Medical Display Market Size Analysis:

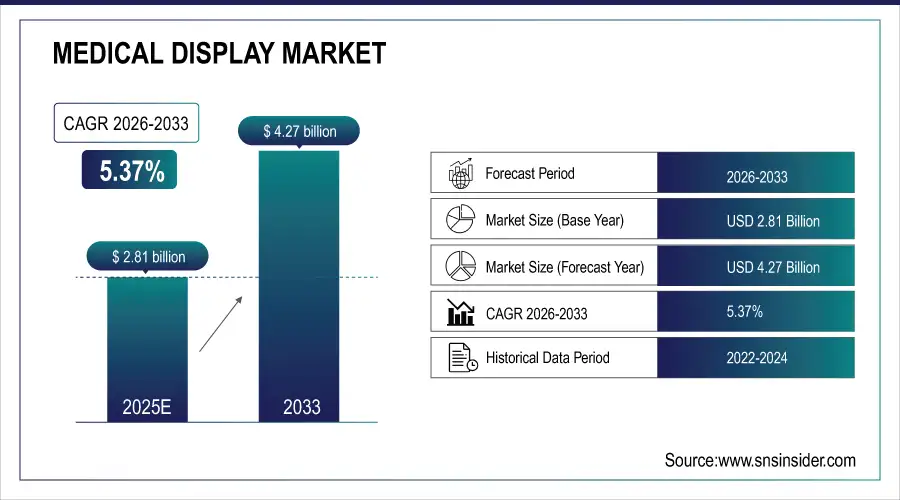

The Medical Display Market size was USD 2.81 Billion in 2025E and is expected to reach USD 4.27 Billion by 2033 and grow at a CAGR of 5.37% over the forecast period of 2026-2033.

The Medical Display Market is witnessing robust growth driven by increasing demand for high-resolution imaging solutions in healthcare. Rising adoption of digital pathology, diagnostic imaging, and surgical displays enhances accuracy and workflow efficiency. Technological advancements in OLED and 4K/8K displays, coupled with growing telemedicine applications, are accelerating market expansion across hospitals and clinics.

Market Size and Forecast:

-

Medical Display Market Size in 2025E: USD 2.81 Billion

-

Medical Display Market Size by 2033: USD 4.27 Billion

-

CAGR: 5.36% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Medical Display Market - Request Sample Report

Key Medical Display Market Trends

-

Growing demand for high-resolution and multi-modality displays to support accurate diagnostics and surgical visualization.

-

Increasing adoption of OLED and 4K/8K display technologies for enhanced image clarity, color accuracy, and contrast.

-

Rising integration of AI-based imaging and advanced visualization tools in medical display systems to improve clinical workflows.

-

Shift toward ergonomic and energy-efficient display designs, supporting long operational hours and reducing eye strain for healthcare professionals.

-

Expansion of telemedicine and remote diagnostics is driving the need for reliable, DICOM-compliant medical-grade monitors.

-

Surging investments in digital healthcare infrastructure and hospital modernization, especially in emerging economies.

-

Growing emphasis on cybersecurity and data protection in connected medical display systems.

-

Increasing use of multi-display configurations in surgical suites and diagnostic imaging centers to enhance collaboration and precision.

Medical Display Market Growth Drivers

-

Growing adoption of AI in medical imaging which drives the market growth.

The increasing use of AI (Artificial Intelligence) in Medical Imaging is majorly driving the medical display market, as it allows for improving the diagnostic ability and automating the workflow for efficiency. AI-based imaging solutions are incorporated with picture archiving and communication systems (PACS) and radiology information systems (RIS) to read the pictures as the images are acquired, process them, and detect abnormalities. High-color accuracy and contrast in high-resolution medical displays are a must to support AI-driven diagnostics within specialties including radiology, pathology, and cardiology. Moreover, AI algorithms play a crucial role in decreasing errors in diagnosis, streamlining image processing, and aiding telemedicine applications, fuelling the uptake of 4K and 8K medical displays.

