Medical Electronic Market Report Scope & Overview:

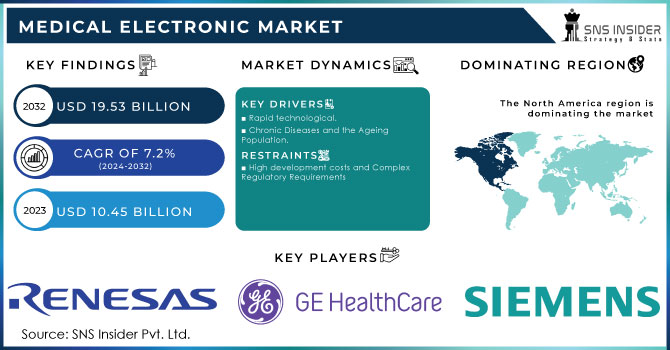

The Medical Electronic Market size was valued at USD 10.51 billion in 2023 and expected to reach USD 19.04 billion by 2032 and grow at a CAGR of 6.83% over the forecast period 2024-2032.

Get more information on Medical Electronic Market - Request Sample Report

The Medical Electronic Market is experiencing significant growth, driven by advancements in technology, increasing patient demand for personalized healthcare, and the growing adoption of electronic health records (EHRs) and telemedicine. As of 2024, the market is expanding rapidly due to the continuous development of medical devices, such as wearable health monitors, diagnostic imaging systems, and AI-powered tools. Patients are increasingly aware of the benefits of these technologies, leading to higher demand for devices that improve diagnostic accuracy, treatment outcomes, and overall healthcare experiences.A major contributor to market growth is the shift towards patient-centered care, with electronic health record (EHR) systems and patient portals becoming more prevalent across healthcare systems. Despite a robust infrastructure of patient portals in the U.S., with 90% of healthcare systems offering these platforms, only 15% to 30% of patients engage with these tools. This gap highlights the opportunity for further innovation and adoption of digital health solutions, particularly those that integrate seamlessly into patients' daily lives. According to a comprehensive study, 54 out of 74 research papers showed positive outcomes from patient access to their EHRs via portals, reinforcing the impact of digital engagement on patient care. Wearable medical devices and AI-based technologies have revolutionized remote patient monitoring and diagnostics, contributing to increased efficiency and reduced healthcare costs. With an emphasis on improving the patient experience, these innovations are expected to drive continued growth in the medical electronic market. As healthcare systems invest more in digital health solutions and patients become more informed, the medical electronic market is projected to expand significantly, fueled by both technological innovation and evolving patient expectations.

Market Dynamics

Drivers

-

Telemedicine and Remote Monitoring Shaping the Future of the Medical Electronic Market

Telemedicine and remote patient monitoring (RPM) have emerged as crucial drivers for the growth of the medical electronic market, transforming healthcare delivery and accelerating the adoption of connected medical devices. While the demand for virtual care services has decreased from its peak during the pandemic, when telehealth usage surged to 70%, it still remains significantly higher than pre-pandemic levels, hovering around 25% compared to just 5% before the pandemic. This demand is projected to continue rising in the coming years, with about 50% of U.S. hospitals now incorporating telemedicine, particularly in areas like radiology and stroke care. Additionally, 67% of employees expect virtual healthcare to be included in their benefits package, and 80% consider it an important factor when selecting an employer. The start-up costs for telemedicine platforms range from USD 10,000 to USD 300,000, based on factors such as staff size, patient volume, and software development, with monthly fees ranging from USD 70 to USD 300. The shift toward virtual healthcare is further supported by new regulatory guidelines and the development of telehealth infrastructure, ensuring safe and efficient patient care. This transition allows healthcare providers to offer real-time care while remotely monitoring patients’ vital signs through connected devices such as wearables, sensors, and mobile applications. The integration of artificial intelligence (AI) is also enhancing diagnostic accuracy and enabling personalized treatment plans, optimizing overall workflow efficiency. RPM has further contributed to improved healthcare outcomes by reducing hospital readmissions, especially for patients with chronic conditions, thereby playing a pivotal role in the continued expansion of the medical electronic market.

Restraints

-

Overcoming Data Privacy and Security Challenges in the Evolving Medical Electronic Market

Data privacy and security remain significant challenges in the medical electronic market as medical devices increasingly become interconnected and share sensitive patient information. The integration of connected medical devices with healthcare systems has raised serious concerns regarding patient privacy, cybersecurity threats, and the risk of data breaches. These issues have emerged as substantial barriers to the widespread adoption of these technologies. These initiatives underscore the need for advanced security technologies that protect against unauthorized access and prevent data breaches, which can erode patient trust and result in severe legal and financial consequences. evolving cybersecurity landscape in healthcare, aligning security requirements with technological advancements while offering clear instructions to healthcare providers on securing medical devices. However, the regulatory environment remains complex, with compliance becoming particularly challenging for smaller healthcare providers with limited resources. The continuous investment in security technologies to maintain compliance and safeguard sensitive patient data adds another layer of complexity for healthcare organizations. These rising challenges, driven by the increasing threat of cyberattacks and the need for ongoing security measures, contribute to the growing complexity of the medical electronic market.

