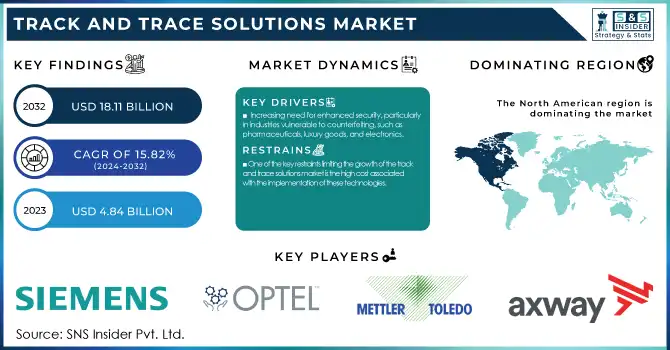

Global Track and Trace Solutions Market Size & Overview:

The Track and Trace Solutions Market size was valued at USD 4.84 billion in 2023 and is expected to reach USD 18.11 billion by 2032 at a CAGR of 15.82% during the forecast period of 2024-2032.

Get more information on Track and Trace Solutions Market - Request Sample Report

The track and trace solutions market is experiencing robust growth, driven by the increasing need for supply chain transparency, regulatory compliance, and enhanced product security. Industries such as pharmaceuticals, food and beverage, and consumer goods are adopting these solutions to ensure the authenticity, safety, and timely delivery of products. According to a 2023 survey by Zebra Technologies, 80% of supply chain professionals reported the need for better visibility to improve supply chain efficiency. The pharmaceutical industry, in particular, is a significant driver of this growth. For example, the FDA’s Drug Supply Chain Security Act (DSCSA) mandates that all pharmaceutical products in the U.S. must have a unique product identifier, a clear requirement for track and trace systems.

Technological innovations such as RFID, GPS, IoT, and blockchain are revolutionizing the way companies track products. RFID alone has been cited as a game-changer in warehouse operations, reducing the time needed for inventory management by up to 50%, according to a study by the Harvard Business Review. Similarly, the global adoption of GPS technology for supply chain logistics has improved asset tracking accuracy, reducing lost goods and minimizing transit delays. Companies like Amazon and Walmart have integrated advanced track and trace solutions into their logistics networks to improve delivery times and customer satisfaction. For example, Amazon’s use of IoT sensors and GPS technology has helped streamline its fulfillment centers, reducing operational costs and enhancing the speed of deliveries.

Blockchain technology is also making waves in industries like pharmaceuticals, where it is used to prevent counterfeiting. Companies such as MediLedger and IBM’s Food Trust network are leveraging blockchain for traceability, allowing every step of a product’s journey to be recorded in an immutable ledger, which helps verify authenticity and safety. Additionally, consumer goods and luxury brands are adopting track and trace systems to combat counterfeiting. For instance, luxury fashion brands like LVMH and Prada use RFID and QR codes to guarantee the authenticity of their high-end products, offering consumers confidence in their purchases.

As e-commerce continues to grow, with global online retail sales projected to reach USD 8.1 trillion by 2026, the need for efficient track-and-trace solutions is more critical than ever. Consumers expect transparency regarding the origin and delivery status of their purchases, pushing businesses to implement real-time tracking and data-sharing technologies. The demand for such solutions is clear: 62% of consumers reported that they would prefer to buy from a brand offering complete product traceability, according to a 2022 study by GS1.

Track and Trace Solutions Market Dynamics

Drivers

-

Increasing need for enhanced security, particularly in industries vulnerable to counterfeiting, such as pharmaceuticals, luxury goods, and electronics.

Counterfeiting is a significant global issue, especially in sectors like healthcare, where counterfeit drugs can pose severe risks to public health. Track and trace technologies, including RFID and blockchain, allow for real-time tracking of products throughout the supply chain. These technologies create a tamper-proof digital trail, verifying product authenticity and ensuring that goods have not been altered or replaced during transportation. This level of security is crucial for maintaining consumer trust, protecting brand integrity, and complying with regulations aimed at preventing counterfeit goods from entering the market. As counterfeiting techniques become more sophisticated, these solutions play a pivotal role in safeguarding both businesses and consumers.

