Omega-3 Fatty Acid Market Report Scope & Overview:

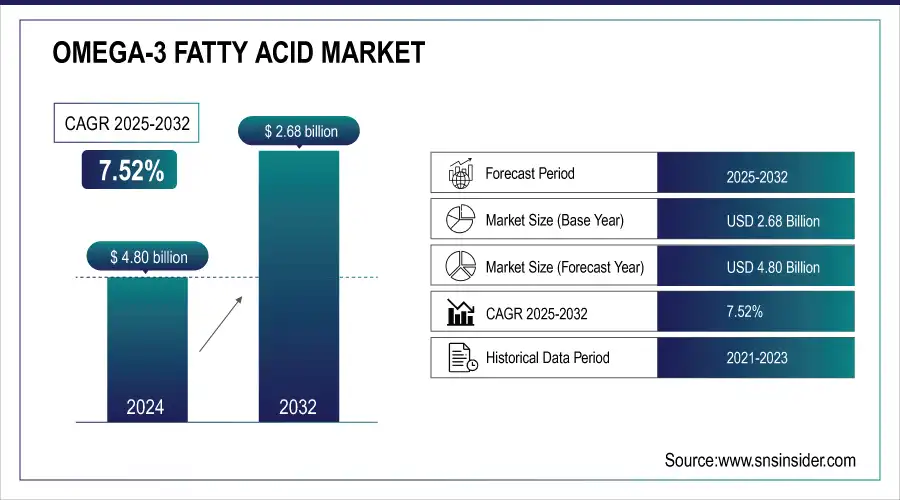

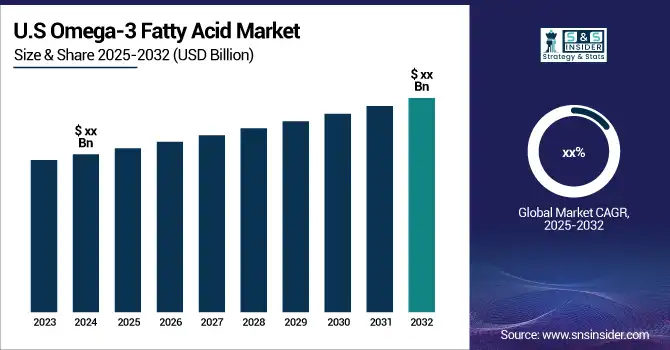

The Omega-3 Fatty Acid Market Size was valued at USD 2.68 billion in 2024 and is expected to reach USD 4.80 billion by 2032, and grow at a CAGR of 7.52% over the forecast period 2025-2032.

Fish and flaxseed, as well as vitamin supplements like fish oil, contain omega-3 fatty acids. The three principal omega-3 unsaturated fats are alpha-linolenic corrosive (ALA), eicosapentaenoic corrosive (EPA), and docosahexaenoic corrosive (DHA). DHA and EPA are found in fish and other seafood, while alpha-linolenic acid (ALA) is found in plant oils such as soybean, flaxseed, and canola oils. Omega-3 fatty acids play a crucial role in the human body because they are important components of the membranes that surround each cell. They also act as a source of calories, providing energy to the body and aiding in numerous biological activities.

Get more information on Omega-3 Fatty Acid Market - Request Sample Report

The omega-3 Fatty acids is being driven by the advent of omega-3 as an active pharmaceutical ingredient (API) and the growing awareness of chronic diseases among people all over the world. The adoption of favorable rules regarding the use of omega-3 in infant formulas, as well as cooperation between key companies to improve the product, are accelerating the growth of omega-3 fatty acids. Increased adoption of omega-3 in supplements and functional foods as it is known to be highly effective in the treatment of a variety of health problems like menstrual health, depression, mental health, and bone loss, as well as an increase in demand for food fortification, particularly for mother and infant nutrition products, all, have an impact on the omega-3 fatty acids market.

Moreover, expanded consciousness of omega-3's wellbeing benefits, use in pet food and feed, a more noteworthy spotlight on deterrent medical care, development in food handling applications, and rising medical services use all lift the omega-3 unsaturated fat industry. Moreover, in the forecast period, innovative production technologies, development of alternative sources of omega-3, microencapsulation, growing awareness of certified food ingredients, favorable regulatory environment, and enhancing consumer demand for plant-based products provide profitable opportunities for omega-3 fatty acids market players.

