Metal Recycling Equipment Market Report Scope & Overview:

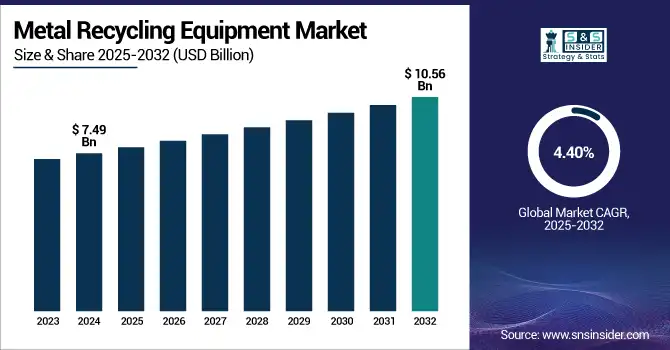

The Metal Recycling Equipment Market size was valued at USD 7.49 billion in 2024 and is expected to reach USD 10.56 billion by 2032, growing at a CAGR of 4.40% over the forecast period of 2025-2032.

To Get more information on Metal Recycling Equipment Market - Request Free Sample Report

The Metal Recycling Equipment Market is experiencing dynamic growth, driven by increasing environmental awareness, stricter regulations on waste management, and a global trend toward sustainable practices. With industries around the world striving to reduce their carbon footprint, there is a rise in demand for advanced scrap metal recycling machines alongside a boom in scrap machinery. The rising demand is also being stimulated by technological innovation, such as automated and AI-powered recycling equipment and machinery, boosting efficiency, lowering labor costs, and improving recovery rates of valuable metals. Therefore, the manufacturers are inclined towards providing solutions that are smart, energy efficient, and manufactured to cater to evolving customer specifications and regulatory standards.

The emerging metal recycling equipment market is the integration of the processing system, which allows multiple types of metals to be processed with little human interaction. In developed and emerging economies alike, growing government investments in circular economy initiatives and infrastructure upgrades are opening new doors. Higher collaboration between private companies and public organizations to simplify the recovery of metals will also drive the recycling equipment market. The recycling equipment and machinery market is likely to witness a sustained growth in the global market for the long-term horizon as innovation in recycling equipment continues while there is a greater emphasis on sustainable industrial consumption in the present age, providing opportunities for substantial growth for players targeting eco-friendly and cost-effective recycling solutions.

In February 2025: Fornnax Technology began constructing a massive 23-acre recycling machinery facility in Gujarat, India. This site is expected to be among the largest globally, to produce 250 units annually by 2030. Led by CEO Jignesh Kundaria and Director Kaushik Kundaria, the move marks a major expansion for the company. The plant will manufacture advanced shredders and granulators to process a wide range of waste materials.

Metal Recycling Equipment Market Dynamics:

Drivers:

-

Environmental Sustainability and Circular Economy Initiatives Boost Metal Recycling by Cutting Energy Consumption, Emissions, and Resource Depletion

The metal recycling equipment market is primarily galvanised by efforts towards environmental sustainability and endeavours aimed towards a circular economy. Using recycled metals saves a substantial amount of energy normally needed for the extraction and processing of virgin materials. Recycling aluminum saves 95% of the energy needed for the energy-intensive primary production, whereas recycling copper saves 85%, and steel saves 74% of energy, respectively.

Translated into greenhouse gas savings, nine tons of CO₂ emissions can be saved per ton of recycled aluminum. In addition, metal recycling ensures the conservation of natural resources. By recycling steel, about 1.5 tons of iron ore and 0.5 tons of coal are saved per ton of steel. Such environmental advantages underlie the global sustainable development objectives and pave the path for even further investments into advanced recycling technologies, further solidifying the importance of metal recycling in sustainable industrial practices.

In May 2025: The U.K. aims to lead in circular textiles through initiatives including Project Reclaim and the Circular Fashion Innovation Network, focusing on large-scale textile recycling. Plans include automated sorting and chemical recycling plants. However, progress is slowed by poor infrastructure, weak policy support, and limited investment. Industry leaders are pushing for an Extended Producer Responsibility (EPR) scheme to drive real change.

