Medical Scrubs Market Report Size Analysis:

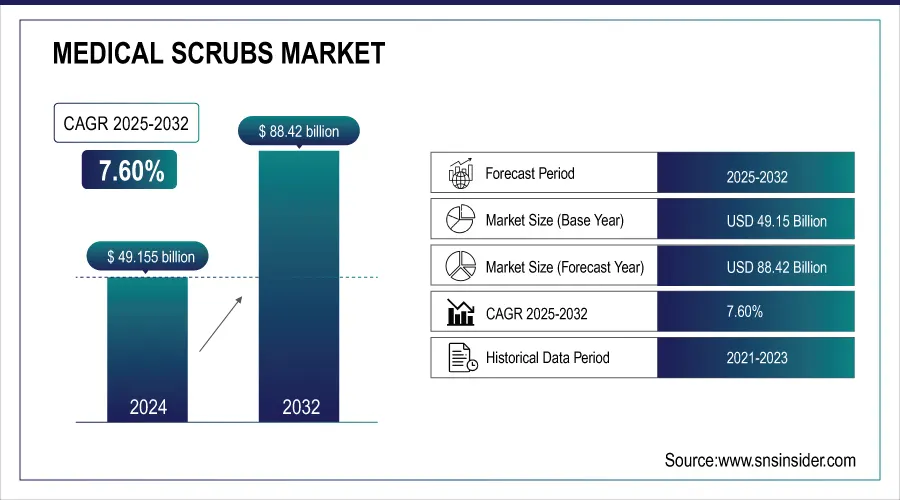

The Medical Scrubs Market size was valued at USD 49.15 billion in 2024 and is expected to reach USD 88.42 billion by 2032, growing at a CAGR of 7.60% over the forecast period of 2025-2032.

The medical scrubs market is experiencing constant growth with an increasing number of healthcare workers, increased awareness regarding hygiene and infection control, and a growing need for reusable as well as disposable clothing. Following the pandemic, safety and standard uniform focus have increased worldwide, particularly in specialty clinics and hospitals. Advances in fabric technology, antimicrobial finishes, and functional, fashionable designs are fueling adoption. In addition, the increasing healthcare facilities in developing countries continue to increase market opportunities in both public and private health facilities.

To Get more information on Medical Scrubs Marke - Request Free Sample Report

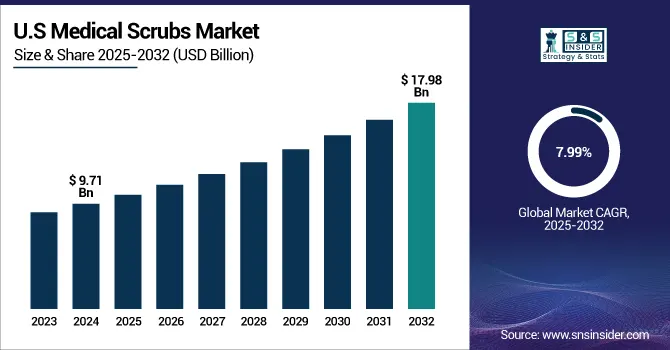

The U.S. medical scrubs market size was valued at USD 9.71 billion in 2024 and is expected to reach USD 17.98 billion by 2032, growing at a CAGR of 7.99% over the forecast period of 2025-2032. The U.S. has a prominent share in North America's medical scrubs companies, which is fueled by the country's massive healthcare infrastructure base, increased strength of healthcare personnel, and severe infection control requirements. The unremitting requirement for functional, high-quality, and comfortable clothes in clinics and hospitals keeps propping up strong adoption of scrubs across America.

Medical Scrubs Market Dynamics

Drivers

-

Increasing Healthcare Workforce Driving the Market Growth

The world healthcare industry is witnessing massive growth in its workforce. The Organization for Economic Co-operation and Development (OECD) has reported that jobs in the health and social care sector grew by 24% between 2011 and 2021, surpassing overall employment growth. In the United States, the Bureau of Labor Statistics estimates that the healthcare and social assistance industry will generate approximately 45% of all new employment opportunities from 2022 to 2032. This growth requires an increase in medical scrubs to dress the increasing number of healthcare workers.

-

Increased Emphasis on Infection Control and Hygiene Propelling the Medical Scrubs Market Trends

The COVID-19 pandemic raised global awareness of the necessity of strict hygiene protocols in health care environments. Scrubs for medical use serve an essential function in infection control through acting as a barrier between the body and potentially contaminated materials. Hospitals now look to invest in high-quality, antimicrobial scrubs that meet industrial laundering standards. The focus on disease prevention and enhanced safety standards remains a principal force behind demand for medical scrubs globally.

