Non-Invasive Fat Reduction Market Overview and Scope

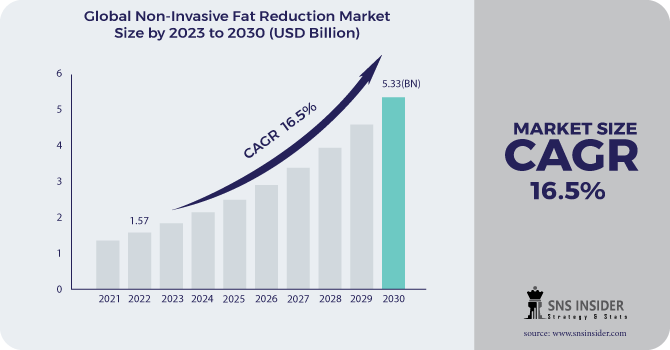

The Non-Invasive Fat Reduction Market was valued at USD 1.56 billion in 2023 and is expected to reach USD 6.21 billion by 2032, growing at a CAGR of 16.67% from 2024-2032.

Get more information on Non-Invasive Fat Reduction Market - Request Sample Report

The non-invasive fat reduction market has been presented with unique statistical insights in this report. The incidence and prevalence of obesity and the overweight population in 2023 will help bring into focus the ever-growing demand for fat reduction treatments. Regional trends and patient preferences have also been discussed in detail, where treatment choices and emerging technologies have varied across regions. This report also discusses aesthetic procedure spending in healthcare by payment model (government, commercial, private, and out-of-pocket) in 2023, providing valuable insights into patient spending behaviors. In addition, it explores technological advancements and adoption trends, illustrating the latest developments in fat reduction technologies and their adoption rates among patients and clinics.

Non-Invasive Fat Reduction Market Dynamics

Drivers

-

Rising demand for aesthetic procedures fueled by obesity and lifestyle changes propels the non-invasive fat reduction market.

Non-invasive fat reduction has become one of the key reasons for its rise in demand as obesity and lifestyle-related disorders keep increasing. Over 1.9 billion adults were found overweight by the WHO in 2023, out of which over 650 million were classified as obese. Therefore, there has been an immense focus on body contouring solutions. In this regard, also, minimally invasive procedures are being preferred along with minimal downtime. For this, techniques like cryolipolysis and radiofrequency-based treatments are gaining momentum. The most recent includes the FDA approval of CoolTone from Allergan Aesthetics, keeping pace with consumer demand.

-

Advancements in technology enhancing procedure safety and effectiveness driving non-invasive fat reduction market

Technology advancements in non-invasive fat reduction appliances, including cryolipolysis, laser lipolysis, and ultrasonic-based, are the ones driving the industry. These innovative technologies ensure much safer, better, and localized fat reduction therapy with minimal adverse effects. An example is when BTL Industries launched the enhanced EMSCULPT NEO equipment in 2024, applying radiofrequency heat and high-intensity focused electromagnetic power to achieve high-quality results. These developments not only bring out better patient outcomes but also expand the market reach because they address a larger range of body types and needs for fat reduction.

Restraint

-

High cost of treatment limiting market accessibility and restraining the market growth.

The high cost of non-invasive fat reduction treatments is a considerable deterrent for the market. Cryolipolysis, laser lipolysis, and ultrasound-based treatments mostly require multiple procedures, and the expenses tend to be too heavy for many patients who would probably undertake them. Since most of these are not covered by insurance, patients will be discouraged from exploring such services. For example, a single session of CoolSculpting can range between USD 2,000 and USD 4,000 depending on the area treated. This high price limits market growth, especially in emerging economies with lower disposable incomes.

Opportunities

-

Growing demand for aesthetic procedures and wellness trends making space for non-invasive fat reduction market.

The growing awareness about personal appearance and the rising wellness and self-care trend will significantly increase the market opportunity for non-invasive fat reduction treatments. Consumers will be more concerned about their body image and look for less invasive alternatives to traditional weight-loss surgeries, which will raise the demand for non-invasive fat-reduction procedures. In addition, the trend for treatments with less downtime and quicker recovery times, such as CoolSculpting and SculpSure, fits well into the lifestyle needs of busy individuals. This trend is strong in millennials and the aging population, further expanding the market's potential.

Challenges

-

One of the biggest challenges that the non-invasive fat reduction market faces is the lack of long-term efficacy data, which creates skepticism in the minds of consumers.

While these treatments work well in the short term, there is not enough clinical evidence to prove the long-term results. This lack of conclusive data may cause potential customers to question the effectiveness and value of these procedures compared to more established fat reduction methods. Additionally, concerns regarding the safety and potential side effects of non-invasive treatments further hinder consumer confidence, limiting widespread adoption.

Non-Invasive Fat Reduction Market Segmentation Analysis

By Technology

The Cryolipolysis segment dominated the Non-Invasive Fat Reduction Market with 35.45% of the market share in 2023 due to its proven effectiveness, non-invasive nature, and increasing patient demand for safe, painless alternatives to traditional liposuction. Cryolipolysis, also known as fat freezing, targets and eliminates stubborn fat cells through controlled cooling, without harming surrounding tissues. This technology has gained popularity because it provides noticeable results with minimal downtime, making it an attractive option for those seeking body contouring treatments. Additionally, the growing trend of aesthetic procedures, combined with the increasing acceptance of non-surgical fat reduction methods, has propelled Cryolipolysis as the dominant technology in the market. Its FDA clearance and numerous clinical studies supporting its efficacy have further bolstered consumer confidence and market growth.