Medical Display Market Restraints

-

The high cost of advanced medical displays may hamper the market growth.

High cost is one of the major restraining factors, as advanced medical displays cannot be easily adopted by small and mid-sized healthcare facilities. The resolution premium medical-grade display monitors and AI Diagnostic Integrated Display are highly-grade medical devices and very expensive to purchase, maintain, and calibrate. Due to such high expenses, investing in state-of-the-art display technology becomes quite difficult for budget-constrained hospitals, diagnostic hubs, and telemedicine solution providers. Software integration, regulatory standards compliance (DICOM, FDA, CE), and regular/upgrading of systems are more aspects related to operational costs.

Medical Display Market Opportunities

-

Growing adoption of PACS and cloud-based imaging solutions creates an opportunity in the market.

One of the foremost opportunities for the growth of the medical display market lies in the high adoption of Picture Archiving and Communication Systems (PACS) and cloud-based imaging solutions. With PACS, the storage, retrieval, and sharing of medical images is streamlined for easier access, and film dependency is lessened, thus enhancing the efficiency of diagnosis. With more hospitals and diagnostic centers moving to cloud-based imaging, the need for higher resolution, medical-grade displays with higher color accuracy and DICOM-compliant characteristics has also increased. These high-end monitoring devices facilitate image cognition, allowing the radiologist and medical team to perform more accurate readings and ascertain a diagnosis. Furthermore, cloud integration facilitates remote access to medical images, making telemedicine and teleradiology possible, which is another factor that propels the demand for high-performance medical displays.

Medical Display Market Challenges

-

Compatibility issues with healthcare IT systems may create a challenge for the market.

One major challenge in the Medical Display Market is compatibility issues with healthcare IT systems, as seamless integration with Picture Archiving and Communication Systems (PACS), Electronic Medical Records (EMR), and AI-powered diagnostic tools is critical for efficient workflows. Like most legacy systems, many healthcare facilities do not have high-resolution medical displays at present or support legacy device resolution practices, hence causing interoperability issues. Software protocols, data formats, and calibration standards vary, leading to discrepancies in image rendering and diminishing diagnostic quality. In most hospitals and imaging centers, synchronizing DICOM-compliant displays with existing infrastructure is challenging, leading to IT upgrades and staff training expenses. This absence of standardization delays the adoption of innovative display solutions, preventing the digital healthcare transformation.

Medical Display Market Segmentation Analysis

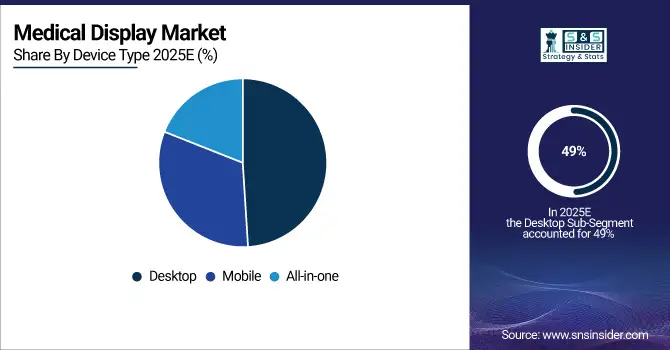

By Device Type

Desktop held the largest market share, around 49% in 2025. It is used for diagnostic imaging, radiology, and telemedicine applications among others. These displays have high-resolution imaging, calibration capability, and DICOM compliance to provide doctors with accurate diagnoses in hospitals and diagnostic centers. Above all, desktop displays are a cheap alternative to surgical and handheld displays, potentially opening wider markets for healthcare facilities. Additionally, they have the added advantage of larger screen size, multi-monitor setup support, and the best image quality to make the workflow more efficient for remote sessions for radiologists and medical professionals.