Restraints:

-

High Costs in Metal Recycling Equipment limit SMEs' competitiveness and efficiency

The metal recycling equipment market is facing a hurdle with high capital investment and operational costs. The cost of this kind of machinery is expensive, especially to get advanced machines including shredders, crushers, sorting systems, etc. In addition to these costs, annual expenses for maintenance, repair, and energy use will only increase over time. For small and medium-sized enterprises (SMEs), these costs can be particularly crippling as some may not be able to set aside funds for costly technologies. This, in the long run, makes it impossible for SMEs to keep up with the latest recycling machinery the industry produces, becoming a big disadvantage in the market. Without sacrificing efficacy, cost-effective solutions remain a major concern for businesses in this space.

In March 2024, Li-Cycle announced plans to lay off 17% of its workforce to conserve funds amid financial strain. The company faced significant cost overruns at its Rochester facility, nearly doubling the initial cost estimates to USD 960 million. Additionally, complexities with its recycling technology led to stock issues and a USD 75 million convertible loan from Glencore.

Metal Recycling Equipment Market Segmentation Analysis:

By Equipment

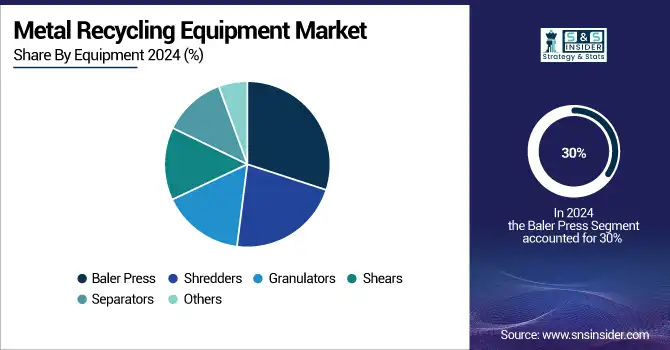

Baler Press segment dominated the market and accounted for 30% of the metal recycling equipment market share. This strong performance is attributed to the widespread use of baler presses for compressing scrap metal into compact, manageable forms, making storage, handling, and transportation more efficient. Their versatility in processing various metal types and their crucial role in streamlining recycling operations make them highly valuable across recycling facilities worldwide. Additionally, growing environmental concerns and increased adoption of sustainable practices have further fueled demand for efficient metal compaction solutions, reinforcing the dominance of this segment.

The shredders segment is emerging as the fastest-growing in the metal recycling equipment market. The growth is attributed to the rising need to make the size of the scrap metal smaller and minimize its volume for easier handling, sorting, and processing. They are key in essentially shredding and breaking down a vast range of ferrous and non-ferrous metals, enabling better recycling and material recovery. Innovative technologies for driving automation and increasing energy efficiency have led to its increased traction across industries.

By Application

In 2024, the automotive segment leads the metal recycling equipment market, commanding a dominant 38% share. Factors, such as the growing demand for recycled metals in vehicle manufacturing, increasing automotive production, and strict environmental policies that encourage sustainable practices are driving this prominence. Over the last few years, the trend of using recycled materials has gained momentum among automakers, as they are looking for a competent method of reducing costs and carbon footprints, which, in turn, is driving the demand for fruit advanced recycling equipment. Also, they had made more fast-type products become end-of-life also contributes to metal scrap, which is the toughest in this segment.

The industrial segment is recognized as the fastest-growing application segment. Which can be attributed to the increase in automation, development in technologies, and growing demand for resource generation for production processes. Smart technologies such as IoT, AI, and robotics are being adopted in industries to streamline operations, decrease expenses, and increase efficiency. Furthermore, increasing focus on industrial equipment becoming energy efficient and sustainable is further boosting the deployment of advanced industrial equipment. This growth is further exacerbated by the rapid industrialization of emerging economies.

