Night Vision Device Market Size & Trends Analysis:

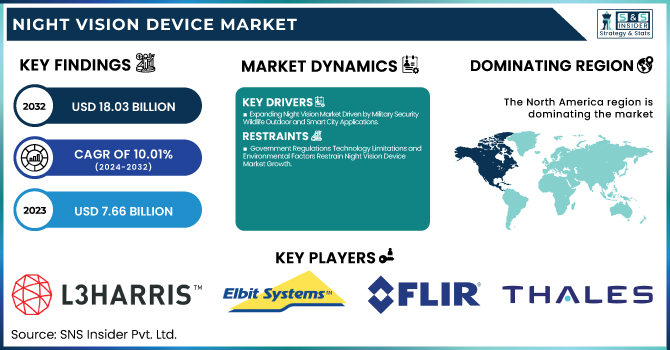

The Night Vision Device Market Size was valued at USD 7.66 Billion in 2023 and is expected to reach USD 18.03 Billion by 2032 and grow at a CAGR of 10.01% over the forecast period 2024-2032. The Night Vision Device market is witnessing advancements in fab capacity utilization, with increased production of CMOS and infrared sensors to meet growing demand. Technology performance metrics are improving, including enhanced image resolution, longer battery life, and lightweight designs. AI and machine learning are driving real-time object recognition and noise reduction in low-light conditions.

To Get more information on Night Vision Device Market - Request Free Sample Report

However, rising cybersecurity risks pose concerns, as wireless night vision devices and surveillance systems are increasingly vulnerable to hacking and unauthorized access. U.S. Night Vision Device Market is Growing Due to Military Modernization, Law Enforcement Needs, and Increasing Civilian Applications: 2024. More than 10,000 Enhanced Night Vision Goggle-Binocular (ENVG-B) units have been fielded with divisions including the 1st Infantry and 82nd Airborne among others, according to the U.S. Army. So far 3,100 ENVG-B units have been acquired for the U.S. Marine Corps.

The U.S. Night Vision Device Market is estimated to be USD 2.24 Billion in 2023 and is projected to grow at a CAGR of 9.84%. The U.S. Night Vision Device market is growing due to growing demand across various applications military, security, and commercial is further driven by technological advancements in AI-driven imaging, thermal sensors, and cost-effective solutions.

Night Vision Device Market Dynamics

Key Drivers:

-

Expanding Night Vision Market Driven by Military Security Wildlife Outdoor and Smart City Applications

The Night Vision Device (NVD) market is anticipated to grow substantially due to an increase in military, defense, and security applications. Governments all over the world are pouring money into new technologies to strengthen border security, fight terrorism, and improve law enforcement practices. Moreover, the growing use of night vision technology for wildlife spotting, hunting, and outdoor recreational activities is also driving the growth of the market. The reduced cost of manufacturing, combined with technological advances like thermal imaging, infrared illumination, and AI-powered enhancements executes device performance to newer heights, thus expanding the horizon for NVD beyond just military applications to commercial and civilian usage as well. In addition, the use of Night Vision among automotive and smart city surveillance systems has opened up opportunities for the market.

Restrain:

-

Government Regulations Technology Limitations and Environmental Factors Restrain Night Vision Device Market Growth

The important factor hampering the growth of the night vision device (NVD) market is the strict norms imposed by the government for NVD applications, especially in cases of civilian and commercial use. Night vision technology is one of a few dozen topics in the world upon which most nations impose tight export controls and licensing requirements due to its importance for military and defense purposes. Moreover, the potential abuse and unlawful access to advanced non-vulnerability descriptors (NVDs) has resulted in limitation that restricts the market growth. The other one is the technical throat above the evening imaginative and prescient tools, that is, they may be reliant on exterior light sources, might have a smaller detection variety within the severe darkness, and will also be extremely affected by dank, rain or smoke and can lose effectiveness at sure times due to those environmental conditions.

Opportunity:

-

Advancements in Technology and Expanding Applications Drive Growth Opportunities in Night Vision Device Market

As manufacturing technologies mature, there are ample opportunities in this market, especially with many low-cost, lightweight, and portable near-eye displays entering the civilian market. Demand is also partly driven by the increasing embrace of night vision-enabled smart cameras and Augmented Reality (AR) based headgear for security and personal safety. Moreover, high investment in research & development of next-generation imaging intensifiers and advanced thermal imaging solutions will likely bolster various future innovations. The increase in NVDs for rescue and navigation and wildlife conservation use is also an area for opportunity. Continued unlocking of use cases beyond conventional defense domains is set to persist as a pivotal trend determining the future of the night vision device landscape.