Segment Analysis

By Component

The sensors segment dominated the medical electronic market, accounting for 39% of the total revenue in 2023. This segment's growth is primarily driven by the increasing demand for wearable devices, remote patient monitoring systems, and diagnostic tools that rely on sensors for accurate data collection. Sensors are integral to a wide range of medical applications, including blood pressure monitoring, glucose monitoring, heart rate tracking, and ECG devices. The advancement of sensor technologies, such as biosensors and optical sensors, has significantly enhanced the performance and efficiency of medical devices. The shift towards personalized healthcare and the growing trend of at-home diagnostics further fuel the demand for sensor-driven devices. With continuous innovations in sensor technology, the segment is expected to maintain its dominance, offering more precise and real-time patient data collection.

The MPUs (Microprocessing Units) and MCUs (Microcontroller Units) segment is poised to be the fastest-growing in the medical electronic market during the forecast period from 2024 to 2032. This growth is driven by the increasing demand for advanced medical devices requiring high computational power, precision, and real-time processing capabilities. MPUs and MCUs are essential in powering a wide range of connected medical devices, including diagnostic tools, patient monitoring systems, and wearable health technologies. These components enable complex tasks such as data processing, communication, and decision-making within medical devices. The rise of the Internet of Medical Things (IoMT) and the growing trend of personalized healthcare further contribute to the demand for MPUs/MCUs, driving innovation and expansion in the market.

By Application

The imaging segment is the dominant player in the medical electronic market, accounting for approximately 45% of the market share in 2023. This segment's growth is driven by the increasing demand for advanced imaging systems, such as X-ray, MRI, CT scans, ultrasound, and nuclear imaging, which are essential for accurate diagnosis and treatment planning. The integration of digital technologies has enhanced the precision, efficiency, and speed of imaging devices, making them indispensable in modern healthcare. Advancements like 3D imaging and portable diagnostic devices are further expanding the reach and capabilities of medical imaging. The growing prevalence of chronic diseases, the aging population, and the need for early disease detection are all fueling the demand for innovative imaging solutions, solidifying its leadership position in the market.

The Homecare/Handheld Products segment is the fastest-growing category in the medical electronic market over the forecast period from 2024 to 2032. This growth is fueled by the increasing shift toward at-home healthcare and the demand for portable, user-friendly devices that allow patients to monitor their health conditions independently. Homecare products, including handheld diagnostic tools like blood glucose meters, blood pressure monitors, and wearable ECG devices, are gaining popularity due to their convenience and cost-effectiveness. Additionally, advancements in wireless connectivity and mobile health applications are enabling seamless data sharing between patients and healthcare providers, ensuring continuous care. The growing emphasis on chronic disease management, remote monitoring, and the aging population's healthcare needs are key drivers of this segment’s rapid expansion.

Regional Analysis

North America holds the largest revenue share in the medical electronic market, accounting for around 44% in 2023, largely due to the region's advanced healthcare infrastructure, strong regulatory frameworks, and significant investment in medical technology innovation. The United States, as the largest market in North America, leads the adoption of cutting-edge medical devices, including imaging systems, sensors, and homecare products. The U.S. government's support for healthcare initiatives, coupled with high healthcare spending, fosters the development and integration of new medical electronic. Additionally, Canada is witnessing growth in medical electronic driven by its robust healthcare system and increasing demand for diagnostic and monitoring devices. The region’s dominance is further supported by its emphasis on research and development (R&D), a high concentration of healthcare professionals, and a growing aging population, all of which contribute to the continued growth and leadership of North America in the global medical electronic market.

The Asia-Pacific region is expected to be the fastest growing in the medical electronics market during the forecast period (2024-2032), driven by rapid technological advancements, increasing healthcare demand, and rising healthcare investments. Countries like China, India, Japan, and South Korea are major contributors to this growth. China, with its large population and expanding healthcare sector, is witnessing significant investments in medical technologies, particularly in diagnostic equipment and remote patient monitoring systems. India is experiencing growth due to a booming healthcare industry, increased healthcare awareness, and the expansion of home healthcare products. Japan, known for its technological innovation, is a leader in the adoption of medical devices, especially in imaging and robotic surgery systems. Additionally, South Korea is witnessing growth in medical electronics, driven by its advanced healthcare infrastructure and demand for high-tech medical equipment. The rising prevalence of chronic diseases, aging populations, and government initiatives in these countries are fueling market expansion.