Key Omega-3 Fatty Acid Market Trends

-

Rising demand for plant-based and algae-derived omega-3s as sustainable and vegan alternatives to fish oil.

-

Expansion of functional foods and beverages with omega-3 fortification to attract health-conscious consumers.

-

Increasing pharmaceutical use of omega-3s in managing cardiovascular and neurological disorders.

-

Strong focus on sustainability and traceability with certified, eco-friendly sourcing methods.

-

Growing adoption of personalized nutrition integrating omega-3 supplements into DNA-based diet plans.

-

Supportive regulatory approvals and health claims driving wider consumer acceptance.

Omega-3 Fatty Acid Market Growth Drivers

-

Increasing awareness of health benefit

Increasing awareness of the health benefits of omega-3 fatty acids is one of the strongest drivers of market growth. Consumers are becoming more informed about the role of EPA and DHA in supporting cardiovascular health, reducing inflammation, improving cognitive performance, and aiding eye development. This shift is fueled by growing scientific research, widespread media coverage, and health authority endorsements that reinforce the preventive and therapeutic value of omega-3 supplements. As a result, demand is not limited to traditional dietary supplements but is expanding into fortified foods, beverages, pharmaceuticals, and even infant nutrition products. The trend reflects a broader global move toward preventive healthcare and wellness, where consumers are proactively seeking products that enhance long-term health outcomes.

-

Advancement in technologies

Omega-3 Fatty Acid Market Restraints

-

Unpleasant sensory experience.

One of the notable challenges in the omega-3 fatty acid market is the unpleasant sensory experience often associated with its consumption. Traditional sources such as fish oil can produce a strong odor, aftertaste, or “fishy burps,” which discourages consistent use among consumers. This sensory drawback not only affects the palatability of dietary supplements but also limits the appeal of omega-3 fortification in everyday food and beverage products. Manufacturers are increasingly investing in advanced encapsulation technologies, flavor-masking techniques, and alternative sources such as algae oil to overcome this issue. Addressing the sensory barrier is essential to improving consumer adherence and expanding the application of omega-3s across diverse product categories.

-

High temperatures

-

Quality effects

Omega-3 Fatty Acid Market OPPORTUNITIES

-

Plant-based product

-

Different geographies

-

High investment in extraction of omega-3

The extraction of omega-3 fatty acids, particularly from sources like fish, krill, and algae, requires significant investment due to the complexity of the processes involved. Advanced technologies such as supercritical fluid extraction, molecular distillation, and microencapsulation are essential to ensure high purity, stability, and concentration of EPA and DHA. These methods not only demand costly equipment but also involve stringent quality control measures to meet regulatory and safety standards. Additionally, sustainable sourcing practices—such as responsible fishing and algae cultivation—further add to operational costs. As a result, the high investment requirement poses a barrier for new entrants and smaller companies, while encouraging established players to strengthen their R&D and strategic partnerships to improve cost efficiency and maintain competitiveness in the omega-3 fatty acid market.

CHALLENGES

-

Competitive price range.

-

Large or scare competition

IMPACT OF COVID-19

The COVID-19 outbreak has helped the international market. There has been a significant surge in demand for omega fatty acid foods and dietary supplements to improve health and immunity, according to research. The widespread dissemination of doctor recommendations to incorporate immunity-boosting dietary supplements into daily living is a major factor in the product's widespread adoption. The supply chains of enterprises in the industry have been disrupted, owing to mobility limitations and geometrically rising logistics and transportation costs as a result of the ongoing pandemic. The product's manufacturing process has been hampered by a slowdown in the import and production of raw materials.

Furthermore, the original lockdowns, as well as their persistence, have resulted in workforce shortages in some manufacturing plants. From now on, product safety, product information transparency, and cleanliness issues are expected to stay prevalent among consumers. Market participants can raise their market value and prominence by ensuring the aforementioned variables are completely addressed during raw material sourcing, product manufacture, and packaging.

