Electronic Medical Record (EMR) Systems Market Report Scope & Overview:

Get more information on Electronic Medical Record (EMR) Systems Market - Request Sample Report

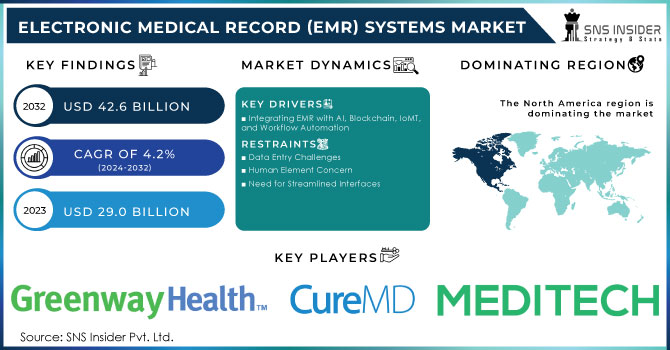

The Electronic Medical Record (EMR) Systems Market size was valued at USD 29.0 billion in 2023 and is projected to reach over USD 42.6 billion by 2032, with a growing CAGR of 4.2% during the forecast period 2024-2032.

Electronic Medical Record (EMR) Systems Market Set for Robust Growth

Surging Demand for Efficient Healthcare Management and Enhanced Patient Care Drives Adoption

The Electronic Medical Record (EMR) systems market is witnessing substantial growth, propelled by the increasing need for efficient healthcare management and improved patient care. As healthcare providers aim to streamline operations, enhance data accuracy, and elevate patient outcomes, EMR systems have become essential in contemporary healthcare environments. The surge in EMR adoption is driven by the need for comprehensive digital solutions that seamlessly and securely manage patient records. Regulatory requirements and the push for better clinical decision-making are further fueling the demand for improved healthcare documentation. Hospitals and clinics are increasingly deploying EMR systems to meet standards for accurate and accessible patient records. Additionally, the integration of advanced technologies like artificial intelligence (AI), machine learning, and blockchain into EMR systems is boosting their appeal. AI and machine learning enhance predictive analytics and diagnostic accuracy, while blockchain technology ensures data security and integrity. The integration of Internet of Medical Things (IoMT) devices also contributes to real-time health monitoring and comprehensive patient profiles, heightening the demand for sophisticated EMR solutions.

|

EHR (ELECTRONIC HEALTH RECORD) |

EMR (ELECTRONIC MEDICAL RECORD) |

|

EHRs are digital records that provide a comprehensive, shareable view of a patient's medical history across multiple healthcare providers. They enhance care coordination and improve patient outcomes by integrating data from various sources like hospitals, specialists, and labs. |

EMRs are digital versions of paper charts used within a single healthcare organization, containing detailed patient information such as diagnoses and treatments. They are designed to improve efficiency and manage patient data within a specific practice or clinic. |

|

Simplified sharing of updated, real-time information |

Used for diagnosis and treatment only |

|

Allows access to tools that providers can use for decision-making |

Is mainly used by providers for diagnosis and treatment |

|

Designed to support medical decision-making with various built-in -tools |

Patient records cannot easily be sent outside the practice |

|

Allows a patient's medical information to be accessed from different places |

Not designed to be shared outside the individual practice |

According to a February 2024 study by the Comptia community, 34% of companies are utilizing AI, with an additional 42% actively exploring AI technologies. Furthermore, 35% of organizations are investing in training and reskilling their teams to effectively use new AI and automation tools. Supply-side factors, including technological advancements and increased investment in healthcare IT infrastructure, are also driving market growth. Vendors are continuously evolving their EMR offerings to include features such as workflow automation, data analytics, and interoperability with other healthcare systems. This evolution has led to the development of more user-friendly and efficient EMR interfaces that address concerns about time-consuming data entry and navigation. Additionally, as healthcare organizations seek operational efficiency and cost savings, the integration of EMR systems with Electronic Health Records (EHRs) and image management solutions is becoming more prevalent, further driving market growth. Despite robust growth, the market faces challenges such as high implementation costs, interoperability issues, and resistance to change among healthcare professionals. However, ongoing advancements and increasing adoption rates suggest a positive outlook for the EMR systems market, with continuous innovations expected to address existing challenges and enhance healthcare delivery.