Need any customization research on Medical Electronic Market - Enquiry Now

Key Players

Some of the major players in Medical Electronic Market along with their product:

-

FUJIFILM Holdings Corporation (Medical Imaging, Diagnostic Equipment, Digital X-ray Systems)

-

CANON MEDICAL SYSTEMS CORPORATION (Diagnostic Imaging Systems, CT Scanners, MRI Systems, Ultrasound Systems)

-

Koninklijke Philips N.V. (Medical Imaging, Patient Monitoring Systems, Healthcare Informatics, MRI Systems, Ultrasound Systems)

-

MCKESSON CORPORATION (Healthcare Software, Medical Imaging Solutions, Medical Supplies, Pharmaceutical Distribution)

-

iCAD, Inc. (Cancer Detection Software, Imaging Systems, Digital Mammography)

-

Siemens Healthineers AG (Medical Imaging, Laboratory Diagnostics, Ultrasound Systems, MRI Systems, CT Scanners)

-

GE Healthcare (Medical Imaging, Patient Monitoring Systems, Ultrasound Systems, MRI Systems, X-ray Systems)

-

Analog Devices, Inc. (Signal Processing Technology, Medical Sensors, Analog and Digital Components for Healthcare)

-

Texas Instruments Incorporated (Medical Electronic , Signal Processing Solutions, Analog Components, Medical Sensors)

-

Biotronik (Cardiology Equipment, Pacemakers, Implantable Defibrillators, Electrophysiology Systems)

-

STMicroelectronic (Medical Sensors, Semiconductor Solutions for Healthcare, Microcontrollers, Wireless Communication Modules)

-

Medtronic (Cardiac Devices, Diabetes Management, Surgical Instruments, Patient Monitoring Systems)

-

Abbott Laboratories (Diagnostic Devices, Diabetes Care Devices, Cardiovascular Equipment, Neurostimulation Devices)

-

Johnson & Johnson (Orthopedic Devices, Surgical Instruments, Patient Monitoring Solutions, Diagnostic Imaging Systems)

-

Roche Diagnostics (Diagnostic Instruments, Laboratory Equipment, Molecular Diagnostics, Immunoassays)

List of suppliers who provide raw materials and components for the medical electronic market :

-

3M Company

-

DuPont

-

Corning Incorporated

-

Honeywell International Inc.

-

TE Connectivity

-

Vishay Intertechnology, Inc.

-

Murata Manufacturing Co., Ltd.

-

STMicroelectronic

-

Texas Instruments

-

Analog Devices, Inc.

-

NXP Semiconductors

-

Maxim Integrated

-

ABB Ltd.

-

Samsung Electro-Mechanics

-

Broadcom Inc.

Recent Development

-

July 16, 2024, Fujifilm Launches APERTO Lucent™ 0.4T Open MRI System, offering a patient-friendly experience with a wide, laterally moving table and innovative RADAR motion compensating pulse sequence technology to reduce rescans and artifacts. The system features high signal-to-noise ratio, enhanced image quality, and low operating costs due to its permanent magnet open architecture.

-

May 1, 2024, Canon Medical Systems installs the first U.S. market Aquilion Serve SP CT Scanner with INSTINX Workflow Automation at Steinberg Diagnostic Medical Imaging (SDMI) in Las Vegas, NV. The scanner integrates AI-driven workflow automation, enhancing imaging efficiency, quality, and patient care while maintaining consistent, personalized low radiation doses.

-

July 22, 2024, Johnson & Johnson MedTech unveils Polyphonic, a secure digital ecosystem designed to enhance surgical collaboration. Initially released to select hospitals, Polyphonic streamlines surgical video management, telepresence, and collaborative planning, improving efficiency and time savings for laparoscopic surgeries.

| Report Attributes | Details |

| Market Size in 2023 | USD 10.51 Billion |

| Market Size by 2032 | USD 19.04 Billion |

| CAGR | CAGR of 6.83% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Sensors, Batteries, Displays, MPUs/MCUs, Memory Chips, Others) • By Application (Imaging, Therapeutics, Homecare/Handheld Products, Patient Monitoring) • By End User (Hospitals, Ambulatory Surgical Centers, Home Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | FUJIFILM Holdings Corporation, CANON MEDICAL SYSTEMS CORPORATION, Koninklijke Philips N.V., MCKESSON CORPORATION, iCAD, Inc., Siemens Healthineers AG, GE Healthcare, Analog Devices, Inc., Texas Instruments Incorporated, Biotronik, STMicroelectronics, Medtronic, Abbott Laboratories, Johnson & Johnson, Roche Diagnostics |

| Key Drivers | • Telemedicine and Remote Monitoring Shaping the Future of the Medical Electronics Market |

| Restraints | • Overcoming Data Privacy and Security Challenges in the Evolving Medical Electronic Market |