Restraint

-

Low Product Differentiation and Intense Price Competition are Restraining the Market Growth

Low product differentiation and intense price rivalry within the global medical scrubs market hinder its growth prospects significantly. With scrubs having a very utilitarian function and often following basic designs, V-neck tops, and drawstring trousers, the opportunity to incorporate special features that distinguish a brand from the others is narrow. Therefore, numerous manufacturers engage in price wars as their source of attracting clients. Such price competition results in thin profit margins and dissuades investment in better quality or green materials, brand building, and innovation. It also prevents new or smaller companies from finding a place in the large-scale suppliers-dominated market where bulk orders are taken.

Segmentation Analysis

By Type

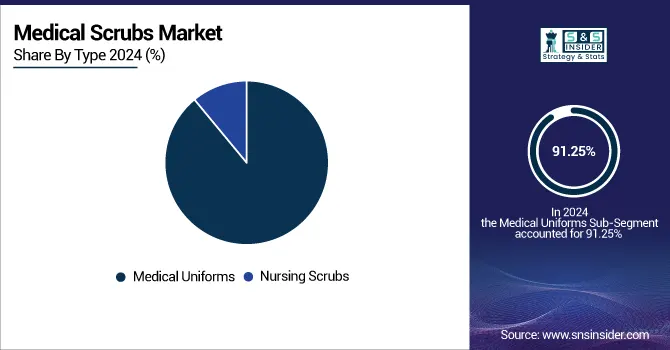

The medical uniforms segment dominated the medical scrubs market share with a 91.25% in 2024 because of its extensive use across healthcare environments. Medical uniforms, including surgeon, physician, and support staff attire, are critical for ensuring hygiene, professionalism, and patient protection. Their extensive utilization in hospitals and ambulatory surgical centers (ASCs) reflects their important role in infection prevention and standardization in healthcare facilities. Moreover, innovations in fabric technology, including antimicrobial finishes and moisture-wicking technology, have increased the functionality and comfort of these uniforms, which has further stimulated their demand.

The nursing scrubs segment is expected to register significant growth in the forecast period, mainly driven by the growing healthcare workforce and the rising focus on infection prevention.

For instance, according to OECD, Nurses are the biggest single group of health and social care workers in the majority of OECD countries, accounting for approximately 20–25% of all staff. Personal care workers, such as healthcare assistants working in hospitals and nursing homes, and home-based carers, are also a major component of the workforce and, in some instances, even larger than nurses.

Nurses form a significant part of the healthcare professionals, and the increasing number of nursing professionals worldwide leads to the increased demand for customized nursing scrubs. In addition, advancements in scrub design, including ergonomic fits and adjustable features, address the unique requirements of nursing staff, supporting comfort and convenience while working long hours. Such an amalgamation of factors positions the segment of nursing scrubs for the medical scrubs market growth in the future years.

By Usage

The reusable segment dominated the medical scrubs market with a share of 90.11% in 2024 due to its affordability and durability. Reusable medical scrubs are usually used in hospitals and clinics due to their ability to be washed and reused several times, hence becoming a more affordable option for hospitals, clinics, and medical professionals. Reusable scrubs are also typically made of robust materials that withstand repeated washing without compromising quality. The dominance of this segment is also supported by growing environmental awareness because reusable scrubs reduce medical waste compared to disposable scrubs. The reusable scrubs' longer lifespan and better quality make them the option for hospitals.

The disposable segment will witness the fastest growth during the forecast period, at an 8.09% CAGR, due to increasing infection control processes and increasing demand for clean, single-use products in healthcare facilities. Disposable scrubs are especially preferred where cleanliness and patient safety are a top priority, i.e., operating theatres, emergency departments, and surgery. Practicality and the added security of reducing the possibility of cross-contamination risk factors contribute to making them extremely popular for temporary application.

By End-User

The Hospitals & ASCs (Ambulatory Surgical Centers) segment held the largest share of 76.50% in 2024 in the medical scrubs market, with their bulk order for scrubs across different healthcare facilities. Hospitals and ASCs are the biggest buyers of medical scrubs because they have huge patient volumes and require hygiene and infection control across different departments, such as emergency rooms, operating rooms, and patient wards. Medical scrubs also depend on continuous supplies of top-grade medical scrubs for everyday use by medical professionals at such facilities, including technicians, nurses, and doctors. Because hospitals and ASCs have high standards of cleanliness and infection control, hospitals and ASCs are the primary end-users of medical scrubs, thereby driving their demand in the market.

The specialty clinics segment is expected to show significant growth during the forecast period due to the increasing rate of specialized medical procedures and outpatient care. Specialty clinics, which have expertise in specific medical disciplines such as dermatology, oncology, and orthopedics, are witnessing increases in patient visits and procedures. As these clinics handle more specialized medical needs, the demand for medical scrubs that are applicable for specialty procedures and patient care is increasing. Additionally, increased specialty healthcare services in regions with a growing middle class and improving access to healthcare are fueling specialty clinic scrub demand, one of the highest-growth end-user groups over the forecast period.

