Thin client Market Size & Growth Trends:

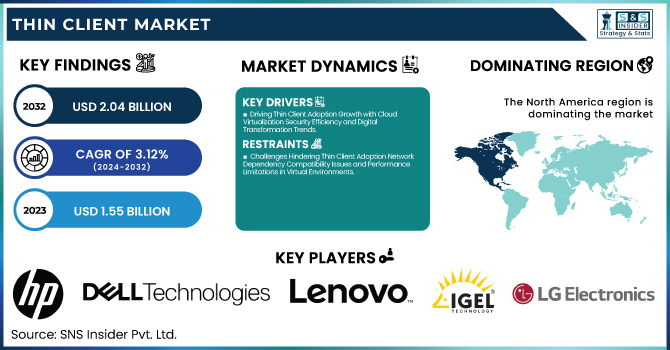

The Thin client Market was valued at USD 1.60 billion in 2024 and is expected to reach USD 2.04 billion by 2032, growing at a CAGR of 3.12% over the forecast period 2025-2032. The thin client market is transforming with higher Virtual Desktop Infrastructure (VDI) penetration, facilitating enterprises with secure and centralized computing. There are also both Windows and proprietary OS solutions, but at the same time, there are also a growing number of Linux-based thin clients. The sustainable nature is critical as green computing initiatives demand devices to be energy-efficient and with low power-consumption ability.

Thin Client Market Size and Forecast:

-

Market Size in 2024: USD 1.60 Billion

-

Market Size by 2032: USD 2.04 Billion

-

CAGR: 3.12% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

To Get more information on Thin client Market - Request Free Sample Report

Thin Client Market Key Trends:

-

Centralized computing adoption – Organizations are increasingly deploying thin clients to centralize data processing, reduce hardware costs, and simplify IT management.

-

Remote workforce expansion – The rise of remote and hybrid work is driving demand for thin clients that enable secure, cloud-based access to enterprise applications.

-

Enhanced security features – Thin clients offer lower vulnerability to malware and data breaches, supporting compliance with strict data privacy regulations.

-

Integration with virtual desktop infrastructure (VDI) – Growing adoption of VDI solutions from providers like VMware and Citrix is fueling thin client demand for seamless virtual access.

-

Energy efficiency and sustainability – Low power consumption and reduced e-waste are motivating enterprises to replace traditional desktops with thin client solutions.

-

Cost-effective scalability – Thin clients allow organizations to easily scale computing resources without frequent hardware upgrades.

Moreover, the development of cloud gaming has accelerated the incorporation of thin clients, allowing for inexpensive, high-performance gaming through remote servers. These trends are driving the market, creating a scenario where thin clients present a great alternative for enterprises and end-users looking for secure, sustainable, and cloud-enabled computing. The U.S. thin client market saw several key developments in 2024 across numerous sectors. Over 48% of the overall share in the market was covered by the commercial segment, which includes BFSI, education, and healthcare fields, due to the demand for central management and automation along with security from loss of time and effort. Standalone form factor also known as the plug-in stick form factor, was the dominant form factor with a share of over one-third of the market, as it offers flexibility and cost-effective computing solutions.

The U.S. Thin client Market is estimated to be USD 0.40 Billion in 2023 and is projected to grow at a CAGR of 2.91%. Cloud computing, virtualization, and Virtual Desktop Infrastructure (VDI) adoption in various sectors is driving the growth of the U.S. thin client market. Increasing demand for energy-efficient, secure, and lower in cost computing solutions is especially prevalent in sectors like BFSI, healthcare, and education to accommodate shifting paradigms in service deliveries, and increasing integration of cloud gaming and remote work trends continues to further bolster market growth.

Thin Client Market Drivers:

-

Driving Thin Client Adoption Growth with Cloud Virtualization Security Efficiency and Digital Transformation Trends

The adoption of cloud computing and virtualization technologies among enterprises is the primary factor fuelling the thin client market. To plug in security holes, reduce IT maintenance costs, and better the efficiency of a workforce, organizations are increasingly adopting virtual desktop infrastructure (VDI) solutions. In addition, the use of thin clients has increased with the increasing need for energy-efficient computing solutions, as they consume much less energy than traditional PCs. Thin clients have increasingly become a go-to choice for businesses as work-from-anywhere and hybrid work models have gained traction, increasing the demand for secure, lightweight, and cost-effective computing devices. In addition, thin client deployment in various sectors including healthcare, education, and BFSI to keep up with the growing digital transformation and e-governance technology due to various government initiatives to encourage these initiatives are expected to provide significant opportunities for the growth of the global e-governance and digital transformation technology during the forecast period.