Omega-3 Fatty Acid Market Segment Analysis

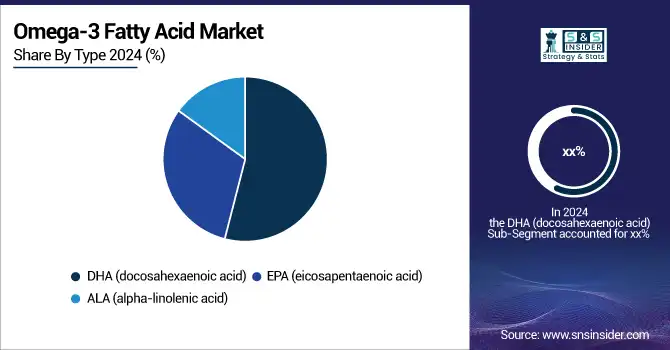

By Type: Alpha-linolenic acid (ALA), eicosapentaenoic acid (EPA), and docosahexaenoic acid (DHA) make up the omega-3 market (DHA).

By Source: Fish oil and krill oil, algal oil, walnut, pumpkin seeds, soybean oil, canola oil, bean curd, and other omega-3 products are available.

By Application: Dietary supplements, pharmaceuticals, infant formula, food and beverage, pet food, and fish feed are all segments of the omega-3 market.

By Type:

Among types, docosahexaenoic acid (DHA) holds the dominant market share in 2024, owing to its critical role in brain development, cognitive function, and eye health. DHA is widely used in infant formulas, dietary supplements, and pharmaceuticals, making it the most commercially significant omega-3 type. Its strong demand is further supported by rising awareness among parents regarding child nutrition and increasing recommendations by healthcare professionals for pregnant women and aging populations.

By Source:

On the basis of source, fish oil dominates the market in 2024, as it remains the most widely used and easily available source of EPA and DHA. The abundance of fish oil, coupled with its established clinical efficacy, has ensured its leadership position. Although algal oil is growing rapidly due to vegan preferences and sustainability concerns, fish oil continues to lead because of its cost-effectiveness, higher omega-3 concentration, and established supply chains.

By Application:

Within applications, dietary supplements emerge as the dominant segment in 2024, accounting for the largest share of omega-3 consumption. The increasing adoption of preventive healthcare practices, coupled with the convenience of capsules and soft gels, has made supplements the most popular channel for omega-3 intake. Strong consumer demand across North America, Europe, and Asia-Pacific, along with the growth of e-commerce platforms, has further cemented dietary supplements as the leading application segment.

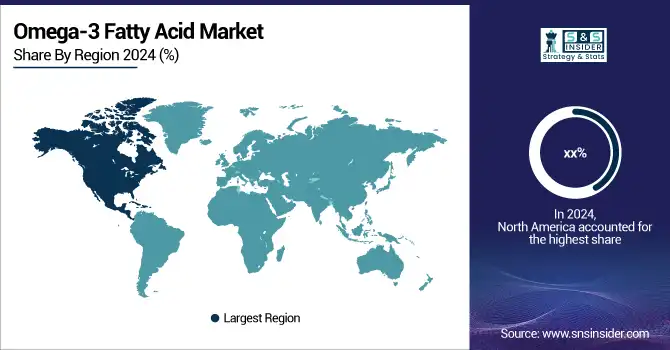

Omega-3 Fatty Acid Market Regional Analysis

North America Omega-3 Fatty Acid Market Insights

North America was the largest regional market. Several regional market players, including Omega Protein Corp., Martek Biosciences Corp., and BioProcess Algae, are focused on R&D activities to create pharma-grade omega 3, which is boosting the regional market growth. The growing demand for omega 3 supplements in Europe can be ascribed to an aging population and an increase in cases of various health disorders, notably in economies.

Need any customization research on Omega-3 Fatty Acid Market - Enquiry Now

Asia Pacific Omega-3 Fatty Acid Market Insights

Over the forecast period, Asia Pacific is expected to have the highest CAGR. Growing awareness of the need for a healthy diet and general well-being, as well as rising disposable income, are predicted to enhance product demand in the region. In the Asia Pacific, the high birth rate and growing population of young mothers are expected to increase demand for baby nourishment, resulting in increased product consumption. Brazil, with increased demand for health supplements, is driving product demand throughout Central and South America.