By End-Use

In 2023, the hospital segment dominated the Non-Invasive Fat Reduction Market with 55.41% of the market share, due to the availability of advanced infrastructure and skilled professionals in hospitals. Hospitals offer comprehensive services, including access to cutting-edge equipment and technologies for non-invasive fat reduction treatments, which attract patients seeking medical assurance and expertise. With the growing demand for safe and effective fat-reduction procedures, hospitals have capitalized on their ability to offer a wide range of treatments, backed by licensed medical practitioners. Additionally, hospitals can provide a higher level of comfort, privacy, and patient care, which makes them the preferred choice for many individuals considering body contouring treatments.

The hospital segment will witness the fastest growth over the forecast period due to high demand for non-invasive cosmetic procedures and expanding medical tourism. Hospitals are enriching their product lines by embracing non-invasive fat reduction technologies, which results in more and more patients selecting these treatments in place of invasive surgical options. In addition, hospitals are looking for personalized care and more general access to treatments as a way to fuel patient volumes. Improvements in medical technology combined with a rising health-conscious consumer are expected to result in more hospitals embracing non-invasive fat reduction treatments, further propelling the segment's growth.

.png)

Need any customization research on Non-Invasive Fat Reduction Market - Enquiry Now

Non-Invasive Fat Reduction Market Regional Outlook

North America dominated the market with a 39.46% market share due to high consumer demand for body contouring and aesthetic treatments. The region is also a hub of technological advancement, with leading companies such as Allergan and Zeltiq pushing the envelope in non-invasive fat reduction technologies like CoolSculpting. High disposable income and an established healthcare infrastructure have made advanced treatments accessible to the masses in North America. Additionally, cultural acceptance of cosmetic procedures, particularly in the U.S., also fuels market growth. The availability of skilled professionals and clinics ensures that the market keeps growing steadily.

Asia Pacific is expected to have the fastest CAGR of 20.64% throughout the forecast period in the non-invasive fat reduction market. With middle-class populations exploding in countries such as China and India, an increased disposable income has led people to spend on cosmetic treatments more than ever. As beauty consciousness increases, it is more in the minds of the youth who are now reaching out for less invasive alternatives instead of surgery-based fat removal methods. The region also benefits from expanding healthcare infrastructure and medical tourism, especially in countries like South Korea and Japan. Affordable non-invasive treatments, along with the adoption of cutting-edge technologies, make the Asia Pacific a rapidly growing market for body contouring solutions.

Key Players in the Market

-

Allergan (CoolSculpting, CoolTone)

-

Cynosure (SculpSure, TempSure Firm)

-

Alma Lasers (Accent Prime, Accent Elite)

-

Cutera, Inc. (truSculpt iD, truSculpt Flex)

-

BTL Aesthetics (EMSCULPT, EMTONE)

-

Lumenis Ltd. (NuEra Tight, UltraShape Power)

-

Venus Concept Inc. (Venus Bliss, Venus Legacy)

-

InMode Ltd. (BodyTite, Morpheus8 Body)

-

Zeltiq Aesthetics (CoolAdvantage, CoolMini)

-

Solta Medical (Thermage FLX, Liposonix)

-

Fotona (SP Dynamis, StarWalker)

-

Sciton, Inc. (JOULE X, ProLipo PLUS)

-

Medtronic (VaserShape, VaserLipo)

-

Zimmer Biomet (Z Wave Pro, Z Cryo)

-

Syneron Candela (UltraShape, VelaShape)

-

REVOLVE Aesthetics (AirSculpt Laser Lipo, AirSculpt+)

-

Hitech Lasers (LipoZero G2, CaviPlus)

-

ThermiGen LLC (ThermiSmooth Body, ThermiTight)

-

Advalight (ADVATx, UltraContour)

-

Evonik Industries (Ultherapy, CelluContour)

Suppliers (These suppliers ensure the production of reliable, high-quality non-invasive fat-reduction devices.)

-

3M Healthcare

-

DSM Biomedical

-

Dow Corning (part of Dow Inc.)

-

Covestro AG

-

Evonik Industries AG

-

Henkel Adhesives Technologies

-

Eastman Chemical Company

-

Mitsui Chemicals, Inc.

-

Saint-Gobain Performance Plastics

-

Foster Corporation

Recent Developments in Non-Invasive Fat Reduction Market

-

In January 2025, CoolMonth reintroduced exclusive offers on CoolSculpting Elite by Allergan Aesthetics, providing substantial discounts on non-invasive fat reduction treatments. This limited-time promotion gave customers the opportunity to take advantage of reduced prices on CoolSculpting sessions, encouraging more people to try body contouring.

-

March 2023, Cutera launched the updated truBody brand in March 2023, an award-winning treatment combining two clinically proven technologies. The innovative approach is tailored, convenient, and comprehensive for fat reduction and muscle toning with only 15 minutes of treatment time.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.56 Billion |

| Market Size by 2032 | US$ 6.21 Billion |

| CAGR | CAGR of 16.27 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Cryolipolysis, Lower-level Laser, Ultrasound, Others) • By End-Use (Hospitals, Stand-alone Practices, Multispecialty Clinics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Allergan, Cynosure, Alma Lasers, Cutera, Inc., BTL Aesthetics, Lumenis Ltd., Venus Concept Inc., InMode Ltd., Zeltiq Aesthetics, Solta Medical, Fotona, Sciton, Inc., Medtronic, Zimmer Biomet, Syneron Candela, REVOLVE Aesthetics, Hitech Lasers, ThermiGen LLC, Advalight, Evonik Industries, and other players. |