Thin Client Market Restraints:

-

Challenges Hindering Thin Client Adoption Network Dependency Compatibility Issues and Performance Limitations in Virtual Environments

The reliance on network dependency and server architecture is among the key restraints in the thin client market. Thin clients depend on existing computing resources, which means that any lag with the network or loss of services can have a very detrimental and immediate effect on the performance and user experience. That makes them rule out of contexts with unreliable internet connectivity. In addition, the lack of compatibility with legacy or older applications and peripherals can present serious issues for companies that want to move away from traditional PCs and to the thin client. If hardware or software is highly specialized for a specific purpose, a lack of virtualization support may cause the components to operate less than efficiently.

Thin Client Market Opportunities:

-

Emerging Opportunities for Thin Clients with Edge Computing 5G BYOD DaaS and Global Digitalization Trends

The growing trend of edge computing and 5g technology will provide lucrative growth opportunities for the thin client market. With enterprises migrating to decentralized computing, we can only assume that such compact and powerful computing solutions will be in higher demand. The rising demand for economic impact by industries that do work on sensitive data such as finance, and healthcare is also contributing towards the fast development of advanced thin clients having advanced cybersecurity features. The growing trend of Bring Your Device (BYOD) and Device-as-a-Service (DaaS) models is also providing growth opportunities in the market. In addition to this, the digitalization and rapid investments in cloud-based IT infrastructure in the Asia–Pacific and Latin American emerging economies have proven to be another major factor aiding the demand for thin clients, thus indirectly helping in the thin client market growth.

Thin Client Market Challenges:

-

Security Privacy and Performance Limitations Impacting Thin Client Adoption in High Performance and Sensitive Industries

Compared with the thick client market, security, and data privacy are still big challenges in the thin client market. Although thin clients come with security features that help centralize data storage, they are not immune to server attacks, unauthorized access, and data interception. Businesses that manage sensitive data need to carry out significant security measures which can get complicated and be resource-heavy. The other move is the usual lack of computing power from thin clients versus traditional desktops. While recent advances in cloud computing and virtualization have helped lessen the performance gap, some high-performance applications, like those that are graphics-heavy for computer-aided design (CAD), or engineering simulation, are still best run on dedicated hardware something that prevents narrow adoption of thin clients in specialized industries.

Thin Client Market Segmentation Analysis:

By Type, Hardware Segment Leads Thin Client Market with 39.5% Share in 2024; Services Segment to Witness Highest CAGR

The hardware segment held the largest share of the overall thin client market in 2024 and garnered 39.5% market share, owing to the growing demand for energy-efficient and secure computing devices in enterprises. This prompted businesses to spend money on thin client hardware, which is affordable, requires minimal maintenance, and is more secure than desktop PCs. Increasing demand for virtualization solutions and cloud-based infrastructures led to increased adoption of thin clients' hardware further across various industries including BFSI, healthcare, IT & telecom, and others.

The services segment is anticipated to have the highest CAGR from 2025 to 2032 due to the increasing need for managed services, IT support, and cloud integration. In this transition to VDI and cloud computing, organizations need specific services for the deployment, maintenance, and cybersecurity of these environments. The growth of the market is further propelled by a shift towards Device-as-a-Service (DaaS) models, which emphasize subscription-based thin client solutions.

By Form Factor, Standalone Thin Clients Dominate with 48.7% Market Share; Mobile Segment Expected to Grow Fastest

The standalone segment accounted for 48.7% of the market share within the thin client market in 2024 This remained the most dominant one as this has the greatest adoption across corporate offices, educational institutions, and government organizations for its easier deployment, cost-effectiveness, and better security. Standalone thin clients provide high performance and reliability, making them a suitable option for enterprises that want to build a maintainable infrastructure while reducing maintenance efforts. Not to mention, the high demand for USB client action is also driving the need for USB devices owing to their compatibility with numerous operating systems and virtual desktop infrastructures (VDI).