Europe Omega-3 Fatty Acid Market Insights

Europe remains a key hub for omega-3 fatty acid consumption, accounting for 29.4% of the global market share in 2024. Germany leads within the region due to its strong nutraceutical and pharmaceutical industries, coupled with high consumer awareness of cardiovascular and cognitive health benefits. Regulatory support for health claims and a preference for premium, high-quality supplements have further fueled market penetration. The growing adoption of algae-based omega-3 also highlights Europe’s shift toward sustainable and plant-based solutions.

United States Omega-3 Fatty Acid Market Insights

The U.S. continues to dominate North America, holding a 35.8% share of the global market in 2024. This leadership is driven by a mature dietary supplement industry, widespread consumer adoption, and ongoing product innovations in functional foods and beverages enriched with omega-3s. Strong regulatory frameworks supporting health benefit claims and a proactive consumer base prioritizing preventive health make the U.S. the largest single-country market globally.

Latin America (LATAM) Omega-3 Fatty Acid Market Insights

Latin America represented 5.3% of the global omega-3 fatty acid market in 2024, with Brazil and Mexico emerging as the fastest-growing contributors. Increasing middle-class income levels, expanding healthcare awareness, and government-led nutrition programs are fostering greater adoption of fortified foods and supplements. Although overall penetration remains lower compared to North America and Europe, the region is witnessing steady growth opportunities in both pharmaceuticals and infant nutrition sectors.

Omega-3 Fatty Acid Market Competitive Landscape

Orkla Health

Orkla Health is a Norway-based leader in dietary supplements, offering a wide range of omega-3 products catering to consumer health and wellness.

-

In September 2024, Orkla Health introduced a new range of vegan omega-3 capsules derived from algae oil, targeting sustainability-conscious consumers across European markets. The launch aligns with growing demand for plant-based alternatives and strengthens the company’s footprint in the functional nutrition segment.

BASF SE

BASF SE, headquartered in Germany, is a global chemical giant with a strong portfolio of high-purity omega-3 ingredients for nutraceuticals and pharmaceuticals.

-

In June 2024, BASF expanded its production facility in Norway to enhance the output of concentrated EPA/DHA formulations, addressing the rising pharmaceutical-grade omega-3 demand in Europe and North America.

Aker Biomarine Antarctic AS

Aker Biomarine is a Norway-based biotech innovator specializing in sustainable krill-derived omega-3 solutions.

-

In March 2024, Aker Biomarine launched a new clinical research program in collaboration with U.S. universities to study the cognitive benefits of krill oil in aging populations, reinforcing its focus on science-backed product development.

Koninklijke DSM N.V.

DSM, a Netherlands-based global leader in health, nutrition, and bioscience, offers advanced algae-based omega-3 solutions.

-

In July 2024, DSM unveiled a partnership with food and beverage companies in Asia-Pacific to integrate algae-derived omega-3 oils into fortified dairy and beverage products, expanding its presence in the functional food market.

Omega-3 Fatty Acid Market Key Players

-

BASF SE

-

Aker Biomarine Antarctic AS

-

BioProcess Algae, LLC

-

Croda International Plc

-

Koninklijke DSM N.V.

-

GC Rieber Oils

-

Polaris Nutritional Lipids

-

Pharmavite LLC

-

NOW Foods

-

NutriGold Inc.

-

Reckitt Benckiser Group (Schiff Nutrition)

-

KD Pharma Group

-

Arista Industries Inc.

-

Golden Omega S.A.

-

GlaxoSmithKline plc (via Lovaza/Omacor)

-

Cargill, Incorporated

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 2.68 Billion |

| Market Size by 2032 | US$ 4.8 Billion |

| CAGR | CAGR of 7.52% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Marine, Vegetable oils, Soya and Soya Products, Nuts and Seeds) • By Type (ALA, EPA, DHA) • By Application (Dietary Supplement, Food & Beverage, Fish Feed, Pharmaceutical, Infant Formula, Pet Food) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Orkla Health, BASF SE, Aker Biomarine Antarctic AS, EPAX, BioProcess Algae, LLC, Lonza, Croda International Plc, Omega Protein Corp., Koninklijke DSM N.V., GC Rieber Oils |