Medical Scrubs Market Regional Analysis

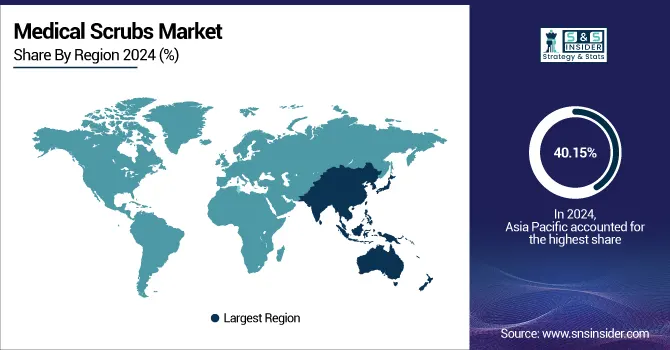

In 2024, Asia Pacific led the medical scrubs market with a 40.15% market share due to its large production capacity, cheaper manufacturing costs, and growing demand in densely populated nations like China, India, and Indonesia. The region has a robust textile industry, allowing for the cost-effective mass production of medical wear. Additionally, the growing number of hospitals, the increasing healthcare workforce, and increasing awareness regarding hygiene and infection control are major drivers of demand. Government support for developing healthcare infrastructure and increasing medical tourism also contributes significantly to reinforcing Asia Pacific's leadership in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America is witnessing the fastest growth in the medical scrubs market, with a 7.99% CAGR over the forecast period, because of its emphasis on infection prevention, rigorous regulatory frameworks, and high healthcare spending. The rising need for antimicrobial and comfortable scrub tops, driven by innovation from high-end brands, is propelling market growth. Also, a growing number of hospital visits, an increase in outpatient care services, and an established e-commerce platform for medical scrubs support the region's fast market growth.

Europe exhibits significant dominance in the medical scrubs market because of its established healthcare systems, high costs for healthcare, and stringent regulatory requirements for hospital cleanliness and safety. Germany, the UK, and France have vast networks of hospitals and an increasingly aging population, which drive up demand for medical clothing. The focus on infection control and prevention in healthcare facilities also enhances the consistent use of quality medical scrubs by healthcare workers.

Germany is a market leader in Europe's medical scrubs market, led by a robust healthcare infrastructure and a strong emphasis on infection control. Germany's multi-payer health care system, with state and private insurers, has been able to accommodate a high density of doctors per 1,000 inhabitants at 4.5 physicians per 1,000 population as of the year 2021. Germany also boasts an expansive healthcare base, which needs sustained demand for scrubs and medical attire to ensure hygiene standards and patient protection.

In Latin America, nations such as Mexico and Brazil are experiencing better-equipped healthcare facilities and growing incidences of diseases, causing more hospitalizations. Such a rise makes the utilization of medical clothing, such as scrubs, for purposes of hygiene and infection control imperative. Also, the increase in the number of elderly persons in the region contributes to the greater need for healthcare services, which further drives the medical scrubs market analysis.

The MEA region is witnessing growth in the medical scrubs market because of massive investments in healthcare infrastructure, especially in Saudi Arabia and the United Arab Emirates. Hospital and clinic expansions, as well as infection control and patient safety focus, have boosted demand for medical scrubs. In addition, increased medical tourism in destinations such as Turkey is also driving the market by increasing higher levels of medical clothing to become compulsory for personnel and patient care.

Medical Scrubs Market Key Players

The medical scrubs market companies include FIGS, Barco Uniforms, Landau Uniforms, Jaanuu, Cherokee Uniforms, Healing Hands, WonderWink, Adar Medical Uniforms, Medline Industries, Koi, and other players.

Recent Developments in the Medical Scrubs Market

-

January 2025 – FIGS introduced cutting-edge upgrades in medical wear, adding yoga waistbands for greater comfort, an antimicrobial technology that withstands industrial washing, and fitted styles that meet a professional look with maximum mobility.

-

July 2024 – Jaanuu, a high-end medical scrubs company, reported robust results after Centric PLM adoption from Centric Software. The company explained its success story, demonstrating how Centric's next-generation enterprise solutions have helped its digital transformation in product planning, development, and distribution.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 49.15 Billion |

| Market Size by 2032 | USD 88.42 Billion |

| CAGR | CAGR of 7.60% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Medical Uniforms, Nursing Scrubs) •By Usage (Disposable, Reusable) •By End-user (Hospitals & ASCs, Specialty Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | FIGS, Barco Uniforms, Landau Uniforms, Jaanuu, Cherokee Uniforms, Healing Hands, WonderWink, Adar Medical Uniforms, Medline Industries, Koi, and other players. |