-

Increasing regulatory requirements across various industries, particularly pharmaceuticals, food, and beverages, are driving the adoption of track and trace solutions.

Governments worldwide are implementing stringent laws to ensure product safety and transparency. For example, in the pharmaceutical sector, regulations such as the Drug Supply Chain Security Act (DSCSA) in the U.S. and the Falsified Medicines Directive (FMD) in Europe mandate the use of track and trace systems to prevent counterfeit drugs from reaching consumers. Similarly, food safety regulations require full traceability of products to respond quickly in case of contamination or product recalls. These regulations require companies to invest in systems that provide real-time visibility, making it easier to trace the origin, movement, and destination of goods. As regulations continue to evolve, compliance with these requirements will remain a major driver for businesses to adopt effective track-and-trace solutions.

-

The rapid growth of e-commerce is another significant factor driving the Track and Trace Solutions Market.

With online shopping expanding globally, customers expect greater transparency and control over their purchases. Real-time tracking, including updates on the location and estimated delivery time of products, is now a standard expectation among consumers. Research indicates that 62% of consumers prioritize the ability to track their orders over other factors when making online purchases. As e-commerce giants like Amazon and Walmart continuously improve their logistics networks, other companies are also feeling the pressure to adopt similar technologies to meet customer expectations. The widespread use of mobile devices and apps that allow consumers to track their orders in real time further amplifies the demand for track-and-trace solutions. Consequently, businesses are investing in these technologies to maintain customer satisfaction and loyalty.

Restraints

-

One of the key restraints limiting the growth of the track and trace solutions market is the high cost associated with the implementation of these technologies.

The integration of advanced systems such as RFID, GPS, IoT, and blockchain into existing supply chain infrastructures can be expensive, particularly for small and medium-sized enterprises (SMEs) that may lack the financial resources to invest in such technologies. Additionally, these solutions often require significant changes in operational processes, employee training, and system upgrades, all of which add to the overall cost. The complexity of integrating multiple technologies, especially in large, global supply chains, can also be a barrier. Ensuring seamless data exchange between various systems while maintaining real-time visibility can be technically challenging and time-consuming. As a result, businesses may hesitate to adopt track and trace solutions despite their potential benefits, slowing the overall market growth.

Track and Trace Solutions Market Segmentation Analysis

By Product

In 2023, software solutions dominated the track and trace solutions market, accounting for 42.2% market share. These solutions are essential for managing data, providing real-time tracking, and enabling reporting across various stages of the supply chain. Software solutions are preferred due to their ability to integrate various technologies like RFID, IoT, and GPS into a unified platform that ensures comprehensive traceability. The growth of cloud-based platforms and SaaS models has made it easier for businesses to deploy track and trace systems with minimal upfront costs while offering scalability and flexibility. The software also enables companies to comply with industry regulations, boost efficiency, and improve supply chain transparency. As the need for digital transformation across industries continues to rise, software solutions will remain the dominant force in the market.

The hardware components segment, which includes devices like RFID tags, sensors, and GPS tracking systems, is the fastest-growing segment in the Track and Trace Solutions Market. This growth is largely driven by the increasing demand for accurate, real-time tracking of products, especially in industries like pharmaceuticals, food, and logistics, where precise monitoring is crucial. The rise of advanced technologies such as IoT and RFID is significantly improving the capability of hardware solutions, enabling more effective and efficient tracking. As industries continue to adopt automation and seek to optimize supply chain operations, the demand for advanced hardware components that provide real-time data will continue to expand.

By Application

Serialization solutions dominated the track and trace solutions market in 2023, as they are critical for ensuring product authenticity and compliance with industry regulations. Serialization assigns a unique identifier to each product, enabling traceability from the manufacturer to the end consumer. This solution is especially important in the pharmaceutical industry, where regulations such as the Drug Supply Chain Security Act and the Falsified Medicines Directive require robust traceability measures to prevent counterfeit products. Serialization helps enhance patient safety, improving brand protection, and enabling efficient recalls, making it a vital component of track and trace systems. With increasing regulatory pressures and growing consumer demands for verified products, serialization is expected to continue to lead the market.