The mobile segment is expected to register the highest CAGR between 2025 and 2032 due to increasing remote and hybrid work models. Enterprises are spending big on mobile thin clients to give their employees secure, lightweight, portable computing. As 5G technology highlights its growth potential, the increasing edge computing, and Bring Your Device (BYOD) trends are driving the mobile thin client market with significant growth potential in sectors in high mobility and secure access.

By Application, Education Sector Leads Thin Client Adoption at 24.5% Share; Healthcare Segment to Experience Rapid Growth

The thin client market was led by the education sector in 2024 with a 24.5% market share, as schools, universities, and training institutions increasingly turn to VDI to provide their users with access across multiple devices (including Chromebooks and other thin clients). Educational institutions have been moving away from traditional PCs to thin clients for centralized management, security, and maintenance cost reduction as the demand for low-cost energy-efficient computing solutions continues to grow. Moreover, the increasing adoption of digital learning platforms, online exams, and remote education is also propelling the demand for thin client solutions in the education vertical.

The healthcare segment is projected to have a rapid CAGR of growth from 2025 to 2032 owing to the growing demand for secure and efficient as well as scalable IT systems infrastructure in hospitals, clinics, and research centers. Healthcare organizations are also taking advantage of thin clients to improve data security, HIPAA regulation compliance, and simplify access to electronic health records (EHR). In addition, the increased adoption of telemedicine, cloud-based healthcare solutions, and AI-driven diagnostics are also propelling the uptake of thin client technology in the healthcare sector.

Thin Client Market Regional Analysis

North America dominates the Thin Client market in 2024

In 2024, North America holds an estimated 41% share of the Thin Client market, driven by widespread adoption of virtualization, cloud-based IT infrastructures, and strong data security regulations. Enterprises across BFSI, healthcare, IT, and government sectors are deploying thin clients to reduce maintenance costs, enhance security, and support remote work. The region benefits from high IT spending, Device-as-a-Service (DaaS) adoption, and technological advancements in VDI, all of which collectively sustain market leadership and steady growth.

-

United States leads North America’s Thin Client market

The U.S. dominates due to its mature IT infrastructure, early adoption of virtualization technologies, and strong focus on cybersecurity. Large corporations and government organizations are investing in thin client hardware and managed services to ensure secure access to sensitive data and optimize operational efficiency. The rise of remote work, cloud integration, and DaaS adoption strengthens U.S. market leadership. Presence of leading vendors, continuous technology innovations, and robust enterprise IT spending further consolidate the country’s position as the primary revenue contributor in North America.

Asia-Pacific is the fastest-growing region in the Thin Client market in 2024

The Asia-Pacific market is projected to expand at an estimated CAGR of 11.4% from 2025 to 2032, fueled by rapid digital transformation, rising cloud adoption, and growing demand for energy-efficient and secure computing solutions. The region is witnessing increased deployment of thin clients in BFSI, education, healthcare, and IT sectors, supporting centralized management, cost reduction, and enhanced security.

-

China leads Asia-Pacific’s Thin Client market

China dominates due to its expanding IT and telecom infrastructure, increasing government digitalization initiatives, and growing adoption of VDI and cloud-based solutions in enterprises. Demand for secure, scalable, and low-maintenance computing devices across education, healthcare, and BFSI sectors drives growth. Remote work, digital learning expansion, and large-scale enterprise virtualization further accelerate adoption. Leading vendors are investing in hardware and services, positioning China as the largest contributor to the APAC thin client market.

Europe Thin Client market insights, 2024

Europe shows steady growth in 2024, supported by increased virtualization, cloud adoption, and stringent data privacy regulations. Enterprises across BFSI, healthcare, and government sectors are transitioning from traditional PCs to thin clients to reduce IT costs and enhance data security.

-

Germany drives Europe’s Thin Client market

Germany dominates due to its robust IT infrastructure, early virtualization adoption, and strict GDPR compliance. Enterprises implement thin clients for secure access, reduced operational costs, and centralized management. High demand across BFSI, healthcare, and public sectors strengthens Germany’s leadership and supports market momentum.