Market Dynamics

Drivers

-

Integrating EMR with AI, Blockchain, IoMT, and Workflow Automation:

The integration of Electronic Medical Records (EMR) with emerging technologies is set to transform the healthcare landscape dramatically. Advanced innovations like artificial intelligence (AI), machine learning, and blockchain are increasingly being incorporated into EMR systems, significantly enhancing their functionality. AI and machine learning algorithms are utilized for predictive analytics, improving diagnostic accuracy, and personalizing patient care plans. Blockchain technology secures EMR data, ensuring tamper-proof records and bolstering patient privacy. Furthermore, the integration of Internet of Medical Things (IoMT) devices enables real-time health monitoring and data collection, feeding directly into EMR systems for comprehensive patient profiles. These advancements are poised to streamline healthcare operations, improve patient outcomes, and provide more accurate, efficient, and secure healthcare services. The shift towards workflow automation and tighter integration with Electronic Health Records (EHRs) is also becoming critical for healthcare providers. Integrating image management solutions with EHRs enhances data accessibility and collaboration among healthcare professionals, driving overall departmental efficiency. This integration allows for a unified view of a patient’s health information and medical images, facilitating faster and more informed decision-making while minimizing duplicate tests, leading to significant time and cost savings for hospitals. By adopting these integrated solutions, healthcare providers can improve care delivery, adhere to best practices, and optimize operational efficiencies.

Restraints

-

Data Entry Challenges:

Physicians face frustration with time-consuming data entry and navigation in EMR interfaces, which disrupts patient care and creates a conflict between documentation and direct patient interaction.

-

Human Element Concern:

Excessive screen time due to EMR systems may compromise the depth of physician-patient interactions, potentially undermining the human aspect of medical care.

-

Need for Streamlined Interfaces:

There is a critical need for streamlined EMR interfaces that support clinical workflows efficiently, balancing documentation requirements with meaningful patient engagement.

Key Segmentation

By Type:

In 2023, General EMR Solutions held a significant market share due to their broad applicability across various healthcare settings, accounting for approximately 65% of the market. These solutions offer comprehensive features suited to general healthcare needs, making them popular among a wide range of healthcare providers. Specialty EMR Solutions, focusing on specific medical fields such as cardiology, oncology, and neurology, are expected to be the fastest-growing segment. The increasing demand for specialized care and tailored features drives the rapid adoption of these solutions, reflecting the growing complexity and specialization in healthcare.

By Component:

In 2023, the Services segment led the EMR systems market, commanding a notable revenue share of around 45%. This segment encompasses essential offerings such as installation, training, and support services, which are pivotal for the successful deployment and ongoing maintenance of EMR systems. These services ensure that healthcare providers can effectively integrate and utilize EMR technology, optimizing its benefits for patient care and operational efficiency. Meanwhile, the EMR Software segment is anticipated to experience the fastest growth. This surge is attributed to the rising demand for advanced software solutions that incorporate cutting-edge technologies like artificial intelligence (AI) and machine learning. These innovations enhance functionality by improving predictive analytics, diagnostic accuracy, and system interoperability, driving substantial growth in the software segment.

By Hospital Size:

Small and Medium-sized Hospitals represented around 55% of the market in 2023. These institutions are increasingly adopting EMR systems to improve efficiency and comply with regulatory requirements. This segment is growing steadily as these hospitals seek cost-effective and scalable solutions. Large Hospitals are expected to be the fastest-growing segment, with adoption driven by their complex needs and the demand for enhanced data management and interoperability.

By Delivery Mode:

On-premise EMR solutions held a market share of about 40% in 2023. They are preferred by organizations needing complete control over their data and systems. However, this segment is growing more slowly compared to cloud-based solutions due to higher initial costs and maintenance requirements. The Cloud-based segment is expected to be the fastest-growing, driven by cost-effectiveness, scalability, and ease of integration. Cloud-based solutions offer flexibility and reduced infrastructure costs, making them highly attractive to healthcare providers.