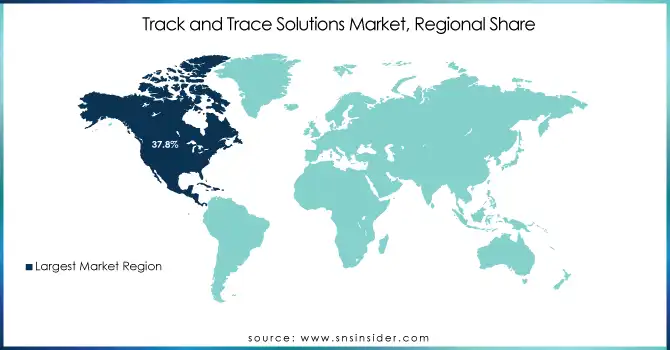

Track and Trace Solutions Market Regional Outlook

The North American region dominated the track and trace solutions market in 2023 with 37.8% market share, with the U.S. being a key contributor. The presence of stringent regulatory frameworks, such as the Drug Supply Chain Security Act (DSCSA), drives the adoption of track-and-trace solutions in sectors like pharmaceuticals. Additionally, the increasing adoption of advanced technologies such as IoT, RFID, and cloud computing further fuels the demand for these solutions in the region. The region's strong focus on supply chain security and product authenticity, along with the presence of key market players, contributes to its market leadership.

In Europe, the market is also witnessing substantial growth, primarily due to regulations like the Falsified Medicines Directive (FMD), which mandates traceability in the pharmaceutical sector. The European market is increasingly shifting toward automated solutions to improve supply chain efficiency, with countries like Germany, the U.K., and France leading the way in adopting these technologies. As e-commerce and logistics become more complex, demand for end-to-end visibility is rising in Europe.

The Asia-Pacific region, however, is expected to grow at the fastest rate due to the rapid industrialization of countries like China, India, and Japan. The region is experiencing a surge in demand for track and trace solutions, particularly in industries such as pharmaceuticals, food, and electronics. With increased regulatory pressure and the rising need for enhanced supply chain management, Asia-Pacific is emerging as a key growth hub for the market.

Need any customization research on Track and Trace Solutions Market - Enquiry Now

Key Players

-

Mettler-Toledo International, Inc.

-

Optel Vision

-

Adents

-

Antares Vision S.r.l

-

Korber AG

-

ACG Worldwide

-

Markem Imaje, a Dover Company

-

Syntegon Technology GmbH

-

Marchesini Group S.p.A.

-

Laetus GmbH

-

Systech International Inc.

-

Zebra Technologies Corporation

-

IBM Corporation

-

SAP SE

-

Siemens S.A.

-

Honeywell International Inc.

-

HCL Technologies

Recent Developments

In March 2024, MNG integrated Venom blockchain technology to enhance its track-and-trace capabilities. Venom's secure, transparent, and scalable ledger is specifically designed to meet the needs of the modern logistics industry.

In March 2024, Systech, a leader in digital traceability and serialization and part of Markem-Imaje and Dover, expanded its product portfolio and global presence with the acquisition of Pharmacontrol Electronic GmbH (PCE), a leading provider of pharmaceutical track-and-trace solutions in Europe.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.84 Billion |

| Market Size by 2032 | US$ 18.11 Billion |

| CAGR | CAGR of 15.82% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Product (Software Solutions, Hardware Components, Standalone Platforms) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Axway, Mettler-Toledo International, Inc., Optel Vision, TraceLink, Inc., Adents, Antares Vision S.r.l, Siemens AG, Korber AG, ACG Worldwide, Markem Imaje a Dover Company, Syntegon Technology GmbH, Marchesini Group S.p.A., Lateus GmbH, Systech international Inc., Zebra Technologies Corportation, IBM Corportation, SAP SE, Accenture Plc.,Siemens S.A., Honeywell International Inc., HCL Technologies. |

| DRIVERS | • Increasing need for enhanced security, particularly in industries vulnerable to counterfeiting, such as pharmaceuticals, luxury goods, and electronics. • Increasing regulatory requirements across various industries, particularly pharmaceuticals, food, and beverages, are driving the adoption of track and trace solutions. • The rapid growth of e-commerce is another significant factor driving the Track and Trace Solutions Market. |

| Restaints | • One of the key restraints limiting the growth of the track and trace solutions market is the high cost associated with the implementation of these technologies. |