By Panel Size Type

23.0–26.9-inch panels held the largest market share, around 42% in 2025. The perfect balance between screen size, resolution, and value, thus, is suitable for diagnostic imaging, radiology, and surgery applications. Utilizing high-resolution displays (most common are Full HD, 4K), these panels also offer increased brightness and contrast and true color clarity to enable accurate reading of images for medical diagnosis. They can be used in PACS workstations, electronic health records (EHR) viewing, and multi-monitor setups, effectively enhancing workflow efficiency in hospitals and diagnostic centers. Moreover, their adoption is further propelling due to mandatory compliance with DICOM standards and compatibility with AI-powered imaging tools.

By Resolution

The global medical displays market share, by resolution, is the range field of 2.1 to 4MP resolution medical displays, which accounted for the largest market share owing to favorable height of resolution against cost and also due to optimal mechanism between imaging needs in diagnostic, radiology, and clinical applications. They give a fine detail appearance of medical scans like X-rays, magnetic resonance imaging (MRI), CT scans etc. for diagnosis at low cost for hospitals and diagnostic centers. They are capable of DICOM-compliant resolution and can be integrated with PACS, EMR systems, and AI-powered diagnostic tools without demanding too much from the processing unit. In addition, multi-monitor workstations supporting 2.1 - 4MP displays are desirable for radiologists and healthcare professionals to optimize workflows. With telemedicine and remote diagnostics increasing in popularity, even 2.1 to 4MP displays have continued to grow in popularity and with better security of their respective market share.

By Application

The digital pathology market segment held the largest market share around 28% in 2025. Advancements in pathology workflows due to the transition from conventional microscopy to high-resolution digital imaging have made remote slide analyses and sharing possible for pathologists. Growing AI-based diagnostics solutions, image analysis automation, and cloud-based pathology platforms adoption have increased demand for medical-grade displays for Digital pathology. The high brightness, contrast, and accurate color reproduction from these displays allows for proper examination of tissue samples. In addition to this, growing cases of cancer and chronic disease and need for better pathology solutions has also been a driver for the market expansion.

Medical Display Market Regional Analysis

North America Medical Display Market Insights

North America held the largest market share, around 42% in 2025. It is superior healthcare infrastructure, high adoption of digital imaging technologies, and investments in AI-driven diagnostics. The presence of top medical display manufacturers and high regulatory standards including compliance with FDA, DICOM standards in the region will strongly drive the market for high quality diagnostic display. In contrast, the increasing telemedicine, teleradiology, and digital-pathology needs are increasing the uptake of high-resolution medical display used across hospitals and diagnostic centers. Moreover, the rising incidence of chronic disease such as cancer, and cardiovascular disorders have pushed the demand for imaging system to the next level. Additionally, government initiatives along with the increasing healthcare expenditure in the U.S. and Canada further enhance continuous technological advancements they promote to strengthen the hold of North America over medical display market.

Need any customization research on Medical Display Market - Enquiry Now

Asia Pacific Medical Display Market Insights

Asia pacific held a significant share market share in 2024. It the largest market with the rising adoption of digital imaging and growing investments in telemedicine and AI-based diagnostics. Increasing healthcare investment in the region is supported by rising healthcare spending and some government drives to promote advanced medical technologies in China as well as Japan and India. Moreover, rising patient pool coupled with the rising cases of chronic disease have enabled hospitals and diagnostic centres to use high-resolution medical displays. The presence of major display manufacturers and medical device companies in the region also encourages market growth by providing cost-effective and efficient solutions. Additionally, high-fi digital pathology, teleradiology and tacit adoption has inflated Asia Pacific leadership in medial display market.

Europe Medical Display Market Insights

The Europe Medical Display Market is projected to experience robust growth in 2025, supported by the region’s advanced healthcare infrastructure and growing investments in diagnostic imaging technologies. Countries such as Germany, the U.K., and France are at the forefront of adopting high-resolution and DICOM-compliant medical displays in radiology, surgery, and telehealth applications. Strong government funding for hospital digitization, along with rising demand for OLED and 4K displays in clinical imaging, is further fueling market expansion. Additionally, ongoing collaborations between display manufacturers and medical device companies are enhancing product innovation and integration across European healthcare systems.