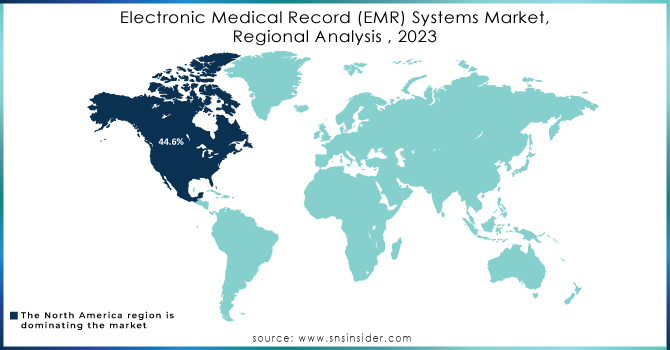

Regional Analysis

North America:

In 2023, North America dominated the EMR systems market, accounting for a revenue share of 44.6%. This growth is driven by supportive policies, strong digital infrastructure, and high digital literacy. Favorable government regulations, such as the Federal Health IT Strategic Plan 2020-2025, which mandates meaningful EMR use, further boost the market. In the U.S., the demand for enhanced healthcare technology, regulatory compliance, and interoperability between EMR systems fueled market expansion.

Europe:

Europe is poised for significant growth, driven by efforts to enhance healthcare efficiency and patient outcomes through digital transformation. Developed economies like Germany, the UK, France, Spain, and Italy are expected to propel the market forward. The UK is implementing policies to promote EMR adoption, including integrating health records across different platforms. The European Commission’s Digital Health Strategy aims to improve digital health tools and systems, supporting market growth.

Asia Pacific:

The Asia Pacific region is expected to experience substantial growth, with increasing adoption of digital health solutions and government initiatives promoting healthcare digitalization. Countries such as China, India, Japan, and South Korea are investing in digital health infrastructure and EMR systems. Government incentives, rising healthcare expenditure, and advancements in healthcare IT technology are driving the market. For example, China’s "Healthy China 2030" plan includes strategies to advance health information technology, including EMR systems.

Need any customization research on Electronic Medical Record (EMR) Systems Market - Enquiry Now

Key Players:

-

Greenway Health LLC

-

Health Information Management Systems

-

CureMD Healthcare

-

Medical Information Technology Inc.

-

eClinicalWorks

-

McKesson Corporation

-

Allscripts Healthcare LLC

-

Care360

-

GE Healthcare

-

Fujitsu

-

Modernizing Medicine Inc.

-

Hitachi Data Systems

-

Praxis EMR

-

NextGen Healthcare Inc.

-

Practice Fusion

-

Athenahealth

-

DrChrono

-

Kareo

-

Cerner

-

AdvancedMD Inc. (Global Payments Inc.)

-

Telus Health

-

Sinosoft

-

Landwind

-

MEDITECH

-

Winning

-

General Electric Company

-

Epic Systems Corporation

-

Other Players

Recent Developments

In September 2024, Hackensack Meridian Health launched a 24/7 AI-powered primary care access system. This cutting-edge solution leverages artificial intelligence to provide round-the-clock primary care services, enhancing accessibility and patient care. The AI-driven platform streamlines patient interactions and offers timely medical advice, marking a significant advancement in integrating technology with primary healthcare services.

In September 2024, the World Health Organization (WHO) officially handed over a new Electronic Medical Recording (EMR) system to the Karnali Academy of Health Sciences. This advanced EMR system is anticipated to improve healthcare delivery efficiency at the academy by enhancing data management, accessibility, and patient care through modern technology.

| Report Attributes | Details |

| Market Size in 2023 | US$ 29.0 Billion |

| Market Size by 2032 | US$ 42.6 Billion |

| CAGR | CAGR of 4.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (General EMR Solutions, Specialty EMR Solutions) • By Component (Services, Software, Hardware) • By Hospital Size (Small and Medium-sized Hospitals, Large Hospitals) • By Delivery Mode (On-premise, Cloud-based) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | eClinicalWorks, McKesson, Allscripts, Care360, GE Healthcare, Fujitsu, Neusoft, Hitachi Data Systems, IBM, Dell, Practice Fusion, Athenahealth, Drchrono, Kareo, Cerner, Henry Schein, Telus Health, Sinosoft, Landwind, Hope Bridge, Winning, Chengdian Yixing, Beijing Zhonghong. |

| DRIVING FACTORS | • Integrating EMR with AI, Blockchain, IoMT, and Workflow Automation |

| Restraints | •Data Entry Challenges •Human Element Concern •Need for Streamlined Interfaces |