Challenges:

-

Emerging Technologies and Portability Challenges Pose Competition and Innovation Needs for Night Vision Devices

Meanwhile, NVDs face competition from alternative technologies achieving rapid advancements, such as LiDAR-based night vision or AI-powered low-light imaging. The resolvability of images from these emerging solutions is greater than what we have today from conventional night vision systems, and smaller size, weight, and power will allow properly engineered SOF-optimized systems to replace conventional systems for some applications. Moreover, because of the size and high power consumption in the case of traditional night vision devices often means that their portability and long-term use by the end-user is limited. The ability to miniaturize devices, improve their battery life, and allow them to function in a variety of environments will need to be addressed if these technological gaps are to be eliminated in the future.

Night Vision Device Market Segments Analysis

By Type

Goggles accounted for the largest share of the night vision devices market during the year 2023, with a value of 28.2% as they are extensively used in military, law enforcement, and security. NVGs, on the other hand, are a hands-free option that can add great additional tactical and situational awareness as well as depth perception making them an excellent option for tactical purposes, operations, and surveillance. In defense and aviation, their integration with helmet-mounted systems also drives up demand. Meanwhile, better lightweight designs and new imaging technology are making it more appealing for both military and civilian users.

Monocular & binocular night vision devices are expected to register the fastest CAGR from 2024 to 2032, owing to increasing demand for wildlife enthusiasts, hunters, and adventurers. Their portability, low cost, and flexibility allow for commercial and personal applications. The growing use of night vision monoculars in search & rescue activities and navigation is another factor boosting the market growth, providing enormous opportunities in the upcoming years.

By Technology

In 2023, thermal imaging held 40.2% of the market for night vision devices, thanks to its ability to find heat signatures in complete darkness, smoke, and rain. Thermal imaging, which is heavily applicable in the military, defense, surveillance, and industrial inspections, provides an effective solution for accuracy in threat detection, search & rescue, and border security. Drones, autonomous vehicles, and smart security systems see an increasing integration of AI, all of which only reinforce its market leadership. Furthermore, recent developments in uncooled thermal sensors have made them more cost-effective for commercial and civil use.

The imaging intensifier technology is predicted to grow the fastest between 2024-2032 owing to its cost, lightweight designs, and real-time image enhancement. It is employed in military night vision goggles, scopes, and low-light cameras. Continuous enhancements in the field of high-resolution intensifiers and digital night vision capabilities will further enhance its penetration in the market, which is expected to continue to remain one of the prominent growth segments of the global combat systems industry.

By Application

The night vision device market for security & surveillance held the largest market share of about 25.2% in 2023, owing to the higher demand for night vision devices for various applications such as border security, law enforcement, and critical infrastructure protection. Even now, governmental and private security agencies alike are investing in night-vision cameras, goggles, and scopes to improve 24-hour surveillance. Moreover, using thermal imaging and Artificial Intelligence (AI)-based analytics in security systems improving threat detection enhanced night vision into a necessity for crime prevention and defense purposes.

The wildlife spotting & hunting segment is projected to register the fastest car over the forecast duration (2024 to 2032) owing to the increasing preference for hunting during nights, wildlife watching, and an increase in ecotourism. Rising demand for affordable and lightweight night vision monoculars, binoculars, and thermal scopes is boosting the market growth. In addition, conservationists and researchers have adopted night vision devices for tracking endangered species and monitoring the behavior of nocturnal wildlife, presenting high-growth market opportunities.

By End-use

The largest market share of 63.5% is accounted to the Government, Military & Defense sector for the night vision device market in 2023 and this is due to the increasing investment in border security, tactical missions, and military modernization programs. Many defense forces across the globe are adopting night vision goggles, thermal scopes, and imaging systems to improve capabilities in low-light poison. Moreover, general concerns over terrorism, cross-border conflicts, and internal security threats are increasing the demand for high-performance night vision solutions. Its market position is also being further solidified with this integration right into AI usage, augmented reality (AR), and next-gen sensor technologies.

