend tracking and mortality data categorization. No such sweeping consolidation of the market relegates HCPCS to a secondary segment.

The field of medical coding has developed significantly and is on the path to being revolutionized by using Artificial Intelligence (AI). However, ICD and CPT both are fundamental building blocks that go into diagnosing patients accurately AND billing for physician services appropriately; which is why they should be prime targets for AI use-case. Certifications such as the Certified AI Medical Coder (CAIMC) that have begun to emerge illustrate a need for coders knowledgeable in using tools like these. Its integration is the one that can lead to a huge improvement in coding quality and productivity, making ICD and CPT as faster growth future segments.

Need any customization research on Medical Coding Market - Enquiry Now

By Component

-

Outsourced

-

In-House

Outsourced Coding is the dominating segment with 56.33% of the market share in 2023, Organizations contract external vendors with experienced coders to manage their coding tasks. This is cost-effective, offers access to specialized expertise, and allows for easy scaling of coding capacity.

In-house coding is the fastest-growing segment in which healthcare providers train and employ their staff for medical coding. This approach gives them greater control over data security, facilitates direct communication with providers for clarification, and allows for customization based on specific needs.

By End-user

-

Hospitals

-

Diagnostic Centers

-

Others

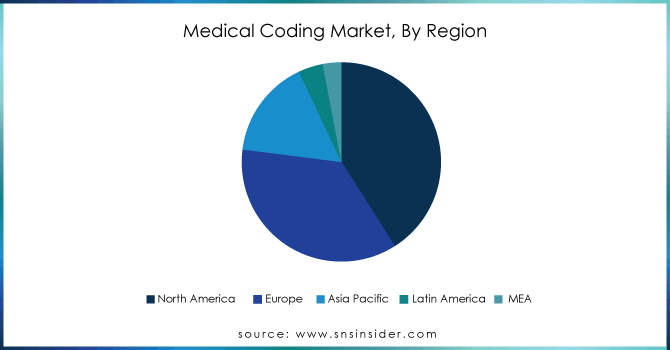

Regional Analysis

The North American medical coding market is dominating with 41% the largest market share in 2023 and poised for continued growth. This dominance can be attributed to several factors including Investments pouring into revamping healthcare infrastructure and establishing healthcare digitization organizations across the region. Governments are also actively developing new technologies for diagnosis, treatment, billing, and record management. The integration of standardized codes like HCPCS, CPT, and ICD-10 CM is gaining traction. This allows for accurate reflection of services rendered and facilitates communication between healthcare professionals when categorizing patient services. The rising prevalence of chronic diseases like cancer is a major driver as reported by the American Cancer Society in January 2024, an estimated 2 million new lung cancer cases are expected in the United States alone for 2024, compared to 1.9 million in 2023. This translates to increased hospitalization rates and a growing demand for accurate medical coding to manage complex patient information.

For instance, in November 2023, AAPC, a key market player, acquired Semantic Health, an AI startup. This move aims to expand AI functionalities in medical coding and bolster AAPC's product offerings. Similarly, Intelligent Medical Objects launched new products in July 2023, focusing on Natural Language Processing (NLP) and problem identification, further enhancing the coding process.

These advancements, coupled with a growing need for streamlined billing procedures and improved healthcare infrastructure, position the North American medical coding market for significant growth in the coming years.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Oracle Corporation, Startek Health, Parexel International Corporation, Verisk Analytics, Maxim Health Information Services, Aviacode, Inc., GeBBS Healthcare, Precyse Solutions, LLC, 3M, AGS Health, Dolbey Systems Inc., Medical Record Associates LLC, MRA Health Information Services, Semantic Health, Optum Inc., Nuance Communications Inc., The Coding Network LLC, Talix and others.

Dolbey Systems Inc-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 18.41 Billion |

| Market Size by 2032 | US$ 40.55 Billion |

| CAGR | CAGR of 9.21% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Classification System (Healthcare Common Procedure Code System (HCPCS), International Classification of Diseases, Current Procedural Terminology) • By Component (Outsourced, In-House) • By End User (Hospitals, Diagnostic Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Oracle Corporation, Startek Health, Parexel International Corporation, Verisk Analytics, Maxim Health Information Services, Aviacode, Inc., GeBBS Healthcare, Precyse Solutions, LLC, 3M, AGS Health, Dolbey Systems Inc., Medical Record Associates LLC, MRA Health Information Services, Semantic Health, Optum Inc., Nuance Communications Inc., The Coding Network LLC, Talix and others. |

| Key Drivers | • Demand for faster claim processing, shift towards electronic billing, and cloud-based solutions for remote access |

| RESTRAINTS | • Documenting Complications Hamper the Market Growth |