Metal Recycling Equipment Market Regional Outlook:

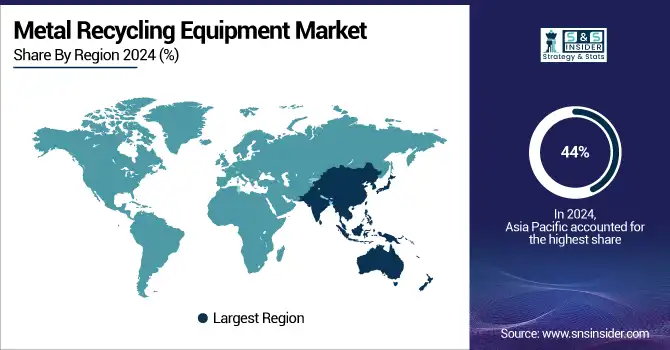

In 2024, Asia Pacific dominates the global metal recycling equipment market with a 44% share and remains the fastest-growing region. Rapid urbanization, industrialization, and rising environmental concerns in emerging economies such as China, India, and Japan are expected to fuel this growth. As such, national administrations in the region are implementing tougher policies to minimize habitat loss and encourage sustainable practices, thereby driving up demand for advanced recycling solutions. Meanwhile, booming construction and industrial camps are producing a massive amount of metal waste, which is resulting in a demand for high-performing recycling equipment. All the above basics make Asia-Pacific the leading stable region in the full market.

China dominates the metal recycling equipment market within the Asia Pacific region. China, with its large manufacturing base, increasing resource efficiency focus, and government-supported recycling initiatives, have been the most significant market growth drivers. China has invested heavily in upgrading recycling infrastructure and taking in machinery to automate tasks in the recycling process.

North America holds a significant share of the metal recycling equipment market, due to advanced recycling infrastructure and healthy industrial activity. The U.S. and Canada are significant markets with an increasing focus on sustainability, resource efficiency, and landfill avoidance. Market growth is only accelerated by government incentives and other policies designed to promote recycling practices. Both nations are responding with the new tech, true metal tech, we have been going over to assist in attaining high metal recovery ratios and enhancing recycling.

The U.S. metal recycling equipment market is expected to grow from USD 1.00 billion in 2024 to USD 1.33 billion by 2032, with a CAGR of 3.71%. Factors, such as increasing expectations for sustainability, expanded environmental regulations, and the efficient processing of metal scrap for remanufacturing have led to significant growth in the U.S. circular economy, similar to what the global momentum is witnessing.

Europe holds a significant share of the global metal recycling equipment market due to strong environmental policies and a distinct commitment to sustainability. Recycling Technologies and Processes, The European Union is promoting the circular economy and implementing very demanding recycling regulations to secure high-quality recycling, as well as large investments in cutting-edge recycling technologies. This commitment to minimizing waste and increasing improvements in recycling efficiency drives manufacturers to demand more novel metal recycling equipment.

Germany leads the metal recycling equipment market in Europe, owing to its advanced recycling technologies, strict environmental regulations, and well-organized waste management systems. Due to its unique sustainability and innovation in recycling equipment manufacturing industry, the country has become the third largest market after Germany and Italy in Europe.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Metal Recycling Equipment Market are:

Metal recycling equipment companies are MARATHON, Advance Hydrau Tech Pvt Ltd., CP Manufacturing Inc., BHS Sonthofen GmbH, JMC Recycling Ltd., Eldan Recycling A/S, General Kinematics Corporation, MHM Recycling Equipment, DANIELI CENTRO RECYCLING, and FOR REC S.P.A

Recent Developments:

-

In April 2024: Eldan Recycling A/S introduced the Eldan MPS (Multi-Purpose Sorter) and SPS (Small Purpose Sorter), designed to improve sorting efficiency across various applications, including WEEE, non-ferrous, and mixed metal scrap systems.

-

In August 2023: Advance Hydrau Tech Pvt. Ltd. released a new product catalogue, "Conquer the Scrap Processing Kingdom," highlighting their latest scrap processing machines, such as balers, shears, shredders, and briquetting presses.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 7.49 Billion |

| Market Size by 2032 | USD 10.56 Billion |

| CAGR | CAGR of 4.40% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment (Baler, Press, Shredders, Granulators, Shears, Separators, Others) • By Application (Automotive, Construction, Electronics, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | MARATHON, Advance Hydrau Tech Pvt Ltd., CP Manufacturing Inc., BHS Sonthofen GmbH, JMC Recycling Ltd., Eldan Recycling A/S, General Kinematics Corporation, MHM Recycling Equipment, DANIELI CENTRO RECYCLING, FOR REC S.P.A |