The consumer segment is projected to register the highest CAGR from 2024 to 2032, owing to the growing usage of night vision devices for hunting, wildlife viewing, adventure activity, and personal security. New developments in inexpensive, lightweight, and high-resolution night vision monoculars, binoculars, and day/night digital night vision cameras bring these sought-after devices into the price range of the average consumer. Additionally, smart home security is highly popular and enhances market growth with scouting activities.

Night Vision Device Market Regional Overview

North America accounted for a 37.6% share of the night vision device market in 2023, owing to high government expenditures on defense, homeland security, and law enforcement. As an example, the U.S. DoD (Department of Defense) and CBP (Customs and Border Protection) are full speed ahead on advanced night vision goggles, thermal cameras, and surveillance system purchases to support military and border operations. Also, increasing usage of night vision technology solutions for wildlife research, outdoor sports, and private security, is expected to foster market growth during the forecast period. Leading companies such as FLIR Systems (Teledyne FLIR) and L3Harris Technologies developed next-gen night vision solutions that can be used in military as well as commercial applications.

During the forecast period of 2024 to 2032, the Asia-Pacific region is anticipated to dominate with the fastest-growing CAGR, bolstered by growing defense budgets, escalating security risks, and expanding adoption of consumer applications. Demand for night vision devices is being driven by aggressive upgrades of defense and surveillance infrastructure in countries such as China and India. As an illustration, the BSF of India is procuring high-performance night vision goggles and thermal imagers especially those developed by the Chinese PLA for border security through LAC. Further aiding the growth of the market are also the trends of night hunting, adventure tourism, and wildlife conservation which are increasingly gaining popularity across Australia and Southeast Asia.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Night Vision Device Market are:

-

L3Harris Technologies Inc. (AN/PVS-14 Night Vision Monocular)

-

RTX (formerly Raytheon Technologies Corporation) (AN/PAS-13 Thermal Weapon Sight)

-

BAE Systems (ENVG III/FWS-I Integrated Night Vision System)

-

Elbit Systems Ltd. (Enhanced Night Vision Goggle – Binocular (ENVG-B))

-

FLIR Systems Inc. (FLIR Breach PTQ136 Thermal Monocular)

-

Bharat Electronics Limited (Passive Night Vision Goggles)

-

Thales Group (Minie-D/Minie-D NVG Night Vision Goggles)

-

American Technologies Network Corp. (ATN Corp.) (ATN PVS7 Night Vision Goggles)

-

Collins Aerospace (AN/AVS-10 Panoramic Night Vision Goggle)

-

Meopta Optica S.R.O (MeoNight 1.1 Night Vision Device)

-

Harris Corporation (F5032 Lightweight Night Vision Binocular)

-

Photonis (Exosens) (16mm Auto-Gated Image Intensifier Tubes)

-

Intevac Inc. (ISIE10 EBAPS Night Vision Sensor)

-

NVLS - NightVision Lasers Spain (Wide Field of View Night Vision Goggles)

-

N-Vision Optics (PVS-7 Night Vision Goggles)

Recent Trends

-

In January 2025, L3Harris Technologies secured a USD 263 million U.S. Army contract for Enhanced Night Vision Goggle–Binocular (ENVG-B) production, enhancing soldiers' situational awareness and battlefield connectivity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.66 Billion |

| Market Size by 2032 | USD 18.03 Billion |

| CAGR | CAGR of 10.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Camera, Goggles, Scope, Monocular & Binoculars, Others) • By Technology (Imaging Intensifier, Thermal Imaging, Infrared Illumination, Other Emerging Technologies) • By Product (Security & Surveillance, Wildlife Spotting & Hunting, Wildlife Conservation, Navigation, Paranormal Research, Others) • By End-use (Government, Military & Defense, Consumer) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | L3Harris Technologies Inc., RTX (formerly Raytheon Technologies Corporation), BAE Systems, Elbit Systems Ltd., FLIR Systems Inc., Bharat Electronics Limited, Thales Group, American Technologies Network Corp. (ATN Corp.), Collins Aerospace, Meopta Optica S.R.O, Harris Corporation, Photonis (Exosens), Intevac Inc., NVLS - NightVision Lasers Spain, N-Vision Optics. |