Middle East & Africa and Latin America Thin Client market insights, 2024

The Middle East & Africa and Latin America markets show moderate growth in 2024. In the Middle East, countries like the UAE and Saudi Arabia are investing in cloud computing and digital government projects, boosting thin client adoption. In Latin America, Brazil and Mexico are deploying virtualization and VDI solutions in BFSI, education, and healthcare to optimize IT costs and improve security. Rising remote work adoption, cloud integration, and energy-efficient computing support steady expansion across both regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Competitive Landscape for the Thin Client Market:

Dell Technologies

Dell Technologies is a U.S.-based leader in computing solutions, offering a wide range of thin client hardware and virtual desktop infrastructure (VDI) solutions. With extensive experience in enterprise IT, the company designs, manufactures, and deploys energy-efficient, secure, and cost-effective thin client devices for corporate offices, healthcare, education, and government organizations. Dell provides end-to-end services, including hardware, software, and cloud-based management, enabling organizations to optimize IT infrastructure while reducing maintenance and operational costs. Its role in the thin client market is significant, providing scalable, reliable, and secure computing solutions across diverse industries.

-

In 2024, Dell Technologies launched its next-generation Wyse thin client series, featuring enhanced security, cloud integration, and improved performance for enterprise virtual environments.

HP Inc.

HP Inc. is a global provider of thin client computing solutions, focusing on hardware, virtualization, and device management services. The company delivers secure, compact, and energy-efficient thin clients for enterprise IT environments, helping organizations simplify desktop management, reduce costs, and enhance cybersecurity. HP’s market presence spans BFSI, healthcare, education, and government sectors, emphasizing scalable and cloud-ready solutions. Its role in the thin client market is vital, offering both hardware and comprehensive software support to ensure smooth integration with virtual desktop infrastructures.

-

In 2024, HP unveiled its Elite series thin clients with enhanced Windows and Linux support, optimized for hybrid work and VDI deployments.

Lenovo Group Limited

Lenovo Group Limited is a global technology leader offering innovative thin client solutions across hardware and cloud-based platforms. The company specializes in delivering secure, high-performance thin clients for enterprises, educational institutions, and government organizations. Lenovo focuses on energy efficiency, reliability, and device management, enabling organizations to reduce IT costs while maintaining robust performance in virtualized environments. Its role in the thin client market is crucial, as it provides versatile solutions for centralized computing, remote work, and Device-as-a-Service (DaaS) models.

-

In 2024, Lenovo expanded its ThinkCentre Tiny series with enhanced VDI support, security features, and lightweight form factors for enterprise applications.

IGEL Technology

IGEL Technology is a Germany-based innovator in software-defined thin client solutions, offering endpoint management, VDI integration, and cloud-ready devices. The company provides enterprises with secure, manageable, and flexible thin clients that optimize virtual desktop and cloud computing environments. IGEL’s focus on endpoint security, centralized management, and OS-agnostic solutions supports cost reduction and operational efficiency for organizations across BFSI, healthcare, education, and government sectors. Its role in the thin client market is strategic, driving adoption of software-defined endpoints and enabling seamless transitions to modern virtualized IT infrastructures.

-

In 2024, IGEL introduced IGEL OS 12, a next-generation thin client software platform, enhancing security, cloud connectivity, and endpoint management capabilities.

Thin Client Market Key Players:

-

HP Inc.

-

Lenovo Group Limited

-

IGEL Technology

-

NComputing

-

10ZiG Technology

-

Samsung Electronics

-

Fujitsu Limited

-

Acer Inc.

-

VXL Instruments

-

Wyse Technology (Dell subsidiary)

-

Stratodesk

-

Atrust Computer Corporation

-

Chip PC Technologies

-

ClearCube Technology

-

Neoware (acquired by Acer)

-

Prostar Computer Inc.

-

Praim

-

VIA Technologies

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.60 Billion |

| Market Size by 2032 | USD 2.04 Billion |

| CAGR | CAGR of 3.12% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hardware, Software, Services) • By Form Factor (Standalone, With Monitor, Mobile) • By Application (Healthcare, Retail, Education, BFSI, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Dell Technologies, HP Inc., Lenovo Group Limited, IGEL Technology, NComputing, 10ZiG Technology, Samsung Electronics, Fujitsu Limited, Acer Inc., VXL Instruments, Wyse Technology (Dell subsidiary), Stratodesk, Atrust Computer Corporation, Chip PC Technologies, ClearCube Technology, Neoware (acquired by Acer), Prostar Computer Inc., Praim, LG Electronics, VIA Technologies. |