Latin America (LATAM) Medical Display Market Insights

The LATAM Medical Display Market is expanding steadily in 2025, driven by increasing healthcare expenditure and modernization of medical imaging facilities. Brazil and Mexico are emerging as primary growth centers, with hospitals and diagnostic centers upgrading to advanced imaging systems that require high-quality displays. Government initiatives to improve public healthcare access and private sector investment in digital health solutions are also contributing to market growth. The region’s growing awareness of accurate diagnostics and real-time monitoring is further stimulating demand for affordable, durable, and energy-efficient medical displays.

Middle East & Africa (MEA) Medical Display Market Insights

The MEA Medical Display Market is witnessing significant growth in 2025, propelled by large-scale healthcare infrastructure projects and the expansion of private hospitals and specialty clinics. Countries such as Saudi Arabia, the UAE, and South Africa are leading the adoption of advanced visualization systems for surgical, diagnostic, and educational applications. Rising investments in smart hospitals, along with the growing integration of telemedicine and remote diagnostics, are boosting demand for medical-grade displays. Additionally, regional efforts to strengthen healthcare digitization and enhance image-based diagnostics are expected to support sustained market development across MEA.

Competitive Landscape for Medical Display Market

Koninklijke Philips N.V.

Philips is a global leader in health technology, providing solutions in medical imaging, patient monitoring, and healthcare informatics. The company focuses on integrating artificial intelligence, automation, and sustainable innovation to enhance clinical efficiency and patient outcomes.

-

-

In September 2024, Philips CEO Roy Jakobs announced a comprehensive turnaround strategy following a major product recall, emphasizing renewed investments in AI-driven diagnostics, healthcare innovation, and stringent process improvements to strengthen patient safety and product quality across its medical device portfolio.

-

EIZO Corporation

EIZO Corporation is a prominent manufacturer of high-end visual display solutions, offering specialized medical-grade monitors designed for radiology, surgery, and diagnostic imaging. The company is known for its precision display technologies and compliance with global quality standards.

-

-

In March 2023, EIZO announced that its RadiForce medical monitors, along with the latest RadiCS quality control software, now comply with the IEC 62563-2 international standard introduced by the International Electrotechnical Commission, reinforcing the company’s commitment to display accuracy, reliability, and global regulatory compliance.

-

Medical Display Market Key Players

Some of the Medical Display Market Companies

-

EIZO Corporation

-

Sony Electronics Inc.

-

LG Electronics

-

Siemens Healthineers AG

-

Advantech Co., Ltd.

-

NEC Display Solutions

-

AsusTek Computer Inc.

-

BenQ Corporation

-

Dell Technologies Inc.

-

HP Inc.

-

ViewSonic Corporation

-

JVC Kenwood Corporation

-

WIDE Corporation

-

Nanjing Jusha Display Technology Co., Ltd.

-

Shenzhen Beacon Display Technology Co., Ltd.

-

Axiomtek Co., Ltd.

-

Coje Co., Ltd.

-

Diva Laboratories, Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD2.81 Billion |

| Market Size by 2033 | USD 4.27 Billion |

| CAGR | CAGR of5.36 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Desktop, Mobile, All-in-one) • By Panel Size Type (Up to-22.9-inch panels, 23.0–26.9-inch panels, 27.0–41.9-inch panels, Above-42-inch panels) • By Resolution (Up to 2MP, 2.1 to 4MP, 4.1 to 8MP, Above 8MP) • By Application Type (Digital pathology, Radiology, Multi-modality, Surgical, Mammography, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Barco NV, EIZO Corporation, Sony Electronics Inc., LG Electronics, Siemens Healthineers AG, Advantech Co., Ltd., NEC Display Solutions, AsusTek Computer Inc., BenQ Corporation, Dell Technologies Inc., HP Inc., ViewSonic Corporation, JVC Kenwood Corporation, WIDE Corporation, Nanjing Jusha Display Technology Co., Ltd., Shenzhen Beacon Display Technology Co., Ltd., FSN Medical Technologies, Axiomtek Co., Ltd., Coje Co., Ltd., Diva Laboratories, Ltd. |